Some Numbers…

Some numbers via BofA’s Michael Hartnett putting the recent market move in context:

-

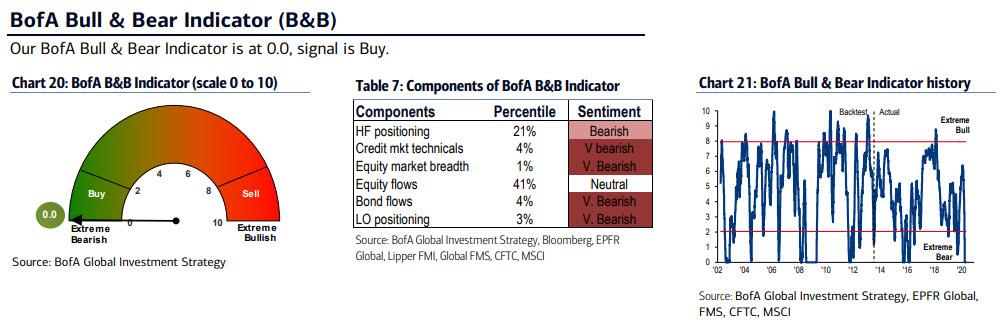

9/10 say bear market rally

-

8/10 say “U” or “W” recovery

-

7/10 say only buy what the Fed buys

-

6/10 expect retest of low

-

2/10 say 10Y yield >1%,

-

<1/10 say stocks in bull market;

-

$15 Trillion: global equity market cap gain since March low

-

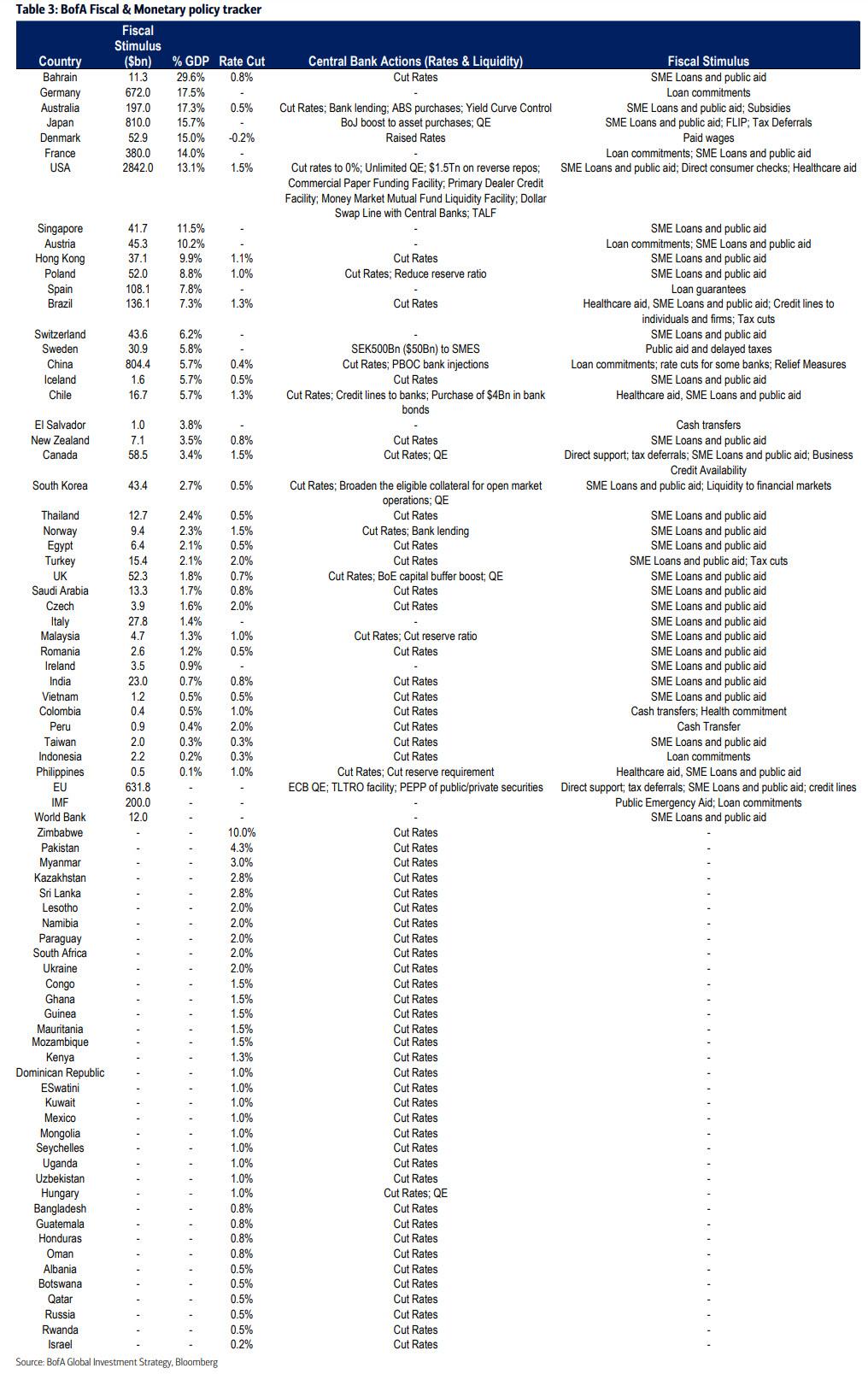

$16.4 Trillion: global policy stimulus (QE + fiscal) in 2020;

