Global Markets Jump On Easing Of Lockdowns, Surging Oil

Traders are buying in May and not going away.

For the second consecutive day, US equity futures rose on Tuesday, bolstered by continued gains in the price of oil which headed for its longest winning streak in nine months amid optimism demand is rebounding and the peak of the production glut is behind us, while a slew of countries eased coronavirus-led restrictions in an attempt to revive their economies bolstering optimism for some random letter-shaped recovery.

Hopes for a recovery in demand boosted oil prices, helping energy giants Exxon Mobil and Chevron lead gains among the blue-chip Dow components.

Over in Europe, every sector climbed as the Stoxx Europe 600 advanced after slumping a day earlier and missing out on the late rebound for U.S. stocks. Shares of energy companies led the gains as oil extended its rebound. U.S. futures and European equities briefly trimmed gains as risk sentiment was curtailed after a 7-to-1 ruling from Germany’s top court over the legality of ECB stimulus found that some parts of the quantitative easing program aren’t backed by European Union treaties and gave the central bank three months to fix the asset purchase program. Total SA was among the big winners despite reporting a 35% plunge in first-quarter profit.

Earlier in Asia, there was little activity with markets closed in Japan, China and South Korea.

Wall Street snapped a two-day losing streak on Monday as gains in large tech and internet companies and oil prices outweighed concerns about the latest U.S.-China tensions and downbeat sentiment from the annual meeting of Warren Buffett’s Berkshire Hathaway.

