Time To Learn About Money

Authored by Alasdair Macleod via GoldMoney.com,

An unexpected destruction of fiat currency has been advanced by the monetary and fiscal response to the coronavirus. Financial markets have yet to discount the possibility of such an outcome, but in the coming months they are likely to awaken to this danger.

The question arises as to what will replace fiat currencies. In the past the answer has always been gold but today there are cryptocurrencies as well, whose enthusiasts are more aware than most of fiat money’s failings.

This article describes the basics about money, what it is and the role it plays in order to understand what will be required by the eventual replacement for fiat. It concludes that gold will return as the world’s medium of exchange, and secure cryptocurrencies, unable to provide the scalability and stability of value required of a medium of exchange will be priced in gold after the demise of fiat. But then the rationale for them will be gone, and with it their function as a store of value.

The destruction of fiat money

These are strange times. Circumstances are forcing governments to destroy their money by debasing it to pay for their obligations, real and imagined. If central bankers had a grasp of what money really is, they wouldn’t have got into a position where they are forced to use their seigniorage to destroy it. They are so ignorant about catallactics, the fundamentals behind economics, that they cannot see they are destroying the means of exchange they have imposed upon their citizens with far worse consequences than the abandonment of the evils they are trying to defray.

Unless you believe in a financial form of perpetual motion you will know that all else being equal if you double the quantity of money you approximately halve its purchasing power. It is therefore an incontestable fact that if a central bank doubles the quantity of a circulating fiat currency, it is taking to itself half of the value of everyone’s cash, currency deposits, profits and salaries. It makes everyone poorer and it is simply a travesty to promote monetary inflation as a costless form of economic rescue. Yet the major central banks are now unashamedly admitting to a policy of deploying an infinite expansion of circulating currency.

The effect on capital allocation is equally destructive, because it undermines economic calculation. The suppression of interest rates and increasing quantities of currency tempt businessmen into unprofitable investment decisions which only appear profitable. But inflationism periodically fails as any follower of credit cycles will attest. And the more extreme the policy of inflationism, the more capital is misallocated, and the worse the periodic failures. Today, we can add to these woes monetary and interest rate policies intended to prevent any and all businesses from going to the wall in a final act of capital misallocation.

We now stand on the edge of a global monetary crisis brought about by a new, rapid acceleration of money-printing. Never before have we seen our own governments and those of all our trading partners embark on the same policies of monetary destruction. Never, therefore, will we have seen the scale of global wealth destruction that we about to experience. Unless governments change their inflationary policies, they will lead to the miseries we read about in countries such as Venezuela and Zimbabwe being visited upon us all.

It is extraordinary that modern economists are blind to the true effects of inflation, which have been known since the dawn of money. Nicolas Oresme, a French bishop in the fourteenth century and a notable translator of Aristotle, warned of debasement:

“I am of the opinion that the main and final cause why the prince pretends to the power of altering the coinage is the profit or gain which he can get from it… the amount of the prince’s profit is necessarily that of the communities’ loss but whatever loss the prince inflicts on the community is injustice and the act of a tyrant and not of a king, as Aristotle says. And so, the Prince would be at length able to draw to himself almost all the money or riches of his subjects and reduce them to slavery and this would be tyrannical, indeed true and absolute tyranny as it is represented by philosophers, and in ancient history.”

As a description of inflation, it was a continuity statement of what was known from classical times. In Oresme’s day and before, the principal form of debasement was of the coinage. It is no different from issuing any form of money or credit unbacked by a valuable metal. Apart from alchemists dreaming of creating gold out of something else, the principal deniers of the true purpose of inflationism have been John Law in eighteenth century France, Geog Knapp and his chartalists in Bismarck’s Germany, and Lord Keynes the consequences from which we are suffering today. Oresme was spot on. The whole purpose of debasement is to fund the state, and the state licences banks for that purpose, extending monetary favours to big business as well. Forget the flummery about stimulating us; that amounts to a cover for statist robbery of our wealth.

