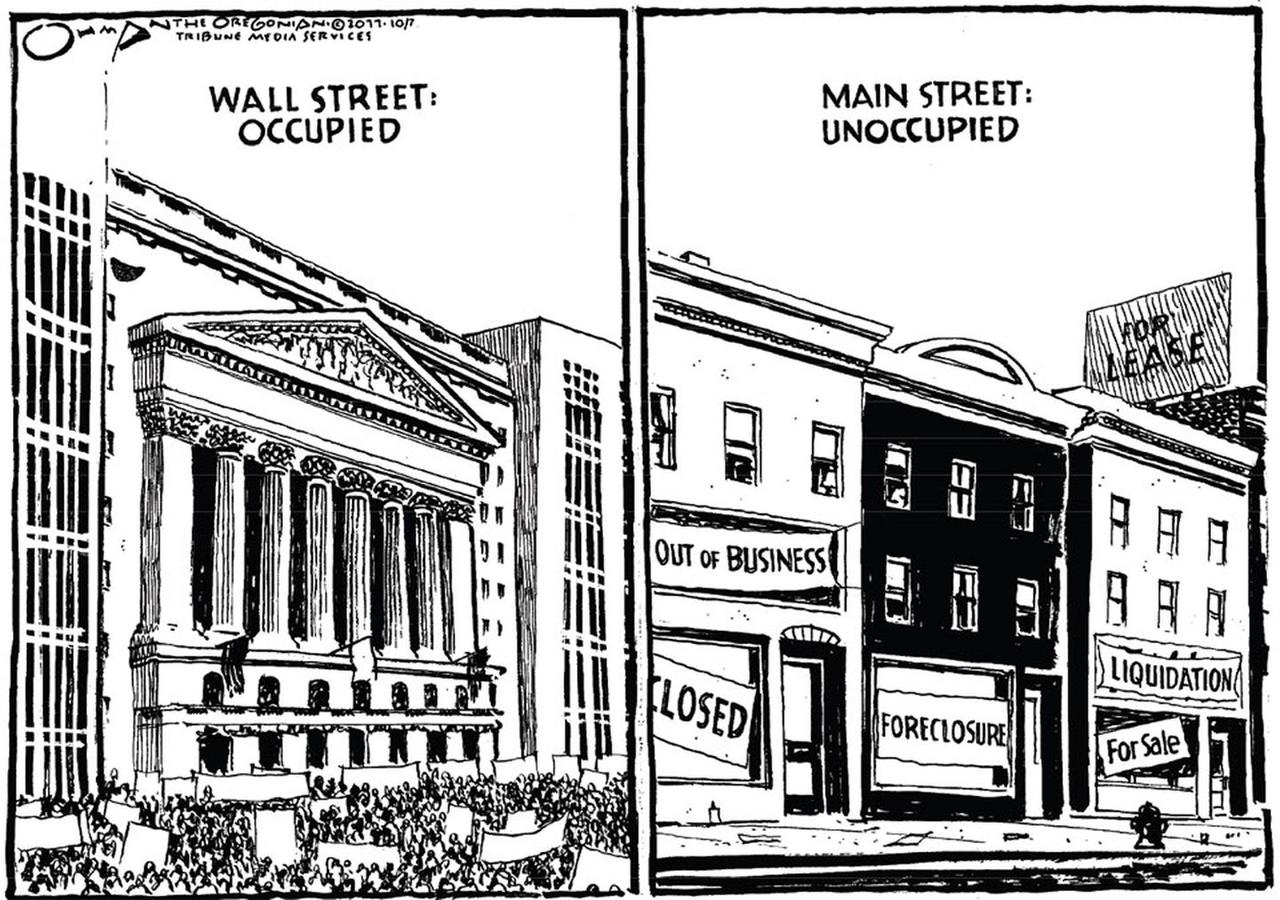

Wall Street Soars As Main Street Struggles With Lo’ Rates, No Jobs, & Mo’ Deaths

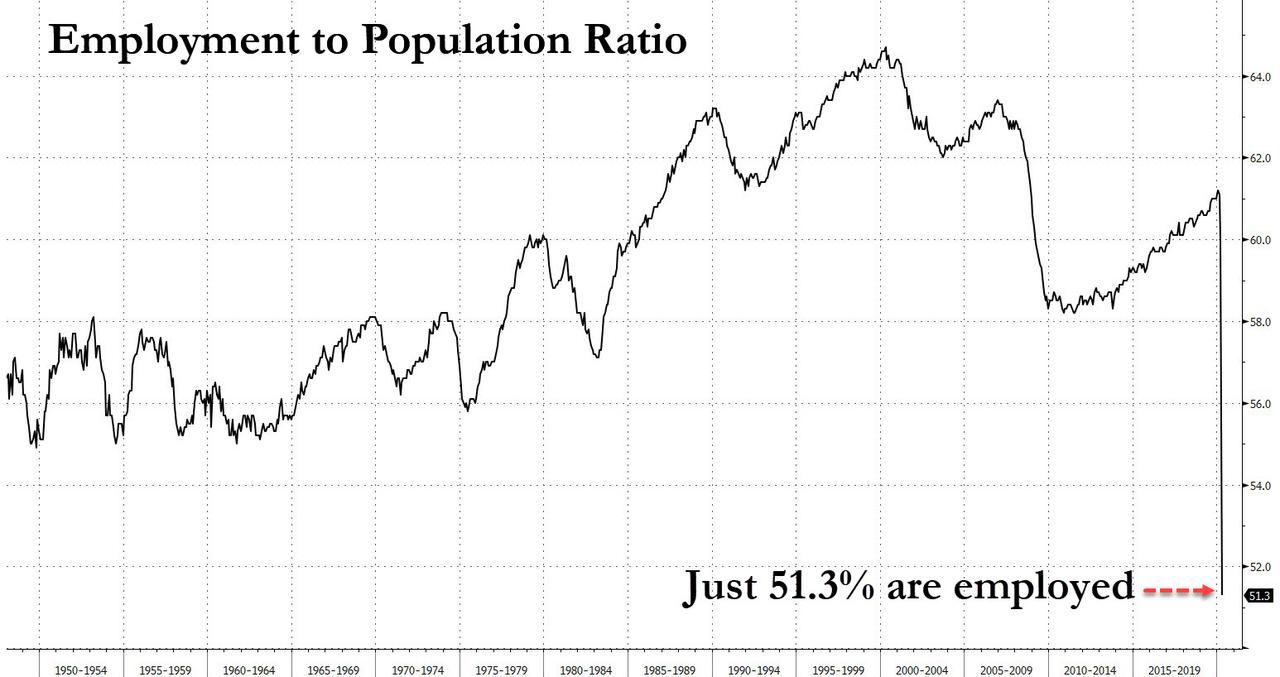

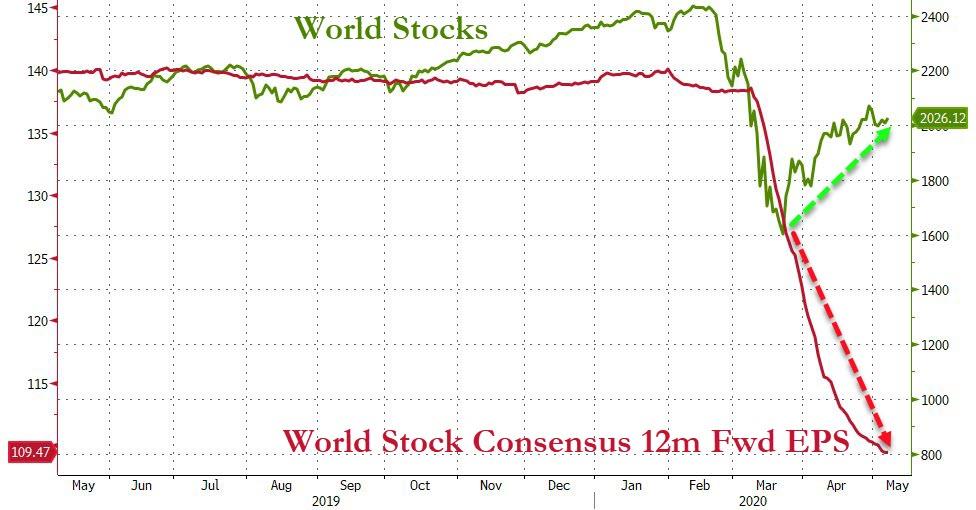

Record-Watch: For the first time ever, more than half the US population is not working; over 76,000 Americans dead from COVID-19; the US economy is contracting at record pace; earnings expectations are collapsing at near record pace; interest-rates at record lows (and imputing negative rates by year-end); and stocks are soaring at their fastest pace ever…

As we noted earlier, there was one especially scary aspect of today’s jobs report that has not gotten enough publicity, namely that as BofA writes, the employment to population ratio plunged to a record low, with only 51.3% of the population working. Inversely, this means that in April, 49% of the US population was not working.

