United Reports $2.1BN Loss As Airlines Brace To Fire 100,000 Once Bailout Loans Expire

United Airlines confirmed the carnage hitting US airlines today when it reported a $2.1 billion loss for first quarter as the coronavirus pandemic drove travel demand down to the lowest level in decades.

United said revenue plunged 17% in the first quarter from a year ago to $8 billion which as a reminder is largely due to the collapse in traffic in just the second half of March, so one can imagine what happens in all of Q2 should the situation fail to normalize.

With revenues unlikely to return any time soon even as losses mount, the Chicago-based airline said it applied for up to $4.5 billion in government loans on top of about $5 billion federal payroll grants and loans it also expects to receive to weather the crisis. As CNBC details, United was the first major U.S. airline to detail the results — while they are preliminary — of the virus on its results in the first three months of the year. The disease and harsh measures to stop it from spreading such as stay-at-home orders has ravaged air travel demand and and prompted carriers to slash most of their flights.

And as US airlines face a bleak future of depressed traffic and volatile revenue well into 2021, they are preparing to cut costs to the bone. As Bloomberg reports, the next big crunch date for airlines is this fall, when billions of dollars in government assistance will come to an end. As a result, key carriers including Delta and United have already begun openly contemplating how they will shrink operations, and one analyst expects that as many as 105,000 jobs could be lost industrywide.

“Without a quick improvement in demand, we could see the airlines look to shed 800 to 1,000 aircraft, which could result in a reduction of 95,000 to 105,000 airline jobs,” Cowen analyst Helane Becker wrote in an April 13 client note. “The rightsizing of the fleet and work force is an unfortunate truth.”

“The challenging economic outlook means we have some tough decisions ahead as we plan for our airline, and our overall workforce, to be smaller than it is today,” United’s chief executive and president, Oscar Munoz and Scott Kirby, wrote in an April 15 employee memo.

As a reminder, under the terms of the $50 billion government bailout, airlines are barred from slashing jobs through Sept. 30 but they’re already warning employees that cuts are almost inevitable. The planned contraction reflects a widespread belief that 2020 revenues could shrink to levels not seen in years. Recovery will probably be a long-term affair, said Cowen & Co., which predicted that ticket sales may not rebound to pre-pandemic levels until 2025.

Unable to cut jobs or salaries while receiving grants to cover payroll, airlines will staff their typical summer peak largely as usual, even with millions of fewer travelers. But come fall, it will get ugly for employees unless the government bailout is rolled into 2021. “We’re going to be smaller coming out of this,” Delta CFO Paul Jacobson told employees last month. “Certainly quite a bit smaller than when we went into it.”

The upcoming mass layoffs will add to 87,000 employees – more than one quarter of the Big Three airlines’ workforce – who have taken voluntary leaves, early retirement or reduced work hours in the past two months.

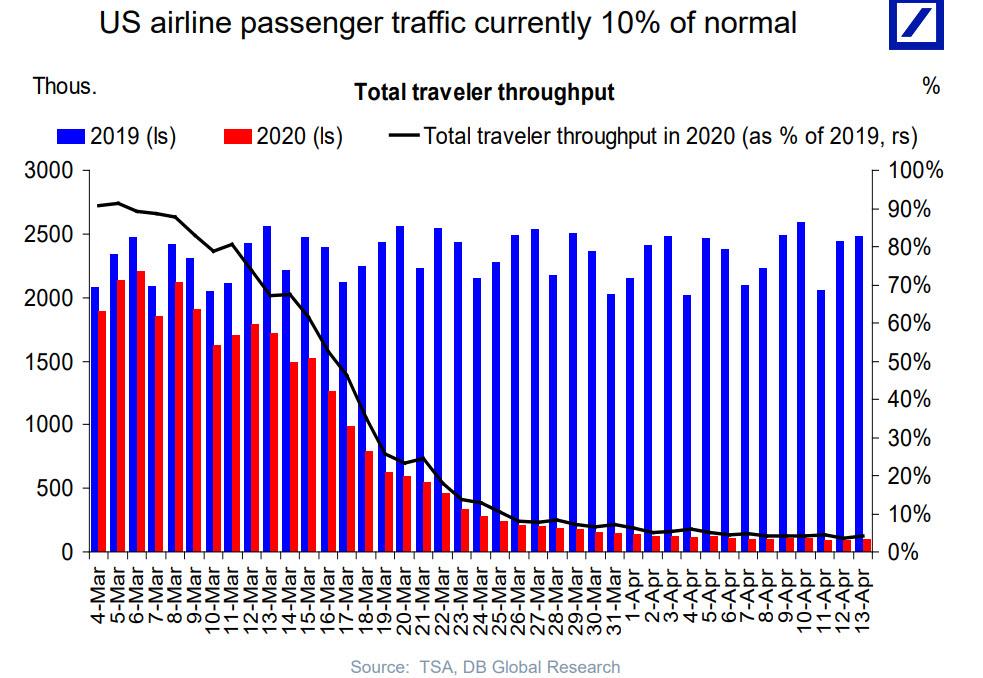

Carriers face “the worst cash crisis in the history of flight,” with booked revenues down 103% year over year, according to industry lobby Airlines for America. Domestic flights are averaging just 10 passengers while international flights average 24, the group said.

Once laid off, those employees have years of unemployment to look forward to.

While airlines foresee an uptick in bargain-hunting leisure travelers this summer, rich travelers will take longer to win back. Corporations will be reluctant to assume the liability of putting employees back in the sky with Covid-19 still in wide circulation. Plus, many companies have learned to function via video conference—which is a lot cheaper than a business class seat.

According to Bloomberg, the airline industry generally has taken three to four years to fully recover from major disruptions, said Samuel Engel, head of the aviation group at consultant ICF. Economic downturns often accelerate trends that were already underway, like pulling down marginal routes and, more recently, the decline in demand for large aircraft, he said.

“The last couple of years, you have seen extensions of flights toward end of day and early morning, and growth of long, thin routes to secondary cities in Asia,” he said. “Those types of things get pulled back, and some don’t reappear until quite late in the economic cycle.”

Tyler Durden

Mon, 04/20/2020 – 11:55

via ZeroHedge News https://ift.tt/2KgqqLs Tyler Durden