Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

With news that the Gilead Remdesivir trial had reportedly met its primary endpoint hitting “coincidentally” just seconds before the Q1 GDP print, and with newswires initially reporting the GDP erroneously as a positive 4.8% print, it was clear that the real number would be a disaster, and sure enough moments later newswires reversed and reported that Q1 GDP was in fact, a worse than expected negative 4.8%, the biggest drop since March of 2009, and officially marking the start of the US recession. Current-dollar GDP decreased 3.5%, or $191.2 billion, in the first quarter to a level of $21.54 trillion, after increasing 3.5% in the fourth quarter.

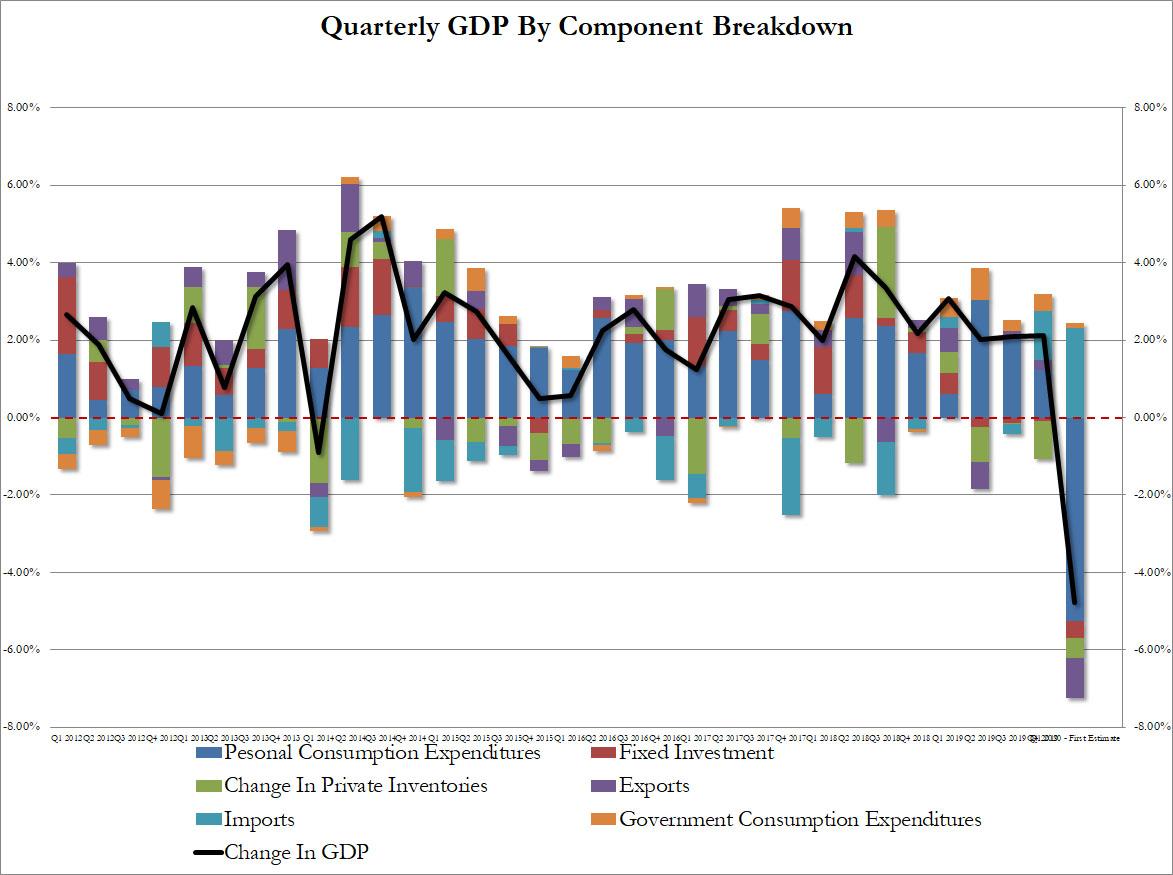

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

The increase in housing investment primarily reflected an increase in new single-family housing, while the increase in government spending reflected an increase in federal government.

Perhaps in response to demands from the White House, the BEA was quick to note that “the decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.”

The BEA nonetheless quantified the hit and found the following:

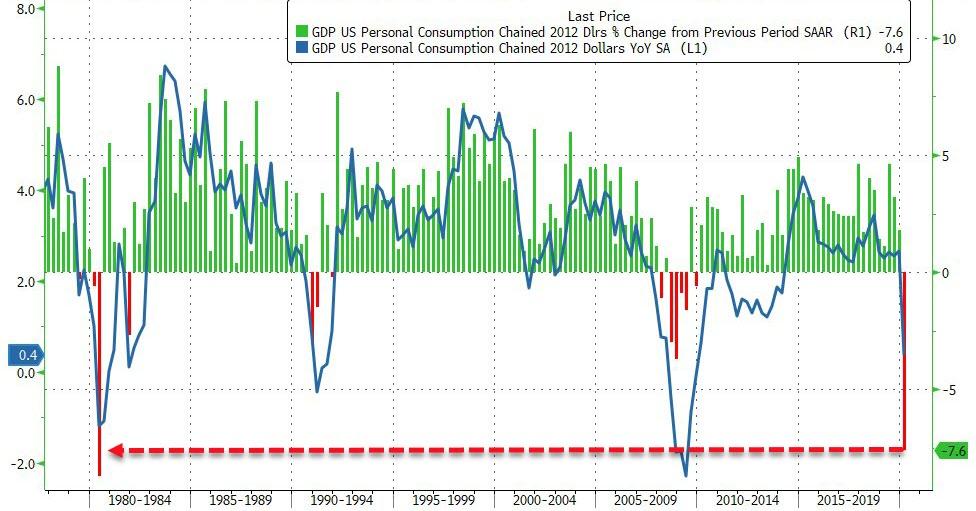

- Personal Consumption contributed -5.26% to the bottom line -4.8% drop, the biggest drop since 1980

- Fixed Investment shrank -0.43%, a drop from the -0.09% decline in Q4

- The Change in Private Inventories detracted another -0.53% from GDP, a modest improvement from -0.98% in Q4

- Exports shrank -1.02%, a deterioration from the 0.24% increase in Q4

- Imports were the sole bright spot, jumping 2.32%, double the 1.27% in the last quarter

- Government consumption also added a modest 0.13% to the bottom line, a decline from the 0.44% in the prior quarter.

Of note, the collapse in consumption was the biggest since 1980 which was to be expected with the economy on lockdown.

Separately, real disposable personal income increased 0.5 percent in the first quarter after increasing 1.6 percent in the fourth quarter. Personal saving as a percent of disposable personal income was 9.6 percent in the first quarter, compared with 7.6 percent in the fourth quarter.

Prices of goods and services purchased by U.S. residents increased 1.6 percent in the first quarter of 2020, after increasing 1.4 percent in the fourth quarter of 2019. Meanwhile, food prices increased 3.1 percent, while energy prices decreased 11.0 percent in the first quarter. Excluding food and energy, prices increased 1.9 percent in the first quarter of 2020, compared with an increase of 1.3 percent in the fourth quarter.

Finally, recall that the sharp slowdown only reflects two weeks of March going offline. As such the real question is what happens to Q2 GDP, and whether the expected ~30% drop in GDP will be the trough and whether a V-shaped recovery will follow.

Tyler Durden

Wed, 04/29/2020 – 08:39

via ZeroHedge News https://ift.tt/2yR8aG4 Tyler Durden