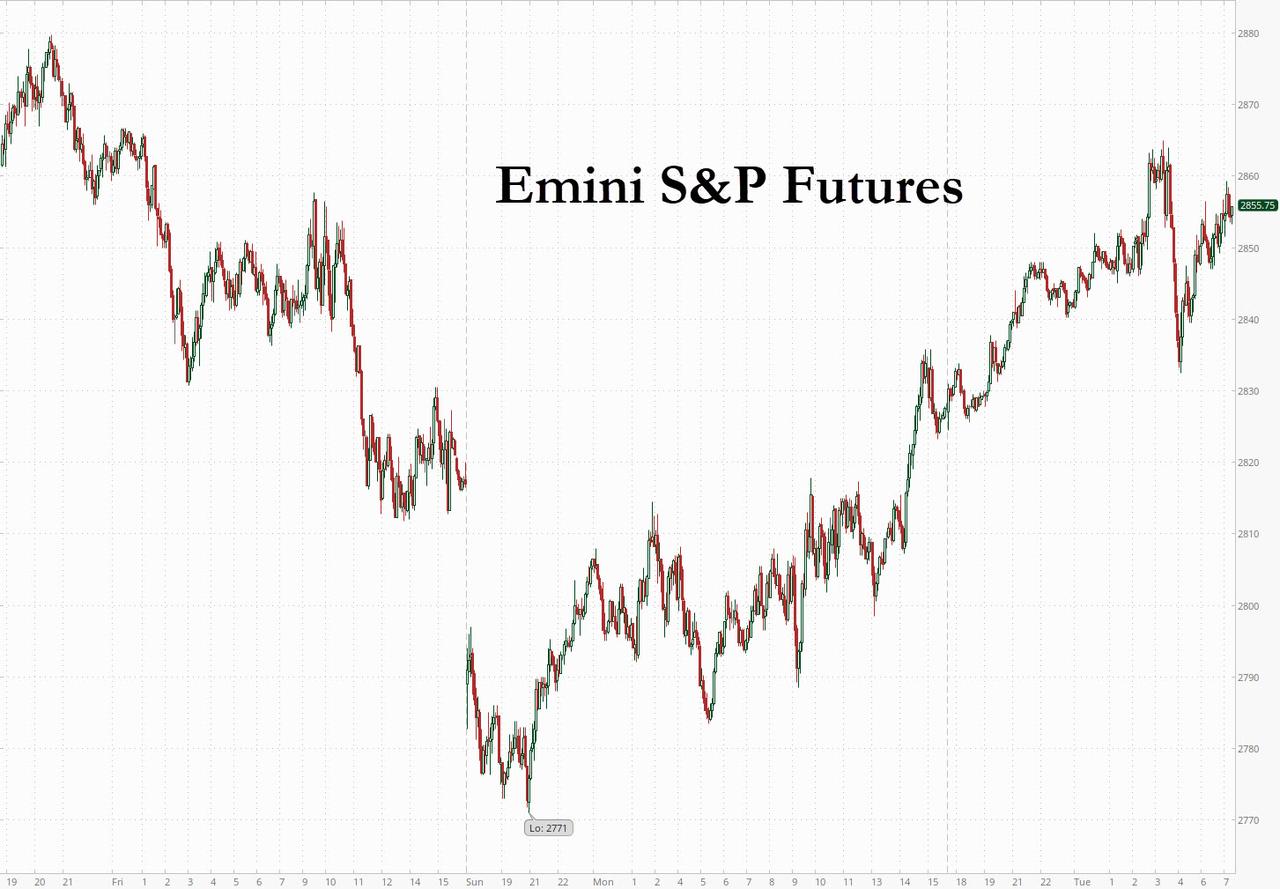

The S&P 500 has climbed about 30% from its March lows on the back of unprecedented stimulus measures and signs of a plateau in new COVID-19 cases in many areas. However, many market experts have warned that the rally could be tested amid a risk of another wave of virus infections and with growing evidence of the damage to economy and corporate America.

The euro fell as investors scrutinized a verdict from Germany’s top judges over the legality of European Central Bank stimulus. They ruled that some actions taken by the country’s Bundesbank to participate in the asset purchase program were unconstitutional. Most bonds in the region turned lower led by Italian debt.

“There is reaction among euro area government bonds, but this ruling in Germany is not definitive for sentiment today on global markets,” said Stephen Gallo, head of European FX strategy at the Bank of Montreal. “Signs that lockdowns aren’t being severely re-tightened are setting the tone.”

Efforts by many major economies to start easing restrictions that have helped contain the coronavirus pandemic are inspiring a fragile confidence and hopes for an economic recovery. Countries including Italy as well as some U.S. states are tentatively lifting some restrictions this week but at the risk of a second wave of infection as global deaths surpassed a quarter of a million. However stocks remain on shaky ground as U.S.-China tension flares, and traders weigh the chances of a second wave of infections.

As global deaths from the pandemic topped 251,000, Hong Kong said it will ease curbs on social gatherings and reopen shuttered schools. California, the first state to shut down its economy over Covid-19, said it will start loosening its lockdown on Friday. Italy began to reopen its economy after two months. Spain started to relax its lockdown regime after weeks of confinement.

In rates and FX, Bloomberg Dollar Spot Index reversed an earlier loss and the greenback rose versus most Group-of-10 peers. The euro whipsawed after Germany’s constitutional court partly dismissed an ECB QE case but said some action is unconstitutional. The euro initially touched a session high against the dollar after the first headline on the ruling, before reversing, and losses extended as stops were hit around the 21-DMA; Italian bonds edged lower after the news. Treasury and bund yield curves bear steepened and commodity currencies, led by Australia’s dollar, held up well against the greenback as oil prices climbed; Australia’s central bank maintained policy and said it was ready to boost bond purchases, if needed.

WTI and Brent front month futures continue their grinds higher amid optimism of a rebalancing market as oil producers curtail output and economies gradually come back online. Further on the supply side, the Texas Railroad Commission is to convene today at 15:30BST to discuss and vote on mandated oil cuts. Markets largely expected the Commission to vote against the production limit.

Elsewhere, spot gold is on the backfoot amid the risk-appetite in the market and trades on either side of 1700/oz. Copper meanwhile remains underpinned by the risk-tone alongside the prospect of demand spurred by the reopening of global economics.

