An “Unprecedented Expansion Of Every Form Of Money Unlike Anything Ever Seen” – Paul Tudor Jones’ Full “Buy Bitcoin” Letter

On Thursday, Paul Tudor Jones revealed he had placed a substantial bet on bitcoin, arguing that the pioneering cryptocurrency was also the vehicle best-suited to outperform during the coming decade, which PTJ argued will closely resemble the 1970s due to a mix of high inflation and low growth, popularly known as “stagflation”.

Of course, bitcoin is deflationary by design, making it a de facto hedge against inflation. And with the ‘halving’ coming up next week, the supply of new bitcoins entering the market is about to shrink dramatically as the supply of freshly printed fiat explodes.

PTJ has been warning readers about the dangers of America’s “crazy” monetary-fiscal mix since at least January, which he told CNBC the situation in contemporary markets reminded him of 1999.

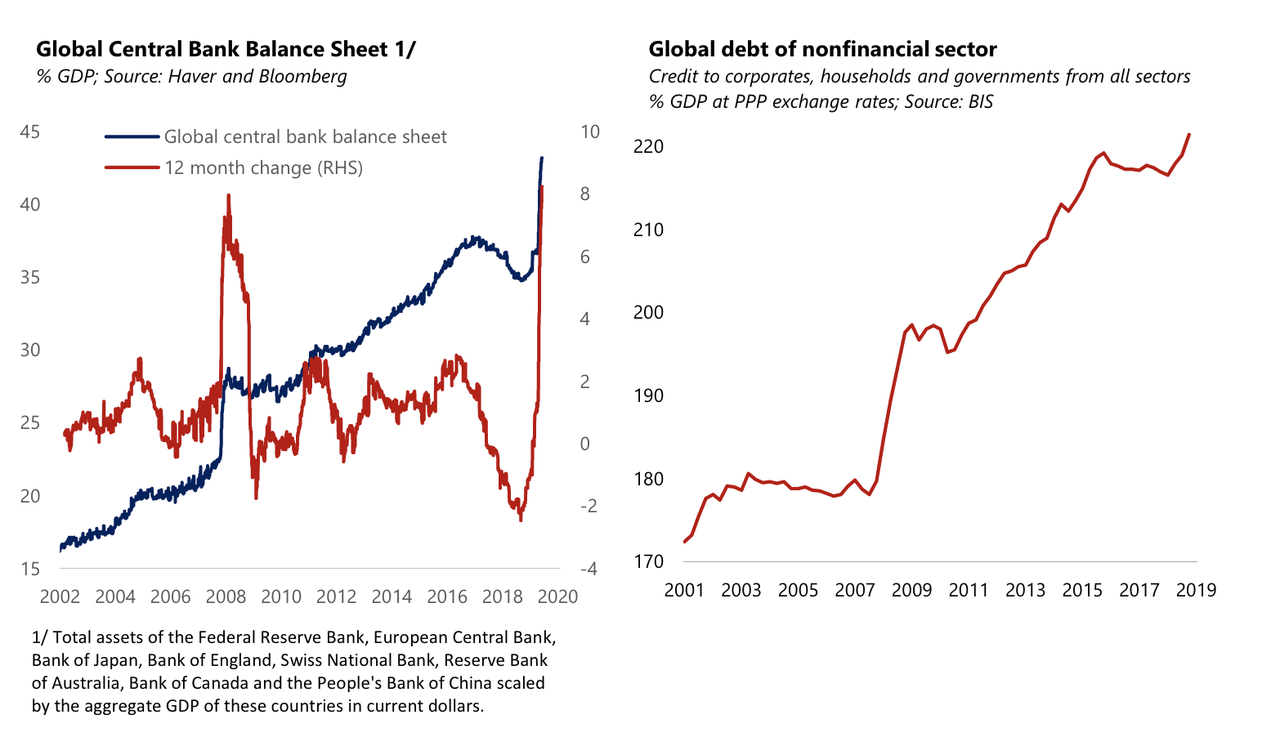

Of course, since that interview was filmed, the Fed’s balance sheet, and the balance sheets of myriad other central banks, has exploded, while a spate of developed-world governments and central banks – via a heady brew of fiscal and monetary policy – scramble to inject as much capital into the real economy as quickly as possible, in a great monetary experiment that – as PTJ argues in the paper below – is putting ‘Modern Monetary Theory’ into practice.

PTJ was conspicuously early to the coronavirus trade. During an interview with the hosts of “Squawk Box” in Davos back in January, Jones said he believed the virus would become “a huge deal” – eliciting scoffs from his interviewers – while asserting he “wouldn’t want to be long [stocks]” heading into February.

News of PTJ’s bitcoin play helped triggered a sharp rally in bitcoin on Thursday; BTC has traded mostly sideways since. In his report, he offers a detailed overview of his investment strategy, and explains why somebody who isn’t a believer in the cause of bitcoin can still come up with a valuation framework which suggests that bitcoin’s value will be recognized by a growing number of people around the world as trust in central banks inevitably continues to erode.

* * *

Read the full report – entitled “the Great Monetary Inflation” – below:

COVID-19 is a one-of-a-kind virus that has triggered a one-of-a-kind policy response globally.

The depth and magnitude of the economic drop-off took modern monetary theory—or the direct monetization of massive fiscal spending—from the theoretical to practice without any debate. It has happened globally with such speed that even a market veteran like myself was left speechless. Just since February, a global total of $3.9 trillion (6.6% of global GDP) has been magically created through quantitative easing. We are witnessing the Great Monetary Inflation (GMI)—an unprecedented expansion of every form of money unlike anything the developed world has ever seen.

