Goodbye Negative Rates? Fed Funds Slide After Powell Adds May 13 Speech On “Current Economic Issues”

Earlier today we reported that 2Y yields hit record lows after Fed Funds futures accelerate their move to suggest increasingly more negative negative rates this morning, with the first negative implied rates expected to hit as soon as November.

And why not: as we explained last night, Powell had to “immediately” address markets and forcefully explain that the Fed will not allow negative rates (unless of course the Fed does plan on greenlighting NIRP) or else risk another crisis if in a few weeks when Powell finally does address this issue, when NIRP has become far more institutionalize, and risk a market revulsion to a hawkish Fed.

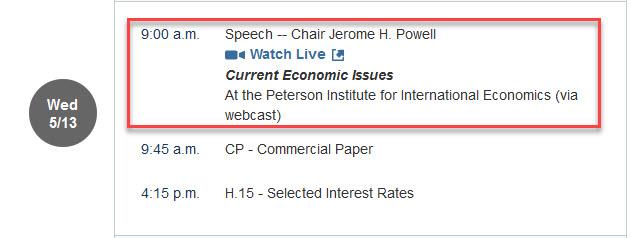

Well, we did not have long to wait, because with late 2020, early 2021 contracts hitting record high levels above 100 (implying increasingly more negative Fed Fund rates), some noticed that Powell’s schedule was updated to include a speech on the economy on May 13 discussing “Current Economic Issues.”

In kneejerk reaction, Fed funds futures, perhaps expecting that the topic of the ad hoc speech will be the rate inversion, immediately dropped with late 2020 contracts lower by as much as 2bp, while most contracts fell to session lows, with Dec20 trading at 99.99 after dropping ~1bp after the schedule change was reported. The Jan21 contract also dropped below 100 vs session high 100.04 reached around the time of U.S. jobs report release.

As a result, all those implied fed funds rates which had turned negative as recently as this morning, spiked above 0% for all the closely watched contracts, from Nov 20 to Jan 21, and no longer price in negative rates, which while potentially hitting yields which are now at session highs, has yet to be noticed by stocks which continue to trade at session highs on the day the US reported its worst jobs report ever.

Tyler Durden

Fri, 05/08/2020 – 15:30

via ZeroHedge News https://ift.tt/3csI6Qk Tyler Durden