Here Is What Hedge Funds Bought And Sold In The Q1 Chaos: Full 13F Summary

Tyler Durden

Sat, 05/16/2020 – 13:00

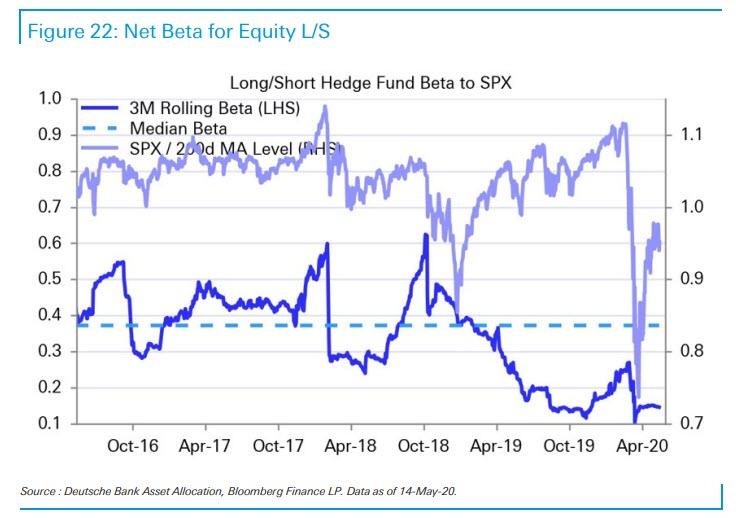

Amid a selling panic that at times surpassed the liquidation observed during both the financial crisis and the great depression, hedge funds were either paralyzed watching their P&L collapse or were busy selling as sentiment vaporized, and has yet to come back as the near record-low hedge fund beta to the S&P indicates…

… but a handful bucked the trend, and loaded up on what BofA has dubbed a “reopening portfolio” of so-called quaratine stocks.

As a result stocks such as Netflix, Peloton (which Citron infamously said to short just two months ago much to the amusement of the “Peloton girl”), Amazon.com and Zoom were some of the most sought-after names in the first quarter, according to the latest round of 13F filings, with investors such as Jim Simons, Stan Druckenmiller, George Soros and Philippe Laffont all piling into these stocks.

It was a good trade: each of the four stocks has soared double-digits as people hunkered down and reverted to television binging, at-home workouts, online shopping and video chatting. Zoom has surged 157% through May 15. Peloton saw its big rally after a first-quarter decline, and is now up about 70% for the year, because apparently millions of laid off people can afford a $2,000 exercise bike with an iPad superglued to the front.

That said, most investors were far less optimistic on the future:

- Warren Buffett’s Berkshire Hathaway which as we reported last night slashed its Goldman position by 84% and trimmed its JPM shares as the pandemic started to roil financial markets, before liquidating its entire airline portfolio.

- Larry Robbins’s Glenview and Zeke Capital Advisors, a money manager for ultra-wealthy families, were among those that drastically cut equity positions according to Bloomberg. Glenview slashed its stock market exposure during the first quarter, disclosing it held U.S.-traded equities with a stock market value of $3.7 billion at March 31, down from $11.4 billion at year end.

- Tiger Global Management trimmed its stake in alternative asset manager Apollo Global Management for the first time in five quarters, even as Bill Ackman built a $25 million stake in private equity powerhouse Blackstone Group during the quarter

- Managers were mixed on Facebook in the quarter. D1 Capital piled into the social-media giant, boosting its stake by 70%, and Soroban Capital Partners and Baupost Group started new positions. On the other side of the trade were Coatue Management and Viking Global Investors which both slashed their holdings. Facebook slumped 19% in the first quarter as its advertising business took a hit in the crisis.

- Aaron Cowen’s Suvretta Capital Management acquired shares in several consumer-focused chains. The list includes a $55 million bet on TJX Cos., parent to TJ Maxx discount stores.

Below, courtesy of Bloomberg, is a summary of what some of the most popular hedge funds did during the most turbulent quarter for capital markets since the financial crisis:

ADAGE CAPITAL

- Top new buys: SO, MNTA, AMTD, SAFM, OSK, GLD, CX, REGN, ATRC, OGE

- Top exits: MMM, JCI, VST, SWX, SCHW, ECL, USB, SPG, MDU, AMRN

- Boosted stakes in: HON, LMT, TGT, LLY, ROST, AMZN, TEL, TJX, DG, SRPT

- Cut stakes in: RTX, BAC, JPM, BURL, T, BA, AAP, BRK/B, MA, UA

BALYASNY ASSET MANAGEMENT

- Top new buys: ATVI, LOW, DG, INTC, JPM, CHTR, TTWO, ICE, PFE, TFC

- Top exits: AIG, PNC, BAC, UNP, ETN, FB, BA, RTX, SPGI, MKL

- Boosted stakes in: NFLX, BSX, QGEN, JD, AMTD, ABBV, LM, KBR, HAS, LMT

- Cut stakes in: XOM, LHX, AJG, CRM, AAP, DE, ESS, AXP, ZEN, GS

BAUPOST GROUP

- Top new buys: GOOG, FB, HDS, ET, XPO, SPR

- Top exits: BMY, SYF, NUAN, ERI, MDRIQ

- Boosted stakes in: EBAY, HPQ, MCK, CARS, QRVO, NXST, LBTYK

- Cut stakes in: LNG, UNVR, PCG, ABC, AKBA

BERKSHIRE HATHAWAY

- Top exits: TRV, PSX

- Boosted stakes in: PNC, UAL, DAL

- Cut stakes in: JPM, GS, GM, LUV, AAL, SYF, AXTA, SIRI, SU, VRSN

BRIDGEWATER ASSOCIATES

- Top new buys: UNH, MCD, LMT, PM, PEP, ACN, SPGI, ABT, HON, FIS

- Top exits: JPM, BAC, WFC, C, USB, GS, MS, BLK, PNC, ADS

- Boosted stakes in: HD, SHW, LOW, ZTO, TAL, GDS, PDD, ORLY, WUBA, IQ

- Cut stakes in: SPY, VWO, IVV, EWZ, IEMG, HYG, EWT, VEA, EFA, IEFA

COATUE MANAGEMENT

- Top new buys: JD, TSLA, CRWD, CREE, LRCX, ZM, FIT, CGC, BBBY, DDD

- Top exits: ATVI, WDAY, EA, XRX, ILMN, CRM, V, PDD, INTU, SCHW

- Boosted stakes in: NKE, DDOG, NFLX, PTON, MU, AMZN, PYPL, GDOT, GLUU, DT

- Cut stakes in: NOW, MA, LBRDK, TWTR, ADBE, BABA, FB, RNG, MSFT, SHOP

CORSAIR CAPITAL MANAGEMENT

- Top new buys: VRT, QQQ, AAPL, CHNG, CC, PSEC, BBCP

- Top exits: IWM, IWO, MDY, EQH, AER, ALLY, CASH, DSSI, LTHM, SBLK

- Boosted stakes in: MSFT, SPY, GOOG, SMIT, CUBI, INFO, CHDN, PRSP, IQV, HMHC

- Cut stakes in: SPXC, KRA, FMC, HGV, LAUR, RHP, PLYA, VOYA, TROX, AON

CORVEX MANAGEMENT

- Top new buys: CRM, BABA, ATVI, UNP, VMC, MPC, GLD, NFLX, MTCH, CNC

- Top exits: FSCT, RTX, TMUS, TWLO

- Boosted stakes in: ZEN, ATUS, AMZN, MGM

- Cut stakes in: FANG, MSGS, ADBE

D1 CAPITAL PARTNERS

- Top new buys: DHR, MSFT, LYV, AZO, MU, PPD, NKE, UNH, USB, BAC

- Top exits: NOW, ARMK, CHWY, NVST, CRM, EXAS

- Boosted stakes in: ORLY, DIS, FB, FIS, LVS, JD, HLT, GOOGL, LIN, BABA

- Cut stakes in: NFLX, AMZN, TME, CCC, RACE

DUQUESNE FAMILY OFFICE

- Top new buys: PYPL, IQV, QCOM, TAL, EDU, LVS, TME, LK

- Top exits: IWM, EEM, JPM, HDB, FDX, PNC, WFC, AEM, MPC, SNAP

- Boosted stakes in: AMZN, NFLX, BABA, FB, GOOGL, ALNY, JD, FIS, NOW, ADBE

- Cut stakes in: GE, INDA, MSFT, FCX, HD, SE, ABT, COUP, PLAN, SNE

EMINENCE CAPITAL

- Top new buys: GLD, VRT, HDS, QSR, CHNG, PANW, MAR, BKNG, DD, SEE

- Top exits: PGR, EA, TTWO, MNST, PYPL, DPZ, WW, LB, NVST, EQIX

- Boosted stakes in: MS, AVTR, HAE, RCL, PINS, SHAK, DHI, ABG, UBER, NEWR

- Cut stakes in: BABA, GDDY, SCHW, NTNX, CI, CF, IQV, RJF, ICE, CNC