Global debt was very elevated entering the pandemic, and this monetary expansion is funding additional large debt creation, for now, without provoking the disciplining response of rising market yields. So far, the result has been asset price reflation. A large demand shortfall will prevent goods and services inflation from rising in the short term. The question is whether that will be the case in the long term with a central bank whose central focus will be repairing the worst employment crisis since the Great Depression.

One thing is for sure, there will be many assets that will move as a result of this money creation. So what is an investor to do? Traditional hedges like gold have done well, and we expect investors to continue to seek refuge in this safe asset. One thing I have learned over time is the best thing to do is let market price action guide your decision-making and then try to understand the fundamentals as they become more evident and comprehensible. Quite often, how the markets respond will be at odds with your priors. But remember, the P&L always wins in the long run. With that in mind, in a world that craves new safe assets, there may be a growing role for Bitcoin.

Debt Addiction

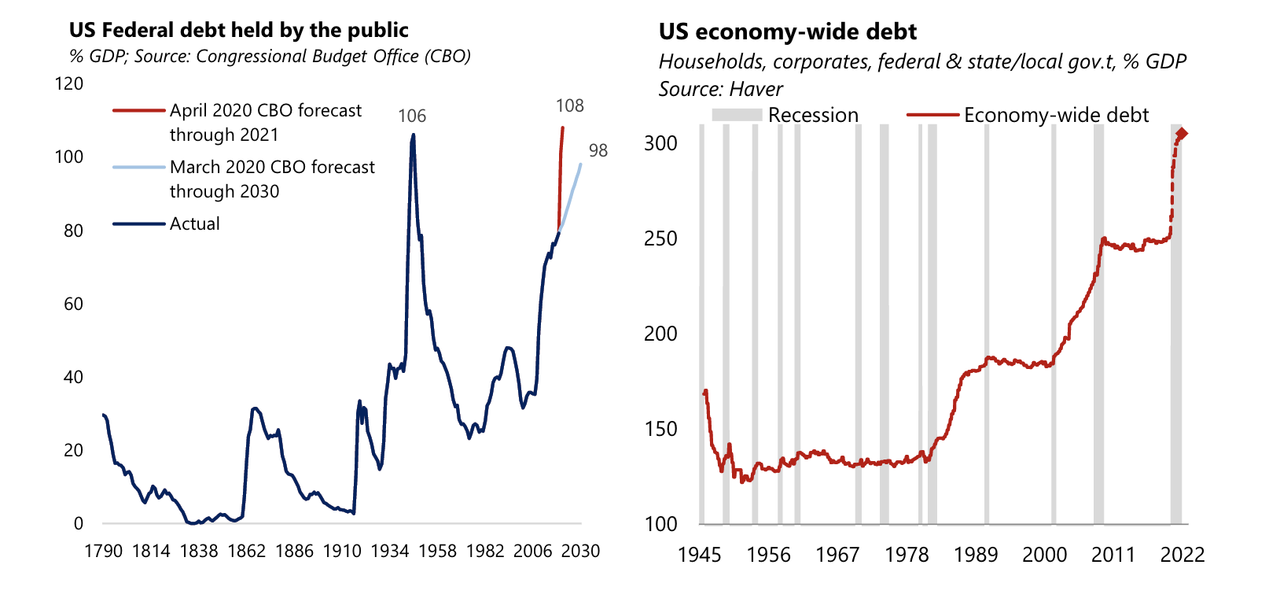

What is apparent to all is the global ramp-up in debt from every sector to deal with the economic downturn. In addition to debt ratios increasing by virtue of a larger numerator, such ratios will also be buoyed by a falling denominator: it may take more than two years to bring nominal GDP back to its pre-shock level. The Congressional Budget Office, for example, projects the US government debt ratio to reach a new historic high next year, above the World War II peak. Corporate debt is also rising briskly to record levels as firms draw down revolving credit lines to self-fund cash flow shortfalls. At this pace, it is not inconceivable that the economy-wide debt ratio may increase by 50% of GDP over the next year and a half.

Money Printing is a Hard Habit to Kick

Central banks are on the hook to help fund this debt increase. Since the end of February, the Fed’s balance sheet has already grown by 60% and is on track to more than double by the end of the year. Even two QE novice central banks have unleashed their printing presses. The Bank of Canada has already tripled its balance sheet, and the Reserve Bank of Australia has allowed its balance sheet to increase by 43%.

