Unintended Consequences: The Fed’s Record Liquidity Flood Has Broken Europe’s Funding Markets

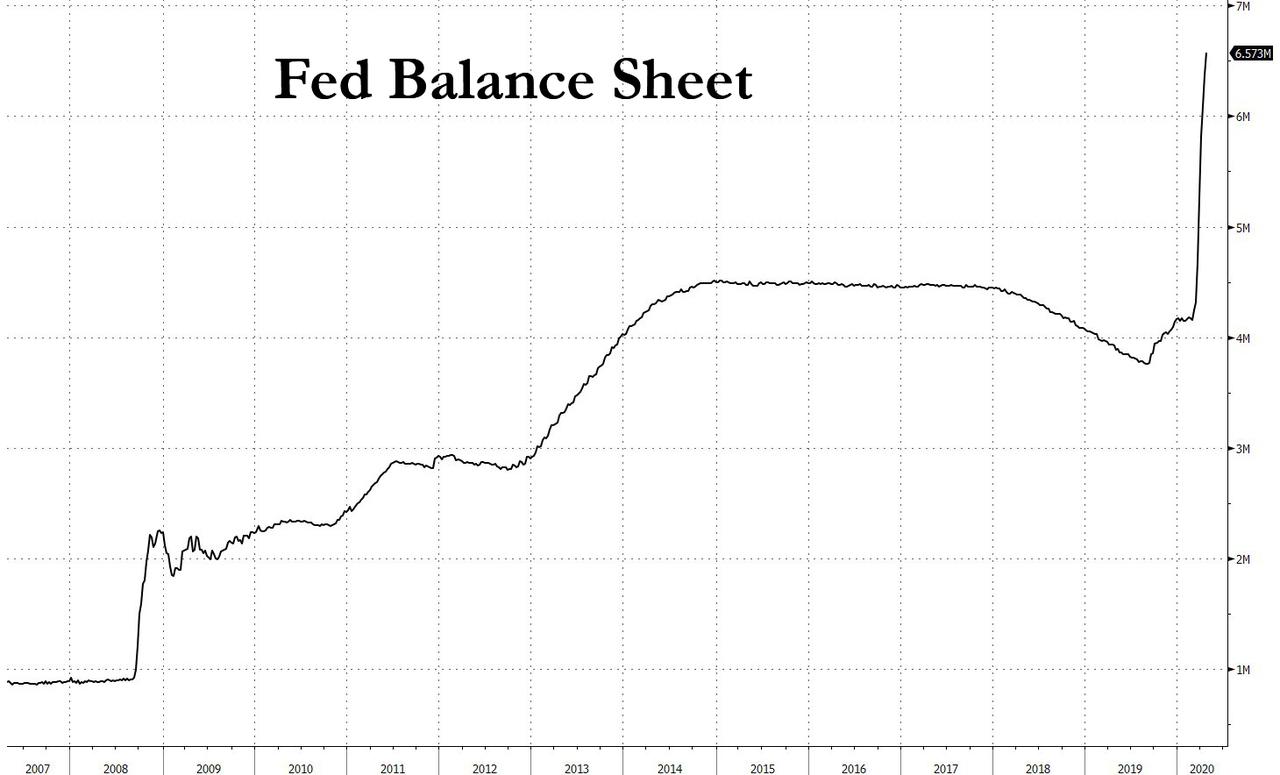

Another week, another record in the Fed’s balance sheet, which as of April 22 hit an all time high $6.573 trillion, an increase of $205 billion on the week, up $2.644 trillion compared to a year ago and well on its way to $10 trillion.

Yet while the liquidity flood unleashed by the Fed’s balance sheet, and its expanded swap lines has calmed dollar funding markets which were paralyzed as recently as a month ago, and USD Libor dropped below 1% for the first time in a month, an unintended consequence of the Fed’s monetary flood is that it now appears to be paralyzing Europe’s interbank market.

This can be seen in Europe’s version of Libor, 3-Month Euribor, or the rate at which banks borrow from one another, which jumped another 2.9 bps to a fresh four-year high on Thursday, of just above -0.20% even after the ECB tried to ease funding pressures by moderating collateral restrictions for financial institutions seeking to borrow from the central bank.