Source: Bloomberg

And it’s going to get worse. How else do you explain the markets pricing in hope for The Fed to cut rates to minus-40bps by Dec 2020?

Source: Bloomberg

We do note that FF futures spiked when The Fed announced Jay Powell would hold a speech next week (theoretically enabling him to jawbone down any expectations of negative rates)…

Source: Bloomberg

Which must be great news for stocks: think of all the people who have nothing better to do than buy the fucking dip all day with all that helicopter money the Fed will be showering on them for the coming years.

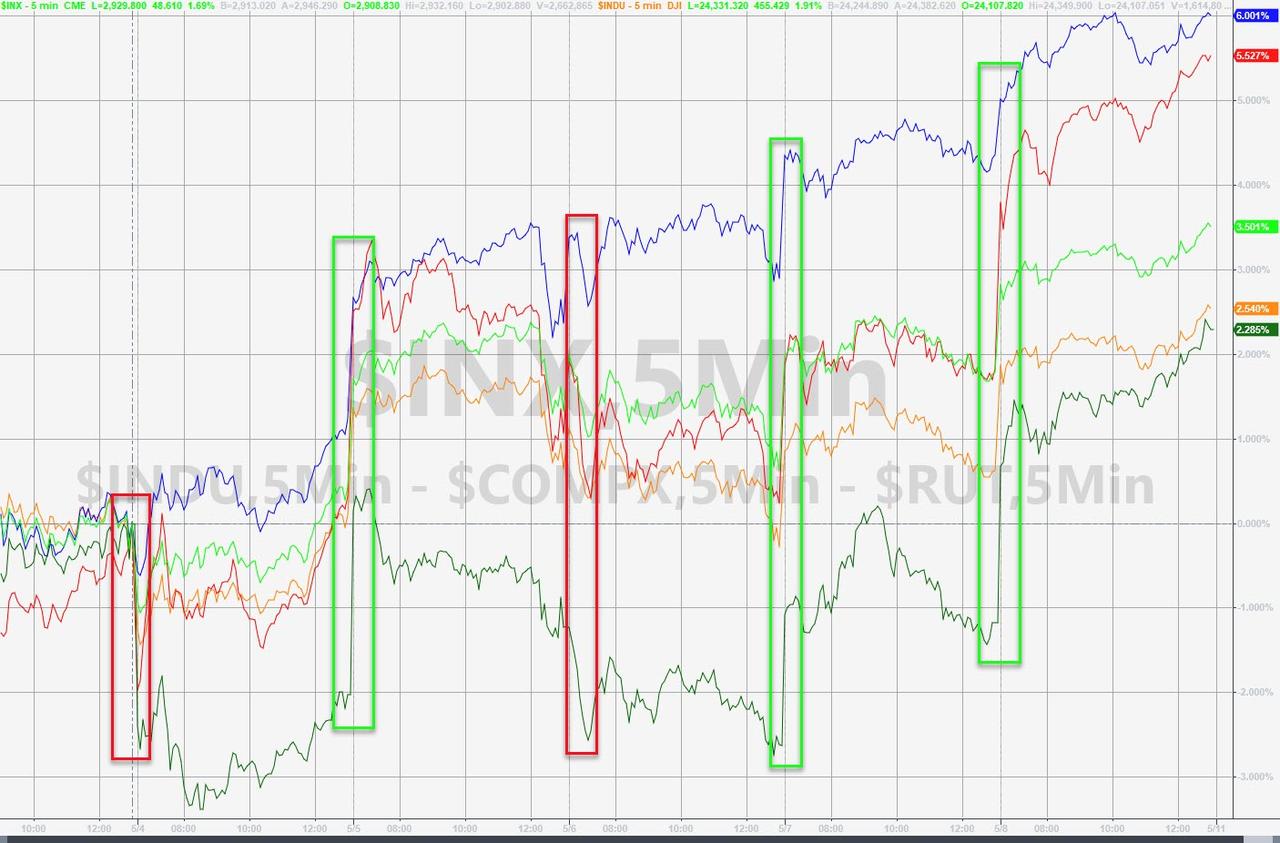

Nasdaq was up almost 6% this week and Small Caps ripped higher…

The Nasdaq composite was up 5 days in a row – the best streak since Dec2019 (when it went 10 days in a row without a drop)…

Sending Nasdaq green for 2020 – as if all those dead and unemployed people never mattered…

Source: Bloomberg

Because fun-durr-mentals are so bad, it must be good!!