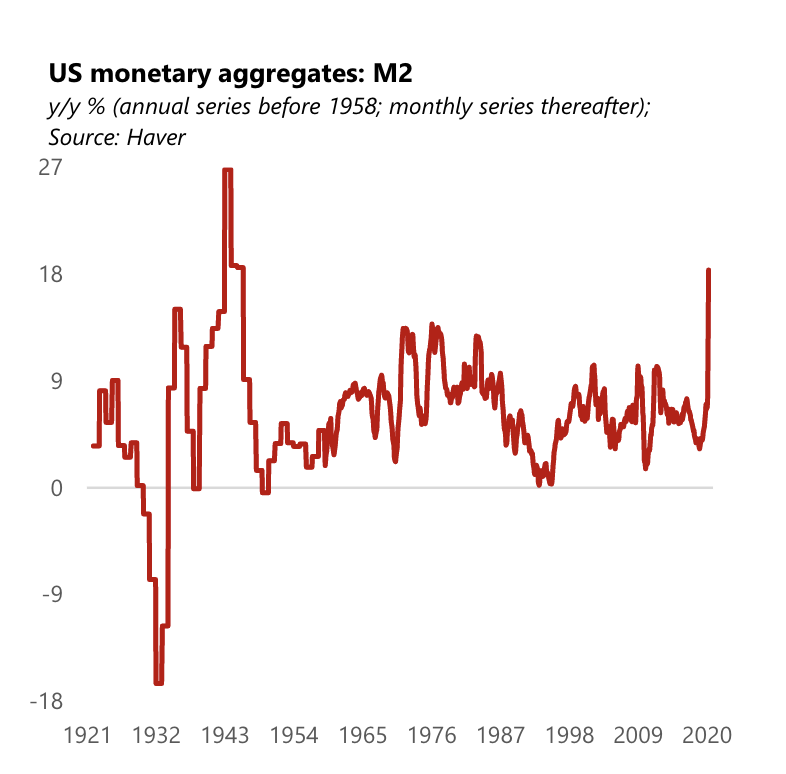

The counterpart of this rapid central bank balance sheet expansion has been a sharp increase in monetary aggregates. In the last weekly release of the Fed’s Money Stock data, M2 rose 18.5% over a year ago, an unprecedented pace of growth in the history of the weekly time series starting from 1981. It is likely that the annual growth in M2 will continue to increase to somewhere between 20% and 40% by year-end. We got these estimates on M2 from a few of the dinosaurs who still work on Wall Street. Rarely have we ever seen so many economists dismissive of an economic metric than when we asked about their notion on this record M2 growth and its meaning. The last time M2 grew at such a high pace was during World War II, when annual M2 growth peaked at almost 27%.

But, monetary expansion alone is not sufficient to generate inflation. The context is very important too. Take Japan, the poster child of debt-deflation. Arguably, this is a case where monetary financing of the deficit has been ineffective. But, Japan was already in a prolonged deflationary spiral that had unanchored inflation expectations when this policy was unleashed in full. In any event, since 1999, their M2 never grew by more than 5% a year. A hobbled banking system focused on healing from a prolonged banking crisis had probably a lot to do with this. In the US, it can also be argued that a large deficit combined with massive money printing were ineffectual at stoking inflation in the aftermath of the Global Financial Crisis (GFC).

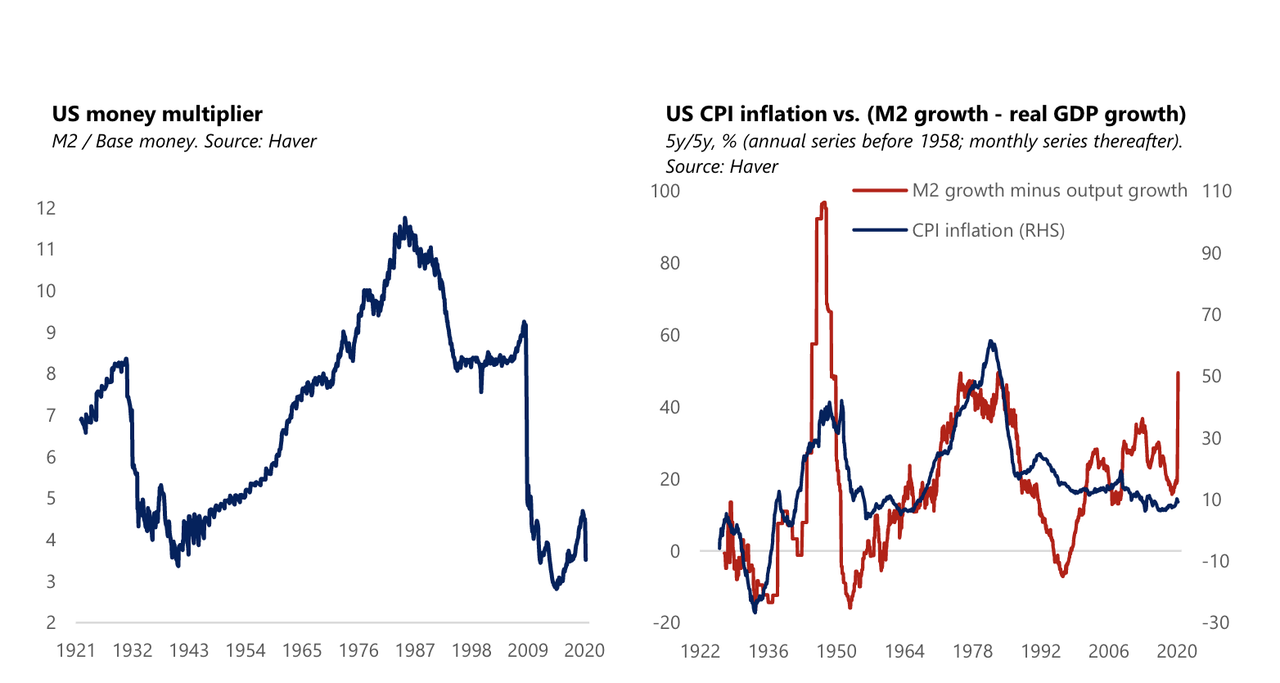

Again, context matters, and the post-pandemic recovery may be different from the GFC aftermath. First, an austerity movement similar to the one that swept the Tea Party to prominence in the 2010 US mid-term elections is very unlikely to emerge. The opposite forces are at play today as growing income inequality breeds populism. Second, the bank-centric GFC induced a one-time paradigm shift in banks’ preference for liquidity, later enforced through regulatory changes. As a result, only a small share of the Fed’s massive injection of high-powered money was re-lent in the banking system: M2 never grew by more than 10% a year even after subsequent rounds of large-scale asset purchases by the Fed. Effectively, banks’ preference for liquidity and the need to rebuild their capital cushions quashed the money multiplier. While the multiplier has recently started to fall—in a crisis, banks are wary to lend to potentially insolvent borrowers and, in fact, start building provisions for loan losses—this time banks entered the crisis in a stronger footing and policy is more squarely aimed at putting liquidity directly in the hands of businesses and households shielding, to some extent, banks from losses. As such, the chance of a large fall in the multiplier as seen in the aftermath of the GFC is now smaller. Plus, the Fed’s elimination of the reserve requirement means that the theoretical money multiplier is now infinite (the multiplier is the inverse of the reserve requirement).

