As Nasdaq Erases 2020 Losses, Negative Rate Forecasts Send Yields To Record Lows

What’s wrong with this picture…

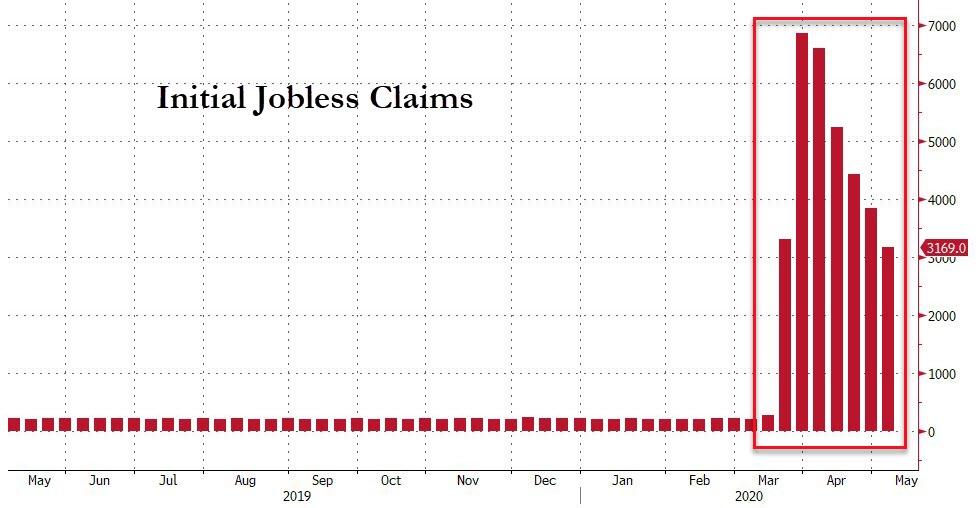

33 million Americans have gone on the dole in the last seven weeks…

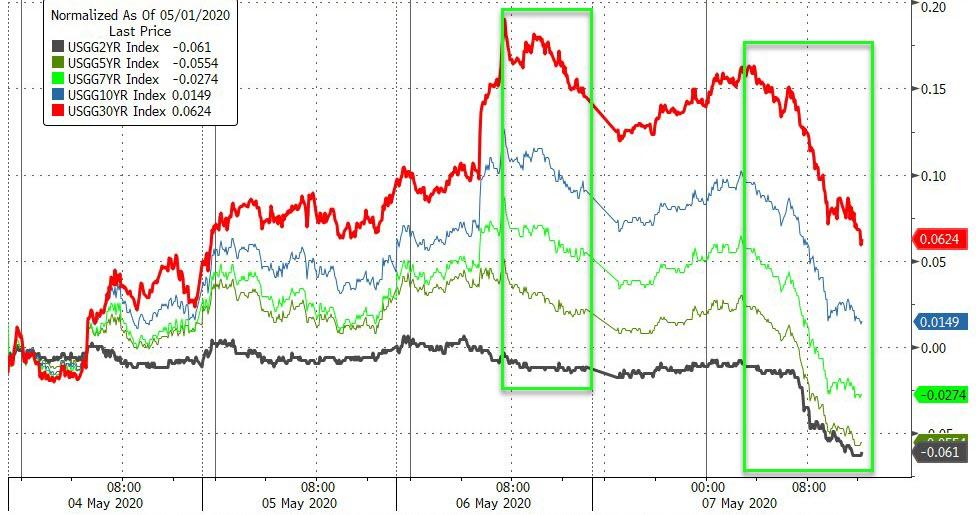

2Y Treasury yields broke down to record lows (as did 5Y)…

Source: Bloomberg

Negative rates are now being priced in for Q4 2020…

Source: Bloomberg

And Nasdaq Composite is now in the green for 2020…

Source: Bloomberg

So COVID-19 is “the worst of times” for Main Street and “the best of times” for Wall Street?

