Eric Peters: “The Real Test Is Only Just Beginning, And Everything Is About To Change”

Tyler Durden

Sat, 05/16/2020 – 15:30

Authored by Eric Peters, CIO of One River Asset Management

“How much is a human life worth?” asked Mario Cuomo in his daily press briefing. “That’s the real question that no one is admitting openly or freely, but we should,” continued New York’s governor, adding, “I say the cost of a human life is priceless, period.”

And that’s kind of a nice thing to say, just as long as no one other than your Sunday School teacher takes it seriously. Great leadership in any field is about aggregating the highest quality data possible, examining a range of possible paths, weighing the risk/reward, making clear decisions, and inspiring teams to deliver optimal outcomes over the medium to long-term. It requires self-reflection too, an ability to admit mistakes, adjust course. This is why the pandemic is such a threat to world leaders. Covid-19 is a pop quiz whose results are clear for all to see. But the real test extends beyond today’s presidents and prime ministers.

It will help all humanity judge the worth of various governance systems. Younger generations are watching especially closely. How will the Swedes fare? The Danes? Will Scandinavia’s vibrant capitalism combined with socialism’s safety nets outperform America’s system in a crisis? We’ll find out. Will the EU endure? Will homogeneous societies outperform heterogeneous ones? How about the world’s autocrats? Putin, Erdogan, Bolsonaro, Duterte. How will their systems perform?

And of course, China appears eager to taunt its greatest ideological adversary. With an under-reported 4,633 deaths, Beijing’s state media takes every opportunity to highlight America’s 79,645 victims, our colossal failure, internal division, infighting. But America’s soaring financial asset prices appear to reflect something better. Perhaps a hope that in spite of the deep faults this test has laid bare, American ingenuity and reinvention will save us yet again.

Or possibly, they simply indicate that a debasement of the world’s reserve currency has finally begun. It’s too early to tell, the real test is only just beginning.

* * *

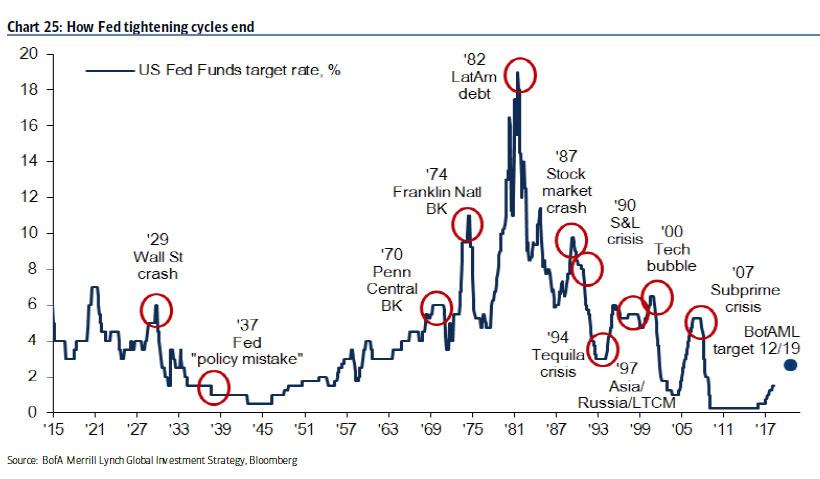

Headed to Chicago in 1989, 2wks after graduating, to trade. Couldn’t wait any longer: Greenspan set Fed Funds at 9.50%. Curve was inverted. 10yr notes yielded 8.25%. In 1990, 10yr yields hit 9.00% as the Fed cut rates – monetary malfeasance scared bond vigilantes. Interest rates have trended down ever since. Look at their chart, squint your eyes, lower highs, lower lows, for 31yrs. Powell just set overnight rates at 0%. 10yr yields are 0.68%. Next comes yield curve control. For all practical purposes, the trend in bond yields has likely bottomed.

Greenspan never saw a problem that wasn’t best solved by rate cuts and rising debt. Bernanke took Alan’s game to a whole new level in the GFC. Yellen tentatively hiked, leaving Powell to discover that further rate hikes were impossible and rate cuts were ineffective. Throughout history, this happens when each incremental dollar of debt produces just dimes of growth. At that point, central bankers turn to treasury secretaries for help, and together they work to inflate away the debt. If this sounds familiar, it’s because the debt super-cycle is likely ending.

US core PCE inflation peaked at 10.25% in 1975. Lower highs, lower lows ever since. By 1989 core PCE was 4.25%. Other things trended during that period too. For instance, union membership, which peaked in 1945 at 33% of the US labor force fell to 16% in 1989 and is now around 10% (roughly 6% in the private sector). It’s unclear what core PCE prints we’ll see in this global depression. But with today’s fiscal/monetary coordination expanding liquidity at an unprecedented pace, the inexorable trend toward lower inflation has likely bottomed.

Global trade as a percentage of global GDP peaked at 28% in 1913, collapsed during WWI, failed to recover in the roaring 1920s, plunged during WWII, bottoming at 8% in 1945 (32yrs from the 1913 peak). By 1989 it recovered to 28% and fueled by China’s 2000 WTO accession surged to a 2007 all-time high of 62%. Global trade then plunged to 42% in the GFC, rebounded, but never recovered the highs. Rising nationalistic trade policies were pressuring global trade pre-pandemic. Post-pandemic, the trend will accelerate. Trade has likely peaked.

The top 0.1% of Americans earned 205x the average wage of the bottom 90% in 1928. In the depths of WWII, they earned 50x more. By 1975 the ratio fell to 35x. In 1989, when I first started trading, the top 0.1% earned 90x the avg wage of the bottom 90%. In 2007 the ratio hit 220x. Then came 2008, and like the decline in global trade, top earners took a hit. Even after trillions in bailouts, and tax cuts that overwhelmingly benefit the top 0.1%, they have never quite recovered that 2007 peak. Like the 1930s, populism is on the rise. Inequality has likely peaked.

The Greatest Generation grew up in the Great Depression. Hardened by shared sacrifice, they won WWII, rebuilt the world, then spawned The Most Selfish Generation, who knew only prosperity. And these Baby Boomers, having learned to protest in the 1970s, directed that activism toward their favorite cause: themselves. As they voted in entitlements for the aged, they cut investment in our youth. Then came the Millennials, they have a different worldview. In 2019, Millennials overtook dying Boomers as the largest generation. Their power likely peaked.

America and its allies had no sooner won WWI then the Cold War began. That multipolar world was all I knew. My generation grew up beneath school desks, in nuclear raid drills, teaching us to fear our common enemy, the USSR. We won in 1989, as I started trading. Ever since, the world has been unipolar. My children now hide beneath desks, in active shooter drills. Absent a foreign threat, they learn that we are our own worst enemy. And into that sad void, China emerged, stronger than the USSR of old. The unipolar world has likely ended.

via ZeroHedge News https://ift.tt/2TeaqhV Tyler Durden