Milton Friedman famously stated that “inflation is always and everywhere a monetary phenomenon that arises from a more rapid expansion in the quantity of money than in total output.” And while the relationship between inflation and M2 growth in excess of real output growth has not been stable over short horizons, it seems to hold over longer horizons. There are only a few times in history when M2 growth exceeded real output growth over a 5-year span by the same or a faster pace than is currently the case: the inflationary periods of the 1970s–80s and the late 1940s. But remember, it is reasonable to expect inflation to first fall in the coming months, given the large contraction in demand relative to supply.

The issue is whether a large monetary overhang in the recovery phase will eventually stoke consumer price inflation.

To answer this question, we need to ask, how reasonable is it to expect that in the recovery phase the Fed will be able to deliver an increase in interest rates of a magnitude sufficient to suck back the money it so easily printed during the downswing? The current Fed leadership has made it a centerpiece of its new monetary policy framework to do whatever it takes to overshoot the inflation target in the recovery phase. This is a risky strategy. If the Phillips curve is truly flat, it requires a large increase in interest rates to bring inflation under control. But, a more levered economy is also one that does not digest interest rate increases well. So, when the time for lift-off finally occurs, any hiking cycle is likely to be delayed and unambitious. Furthermore, the risk of a complicit (politically-appointed) central bank chairman cannot be easily dismissed given that central bank independence is no longer a sacred cow.

High debt accommodated by money printing is difficult to banish. Inflation expectations could one day respond to this reality. It is the risk of fiscal dominance that makes the current GMI potentially inflationary during the next cyclical upswing. After all, fiscal dominance was a key reason for inflation to flare up in the late 1930s and the 1940s when the Fed was strong-armed to keep rates low and to monetize Treasury debt issuance well beyond the economic recovery phase.

There are other reinforcing considerations to fear a resurgence of inflation down the line. The pandemic has exposed the vulnerability inherent in global interdependence and stoked tensions between the US and China. There may come a tipping point when a breakdown in global supply chains spills overs to goods prices, undoing two decades of disinflation attributable to globalization.

Seeking Refuge from the Great Monetary Inflation

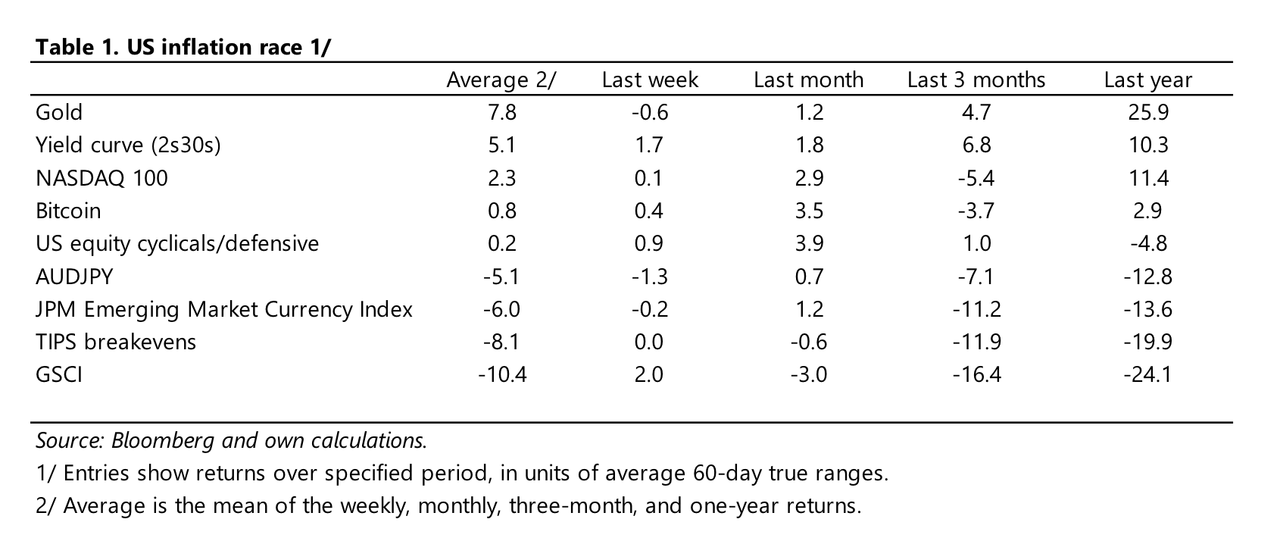

So with this type of monetary growth as a backdrop, here is one way to navigate these extraordinary times and policy actions. Below is a list of inflation hedges, rank-ordered in what we call the Inflation Race. While some of this list will track inflation in the classic sense, other instruments have been added to pick up the assets that will respond best to an acceleration in monetary growth, not just consumer goods and service price inflation.

