“Unprecedented Crisis” – Global Luxury Goods Market Collapses, No Recovery For Years

New findings published in “Bain & Company Luxury Study 2020 Spring Update” this week suggest a collapse in the global luxury goods market is underway with no recovery for several years, shredding any hope that a V-shaped recovery will be seen in the back half of 2020.

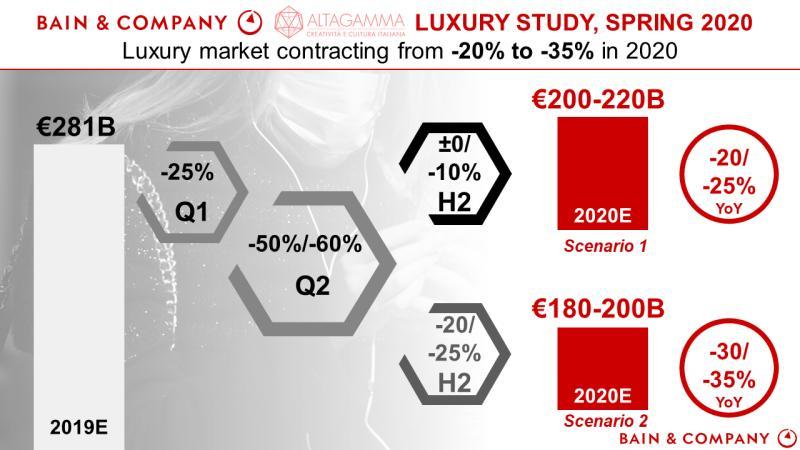

The report says the plunge of travel and tourism in all key markets has triggered “an unprecedented crisis” for companies operating in the luxury goods space. Claudia D’Arpizio, a Bain & Company partner and lead author of the report, said jewelry, watches, cosmetics, clothes, and accessory sales will drop 25% in 1Q20, and continued lockdowns across the world will lead to further declines in 2Q20. Those declines, she noted, could be in excess of 50-60% in the three months ending in June. Her full-year estimate is a contraction between 20-35%.

“There will be a recovery for the luxury market but the industry will be profoundly transformed,” she wrote. “The coronavirus crisis will force the industry to think more creatively and innovate even faster to meet a host of new consumer demands and channel constraints.”

The report notes a strong start of the year in all key regions (Mainland China, Europe, America) was eventually derailed by virus-related shutdowns of businesses and lockdowns across the world. The collapse of the travel and tourism industry, due to flight restrictions, amplified the chaos currently experienced by industry players.

Though online sales “remained resilient,” she said, adding that, traditional brick and mortar stores saw rapid declines in sales in many parts of the world. As economies reopen, luxury goods shops will have social distancing in mind:

“As consumers slowly emerge from lockdowns, the way they see the world will have changed and luxury brands will need to adapt,” said Federica Levato, Bain & Company partner and report co-author of the report. “Safety in store will be mandatory, paired with the magic of the luxury experience: creative ways to attract customers to store, or to get the product to the customer, will make the difference.”

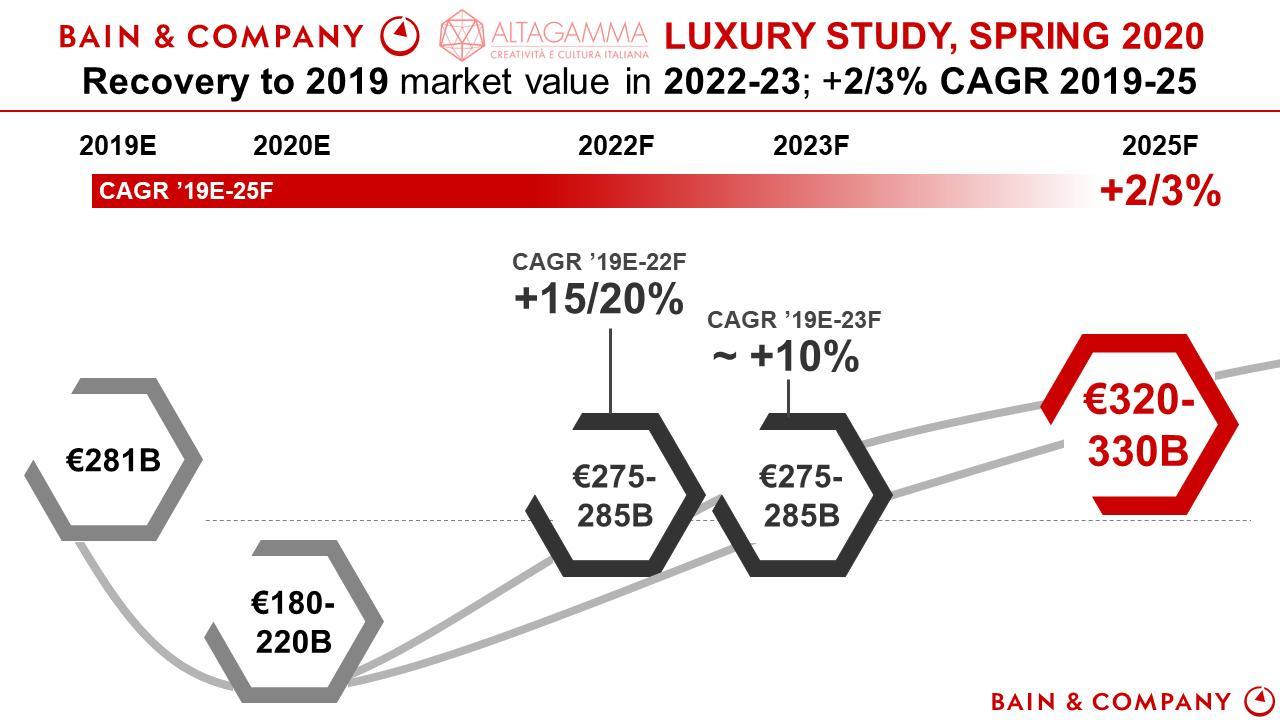

The report anticipates that a recovery in the industry to 2019 levels might not be seen until 2022-2023. The global luxury goods market might return to growth in the years after. What the authors are saying is that there’s no V-shaped recovery for luxury goods this year – suggesting consumers will remain pressured by job losses and sagging growth in a post-corona world.