Source: Bloomberg

Meanwhile, the nation is split politically between lockdown-deniers and stay-at-home-ers; and Democrats (who politicized the DoJ to entrap Flynn and launch a coup against Flynn) have demanded an IG probe into Barr’s politicization of The DoJ; and states/cities are demanding Federal bailouts for what they have over-promised their voters and benefactors for decades….

Small Caps and Nasdaq are up 38% from the 3/22 lows…

But volume has collapsed as stocks have gained…

Source: Bloomberg

Stocks piked to end the day on the highs as the Fed Funds futures market “tightened” away from negative rates expectations…

Source: Bloomberg

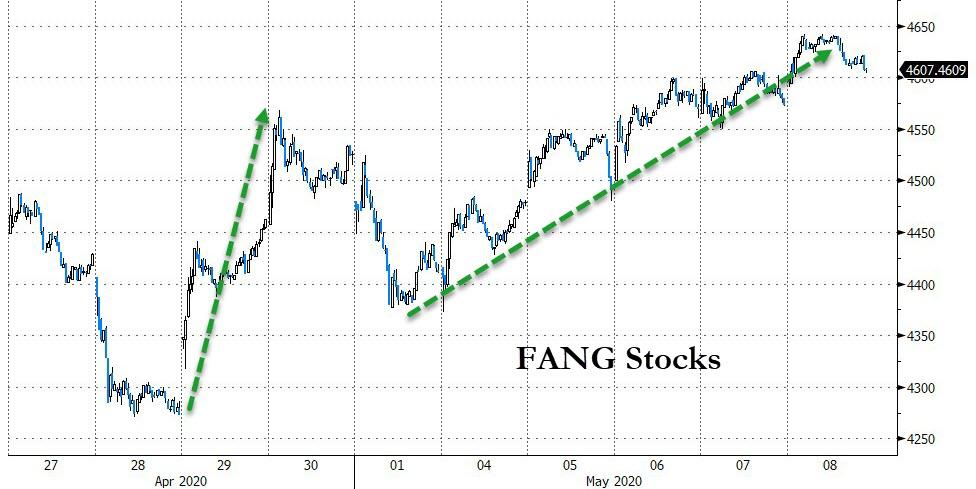

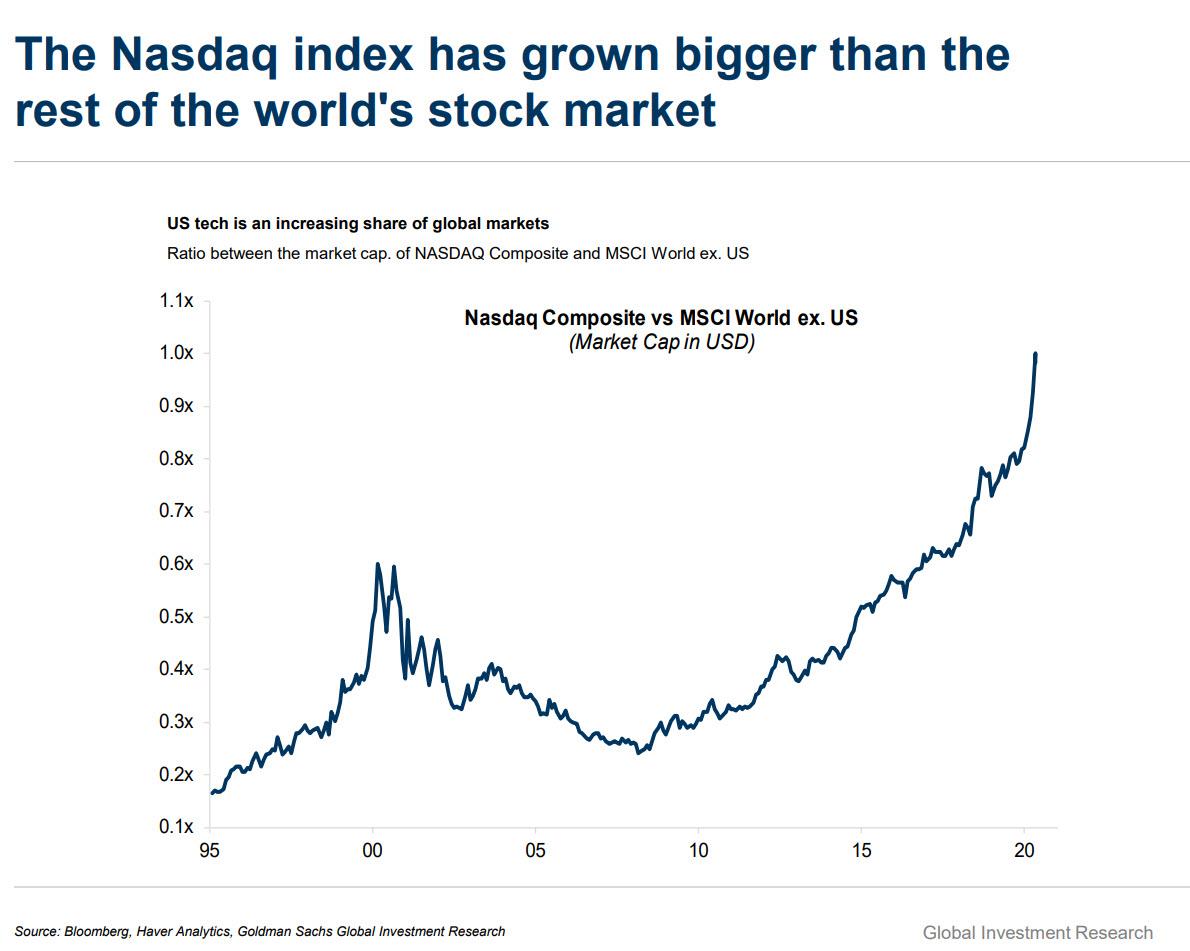

It’s the Internet, stupid!