A key driver behind the Euribor spike is that, in Bloomberg’s view, the Fed has helped bring down the cost of dollars to such an extent that they’re cheaper to borrow in cross-currency markets than any major currency. As a result, opportunistic players are tapping local markets to swap into dollars, elevating domestic borrowing costs.

Others have a more nuanced view, with Bank of America pointing out that the rise in EURIBOR to its highest level since 2016 “signals stress in the euro area’s interbank market.“

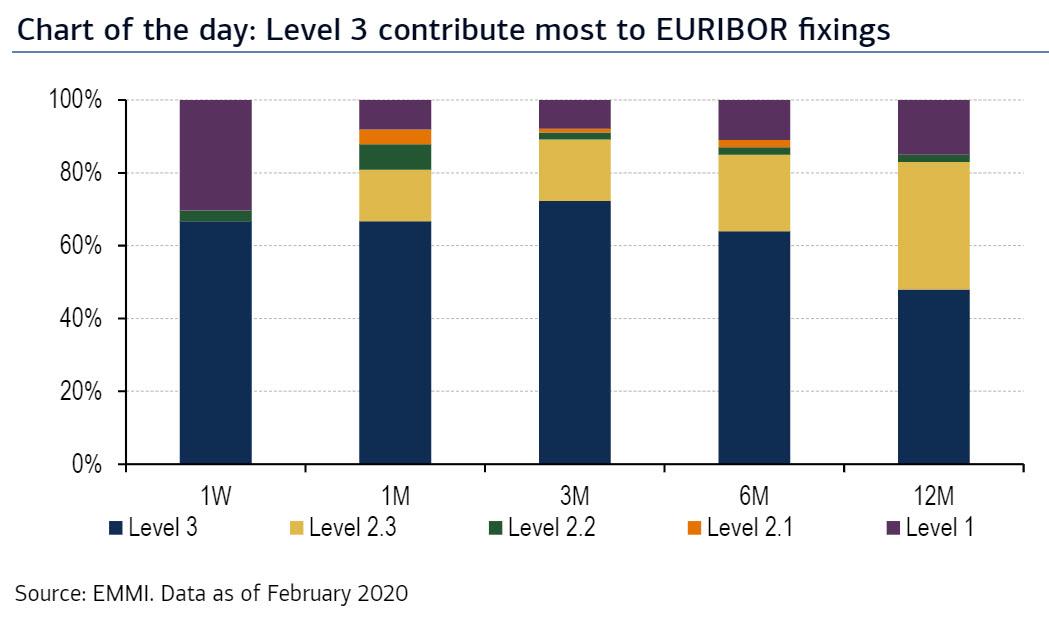

According to BofA, the surge in Euribor means that the wholesale euro unsecured borrowing rate of 18 panel banks in the EU and European Free Trade Association (EFTA) countries has increased. As the bank explains, EURIBOR fixing submissions are based on a hybrid methodology that uses transactions to the extent possible. But eligible EURIBOR volumes are low, especially for tenors above 1W.

In February, between 48% and 66% of EURIBOR fixings were based on level 3 contributions, which are least dependent on eligible transactions.

EURIBOR’s Governance Framework states that level 3 contributions are based on additional transactions data in the underlying interest that were excluded from level 1 and level 2 contributions, and other data from a range of markets closely related to the unsecured euro money market.

The data should then be used through a combination of modeling techniques and/or the panel bank’s judgment. A particular model is not mandated by the administrator and panel banks should determine their contribution based on their own circumstances. This implies there is unlikely to be a one-size-fits-all model for level 3 contributions across panel banks and different markets could have varying influence over time.