Expected data include trade balance and PMIs. Fiat Chrysler, Cheesecake Factory, and Disney are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.5% to 2,840.25

- STOXX Europe 600 up 1.6% to 333.65

- MXAP up 0.6% to 143.59

- MXAPJ up 0.9% to 462.76

- Nikkei down 2.8% to 19,619.35

- Topix down 2.2% to 1,431.26

- Hang Seng Index up 1.1% to 23,868.66

- Shanghai Composite up 1.3% to 2,860.08

- Sensex up 0.6% to 31,889.14

- Australia S&P/ASX 200 up 1.6% to 5,407.07

- Kospi down 2.7% to 1,895.37

- Brent futures up 6.8% to $29.05/bbl

- Gold spot down 0.1% to $1,699.70

- U.S. Dollar Index up 0.4% to 99.92

- German 10Y yield rose 3.4 bps to -0.529%

- Euro down 0.1% to $1.0892

- Italian 10Y yield rose 0.4 bps to 1.593%

- Spanish 10Y yield rose 0.3 bps to 0.762%

Top Overnight News from Bloomberg

- The European Central Bank’s quantitative-easing program looks set to fight another day, even after German judges issued a three-month ultimatum to fix flaws in the controversial measure. In a 7-to-1 ruling, judges said that it isn’t backed by European Union treaties

- Hong Kong’s leader said some social distancing measures will be eased, Italy began to reopen its economy after two months and Spain started to relax its lockdown regime after weeks of confinement. In the U.S., California and Arizona took steps toward reopening as New York reported the fewest new infections since mid-March

- Chinese state media unleashed a torrent of criticism against Secretary of State Michael Pompeo – – calling him “evil” and a liar — as Beijing sought to push back against the U.S.’s virus allegations without prompting a confrontation with President Donald Trump

- Italian banks are seeking to remove another 6 billion euros ($6.6 billion) of non- performing loans from their books before a new wave of toxic debt is unleashed because of the coronavirus outbreak

- Australia’s central bank kept the interest rate and yield objective unchanged Tuesday as it braces for the shock from the shuttering of large parts of the economy to stem the spread of the coronavirus

- With the U.K. government all but certain to ramp up spending to save jobs and keep businesses afloat, BOE Governor Andrew Bailey may signal he’s willing to buy more debt to keep borrowing costs from rising. At the current pace, the central bank will hit its current bond-buying goal around the end of June

- U.K. new-car registrations plunged 97% in April to a level not seen since February 1946, after the government closed auto dealerships and other businesses to slow the spread of the coronavirus

Asian equity markets traded positively as the region took impetus from the rebound on Wall St where all major indices spent the session gradually paring earlier losses from the renewed US-China trade tensions and geopolitical concerns in the Korean peninsula, with the upside led by strength in tech and energy. As such, ASX 200 (+1.6%) is higher with the energy names mirroring the outperformance of the sector stateside on continued gains in oil prices and with strength seen across all of the big 4 banks, while Afterpay Touch extended on its rally after Tencent recently became a substantial shareholder in the Co. Hang Seng (+1.1%) was also underpinned by the improved risk tone and following comments from Chief Executive Lam who stated the time has come to ease social distancing measures and that she will announce the easing of restrictions as soon as possible. However, gains were limited by GDP data which showed Hong Kong fell deeper into a recession with the largest contraction on record for Q1 and as mainland China remained shut, alongside holiday closures in Japan and South Korea.

Top Asia News

- Australian Central Bank Holds Fire as It Braces for Economic Hit

- At Least China’s Big Market Reopen Won’t Be So Brutal This Time

- ‘Mind Boggling’ 122 Million Jobs Lost in India, CMIE Says

- Malaysia Cuts Key Rate by Most Since 2009 as Economy Reopens

Stocks remain positive territory [Euro Stoxx 50 +1.0%] following on from a similarly positive APAC session, albeit stocks saw substantial downside on the release of the German Constitutional Court verdict which issued a three-month ultimatum to the ECB in order to demonstrate proportionality – i.e. the monetary objectives of PSPP are not disproportionate to the economic and fiscal policy effects. Should the ECB fail to show this, then the Bundesbank may no longer participate in PSPP. On the release, DAX cash slipped from around 11,700 to around 10,6200 before continuing to trickle lower before finding a recent base just above 10,500. Sectors are all in the green with outperformance in the energy sector as the oil market continues its upwards trajectory. Some defensive sectors also lag cyclicals – with the exception of Healthcare. The sector breakdown also paints a similar picture with Oil & Gas and Basic Resources the top performers – whilst Household Goods and Food & Beverages reside on the other side of the spectrum. In terms of individual movers Infineon (+2.5%) rises post-earnings despite mixed numbers as the group issued earnings following its withdrawal earlier in the year. SAP (-0.8%) is weighted on after it identified that some of its cloud products did not meet one, or more, of the contractually, agreed or statutory IT security standard conditions – this affects 9% of customers. Total (+5.4%) is supported post-earnings amid the rise in oil prices alongside announcing that new measures taken will allow organic cash breakeven to remain below USD 25/bbl in 2020. Finally, Pandora (+6%) resides towards the top of the Stoxx 600 after noting in its earnings that it has the liquidity to sustain a stress-test scenario where all physical stores are temporarily closed throughout 2020.