So, it includes a host of assets that at one time or another have worked well in reflationary periods:

- Gold–A 2,500 year store of value

- The Yield Curve–Historically a great defense against stagflation ora central bank intent on inflating. Forour purposes we uselong 2-year notes and short 30-year bonds

- NASDAQ100–The events of the last decade have shown that quantitative easing can rapidly leak into equity markets

- Bitcoin–There is a lengthy discussion of this below

- US cyclicals (long)/US defensive (short)–A pure goods’inflation play historically

- AUDJPY–Long commodity exporter and short commodity importer

- TIPS(Treasury Inflation-Protected Securities) –Indexed to CPI to protect against inflation

- GSCI(Goldman Sachs Commodity Index) –A basket of 24 commodities that reflects underlying global economic growth

- JPM Emerging Market Currency Index–Historically when global growth is high and inflationary pressures are building, emerging market currencies havedone quite well

Now it would be wonderful if we knew ex-ante which horse to bet on. The goal,of course,is to be invested in the fastest horsesover the duration of the ride. And to help monitor this,we review the horse race over the short, intermediate, and long term by averaging price performance over such periods. This provides a snapshot such as shown below, which was taken on May 6th (Table 1). We have rank-ordered the instruments below by averaging the 1-week, 1-month, 3-month, and 12-month returns. We show the performance in volatility-adjusted returns,not in nominal returns, so think of each unit as approximately a day’s average trading range. So,gold under the “Last year” column has gone up about 26 daily ranges, which also equates to about $406, from $1,280 to $1,686

From the table, gold is the clear winner of the Inflation Race at this time. In second place is long the US 2s30s yield curve. In third place is the NASDAQ100: remember this GMIis going to show up somewhere so why not stocks? And in fourth place it is Bitcoin – yes, Bitcoin. It did trade $18 billion of volume on the last day of April and is an “emerging” asset class by any metric. Of course, bringing up the bottom with a hugely damaging return of negative10 daily ranges (also equivalent to -46% in the trailing 12 months) is the Goldman Sachs Commodity Index. This index has been pummeled due to the crash in oil prices as producers are at war to preserve their market share and stay afloat.

One thing that piqued my interest from this list of assets,and that one day might be brought to prominence by the GMI, is Bitcoin. Truth in advertising, I am not a hard-money nor a crypto nut. I am not a millennial investing in cryptocurrency, which is very popular in that generation, but a baby boomer who wants to capture the opportunity set while protecting my capital in ever-changing environments.

One way to do that is to make sure I am invested in the instruments that respond first to the massive increases in global money. And given that Bitcoin has positive returns over the most recent time frames, a deeper dive into it was warranted. I did have some experience with it back in 2017, having a tiny amount in my personal account for fun. Amazingly, I doubled my money and got out near the top when it was apparent to any market technician we were blowing off. It is amazing how well one can trade when there is no leverage, no performance pressure and no greed to intrude upon rational reflection! When it doesn’t count, we are all geniuses.

But the GMI caused me to revisit Bitcoin as an investable asset for the first time in two and a half years.It falls into the category of a store of value and it has the added bonus of being semi-transactional in nature. The average Bitcoin transaction takes around 60 minutes to complete which makes it “near money.” It must compete with other stores of value such as financial assets, gold and fiat currency, and less liquid ones such as art, precious stones and land. The question facing every investor is, “What will be the winner in ten years’ time?”

At the end of the day, the best profit-maximizing strategy is to own the fastest horse. Just own the best performer and not get wed to an intellectual side that might leave you weeping in the performance dust because you thought you were smarter than the market. If I am forced to forecast, my bet is it will be Bitcoin.

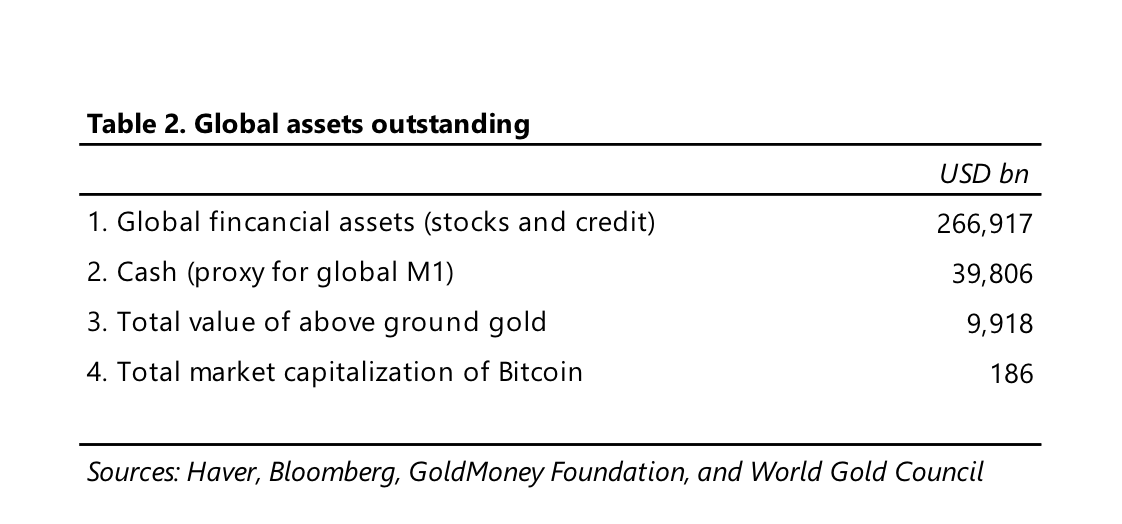

A store of value is anything that holds its purchasing power in the future. It is completely a function of people’s perception of its worth. Even tulips at one time were considered a store of value. Financial assets comprise the largest store of wealth in the world as they generally have the added advantage of providing yield,which helps offset the impact of inflation. Gold has survived the test of time although a rational person could ask “Why gold over any of the other 118 elements?” Fiat currency (cash) is backed by the full faith and credit of the people of that country,although that promise has high variability,as history has shown. And the newest entrant is Bitcoin, which seems to have emerged from the crypto war of 2017 as the clear winner with a market cap 10x that of its closest competitor.