The coronavirus is not the cause of this folly. It has only shortened timescales, the likely time before we discard fiat currencies entirely. It has brought forward the time when homo economicus anticipates the total loss of the government currency’s purchasing power. From that moment, those of us unwilling to descend into barter will seek a new medium of exchange. In desperation, governments are likely attempt to provide alternatives. If so, it almost certainly will be a variation on the fiat theme, which they find impossible to abandon for lack of finance. They will then discover that a lasting money is not to be chosen by the state, but by the people.

This has been the lesson of history. Those who think economics as a science started with Keynes, and preceding theories were thereby invalidated, are in for a primal shock. It is time to relearn the basics about money so that we can anticipate what form of money will endure as a replacement for the failure of government fiat currency.

Defining money

There are two incontrovertible facts that underlie economic analysis and the role of money.

The first is that the division of labour is more productive than the work of isolated individuals. That is to say, individuals maximise their productivity by deploying their individual skills, relying on their enhanced output to acquire all their other needs and wants from other specialising producers in their community. Not even Marx denied this, nor all the other socialists who emerged on the economic and political scene from his time onwards. Only Keynes denied it in order to impart validity to his General Theory.

Socialist economists even agree with the second incontrovertible fact, that, ascetics aside, individuals prefer a higher productivity of their labour to a lower one. Socialist arguments were not against these facts but dispute which way of dividing labour is most productive. Marxists have argued that the division of labour should be harnessed for the benefit of the state, and that instead of being exploited by employers, labourers would become happier and more productive. Less extreme socialists simply believe that there is little or no difference of production output in a business controlled by the state, compared with one in private ownership.

It therefore follows that to facilitate the division of labour, the role of money is to facilitate an exchange of goods. It enables people to choose between goods and services, and therefore for people to exercise their judgement of the relative values they place on different goods. It enables them to choose.

Value is not to be confused with prices. Value is an expression of a graded preference between goods, the assessment of one against another. Money is the commodity whose sole function is to facilitate the transfer of production into needed and desired consumption in order to satisfy individual scales of value. The difference between value and its realisation as a price in a transaction devolves into subjective values placed by different individuals for goods and services being exchanged and into a common objective value for money.

Separately from money’s objective transactional value, transacting individuals have different values for money itself relative to a particular product within money’s objective context. In a transaction it follows that one party will value a given quantity of money more than the good at the point of exchange, while the other party will value the good more than the quantity of money demanded; otherwise an exchange cannot take place. The exchange is recorded as a price expressed in money terms.

This description crams into a few paragraphs the relationship between value and money. It is a topic rarely addressed by modern economists, which is one reason the catallactic role of money is poorly understood. A second, and no less important reason is the defining literature on the subject originated in Austria in German, with the unfamiliar names to the Anglo-Saxon ear of Menger, Böhm-Bawerk, Wieser and Mises amongst others. Instead, the neo-classical economics of today ignores all subjectivity and has evolved into an inflexible mathematical macroeconomic certainty, eliminating unpredictable human action, melding value with prices.

But from these basics all other roles of money are derived. Clearly, while one party wants the money more than the item being exchanged and the other prefers the item to the money, both parties in a transaction will require a medium of exchange that is stable. They can then agree an objective value at the time of the transaction. But when an individual or business sells his, her or its production, the money gained is not immediately exchanged for other goods. Money must therefore have more than an objective value at the time of a transaction, because it is also the temporary storage of labour or of a business’s output.

It is fundamental that all economic actors are confident that the purchasing power of money does not alter for the time they are likely to possess it in lieu of the goods and services yet to be acquired, else they will either dispose of the money more rapidly than they would otherwise, or alternatively hoard it to a greater extent than they would normally require. And when the division of labour is organised into a cooperative system, such as a business involving numbers of people, rewarding them for production by paying fixed salaries, it is a fundamental assumption of all employment contracts that the salary does not alter in its purchasing power.

The stability that qualifies money as the medium of exchange over time is also fundamental to related functions, such as the ability of transacting parties to agree deferred payment terms and the facility of money to permit adjustment for risk factors between a transaction and its final settlement. Other than deferred payments based purely on trust, deferred settlements will reflect a level of time preference agreed between acting parties. This is the measure of the difference between values of immediate possession and deferred possession for the period agreed.