“Who care about COVID-19 anyway for Christ’s sake…”

By the close, The Nasdaq Composite had actually fought for that 8972.64 closing 2029 level…

On the day, US stocks were higher but well off the European close highs intraday…

Stocks were weak once again in the last hour or so of the day…

Source: Bloomberg

S&P Futs seem unable to break that 2880 level convincingly (which just happens to be the neutral gamma level)…

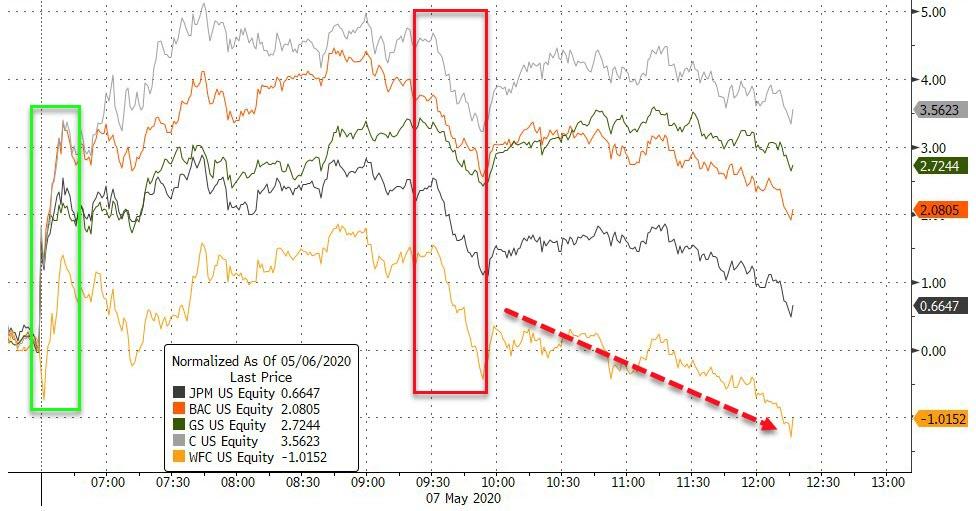

Bank stocks rolled over as the ED futs signaled negative rates (but remained higher on the day thanks to the early panic bid)

Source: Bloomberg

FANG Stocks made a new record high today…

Source: Bloomberg

The Internet stocks are soaring (and if you don’t know, “you’re too old to understand…” just buy ’em remember, nothing can go wrong)

Source: Bloomberg

Treasury ‘VIX’ jumped notably today as S&P ‘VIX’ drifted lower…

Source: Bloomberg

Treasury yields all tumbled today with the long-end outperforming (30Y -8bps, 2Y -5bps)

Source: Bloomberg

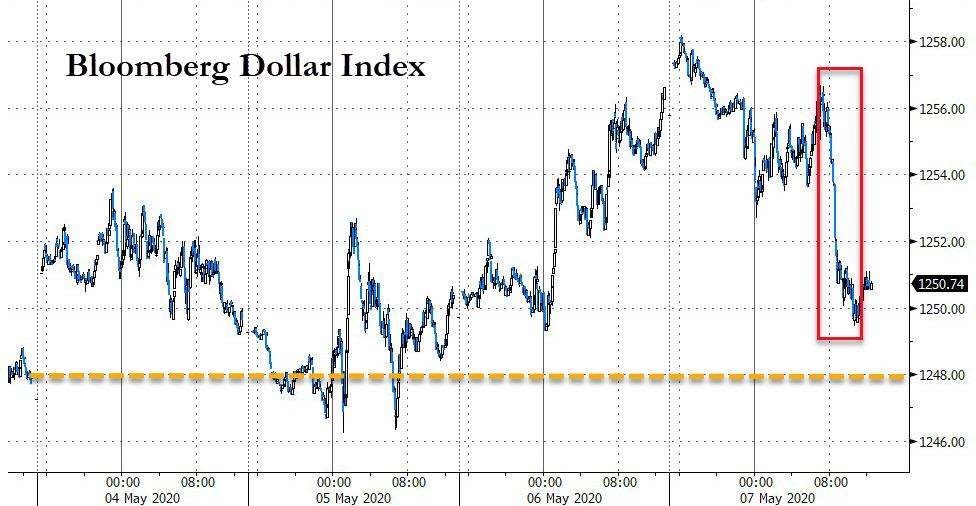

The dollar was also dumped as ED futs flipped negative…

Source: Bloomberg

As the dollar dropped, cryptos were bid but once again the rotation from alt-coin to bitcoin is clear…

Source: Bloomberg

And Bitcoin soared up towards $10,000

Source: Bloomberg

And gold was bid…

Another chaotic day in crude oil land but for once, WTI actually ended the day lower…

Finally, bonds and stocks have become drastically decoupled from one another…

Source: Bloomberg

But the big theme was the surge in Bitcoin and Bullion as NIRP came into play…

Source: Bloomberg

Tyler Durden

Thu, 05/07/2020 – 16:02

via ZeroHedge News https://ift.tt/3bk9oHD Tyler Durden