Historic Eurodollar Panic: Negative Rates Now Expected As Soon As November

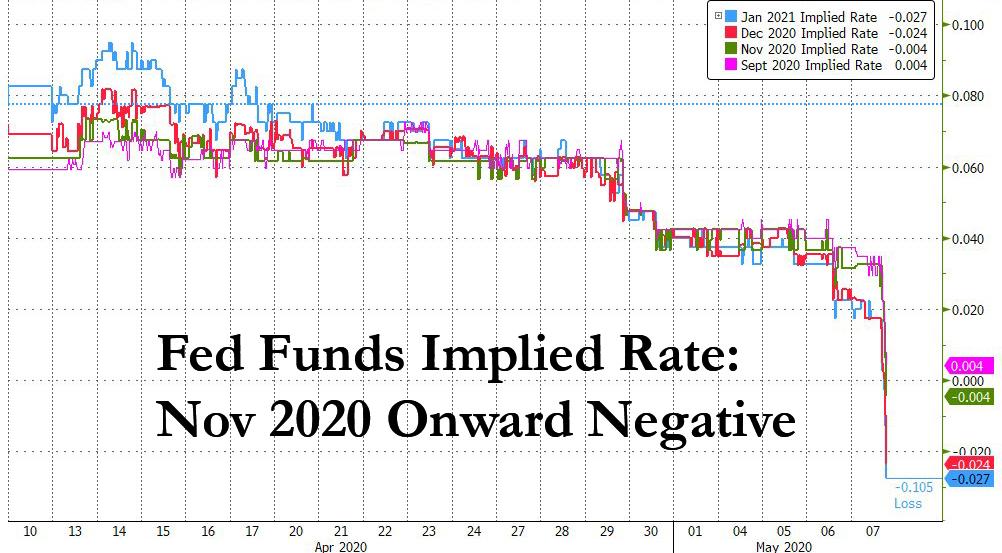

We, as well as every Short-Term Interest Rate trader on Wall Street (or rather at home) is speechless at the insane action in the Eurodollar futures complex, where shortly after the Jan 2021 implied fed funds rate turned negative, the cascade of buying in ED futures has tripped above 100 in both Dec and moments ago, November 2020, meaning that the market is now expecting negative rates as soon as November.

And if one waits just a few more minutes, the Sept 2020 contract is about to flip negative too, as the market now expects the Fed to go NIRP in as soon a 4 months!

Needless to say, for ED traders to expect negative rates in months if not weeks, means that the economy is about to implode, and it appears bank stocks are starting to wake up to just how bad this news is…

How that is still positive for stocks we leave to Jerome Powell to explain who is about to have the worst summer/fall of his life.

Tyler Durden

Thu, 05/07/2020 – 13:00

via ZeroHedge News https://ift.tt/2YKg1jE Tyler Durden