The greatest value for transacting parties is for possession sooner, with future possession valued less. All commodities are subject to this rule. Furthermore, money’s time preference is also subject to this rule and will reflect money’s own characteristics as well as those of goods being exchanged.

Instead of being expressed as a discount to current possession, the time preference of future possession is expressed as an annualised interest rate. Assuming a current valuation of a future value, a time preference value of 95 per cent of current ownership in one year’s time is the same as an interest rate of (100-95)/95 = 5.26%.

Time preference can only be agreed between transacting parties, and it is impossible for outsiders, such as the state, to know what that value is. With respect to money, this is commonly termed the originary rate of interest, shorn of other considerations, such as transactional risk and anticipated changes in the prices of future goods, which are additional factors.

It should be apparent that a medium of exchange discharges its functions most effectively when the transacting public has the greatest confidence in the money’s stability, leading to a relatively low level of time preference. Policies of state inflationism undermine this condition and, if continued, inevitably leads to the loss of confidence in fiat money altogether. Recent events, the combination of a downturn in the credit cycle and the economic consequences of the coronavirus, have committed central banks to an unlimited increase of monetary inflation, which in addition to the suppression of all time preference, by imposing zero and negative interest rates on economic actors, will bring forward the day when faith in fiat currencies is lost entirely.

We can therefore anticipate the death of today’s fiat currencies. It is a mistake to think it will be a gradual process: it has already been gradual since the late 1960s, when the remaining fig-leaf of gold convertibility was finally abandoned with the failure of the London gold pool. Since then, measured in gold the dollar has lost over 97% of its purchasing power compared with gold. Given this latest acceleration of monetary debasement, it is likely to be the nail in the coffin for the fiat dollar. Instead of a continuing decline, the outcome is likely to be a final collapse, not just through its over-issuance, but because fiat money will have lost all its derivative functions. The only thing missing is public awareness.

The end of fiat money can be defrayed by reverting to a gold standard, turning it from pure fiat to a representative of gold. But that will only be a lasting solution if the state stops intervening in the economy, runs balanced budgets and embraces free markets. Unfortunately, inflationism in the form of neo-Keynesian economics is so ingrained in political thinking that many central banks will look to invent new forms of fiat money instead of returning to a gold exchange standard.

One of the alternatives being experimented with is state-issued cryptocurrencies, but it is not yet clear what purpose they are intended to serve. Crucially, they are sure to differ from bitcoin and similar cryptocurrencies by having a centralised ledger under state control. Apart from the questions raised by wider uncertainties surrounding the durability of a cryptocurrency’s use-value, unless the state version is backed convincingly by gold, it will be no more than a dressed-up fiat currency, a successor to failure unlikely to obtain enduring public trust. For the moment, we must dismiss state issued cryptocurrencies as irrelevant to our analysis, because independent cryptocurrencies are better stores of value due to their distributed ledgers.

Gold as money

The inflationists deny that gold should play any monetary role, for the simple reason that it hampers inflationist policies. Being the most likely way of securing a currency, for a gold exchange standard to work will require strict rules-based monetary discipline.

A gold exchange standard is comprised of the following elements. The new issues of state denominated currency must be covered pro rata by additional physical gold, and it must be fully interchangeable at the public’s option. The state is not required at the outset to cover every existing banknote in circulation, but depending on the situation, perhaps a minimum of one-third of the issue should be covered by physical gold at the outset when setting a fixed conversion ratio. The point is that further note issues must be covered by the issuer acquiring physical gold.

Banknotes which are “as good as gold” are a practical means of using gold as the medium of exchange. Electronic money, being fully convertible into bank notes must also be convertible into gold.

A gold exchange standard also requires the state to radically alter course from its customary inflationary financing. The economy, which has similarly become accustomed to future flows of apparently free money, will have to adjust to their future absence. Consequently, the state has to reduce its burden on the economy, such that its activities become a minimal part of the whole; the smaller the better. It must privatise industries in its possession, because it cannot afford to absorb any losses and inefficient state businesses detract from overall economic performance. At the same time, the state must not hamper wealth creation and accumulation by producers and savers as the means to provide investment in production. Government policy must be to stop all socialism, allowing charities to fulfil the role of welfare provision, and let free markets have full rein.

