Netflix Junk Bond Offering 10x Oversubscribed, Will Price At Record Low Yield

It’s refreshing that credit investors have learned absolutely nothing from the March crash.

After warning in its earnings release that it would fund its ongoing cash burn with junk bonds, Netflix wasted no time, and just hours later announced it would issue $1 billion in dollar-denominated and euro bonds. The response was remarkable, with the offering said to be 10x oversubscribed despite offering what according to Bloomberg will be a record low yield for high yield debt.

Thanks to the massive oversubscription, Netflix, which is rated a high junk Ba3/BB, was able to reduce yields on both portions on Thursday, sourced told Bloomberg. As a result, investors in the dollar bonds are now looking at a 3.625% yield, the lowest ever seen in the U.S. high-yield bond market and in line with prices typically offered on investment-grade bonds. The euro portion is being offered even lower, at 3%.

Such low yields were last seen before the virus sparked the biggest sell-off since the financial crisis, and prompted the Fed to announce it would purchase both investment grade and fallen angel junk bonds. Technology firm PTC Inc. priced a $500 million five-year bond at 3.625% in January, while VICI Properties Inc. got a $750 million deal at 3.5% that month. By the time the offering is complete, we expect the yield on US bonds to slide even further, potentially below 3.5% as underwriters capitalized on the unprecedented demand.

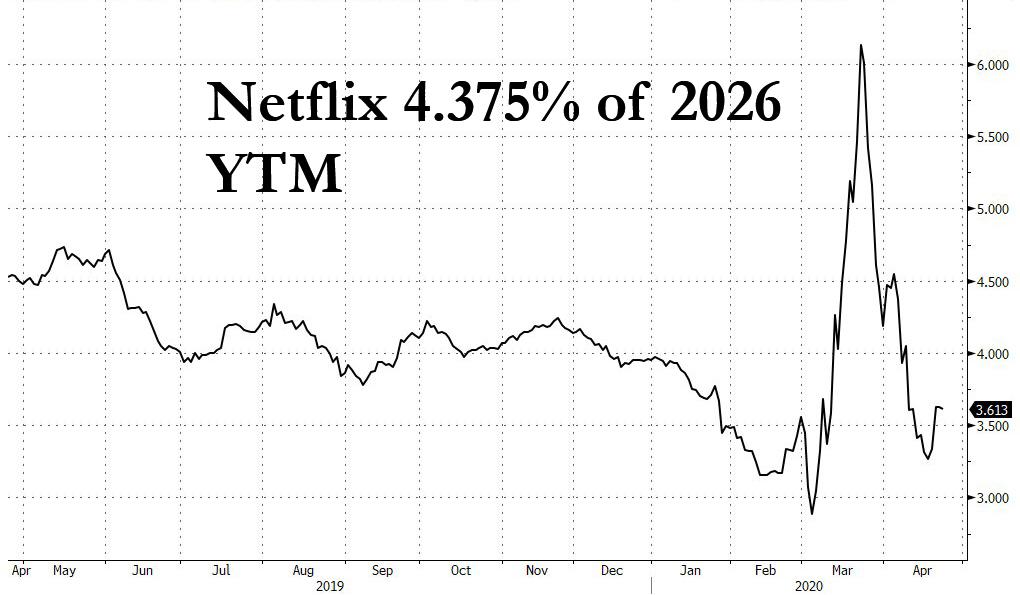

During the March crash, Netflix bonds tumbled, with the yield on its bonds maturing in 2026 doubling from 3% to above 6% briefly, before tumbling right back down to 3.6%

Bond investors are rewarding Netflix for benefiting from the coronavirus pandemic, after adding a record 15.8 million subscribers in the first quarter and turning its first quarter of positive free cash flow since 2014, mostly due to shuttering its new content production pipeline.

Even so, Netflix remains a years away from achieving sustained positive free cash flow, so it makes sense to build up a war chest especially at such cheap rates, according to Bloomberg Intelligence analyst Stephen Flynn.

“Given the outlook for many high-yield issuers is so uncertain in response to the pandemic, Netflix may offer a much higher level of certainty in future performance given its business model,” he said. The model “is well-situated for a social-distanced environment,” according to Flynn.

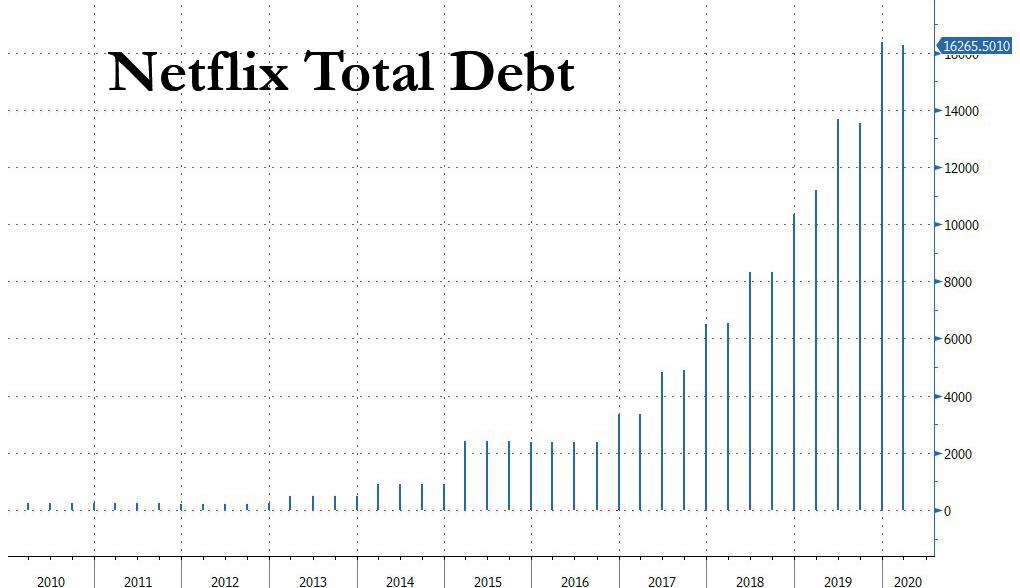

The new offering means that Netflix’ total debt will rise from an already record $16.265 billion to a new all time high above $17 billion, even as both LTM EBITDA and cash flow remain deep in the red.

Netflix will use the net proceeds for general corporate purposes, which may include content acquisitions and for production and development.

Tyler Durden

Thu, 04/23/2020 – 15:17

via ZeroHedge News https://ift.tt/34Zf8EZ Tyler Durden