Top European News

- Irish Banks Again Europe’s Worst Performer as Crashes Add Up

- Britain May Get First Floating Gas Store to Ease Reserve Crunch

- U.K. Services Hit a Wall in April, Deepening Virus Malaise

- Italian Bonds Fall After German Court Rules on ECB Bond Buying

In FX, The euro currency was already on the verge of relinquishing 1.0900+ status vs the Dollar ahead of the German Constitutional Court’s judgement on ECB QE and only got a fleeting fillip when the verdict went in favour on the grounds of insufficient evidence support the motion that the policy measure violates the prohibition of monetary financing. However, some of the Bank’s actions are deemed to be illegal and not backed by the EU Treaty, so the Senate has set a 3 month deadline for the GC to clearly define PSPP proportionality in the context of associated economic and fiscal effects, after which time the Bundesbank may not be permitted to participate in the asset purchase scheme, or reinvestment following the transition period. Eur/Usd has subsequently slumped towards 1.0800 and support seen around 1.0800, with the DXY eyeing 100.000 given the Euro’s hefty weighting in the index.

- CHF – The Franc has extended declines against the Greenback to sub-0.9700 in wake of downbeat Swiss data and survey releases in the form of CPI and consumer confidence both turning more negative, but Eur/Chf has retreated further towards 1.0500 on the aforementioned Euro depreciation that may also have implications for the PEPP.

- NOK/SEK/AUD/CAD – Relative G10 outperformers, as the Norwegian Crown draws more momentum from oil’s continued recovery and the aforementioned Euro weakness to retest 11.2000, while the Swedish Krona takes some encouragement from preliminary Q1 GDP metrics showing resilience the economy before the anticipated COVID-19 demise, with Eur/Sek hovering just above 10.7000. Elsewhere, the Aussie is holding a portion of its post-RBA gains following unchanged rates, albeit off overnight peaks when stops were tripped beyond 0.6450, and the Loonie is also benefiting from the more pronounced rebound in crude prices within a 1.4030-95 range ahead of Canadian and US trade reports.

- GBP/NZD/JPY – All struggling to contend with Buck’s revival at the expense of the Euro in large part, but Cable has taken comfort from an upward tweak to the UK’s services PMI and Eur/Gbp’s reversal through the 200 DMA to stay afloat between 1.2420-85 parameters. Conversely, the Kiwi is being hampered somewhat by cross-winds given upside in Aud/Nzd from the low 1.0600 area to just shy of 1.0650 after the RBA, but pivoting 0.6050 vs its US counterpart in advance of NZ Q1 labour data tonight. Meanwhile, the Yen remains entrenched in Japanese holiday trade within a 106.50-90 band and waiting for the end of Golden Week that ends just in time for NFP on Friday.

- EM – Little respite for the Lira as attempts to pare losses become less compelling and shallower into the 7.0000 handle, with Usd/Try increasingly more inclined to extend the break and target record peaks not seen since Turkey’s economic, fiscal and currency crisis in 2018.

