Bitcoin & Bullion Battered As Stocks, Bonds, & The Dollar Do Nothing

Tyler Durden

Thu, 05/21/2020 – 16:01

Another 2.4 million Americans added to the jobless rolls, China tensions soar, Leading Indicators were a disaster, Housing Data a shitshow, PMIs bounced but remain historically bad… so buy small cap (domestically focused) stocks, and dump gold, silver, and cryptos…

Gold puked on major volume at 10amET…

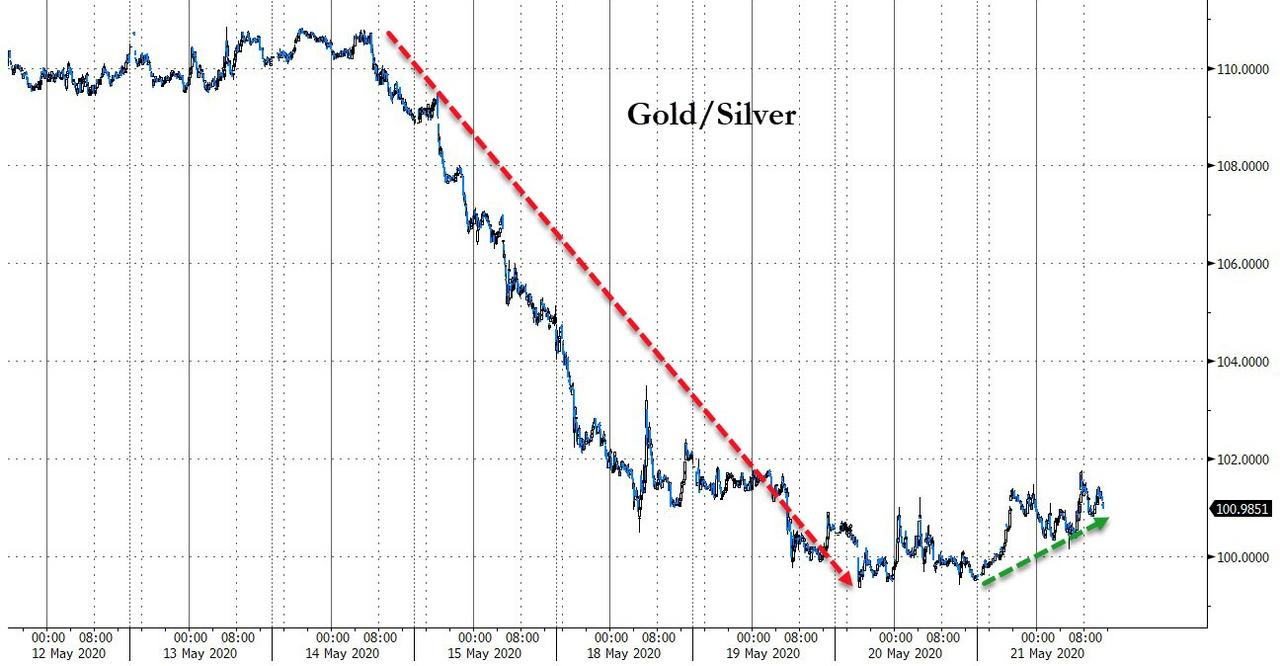

Silver was monkeyhammered even more than gold…

Which stalled the silver outperformance of late…

Source: Bloomberg

Bitcoin was also battered at the same time (around 10amET)…

Source: Bloomberg

Cryptos have erased a lot of the post-Bitcoin-Halving gains…

Source: Bloomberg

Notably, the plunge in bullion and bitcoin coincided with the ugly PMI data and a jolt lower in Fed Rate expectations (back towards negative rates)…