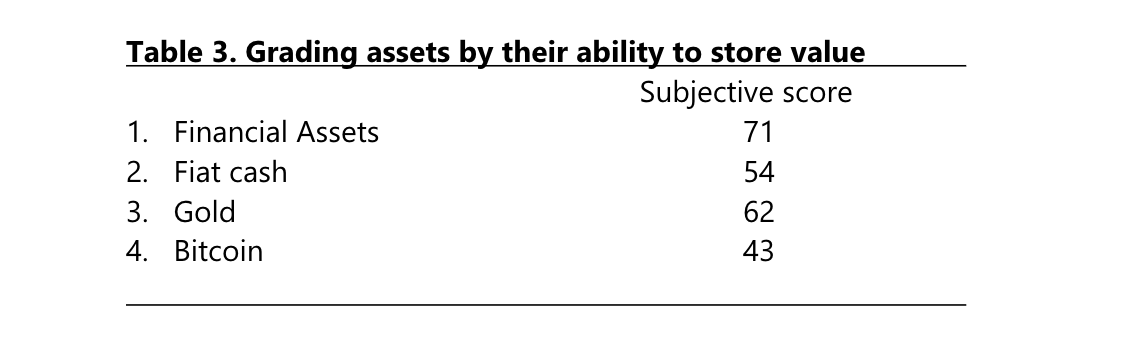

So how do these storesof value stack up against each other? We graded stores of value on four characteristics:

- Purchasing Power–Howdoes this asset retain its value over time?

- Trustworthiness–How is it perceived through time and universally as a store of value?

- Liquidity–How quickly can the asset be monetized into a transactional currency?

- Portability–Can you geographically move this asset if you had to for an unforeseen reason?

For the purpose of this exercise, real estate, art and precious stones have been excluded as they will fall to the bottom of the ranking automatically because of generally poor liquidity and portability characteristics. So let’s focus on financial assets, fiat currency, gold, and now Bitcoin. To offer perspective, Table 2 shows the value of these assets at the present time. It is an important table, which I will come back to.

Remember, the challenge here is to understand which store of value will be the winner in the next ten years. The first thing is to score the four assets against the four criteria laid out above. So I polled my research group to see what this team of informed persons thought. After discussion, we created a scoring system for a store of value with the maximum score being 100. We considered some categories more important than others, so we allocated 30% each to the categories of purchasing power and trustworthiness and 20% to each of liquidity and portability. Then, we scored the four sets of assets above and came up with a composite and highly-subjective value for each in Table 3 below.

Before drawing broad conclusions, here were some of the more salient points in each category. When it came to purchasing power, everyone was a carry merchant arguing the only way to defeat inflation was with some type of yield—i.e., financial assets. This was particularly popular with the 30-something crowd who gave financial assets the highest score across the board. I reminded them that in the 1970s, inflation was near double-digits at times and the road to hell was paved with carry. In fact, virtually all financial assets were shunned because the yield could not keep up with inflation—in many cases like now.

I also made the case for owning Bitcoin, the quintessence of scarcity premium. It is literally the only large tradeable asset in the world that has a known fixed maximum supply. By its design, the total quantity of Bitcoins (including those not yet mined) cannot exceed 21 million. Approximately 18.5 million Bitcoins have already been mined, leaving about 10% remaining. On May 12th Bitcoin’s mining reward – the pace at which the supply of Bitcoin is increased – will for the third time be “halved” (falling from 12.5 to 6.25 Bitcoins per block of transactions added to the blockchain). Future halvings will likewise occur approximately every four years consistent with Bitcoin’s design, thus continuing to slow the rate of supply increase and causing some to estimate that the last available Bitcoin will not be mined for another 100+ years. This brilliant feature of Bitcoin was designed by the anonymous creator of Bitcoin to protect its integrity by making it increasingly near and dear, a concept alien to the current thinking of central banks and governments.

The most surprising result of our research group poll was the score ascribed to fiat cash. It got a 0 almost across the board! The cry from the troops was “If something is by design going to depreciate 2% per year through inflation, why own it?”

The next category we discussed in determining whether or not something was a good store of value was trustworthiness. No surprise here Bitcoin got the lowest score because it is also the youngest entrant at 11 years of age. Someone mentioned that it has 60 million users in almost 200 countries, but that did nothing to sway people. Gold, as one would have guessed, scored first in this category, as it has stood the test of time for thousands of years.

Liquidity is one of those things that never matters until it does (every 10 years it seems), which is why we weighted it only 2/3 of the value of purchasing power and trustworthiness. But as we have all probably experienced in the last two months, liquidity is hugely important when things go pear shaped. It is reasonable to assume, given the number of bankruptcies we are about to witness and the number of people who will be jobless and near poverty, that both companies and individuals will have a much higher preference for liquidity in coming years. Cash scored the highest here and rightly so. Financial assets are a mixed bag because some, like private equity and bespoke credit instruments, take forever to liquidate and often at severe discounts. Interestingly, Bitcoin is the only store of value that actually trades 24/7 in the entire world.