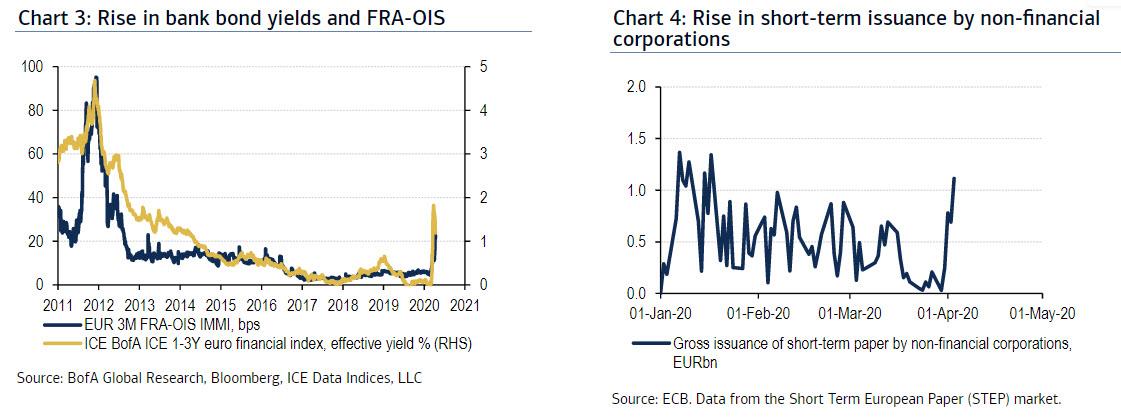

BofA then suggests that the recent stress in key markets has impacted level 3 EURIBOR submissions via other data closely related to the unsecured euro money market. One such transmission mechanism involves the increase in bank bond yields, which could have put upward pressure on EURIBOR forwards.

It is at this point that the two narratives combine, because in picking up on Bloomberg’s story, BofA observes that the recent tightening (less negative) of the cross currency basis due to the FX swap lines established by the US Federal Reserve with central banks globally and high USD funding costs have also increased supply of, and decreased demand for, EUR-denominated bank paper swapped back into USD.

Indeed, the EUR FRA-OIS spread also increased to its highest level since 2012, which suggests the rise in bank bond yields is related to interbank stress (Chart 3). But BofA previously noted there were no liquidity concerns in the euro overnight repo market when the FRA-OIS spread first started to widen. Therefore its interpretation is that the increase in the FRA-OIS spread is driven by broad credit concerns due to developments in COVID-19 and in the oil market negatively affecting the global outlook. Furthermore, broad credit concerns may have also been reflected in the rise in non-financial CP issuance and yields (Chart 4).

Looking ahead, BofA is optimistic and believes that the ECB’s inclusion of non-financial CPs to its asset purchasing programme (APP) and Pandemic Emergency Purchasing Programme (PEPP) could act as a strong backstop for the rise in non-financial CP yields. A rebound in global oil prices would also help. But while these measures may address the negative consequences of COVID-19, they do not address the issue of COVID-19 itself. As such, the prospect of deterioration in the COVID-19 situation remains a key upside risk for EURIBOR.

Bloomberg is similarly optimistic, writing that some analysts view the latest ECB measures as helping, and Pictet’s Frederik Ducrozet who wrote that “it provides a backstop for the market not to be concerned about bank funding issues related to a shrinking collateral pool in case of rating downgrades.”

Meanwhile, early signs in the futures market already suggest Euribor will ease lower within the next couple of months. One such easing will impact dollar Libor, whose spreads over swaps are expected to tighten – as indicated by futures markets – at which point three-month cross-currency basis should drift lower to erode the funding advantage for local currencies, and reduce the incentive for opportunists to bid up the cost of funds in domestic markets, in other words, the market is confident that the ECB’s massive liquidity injection will offset a similar action by the Fed, and offset the cheapness of the dollar in cross fx.

While Euribor is soaring, US Libor appears to have gotten over its recent scare, and has been declining, falling by 2.9bps on Thursday, below 1% for the first time since the covid crisis, and driving its premium above OIS by a similar amount. As we have noted previously, some traders are even bracing for negative Libor prints as the Fed inches closer to NIRP.