Source: Bloomberg

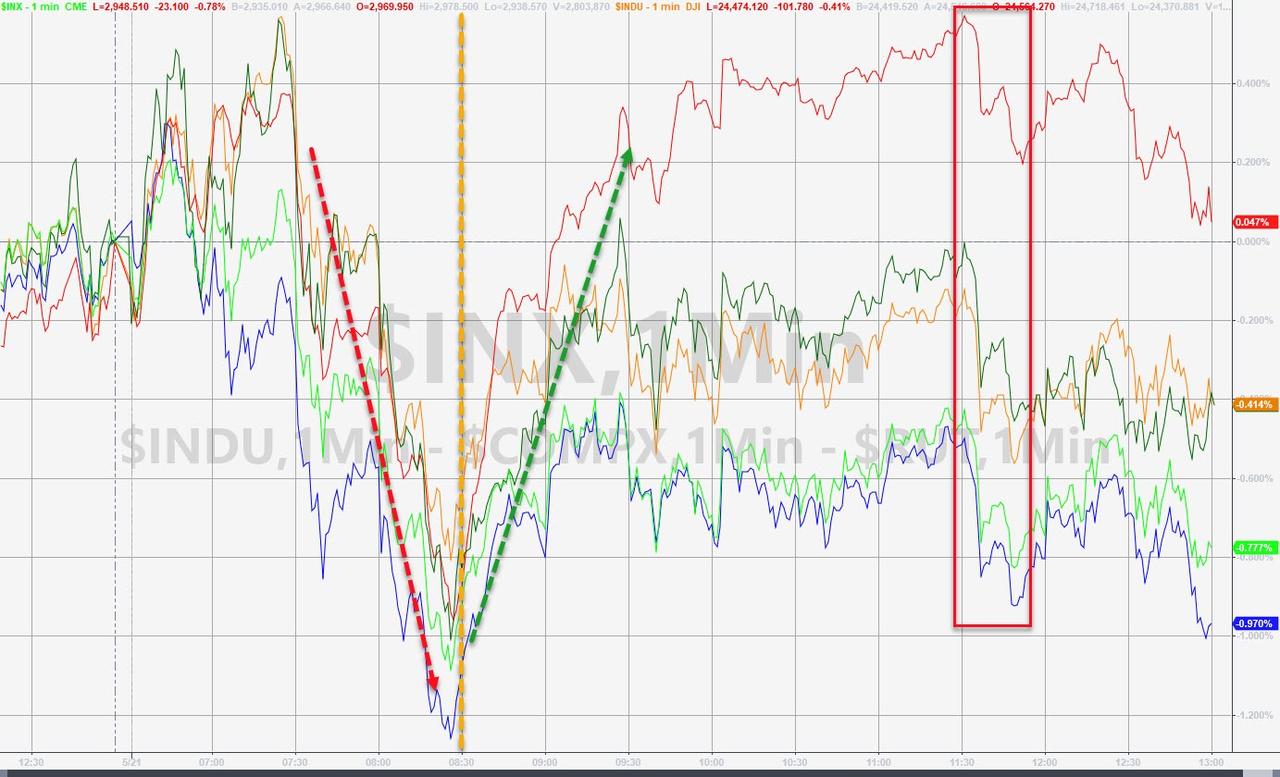

Nasdaq was the laggard on the day but Small Caps were manically bid off the European Close lows (and took a hit on the China sanction headlines late on)…