Broadly, this was how British government policy developed following the Napoleonic wars until the First World War, and the proof of its success was Britain’s commercial and technological development, entirely due to free markets. But the British made one important mistake, and that was in the Bank Charter Act of 1844, which in England and Wales permitted the expansion of unbacked bank credit. For this reason, a cycle of credit expansion developed, punctuated by sharp contractions, the boom and bust that led to a series of banking crises. A future gold exchange standard must address this issue, by separating deposit-taking into a custodial role and the financing of investment into an agency function.

It is a common error of neo-Keynesian economists to believe gold is an unsuitable medium for financing modern trade and investment, because, it is often alleged, it lacks an interest rate. Since interest rates existed throughout gold standards, the confusion arises from assuming an interest rate attaches to paper currency. But if a paper currency is fully convertible into gold, then interest rates are effectively for borrowing and lending gold, and do not apply to the currency. The best measure of what savers may gain by lending their gold savings risk-free is the yield on government debt, repayable in gold and realisable in the market at any time. This is illustrated in Figure 1.

Shortly after the introduction of the gold sovereign in 1817, the yield on undated government debt gradually fell to 2.3% in 1898. This reflected a natural decline in time preference as free markets delivered increasing benefits and accumulating wealth for the British population. Following the gold discoveries in South Africa, between the early-1880s and the First World War global above-ground stocks of gold doubled, and the inflationary effects led to a rise in government Consols yields to 3.4%.

The encouragement to investors to provide financial capital for investment in industry and technology was two-fold. A family’s investment in 1824 rose in value due to the long-term fall in Consols yields. By 1898, invested in Consols it would have appreciated by 65%. At the same time, the rise in the purchasing power of gold-backed sterling increased approximately 20%. Saving and family inheritance were rewarded.

Importantly, above ground gold stocks have grown at approximately the rate of that of the global population, imparting a long-term stability to prices in gold. For this reason, it is often said that measured in gold the cost of a Roman toga is not much different from that of a modern lounge suit. Other money-related benefits of gold and gold exchange standards compared with those of pure fiat also follow from this stability.

Between countries that use gold and gold substitutes as money, except for short-term settlement differences covered by trade finance, balance of payments imbalances only existed to adjust price levels between different nations. If a country exports more goods and services than it imports, it imports gold or gold substitutes on a net basis. The increased quantity of gold in that country tends to adjust the general level of prices upwards to the general level of prices in countries that are net importers of goods and services, which find the outflow of gold has moved their prices correspondingly lower. The ability to issue unbacked currency has been removed, so net balance of payment flows become a pure price arbitrage. This is in accordance with classical economic theory and has its remnants today in concepts such as purchasing power parity.

In summary, gold retains the qualities that ensure it will always be the commodity selected by people to act as their medium of exchange. It offers long term price stability and is the ultimate fiscal and monetary discipline on governments, forcing them to reduce socialist ambitions, to accept the primacy of free markets, and to permit acting individuals to earn and accumulate wealth. Being fully fungible, gold is suitable backing for substitute coins and banknotes. It is an efficient medium for providing savings for the purpose of capital investment. And the tendency for prices measured in gold to fall over time driven by natural competition and technology ensures a low and stable originary rate of interest.

Bitcoin and similar distributed ledger cryptocurrencies

Now that we have defined money and identified why fiat currency is on an accelerating path to failure, we must look at the much-mooted alternative to gold of cryptocurrencies, the most notable of which is bitcoin. For simplicity we shall comment on bitcoin only.

The principal characteristics of bitcoin are its pre-programmed limited and capped rate of issue, and its distributed ledger otherwise known as the blockchain. The former distinguishes it from fiat currencies, which as we have seen are beginning their final inflation run, and the latter ensures governments cannot gain control or otherwise interfere with it.

While governments can confiscate their citizens’ profits, close down cryptocurrency exchanges and direct their licenced banks not to accept or make payments in connection with cryptocurrencies, they have yet to do so. So far, when authorities have intervened, the reasons given have been to tackle fraud, real and imagined, and alleged money-laundering. For governments to shut cryptocurrencies down would probably require international cooperation by all governments to deny the right to own cryptocurrencies. An agreement on these lines would be almost impossible to achieve and would take many years of intergovernmental negotiation, given the violation of property rights involved and the precedents created. Due to the accelerated timescale of the demise of fiat currencies, intervention of this sort seems unlikely.