ENGAGED CAPITAL

- Cut stakes in: APOG, NCR, INWK

FIR TREE

- Top new buys: DELL, CMCSA, DIS, EXC, FLT, SHLL, THCA, GIX, NFIN, PIC

- Top exits: VER, JNJ, LHX, SATS, RTX, VVNT, PAE, VRT, DKNG, I

- Boosted stakes in: TMUS, ANTM, TRNE, LCA, SLM

- Cut stakes in: LAUR, CTXS, BKNG, CNC, CHAP, FPAC, MSFT, OAC

GREENLIGHT CAPITAL

- Top new buys: CHNG, CCK, CNC, MO, PAYX, AXP, GS, DHR, BRK/B, DIS

- Top exits: GM, DXC, SGMS, SATS, TPX, CEIX

- Boosted stakes in: CNX, BHF, AER

- Cut stakes in: CC, ADNT, ATUS, TGP, XELA

ICAHN

- Top new buys: DK

- Boosted stakes in: OXY, WBT, NWL, HTZ, LNG

IMPALA ASSET MANAGEMENT

- Top new buys: TGT, SIX, CSX, VMC, AAWW, MA, AMZN, FDX, EXP, FUN

- Top exits: HES, GD, FCX, CAT, CLR, XOP, HD, WAB, TRN, PII

- Boosted stakes in: KSU, MSFT, PCAR, KNX, TTWO, KBH, NVR, HOG, UFI, LPX

- Cut stakes in: RIO, SBLK, QCOM, WYNN

JANA PARTNERS

- Top new buys: HI, NEWR

- Top exits: ZBH, WMGI

- Boosted stakes in: AXTA, JACK, BLMN

- Cut stakes in: CAG, ELY, SPY, HDS

LAKEWOOD CAPITAL MANAGEMENT

- Top new buys: MA, HCA, NSP, APO, AGNC, MCD, AMZN, CB, ICE, KFY

- Top exits: CDK, ON, ATUS, SLV, GLD, MAS, RTX, FDX, KSS, BMCH

- Boosted stakes in: WRK, GTS, BIDU, DELL, ANTM, CWK, FB, BC

- Cut stakes in: C, CIT, ALLY, GS, ATH, CMCSA, WH, COF, WUBA, GOOGL

LANSDOWNE

- Top new buys: NSC, ONEM, DAR, VTIQ, AGI, NKE

- Top exits: AAL, TXN, GRUB, CVE, CNQ, GS

- Boosted stakes in: FSLR, ETN, MU, RTX, SMMT, ADI, IQ, REGI, EGO, LRCX

- Cut stakes in: DAL, UAL, TSM, GE, DHT, TT, BABA

LONG POND

- Top new buys: RHP, MGM, AVB, VAC, JLL, CPT, CUZ, ESS, MLCO, MAA

- Top exits: VTR, OC, DIA, LOW, LEN, CONE, PEAK, ALX, CTRE, EPR

- Boosted stakes in: WH, FR, PEB, AIV, JBGS, KRC, HGV, RRR, HLT, MSGS

- Cut stakes in: DHI, VNO, H, PGRE, SBRA, HPP

MAGNETAR FINANCIAL

- Top new buys: WLTW, HPQ, ETFC, MEET, DLPH, BROG, IOTS, DLR, PPD, TERP

- Top exits: SPY, MPLX, NVS, CCC, SDC, ANTM, MMP

- Boosted stakes in: QGEN, PFE, WMB, KMI, EPD, BSX, PRGO, ABBV, CHNG, BMY

- Cut stakes in: CZR, TIF, AMTD, WBC, ET, WMGI, PACB, LH, PAA, UBER

MAVERICK CAPITAL

- Top new buys: ONEM, AMZN, MNTA, ALKS, BX, GME, DECK, ARMK, WEN, JACK

- Top exits: WLK, INTC, AGCO, WDC, NKE, TAK, DEO, MKC, KSS, GIS

- Boosted stakes in: QSR, HUM, MSFT, FB, KKR, FLT, NKTR, FTDR, PEP, ADBE

- Cut stakes in: MNST, DXC, GOOG, CNC, TMUS, LOW, BABA, ALNY, STNE, NFLX

MELVIN CAPITAL MANAGEMENT

- Top new buys: AZO, MSFT, DPZ, DRI, JD, LB, EFX, ADI, DECK, WEN

- Top exits: ATUS, AWI, TEAM, SEAS, SE, BILL, CHWY

- Boosted stakes in: AMZN, EXPE, BABA, TTWO, FIS, EDU, FISV, NFLX, IAA, FICO

- Cut stakes in: WYNN, PLAN, MA, RACE, PUM, ADBE, NOW, DLTR, IQV, LK

OAKTREE CAPITAL MANAGEMENT

- Top new buys: TMHC, BIDU, LBTYK, PBR, SRLP, ERI, WMB, BATL, MELI, SQM

- Top exits: YPF, YETI, HUYA, VRS, FPI, XOG

