The Extremely-Overvalued & Top-Heavy US Stock Market

Caveat freaking emptor.

After the Fed effectively fully nationalized the financial markets by bailing out junk bonds on April 9th, turning Wall Street into a Soviet Sausage Factory, almost any type of analysis, which was on its way out anyway, was rendered completely meaningless.

The new rocket scientists on Wall Street are the market Kremlinologists, who try to guess the new ranges where the Politburo will set yields and how many notes and bonds the Kommissar of Free Money is going to buy in order to monetize a $4 trillion-plus deficit and help rollover existing maturities. All good until it isn’t

Stock Picking

That doesn’t mean you can’t make money picking and being in the right stocks. We crossed swords this weekend with a very savvy ex-Morgan Stanley stock picker (she knows exactly who she is) and we had to concede that she has been right.

The market does appear to be looking forward to the other side. The new world looks a few high tech giants in a less mobile (physical), work from home world. Maybe.

Not sure if that is good or sustainable or the body politic will stand for it.

Nevertheless, that world is foreign to us as our background is top-down global macro but always good to have someone like her on the team.

Global Macro

What we are seeing scares the bejeezus out of us, however.

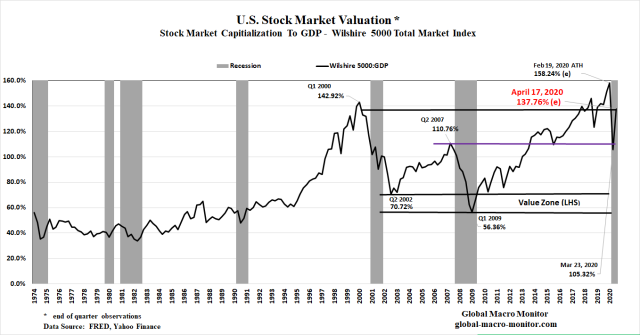

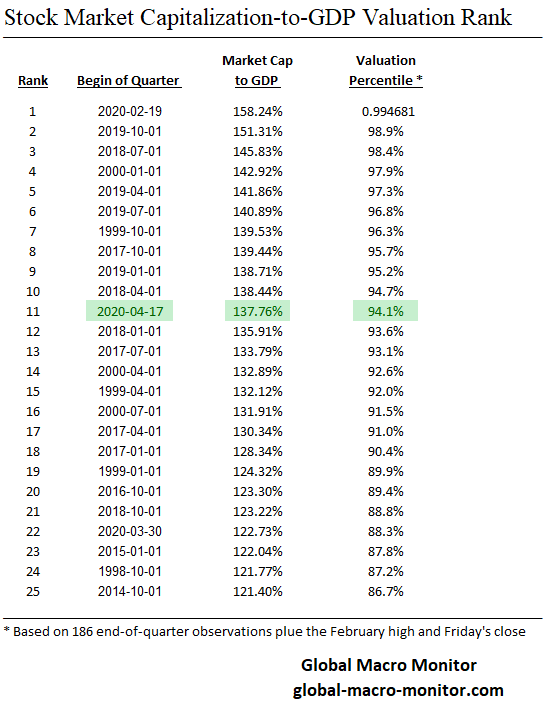

Our favorite (and Warren Buffet’s) valuation metric, is, unbelievably, even without COVID, trading at its 94th valuation percentile while unemployment heads to the worst levels of the Great Depression, more than half of the Los Angeles workforce is unemployed, and uncertainty still reigns. Even more unbelievable the valuation metric sits just 5 points below its dot.com high in Q1 2000.

Of course, there will be some snapback when the economy reopens but there are 2nd, 3rd,……………….nth order effects markets will still have to deal with.

Warren Buffet is apparently having nothing to do with this market,

“I would say basically we’re like the captain of a ship when the worst typhoon that’s ever happened comes. We just want to get through the typhoon, and we’d rather come out of it with a whole lot of liquidity. We’re not playing ‘oh goody, goody, everything’s going to hell, let’s plunge 100% of the reserves [into buying businesses]”

This also assumes the markets and economy were structurally sound pre-COVID, which, they were not, in our opinion, and we’re in multiple asset bubbles and weakened from the trade wars.