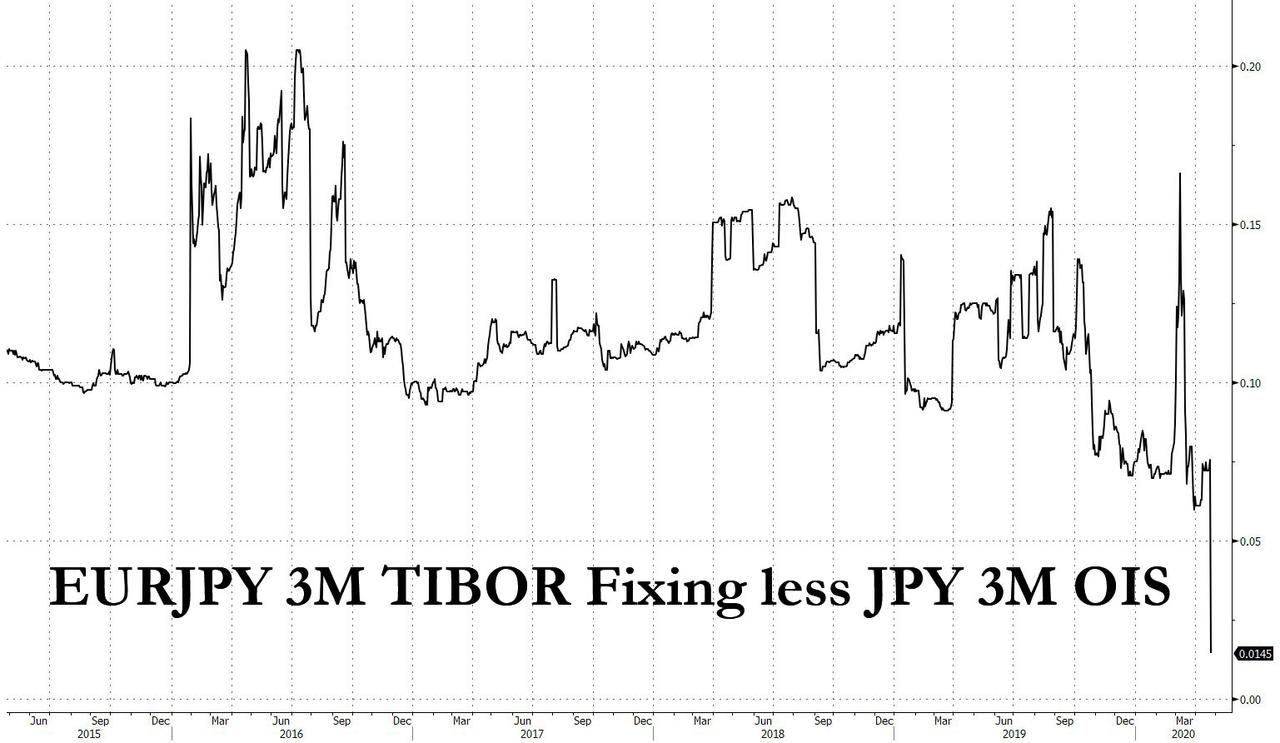

Yet as the US inches to the monetary singularity of negative rates, sub-zero rates are already a reality in Japan, where the three-month euro-yen Tibor fixing dropped 6.6 bps to -0.048%, posting a negative fix for the first time ever, with Euroyen futures popping higher in response.

With yen-OIS rates steady, Bloomberg suggests that the move was unrelated to policy expectations, and instead, overseas banks could be in the driving seat, potentially a result of the same stress that is pushing Euribor higher.

Whatever the explanation behind this odd squeeze in European money market rates, one thing is clear: we have gotten to the point where overly aggressive intervention by one central bank immediately necessitates an equal and offsetting intervention by all other central banks, or else the entire domestic banking system of whichever bank isn’t debasing its current the fastest faces immediate peril. And another dire consequence: we may have gotten to the point where it is no longer possible to find an equilibrium funding level for global currencies, one which – by definition – exists in a world of positive rates; however when interest rates everywhere are negative (or expected to be), then all bets are off and every single day is a new struggle by the central bankers to keep the system from collapsing.

Tyler Durden

Thu, 04/23/2020 – 22:12

via ZeroHedge News https://ift.tt/2Y20jjq Tyler Durden