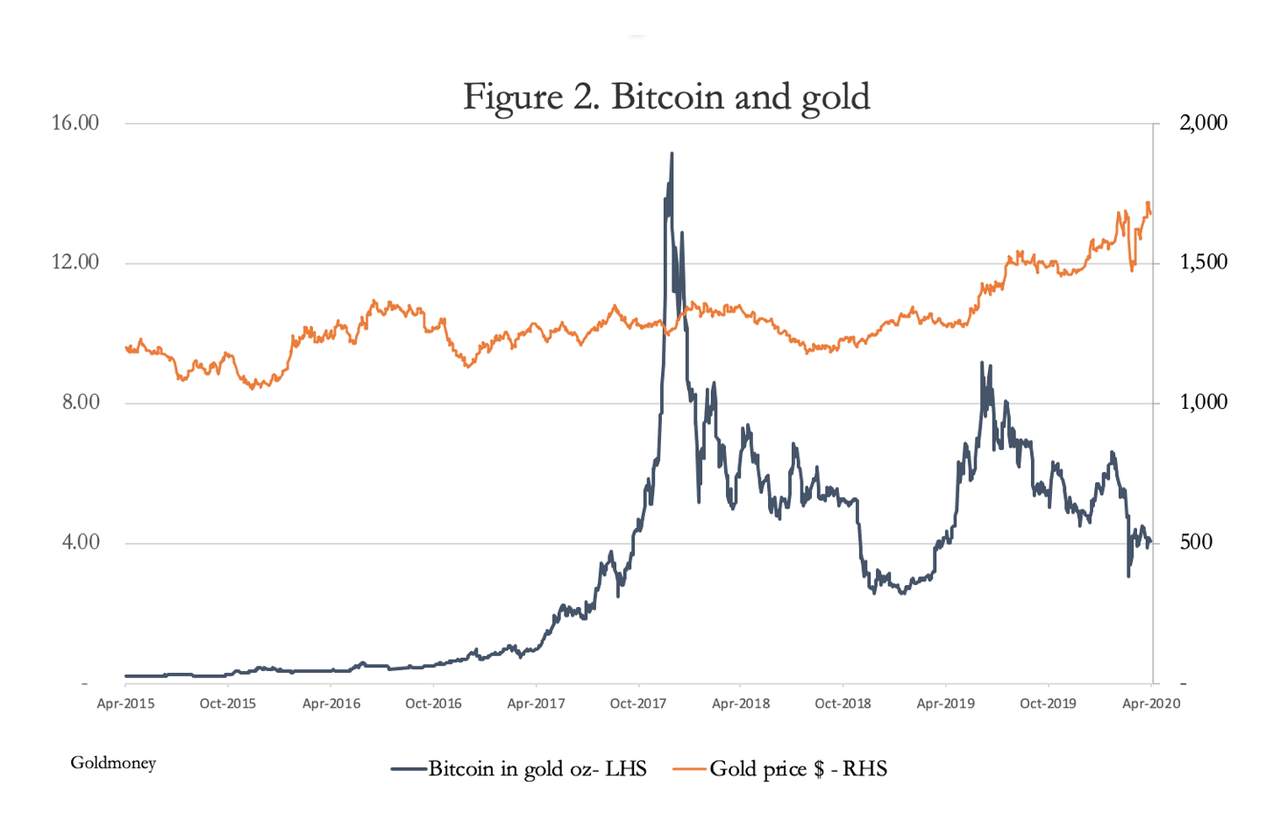

Bitcoin will therefore survive government intervention to become a possible replacement for fiat currencies. But there is the practical problem of exchange being broadly limited by users looking for investment and speculation, rather than being used as payment for goods. This is for good reason: in any transaction an acting man will want all the price subjectivity to be reflected in the goods being exchanged and objective values to be confined to the currency. Currently, bitcoin’s volatility is extreme as shown in Figure 2, which compares bitcoin priced in gold ounces with gold priced in dollars.