Top Heavy Market

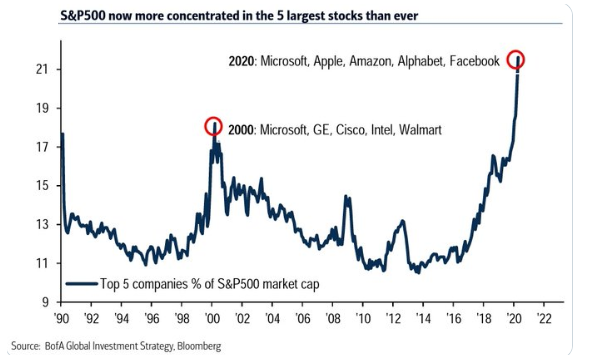

This BofA chart comes to us via the great Kiwi analyst, Callum Thomas @Callum_Thomas. Sure wish the U.S. had his Prime Minister, a strong, decisive leader with brass balls. Have you seen New Zealand’s COVID Curve?

How about a trade, Callum? Four Generals: 2 Four-Stars, General Electric, and General Dynamics for Jacinda? Deal?

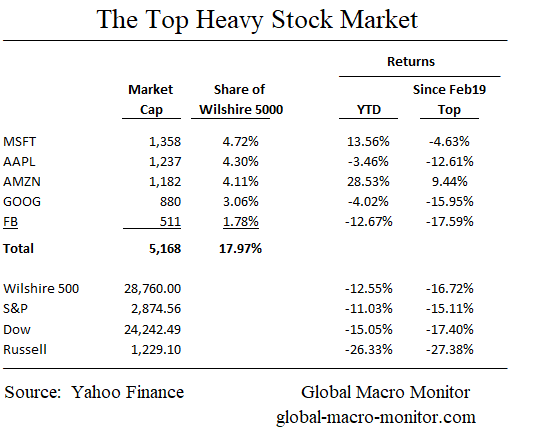

The chart is stunning enough but check out the data table.

As of the Friday close, the big five alone make up 17.97% of the value of almost all publicly traded stocks in the United States as measured by the Wilshire 5000. Stunning.

There are an estimated 3500 publicly companies traded and on U.S. exchanges and the pool of public companies is getting smaller even while the population and economy have expanded. This makes our stock market cap-to-GDP chart above a bit distorted and at current levels even more relatively overvalued than past levels. The following WSJ tidbit is a bit dated but still rings true,

In 1996 there were 7,322 domestic companies listed on U.S. stock exchanges. Today there are only 3,671 – WSJ, Nov’17

The Second Great Gift Of The Magi

Unless we are on the road to runaway inflation, not a zero probability with the monetization that is coming, this bounce is an incredible gift to rebalance, take some risk off, go to the virtual beach and wait this thing out.

We talked to a lot of traders over the weekend still trying to time the market and trade the noise. Hard to get out even with your stops with 10 percent daily trapdoor moves, fellas (both feminine and masculine). I would rather surf elevator shafts.

The twenty- somethings in designer Nikes and physics degrees just haven’t learned or have enough context to understand monetary policy is more placebo than economics or that their is a tipping point when the printing presses run to hot.

Moreover, the waters are too rough for us to fish, which we learned as an undergrad working on swordfish boats out of Newport during the summers. Walking the plank with the harpoon, those were the daze!

Waiting For The Shorts To Capitulate

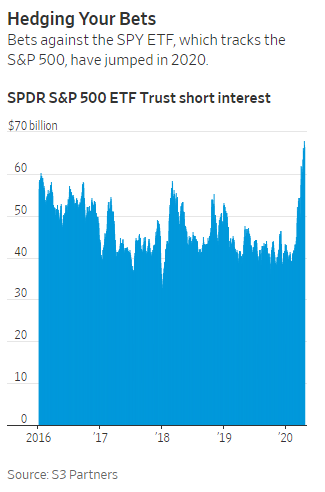

The info we are conveying here is, no doubt, something already know. It is the record short interest that is now driving and holding the market up here, in our opinion.

Short sellers have revived their wagers against the stock market in recent weeks, taking their most aggressive positions in years.

Bets against the SPDR S&P 500 Trust, the biggest exchange-traded fund tracking the broad index, rose to $68.1 billion last week, the highest level in data going back to January 2016, according to financial analytics company S3 Partners. That was up from $41.7 billion at the beginning of 2020 and $41.2 billion a year ago.

– WSJ

If the central banks were all-powerful, by the way, the Nikkei stock index would be at 200,000 instead of around 50 percent below its Dec 1989 high of around 40,000. Over the past 20 years, the Bank of Japan has bought up just about everything and bailed out everyone, probably including all the country’s sperm banks, yet Japan still has a big demographic problem!

When the placebo effect on stocks goes? Yikes!

Upshot

We like to buy low, sell high. Most prices are way too high. It is preservation of capital time until we get to the value zone, folks. Patience, young grasshopper.

Still sitting on the couch with cash and gold. We will let you trade the noise.

Tyler Durden

Mon, 04/20/2020 – 13:25

via ZeroHedge News https://ift.tt/2XQdKTB Tyler Durden