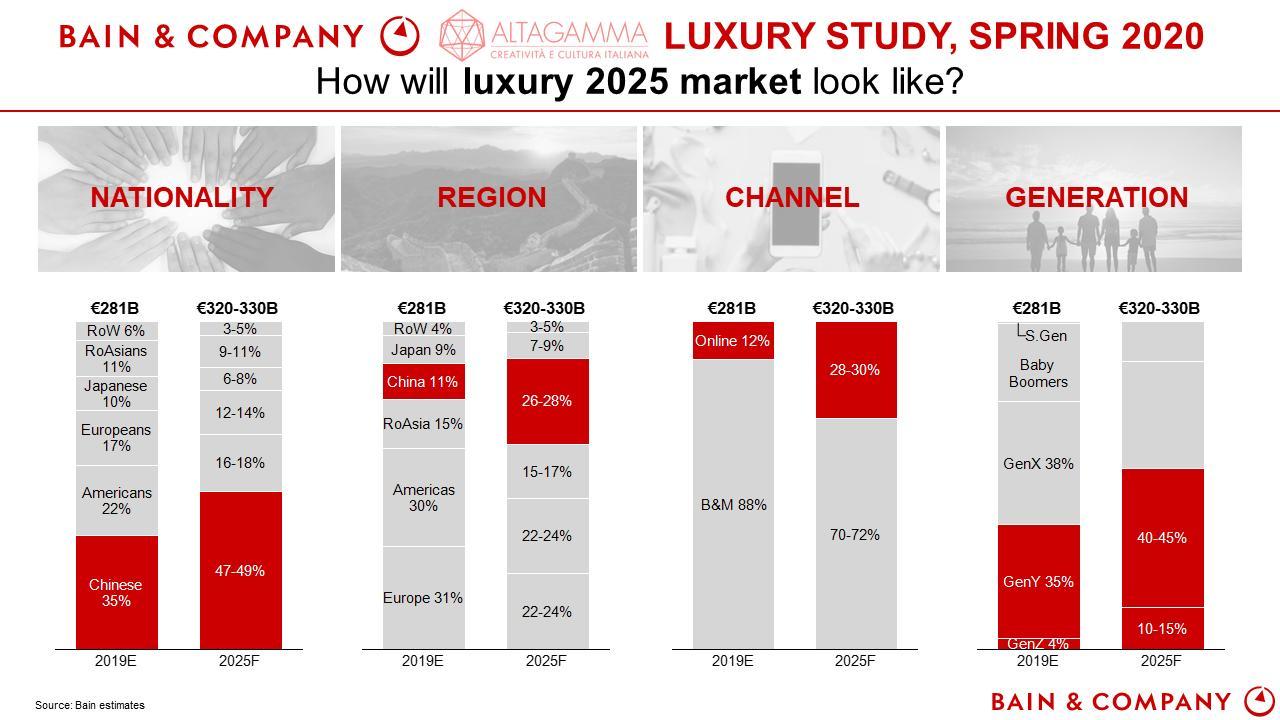

D’Arpizio said the Chinese would account for nearly 50% of all luxury goods purchases by 2025.

It’s not just luxury goods that are slumping at the moment. We noted this week that luxury real estate in many regions is experiencing slumping sales and price declines.

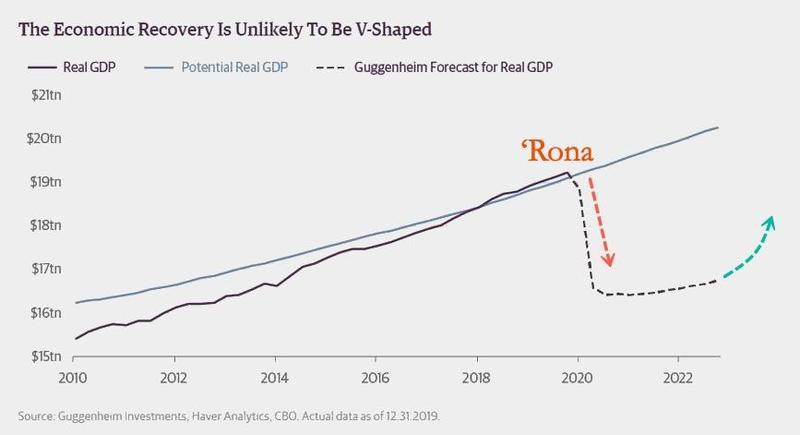

The decline in the luxury goods market suggests to us that Scott Minerd, the CIO of Guggenheim Investments, could be right, there’s no V-shaped recovery ahead, and it could take upwards of “four years” for a recovery phase to unfold.

It appears the world could remain in a low-growth, or even negative growth period, through the mid-point of this decade.

Tyler Durden

Sat, 05/09/2020 – 09:55

via ZeroHedge News https://ift.tt/2SQCisd Tyler Durden