Gold’s volatility against the dollar approximates to the volatility of any another currency, and its upward trend principally reflects the declining purchasing power of the dollar. Even priced in gold ounces, bitcoin’s volatility has been dramatic, too dramatic to act as the objective value in an exchange for goods.

Unless bitcoin’s volatility subsides sufficiently so that it becomes widely accepted as a medium of exchange, it cannot act as efficient money in the catallactic sense. Furthermore, the blockchain system is too cumbersome for a global medium of exchange, currently limited to about half a million transactions daily when trillions are required.

While accepting that bitcoin’s other monetary features have yet to be developed, volatility would also appear to rule out agreements between lender and borrower on the value of time preference as the basis of using it for deferred settlement. For now, bitcoin appears to be good for buying with a view to selling in return for another form of money, rather than acting as money itself. Undoubtedly, owners of bitcoin, or hodlers as the slang term puts it, are valuing them in dollars, and thinking of taking profits in dollars. It appears that hodlers are speculating on bitcoin’s rise, rather than the dollar’s fall, though that will change as the general public begin to ditch their fiat currencies.

When hodlers finally understand this distinction, in the absence of fiat money and using bitcoin for day-to-day exchanges for goods, what will they sell them for? If we rule out purchases of other cryptocurrencies, the answer can only be for metallic money, gold, or properly constituted gold substitutes.

While we can draw attention to a cryptocurrency’s lack of monetary characteristics, it does not mean we can dismiss them as being merely speculative counters. Circumstances change, and it is likely that when the general public finally understands that fiat currencies are worthless, it will look for alternative stores of wealth. Bitcoin enthusiasts are among the first to understand the benefits of hoarding wealth against failing fiat currencies. Furthermore, technological innovation could provide solutions to bitcoin’s lack of transactional scalability.

Central banks are also running cryptocurrency and blockchain projects, so far with little apparent sense of direction beyond trying to keep abreast of developments. The most advanced state appears to be China, which is trialling a digital version of the yuan. But far from having the characteristics of a cryptocurrency, any version of the yuan digitised or not is, for the moment at least, just a fiat currency.

In the final analysis, whether bitcoin becomes money is down to what the transacting public decides. But for now, it remains a hedge to fiat currency risk, with the potential for the price to rise, not just reflecting the demise of the dollar and other fiat currencies but rising in its own right. The market for bitcoin is potentially huge, far larger than the feed into any speculative bubble in history, with billions of people possessing mobile phones capable of acquiring them.

Concluding remarks

The inflationists, encompassing the entire financial establishment and their epigones, fail to see the ending of fiat currencies. But a rational and objective analysis coupled with empirical evidence tells us that the sudden and rapid escalation of monetary expansion, aimed to ensure financial assets do not fail, will lead to the destruction of the dollar as the world’s principal medium of exchange. And with the reserve currency gone, it is very unlikely the other major fiat currencies will survive.

The question then arises as to what will replace fiat currencies. Government attempts to extend the life of fiat money by issuing new versions imitating cryptocurrencies will fail, only likely to extend the life of fiat by a matter of months, if at all. Existing cryptocurrencies, even the best of them, are not currently suitable replacements due to their lack of scalability and volatility. Furthermore, for now bitcoin is the preserve of investors and speculators, taking a punt on the demise of fiat, without an exit plan other than to measure or take profits in a fiat currency.

The same accusation can be levelled at gold, which is probably even less used in transactions for goods than bitcoin. But gold has the advantage of a track record of always returning as the money of public choice after fiat fails. Together with its suitability for deferred settlements, we can therefore be certain that gold will be money once again, while we cannot be so certain of the future for cryptocurrencies.

This is not to say that cryptocurrencies will not afford protection for individuals as fiat fails, only that an exit route has yet to evolve, other than being spent as money. Consequently, cryptocurrencies might retain investment or speculative value, but it will end up being measured in gold. That being the case, the reasons for using cryptocurrencies as an escape from failing fiat will disappear when gold becomes money again, along with a future role for cryptocurrencies as mediums of exchange.

Tyler Durden

Sat, 05/09/2020 – 07:00

via ZeroHedge News https://ift.tt/3blMZcK Tyler Durden