- Boosted stakes in: BABA, SMCI, AFYA, TV, INDA, CX, LOMA, VEON, TEO, PAM

- Cut stakes in: IBN, BRFS, CEO, BCEI, MX

OMEGA ADVISORS

- Top new buys: JPM, NBR, FB, LEE

- Top exits: UAL, DD, NRG, UNH, CCL, FANG, HES, DOW, GLD, WFC

- Boosted stakes in: FOE, COOP, CNC, RTIX, AMCX, STKL, VICI, FLMN, NAVI, OCN

- Cut stakes in: FISV, GOOGL, C, CIM, ASH, TRN, GTN

SOROBAN CAPITAL

- Top new buys: AMZN, NOC, MSFT, LHX, FB, QSR, SNE

- Top exits: MAR, NXPI, HLT, RTX, AXTA

- Boosted stakes in: CSX

- Cut stakes in: BABA, NSC, UNP, GOOGL, GRA

SOROS CAPITAL MANAGEMENT

- Top new buys: AMZN, AAPL, V, TMUS, BKNG, STZ, CDK, LRCX, HDS, IAC

- Top exits: TSG, BABA, FB, CRM, AMT, PYPL, PANW, AMD, C, FCX

- Cut stakes in: GLD, GOOGL, ATUS, IBN, CHTR, YNDX, ORCC

SOROS FUND MANAGEMENT

- Top new buys: TDG, XLU, MUB, LM, LQD, TMUS, ARMK, TCO, NI, LNT

- Top exits: MDLZ, ADM, EPC, KDP, JPM, NLY, C, BAC, ALLY, NRG

- Boosted stakes in: PTON, ATVI, ETFC, ALC, WMGI, DHI, AMTD, EQH, BK, ALL

- Cut stakes in: LBRDK, VICI, GOOGL, ENR, NLOK, VST, UNH, BGCP, TIF, CZR

STARBOARD

- Top new buys: CVLT, MMSI, GDOT, ACIW, REZI

- Top exits: SPY, IWR, MGM

- Boosted stakes in: BOX, GCP, MD, EBAY

- Cut stakes in: CERN

TEMASEK HOLDINGS

- Top new buys: BILL, BEAM, VRT, VMW, FSLY, UBER

- Top exits: BP, TOT

- Boosted stakes in: MA, DDOG, HDB, PYPL, TMO, BGNE, V

- Cut stakes in: BABA, INFO, RDS/B, NIO, UNVR, WORK, STNE, VNET, TOUR, TAL

THIRD POINT

- Top new buys: DIS, CHTR, ROP, TEL, SERV, SHW

- Top exits: CPB, BSX, FOXA, FIVE, AMTD, BKI, SCHW, GO, XP, GTT

- Boosted stakes in: AMZN, CNC, RACE, SHY

- Cut stakes in: BAX, RTX, BURL, CRM, IQV, ADBE, DHR, AVTR, FIS, SNE

TIGER GLOBAL

- Top new buys: ATH, PTON, DNK

- Top exits: WORK, VXX

- Boosted stakes in: WDAY, RNG, BABA, DDOG, PLAN, EDU, CRM, ADBE, MA, CVNA

- Cut stakes in: APO, TDG, UBER, FLT, SPOT, GOOGL, AMZN, ZEN, PYPL, SMAR

TUDOR INVESTMENT

- Top new buys: GLIBA, PYPL, AAPL, MAA, SBBX, DEI, KO, CERN, SOXX, GL

- Top exits: IBKC, NNN, USB, LKQ, JCI, TAK, ESS, EXR, EQR, FLT

- Boosted stakes in: LM, RTX, AMTD, ETFC, MSFT, PJT, EQIX, AMZN, MTCH, TTWO

- Cut stakes in: SPY, CZR, TIF, EBAY, XLF, MPC, EW, PSX, TIP, STZ

VIKING GLOBAL INVESTORS

- Top new buys: JPM, AXP, WDAY, CME, MU, ORLY, A, PGR, LVS, CHNG

- Top exits: MNST, SQ, MET, UNH, ATVI, EQH, TXT, MCK, COUP, MIDD

- Boosted stakes in: CMCSA, MSFT, FIS, CI, GOOGL, CNC, IR, AON, BSX, NSC

- Cut stakes in: FB, NOW, ANTM, UBER, ADPT, MELI, CRM, NFLX, MOH, GOOS

WHALE ROCK CAPITAL MANAGEMENT

- Top new buys: ZM, DOCU, JD, INTC, MU, ZS, LRCX, ATVI, NVDA, AAPL

- Top exits: MTCH, MRVL, WDAY, SNAP, CRUS, GRMN, MELI, RVLV

- Boosted stakes in: AMZN, TSLA, MSFT, CRWD, DDOG, FTNT, BILL, SHOP, FIVN, NOW

- Cut stakes in: COUP, DIS, FB, STNE, CVNA, CDAY, W, TSM, BABA, MIME

via ZeroHedge News https://ift.tt/3cEVjWq Tyler Durden