In commodities, WTI andBrent front month futures continue their grinds higher amid optimism of a rebalancing market as oil producers curtail output and economies gradually come back online. Further on the supply side, the Texas Railroad Commission is to convene today at 15:30BST to discuss and vote on mandated oil cuts. Markets largely expected the Commission to vote against the production limit –called “pro-rationing”. Texas is the largest US oil-producing state, with an output of around 5.4mln BPD, accounting for around 41% of the nation’s production. The State of Oklahoma (557k BPD) is expected to discuss quotas on May 11th followed by North Dakota (1.425mln BPD) on May 20th. In terms of bank commentary, UBS expects oil markets to be balanced in Q3 followed by a period of undersupply in Q4. The Swiss bank expects Brent proves to recover to USD 43/bbl by end-2020 but notes that global travel restrictions are likely to keep the market oversupplied in Q2. WTI June resides at the top of its current USD 21.13-22.77/bbl range while Brent July also sees itself at the top-end of its intraday USD 27.77-29.41/bbl band. Later today, eyes will be on the API data for back the storage decline narrative, with extra focus on Cushing. Some traders warn that although the metric may print a smaller build, this does not mean storage capacity is expanding – but rather less room for larger builds. Elsewhere, spot gold is on the backfoot amid the risk-appetite in the market and trades on either side of 1700/oz. Copper meanwhile remains underpinned by the risk-tone alongside the prospect of demand spurred by the reopening of global economics.

US Event Calendar

- 8:30am: Trade Balance, est. $44.2b deficit, prior $39.9b deficit

- 9:45am: Markit US Services PMI, est. 27, prior 27

- 9:45am: Markit US Composite PMI, prior 27.4

- 10am: ISM Non-Manufacturing Index, est. 37.9, prior 52.5

DB’s Jim Reid concludes the overnight wrap

One of the things that has kept me going through a busy but hard lockdown has been the final series of Homeland and the penultimate series of Better Call Saul. We finished both over the last two nights. For those who gave up on Homeland seven seasons ago after the ridiculous plot, all I can say is you’ve missed a show that got better and better with age. As for Better Call Saul it is possibly as good as Breaking Bad which is an incredibly high bar. So my wife and I now have a hole to fill. After high level negotiations we’ve decided to move onto the latest series of Narcos tonight.

Global equity markets had a plot twist last night as after looking set to continue their fall yesterday a late rally saw US stocks finish slightly higher as oil continued to recover (WTI +3.08%). However the rally also seemed to coincide with California reporting the fewest covid-19 deaths since early April and potentially opening lower-risk businesses as soon as this Friday.

The S&P 500 was up slightly (+0.42%) by the close, impressive given futures were -1.74% at the lows in Asia on Monday with the index over -1% lower just after the US open. One sector that couldn’t claw all the way back were US airlines following Warren Buffet’s weekend announcement that Berkshire Hathaway had completely exited its stakes in the four major carriers. American Airlines (-6.96%), United Airlines (-4.34%), Delta Airlines (-5.67%) and Southwest Airlines (-4.95%) all saw major falls. Technology stocks continued to be the outperformers, with the NASDAQ finishing +1.23%. The VIX reversed course as risk assets rallied, with the volatility index falling -1.22pts to 35.97. Earnings weren’t the main driver yesterday but Tyson Foods fell -7.82% after the largest US meat supplier forecast lower production and higher costs during their earnings call before the US open, while not offering official guidance. After the close AIG reported earnings with about $272 million in costs attributed to virus losses, with the stock down only slightly -0.54% in post-market trading. CEO Duperreault said on the accompanying earnings call that it would probably be the “single largest” catastrophe loss ever, but that AIG was “in a strong financial position before this crisis began.” Like many other companies this quarter, the company withdrew previously released guidance and failed to offer a concrete forecast.

The bounce back overshadowed the US/China story as various news items over the last few days have all pointed to a further escalation in tensions. Reports yesterday suggested that the response will spill over into the trade arena too, with Reuters reporting US officials who said that the administration were seeking to remove global supply chains from China and were considering further tariffs as well.

Those Asian markets that are open are trading up this morning after taking their cue from Wall Street with the Hang Seng (+0.55%), ASX (+1.27%) and India’s Nifty (+1.46%) all advancing. Markets in Japan, China and South Korea are closed for a holiday. Futures on the S&P 500 are also trading up +0.59% while WTI is up a further +6.52% and closing in on $22.