Source: Bloomberg

FANG stocks are up 5 straight days (and 7 of last 9)…

Source: Bloomberg

Bank stocks were mostly higher on the week but quite volatile…

Source: Bloomberg

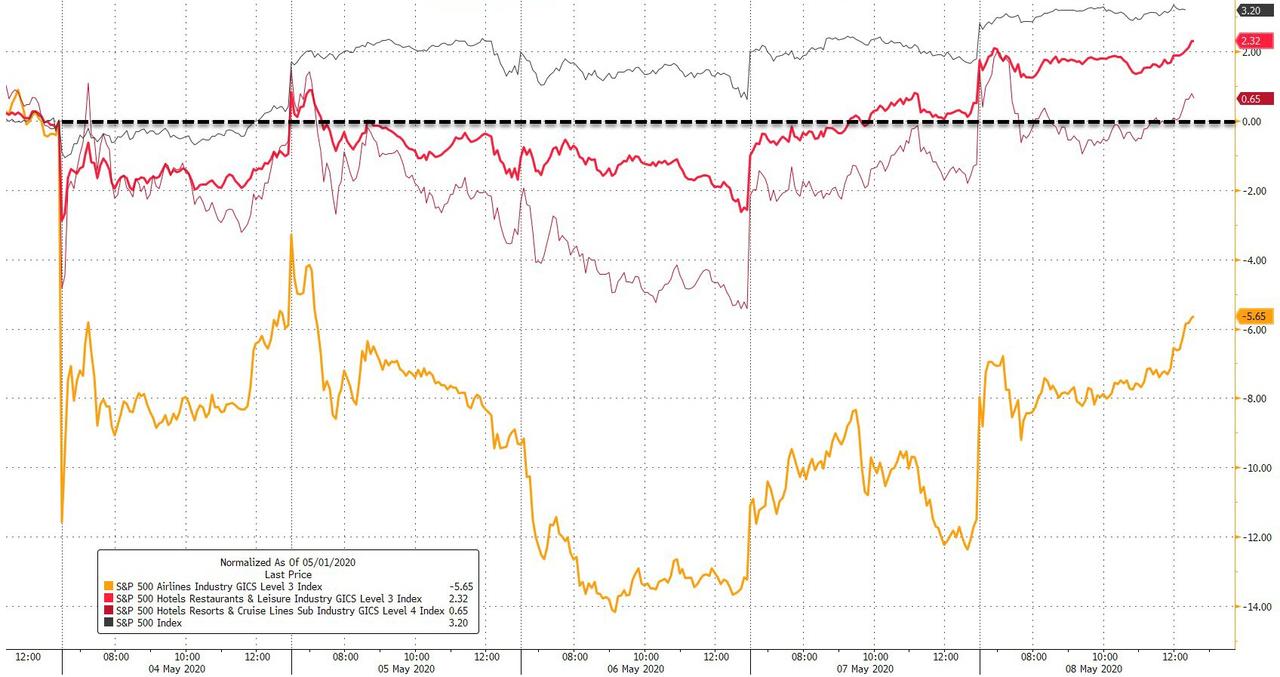

Airlines were down on the week but Hotels managed gains…

Source: Bloomberg

Overall, the median stock (Value Line Geometric index) is drastically underperforming the broader market…

Source: Bloomberg

HY was better this week but IG bonds lagged…

Source: Bloomberg

A very choppy week for bonds ended with the curve notably steeper (30Y +13bps, 2Y -4bps)

Source: Bloomberg

10Y spiked today – despite the dismal jobs data (on more Fed taper and Powell speech headlines)…

Source: Bloomberg

New record all-time lows for 2Y and 5Y yields…

Source: Bloomberg

The dollar ended the week unchanged… with weakness in the last two days as negative rates started to rear their ugly head…

Source: Bloomberg

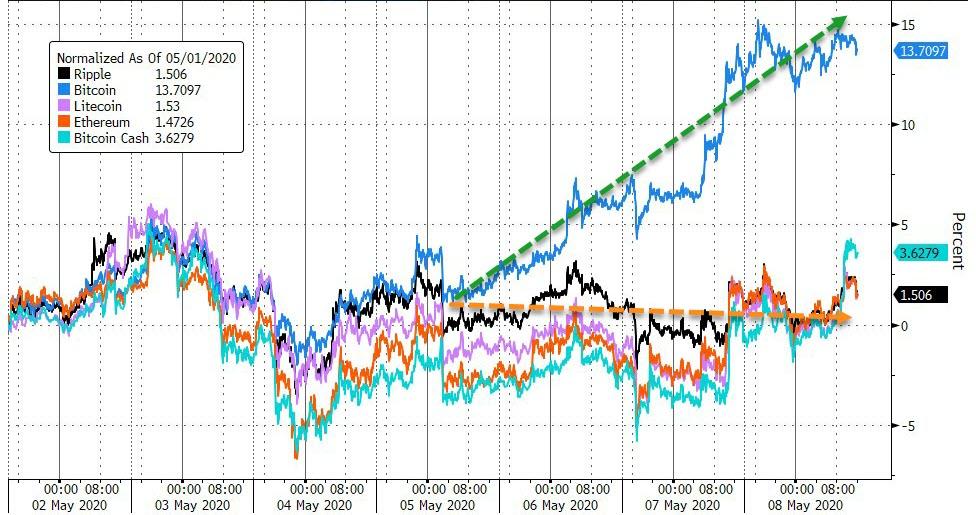

Cryptos were all higher on the week, with a notable alt-coin to bitcoin rotation…

