Record Plunge In Service Sector “Business Activity” Points To Profits Crash

Submitted by Joseph Carson, former chief economist of Allianz,

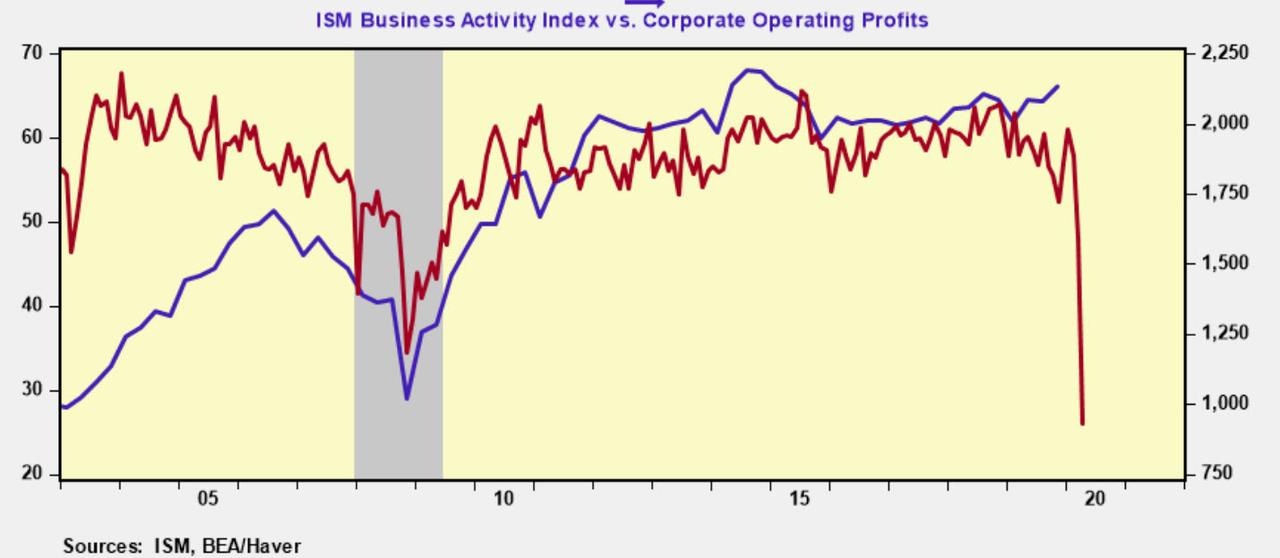

The Institute of Supply Management’s April Survey of the non-manufacturing sector (i.e., service industries) showed a record plunge in “business activity”. The scale of the decline is far bigger than anything seen during the Great Financial Recession and signals a record drop-in service sector Q2 revenue and operating profits.

The composite index for the non-manufacturing sector fell 10.7 percentage points to 41.8 percent in April, the lowest reading since March 2009. But the headline reading dramatically understates the severity of the collapse in the service sector.

The “business activity index”, one of the subcomponents of the current composite index, declined 22 percentage points to 26%, the lowest reading in the 22-year history of the non-manufacturing survey.

It is worth noting that the non-manufacturing composite index, which started in June 1998, initially used the “business activity index” as its composite index. Service industries define manufacturing categories such as orders, backlogs, exports, and supplier deliveries differently and in some cases, they are not even reported. As a result, when the ISM non-manufacturing index was launched in 1998 the “business activity index” proved to be the most timely and accurate measure of the growth and direction of change in the service sector.

(Note: the current composite index for the non-manufacturing index is based on four indicators with equal weights: “business activity”, employment, new orders, and supplier deliveries.)

Last month, 17 of the 18-service sector, industries reported a decline in “business activity”. The only service industry that recorded an increase in “business activity” in April was Finance and Insurance—an unusual gain as the economy faced a record plunge in sales and profits but is probably explained by the rapid and broad policy actions taken by the Federal Reserve.

Nonetheless, the historic low reading for “business activity index” suggests 17 of the 18 service industries saw almost no sales activity during the month. That plunge in revenue will result in a historic drop in Q2 operating profits.

During the Great Financial Recession the “business activity index” dropped to 34 percent in November 2008 and that coincided with a record drop in profits.

The current drop to 26 percent in the business activity index indicates that the decline in operating profits will be even larger than that of 2008/09.

Tyler Durden

Thu, 05/07/2020 – 15:50

via ZeroHedge News https://ift.tt/2A6w6Wx Tyler Durden