Back to yesterday and European equities were among the hardest hit, although that was mainly because they were reacting to Friday’s falls elsewhere when they were closed for the Labour Day holiday. The DAX (-3.64%), the CAC 40 (-4.24%) and the FTSE MIB (-3.70%) all saw major declines, though the continent’s sovereign bonds had a more mixed performance. While the spread of both Italian (-1.9bps) and Greek (-1.4bps) 10yr yields over bunds tightened, those on Spanish (+1.3bps) and Portuguese (+2.2bps) widened. Elsewhere the dollar had its second strongest day in over two weeks, with the dollar index up +0.41%, though the pound continued its falls from last Friday, ending the session down -0.50% against the US dollar. That move comes ahead of the start of trade negotiations between the US and the UK today, which will be taking place via videoconference.

The moves in sovereign debt markets came ahead of an expected ruling from the German Constitutional Court this morning. They’ll be delivering their final verdict on the compliance of the ECB’s Public Sector Purchase Programme (PSPP) with the ECB’s mandate and the EU treaties, which prohibit the monetary financing of member states. The original case was actually filed back in 2015, shortly after the ECB started their original asset-purchase programme. The German Constitutional Court then requested an interim ruling from the European Court of Justice, who said in December 2018 that PSPP was acceptable as an instrument of monetary policy, so all eyes will be on whether the GCC agree with the ECJ or whether they might constrain German participation in ECB policy. As I said yesterday what I know about the German constitutional court could be placed on the back of a postage stamp with room to still write. However after an extra day of reading this has increased to a postcard size and from listening to our expert from Frankfurt Barbara Bottcher, it seems that the court could remind the euro area (and the markets) that the question of the Bundesbank’s participation in future risk mutualisation shouldn’t be taken for granted even as they’ll likely accept PSPP today. Whilst it would be a major shock to see a negative ruling the court could still define some conditions around PSPP. Don’t forget we haven’t even got to the legality of PEPP yet but as this current case has taken a few years to get to where we are then the market will cross that challenge when it eventually needs to.

Back to the US, DB’s Matthew Luzzetti has just gone live with his second podcast episode looking at how the US economy is being impacted by the Coronavirus. Visit https://www.dbresearch.com/podzept/ to listen and subscribe to Podzept on Spotify, Google and Apple Podcasts. Sticking with the US, the New York Fed said yesterday that it expects to begin purchasing shares of eligible ETFs in early May through the SMCCF and added that its lending through the PMCCF and SMCCF via purchases of corporate bonds will begin soon thereafter. In additional details, the New York Fed said that it “will generally not purchase shares of an ETF that are trading at a premium” of 1% above its net asset value, or if the NAV premium diverged from the trend of the previous year. It also clarified that companies will have to provide written certifications that they were not able to obtain financing through traditional channels if they wish to place debt directly with the Fed through the PMCCF and added that subsidiaries of foreign companies may use the facilities if they have “significant operations” – meaning “greater than 50%” of assets, income, operating revenues, or operating expenses – in the US, and a majority of employees based there. Meanwhile, the US Treasury said that it plans to boost the US borrowing from April to June by c. $3tn to fund new stimulus spending legislation and tax receipt deferrals.

In terms of data out yesterday, we got a bunch of manufacturing PMIs, though they didn’t get much attention since countries not on holiday had released on Friday, while the flash PMIs had already given us a clue as to the numbers. Anyway, once again the figures showed sharp contractions, with the final Euro Area PMI revised down two-tenths to 33.4, a record low since the series began in 1997. In terms of the countries without a flash reading, Italy and Greece came in at 31.1 and 29.5 respectively, a record low for both. Outside of Europe, India was another badly affected country, with a 27.4 reading.

Wrapping up with the other data, US factory orders fell by -10.3% (vs. -9.7% expected) in March, while durable goods orders fell by -14.7% (vs. -14.4% expected). Meanwhile in Hong Kong, GDP fell by -5.3% in Q1, the largest quarterly decline on record.

To the day ahead now, and there’ll be the aforementioned German Constitutional Court verdict on the ECB’s PSPP, as well as the start of negotiations on a UK-US trade agreement. We have a number of earnings announcements including Disney, while we’ll hear from the Fed’s Evans, Bostic and Bullard. Finally, data highlights include the services and composite PMIs for April from the UK and US, while there’s also the ISM non-manufacturing index for April from the US and March’s trade balance.

Tyler Durden

Tue, 05/05/2020 – 08:06

via ZeroHedge News https://ift.tt/2KZ8c1q Tyler Durden