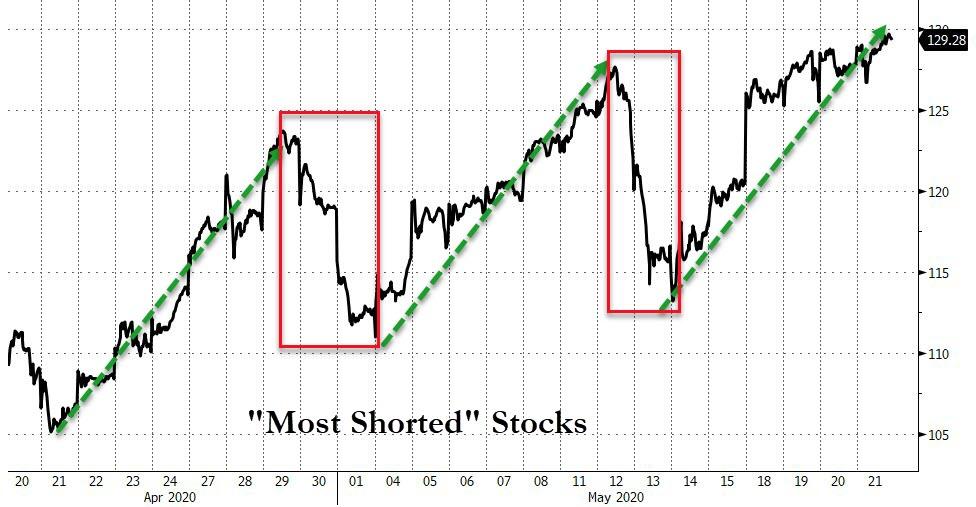

As shorts were squeezed yet again…

Source: Bloomberg

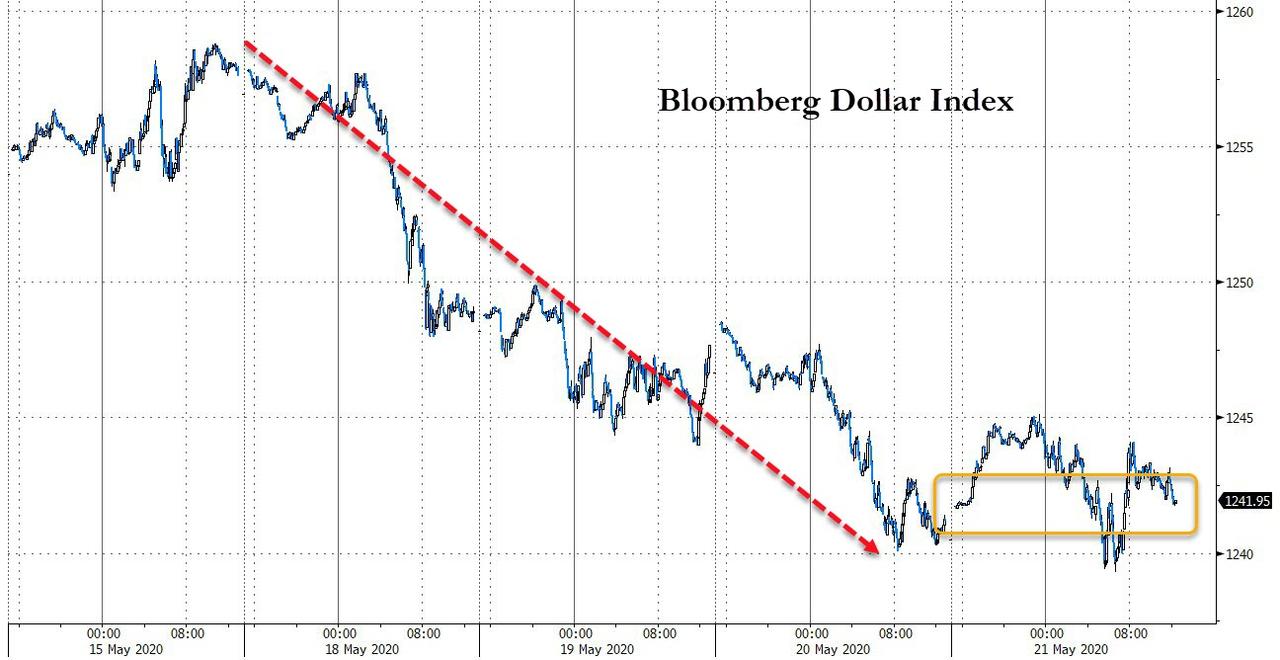

Meanwhile, The dollar did nothing…

Source: Bloomberg

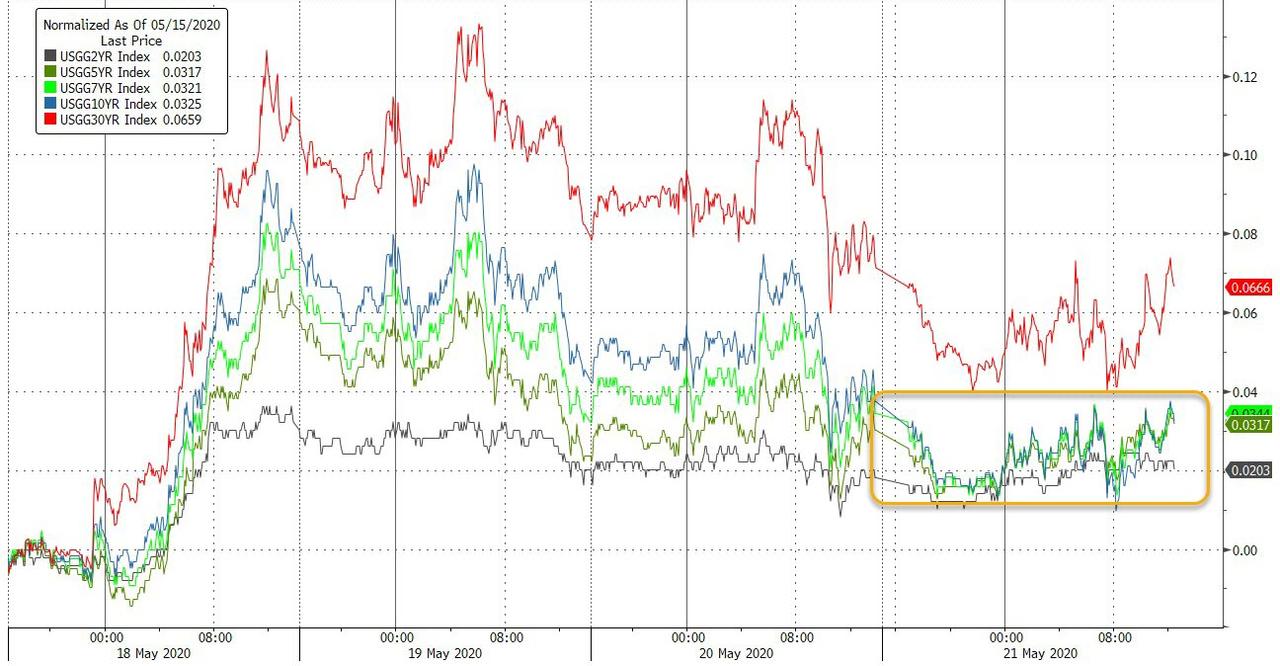

Bonds did nothing… (long-end yields rose around 1bps on a major corporate issuance day)

Source: Bloomberg

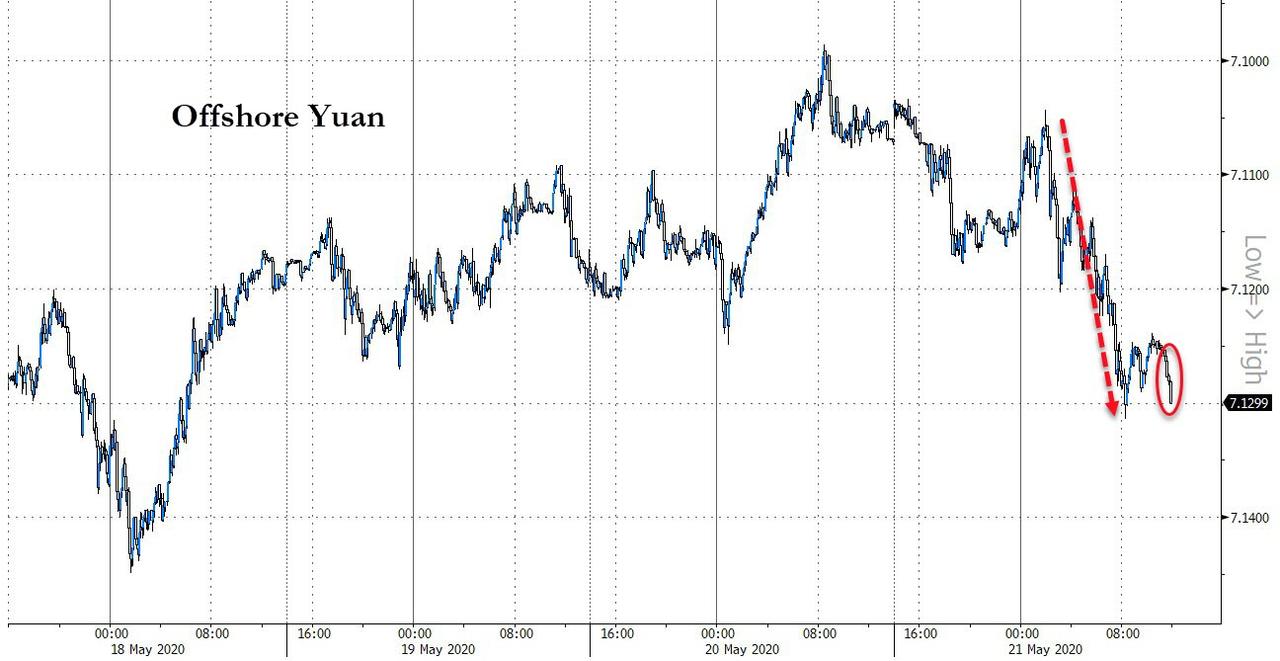

Yuan was dumped as sanctions and threats were traded…

Source: Bloomberg

Finally, whatever The Fed, The Market, The Politicians are doing… it’s not working for sentiment…

Source: Bloomberg

Americans haven’t been this pessimistic about current economic conditions in six years. The Bloomberg Consumer Comfort Index fell to 34.7 last week, a 1.1-point drop from the prior week and its ninth straight weekly decline, matching the longest streak on record.

via ZeroHedge News https://ift.tt/2Tpf6S3 Tyler Durden