Finally, there is portability. Like liquidity, it is not an issue until it is. Imagine a geographic upheaval whether it be caused by war, an epidemic, or change in government that becomes hostile to holders of wealth. A great store of value can be seamlessly moved from one jurisdiction to another with little or no transaction costs. Cash is obviously good for that; gold is ok but clunky; but, of course, nothing beats Bitcoin, which can be stored on a smartphone among other options.

So that was the flavor behind some of the discussions that were had when scoring the suitability of each asset as a store of value. What was surprising to me was not that Bitcoin came in last, but that it scored as high as it did. Bitcoin had an overall score nearly 60% of that of financial assets but has a market cap that is 1/1200th of that. It scores 66% of gold as a store of value,but has a market cap that is 1/60th of gold’s outstanding value. Something appears wrong here and my guess is it is the price of Bitcoin.

The most compelling argument for owning Bitcoin is the coming digitization of currency everywhere, accelerated by COVID-19. Bull markets are built on an ever-expanding universe of buyers. Central to the price of Bitcoin is how many more (or less) owners of Bitcoin will there be beyond the 60 million who currently own it? The probable introduction of Facebook’s Libra (whose value will be pegged to the US dollar and will not be a store of value in that sense) as well as China’s DCEP, also tied to the yuan, will make virtual digital wallets a commonplace tool for the world. It will make the understanding, utility, and ease of ownership of Bitcoin a much more commonplace option than it is today.

Owning Bitcoin is a great way to defend oneself against the GMI, given the current fact set. As Satoshi Nakamoto, the anonymous creator of Bitcoin, stated in an online forum around the time he launched Bitcoin, “the root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” I am not an advocate of Bitcoin ownership in isolation, but do recognize its potential in a period when we have the most unorthodox economic policies in modern history. So, we need to adapt our investment strategy. We have updated the Tudor BVI offering memoranda to disclose that we may trade Bitcoin futures for Tudor BVI. We have set the initial maximum exposure guideline for purchasing Bitcoin futures to a low single digit exposure percentage of Tudor BVI’s net assets, which seems prudent.We will review this exposure guideline regularly.