Source: Bloomberg

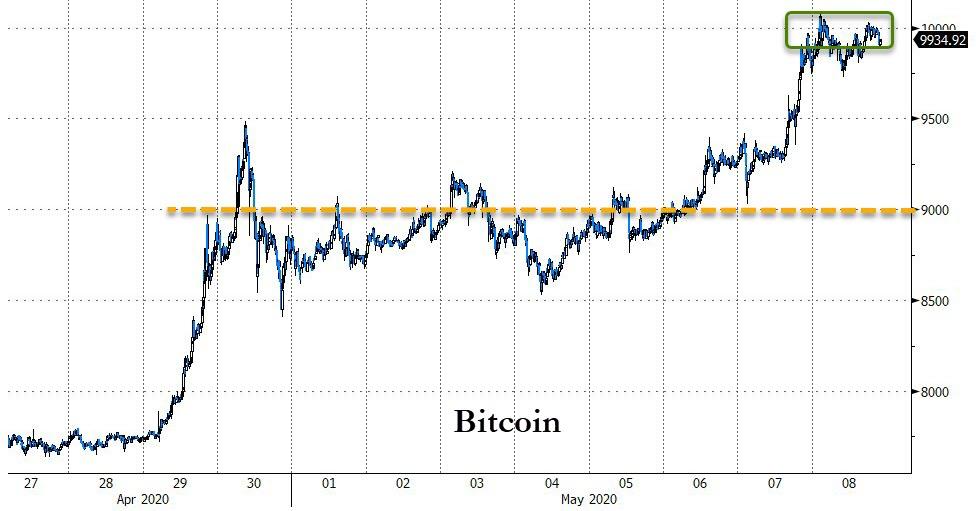

Bitcoin pushed up to $10,000 today…

Source: Bloomberg

Notably gold and Bitcoin surged as negative rates came into the picture (and gold dipped today as negative rates were priced out)…

Source: Bloomberg

Commodities were all higher this week…

Source: Bloomberg

But oil – again – was the big winner…though largely sideways $23-25…

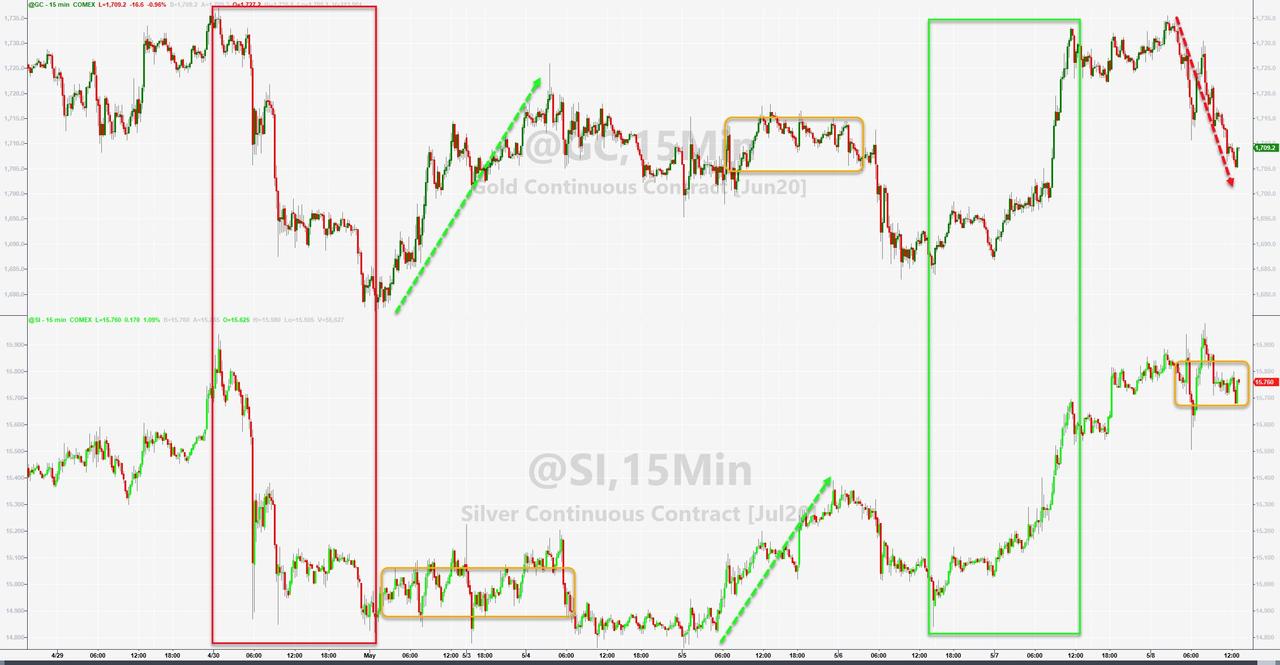

Gold and Silver decoupled a few times this week…

GLD inflows continue their streak (30 days straight and counting)…

Source: Bloomberg

Finally, as we noted earlier, the Nasdaq is now bigger than the rest of the world’s stock markets put together…

Tyler Durden

Fri, 05/08/2020 – 16:01

via ZeroHedge News https://ift.tt/3ck91Oy Tyler Durden