-

$9 Trillion 2020 QE

-

$7.4 Trillion: 2020 fiscal stimulus

-

107: global rate cuts in 2020

-

$9 Trillion: global GDP loss in 2020/21

-

$4.8 trillion in money market funds

-

33 Million: jump in US unemployment past 8 weeks;

-

13%: US household savings ratio

-

1945: last year in which Royal Dutch Shell cut dividend

-

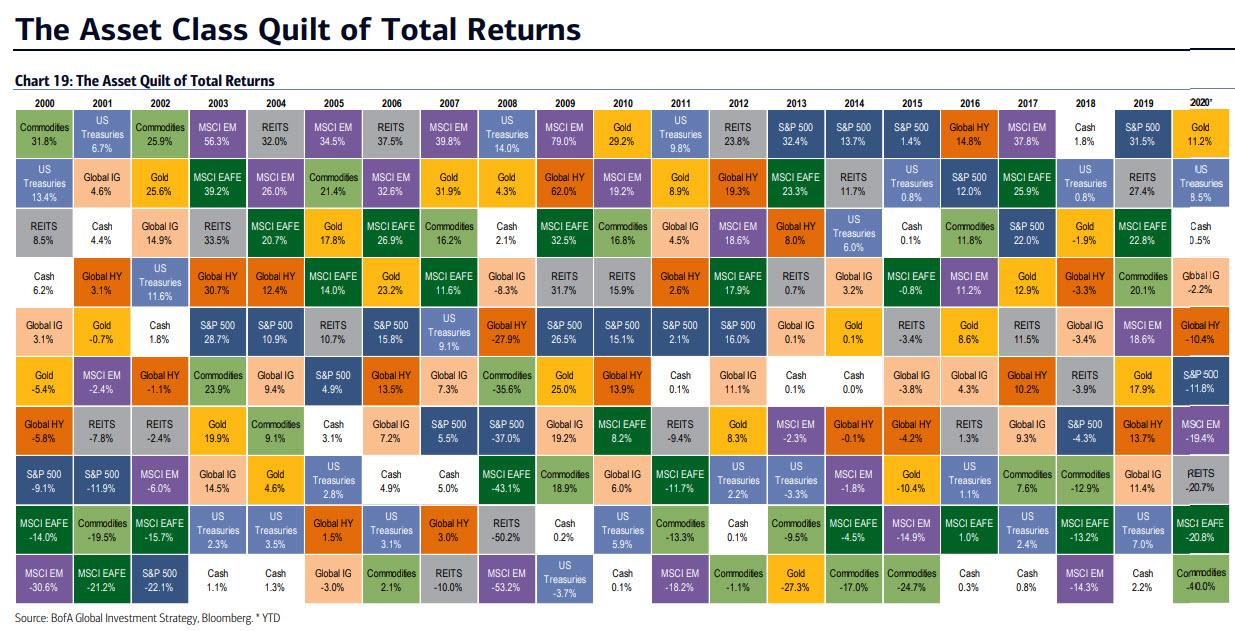

10.9% YTD performance of gold

-

8.5% US Treasuries

-

3.8% US dollar

-

2.9% government bonds;

-

0.5% cash

-

-11.8%: S&P500

-

-40%: commodities

-

0: BofA’s Bull and Bear Indicator

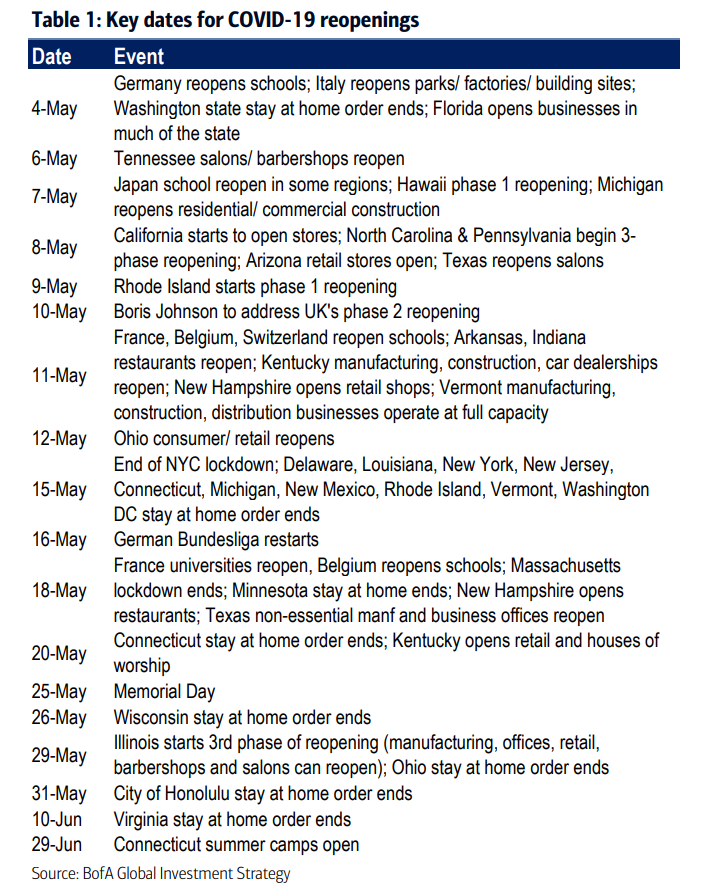

Bonus 1: Some Dates

Bonus 2: Some Bailouts

Bonus 3: Some Returns

Bonus 4: Some Investor Sentiment

Tyler Durden

Fri, 05/08/2020 – 15:55

via ZeroHedge News https://ift.tt/3chD21d Tyler Durden