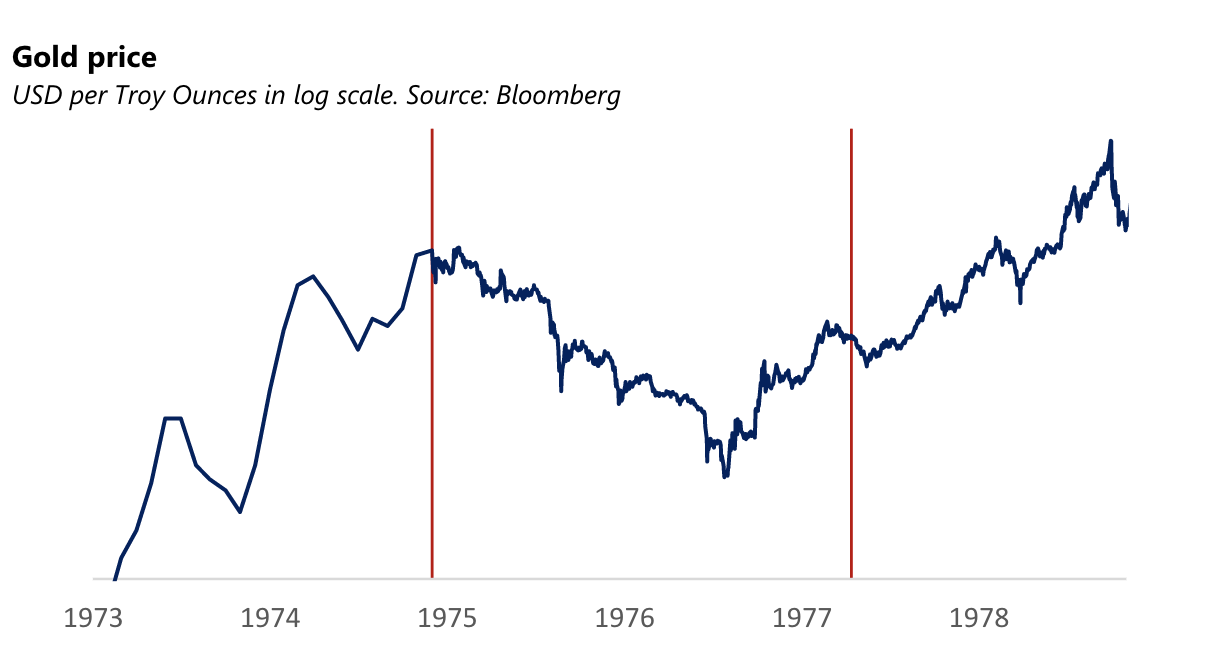

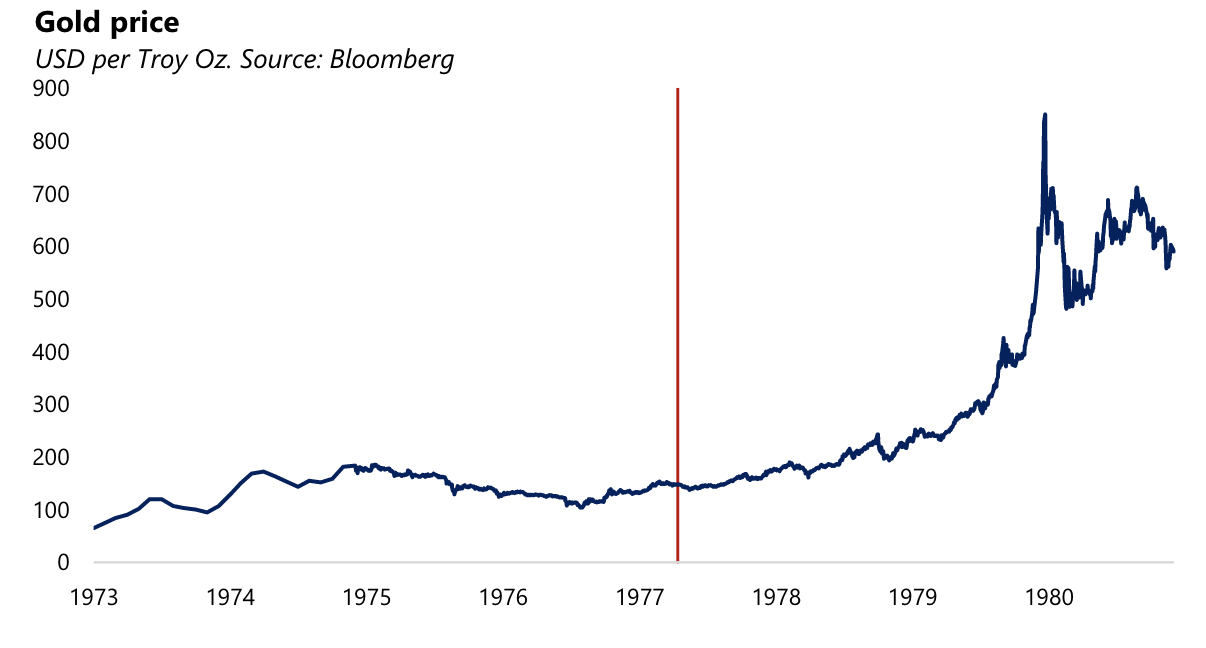

Many of you know my fondness for analogues. Bitcoin reminds me of gold when I first got in the business in 1976. Gold had just been productized as a futures instrument (like Bitcoin recently) and had enjoyed a heck of a bull market, almost tripling in price. It then corrected almost 50% in nearly two years similar to Bitcoin’s 28-month 80% correction! You can see the similarities in the two charts below.

But in the case of gold, it was a tremendous buying opportunity as gold went on to more than quadruple past the prior highs. The red line in the chart below is where we might be in Bitcoin today.

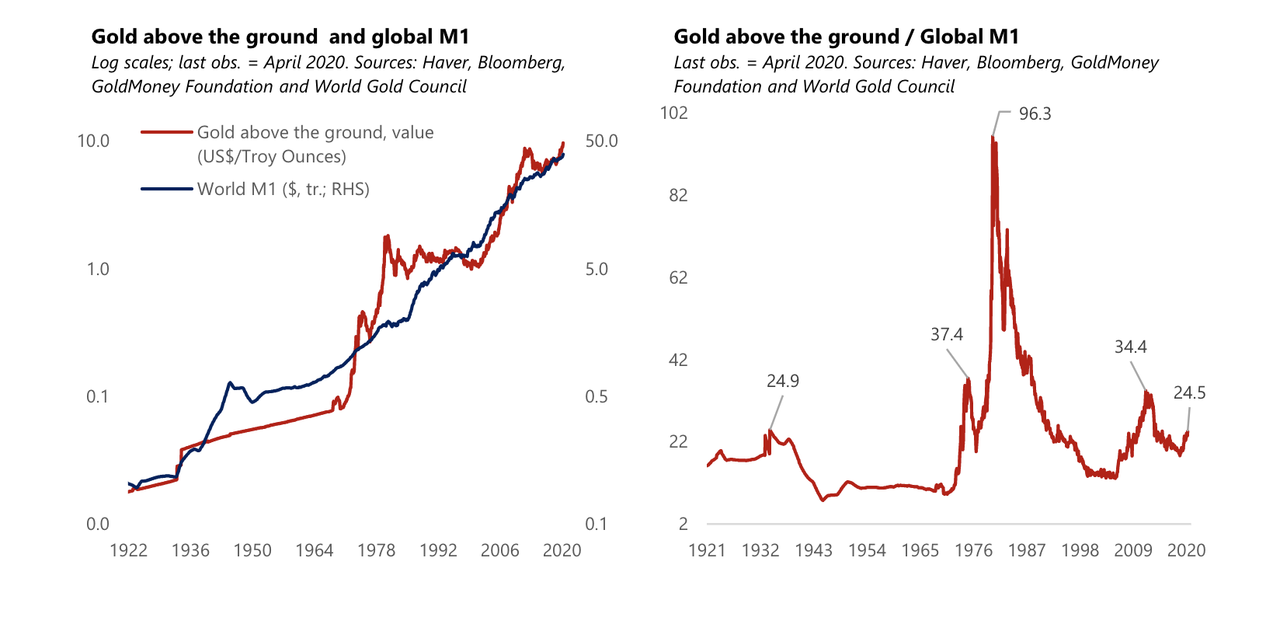

Speaking of gold, in a low-carry world, gold remains a very attractive hedge against the Great Monetary Inflation and hedges against other risks clouding the outlook, including a renewed flare up in the China-US relationship where financial sanctions could eventually be used in a brute-force decoupling. How far can gold rally from its current price? A simple metric based on the ratio of the value of gold above ground to global M1 suggests gold could rally to 2,400 before it reaches valuations consistent with the lowest of the last three peaks in this valuation metric and 6,700 if we went back to the 1980 extremes.

One thing is for sure, these are going to be incredibly interesting times.

Tyler Durden

Sat, 05/09/2020 – 15:21

via ZeroHedge News https://ift.tt/2zrHbkx Tyler Durden