Retail Investors Are Crushing Hedge Funds Again

Tyler Durden

Sun, 05/24/2020 – 18:45

They may have been burned on USO and Hertz, but for retail investors across the US, the joys of trading stocks are just too great to offset these two “BTFD-gone-wrong” blemishes. In fact, bored and flooding into zero-cost online trading platforms like Robinhood, Etrade and Schwab…

… retail investors’ recent pursuit of some of the hottest momentum stocks has created a self-fulfilling prophecy whereby the biggest momentum stocks keep rising, drawing in even more retail investors who – in the spirit of Mrs Watanabe – chase not only what goes up resulting in even higher prices for the most visible momentum names and megacap growth stocks such as the FAAMGs…

… and Moderna (where management is all too eager to sell as eager amateur traders buy)…

… but also happily buy any dip they see, such as the one in SBUX.

To be sure, there was some initial confusion where retail investors found all this capital they are now allocating to risk assets, but that was laid to rest last week when we reported “How Retail Investors Took Over The Stock Market“, in which we showed that according to credit card data analytics company Yodlee, after putting some money into savings and withdrawing cash, the third most popular activity for most income segments was “securities trades” – i.e., buying stocks – especially among the pure middle class, those making between $35K and $75K.

But what is even more remarkable is that as retail investors chase many of the same names that make up the Hedge Fund VIP list (profiled here), however without a downside hedging pair-trade which has hurt so many hedge funds which, as the name implies, must hedge and can’t be all in a handful of long positions which has detracted substantially from broad L/S equity hedge fund gains this year…

… which are down 9% YTD and performing far worse on a risk-adjusted basis…

… retail investors have successfully outperformed the so-called smart money once again.

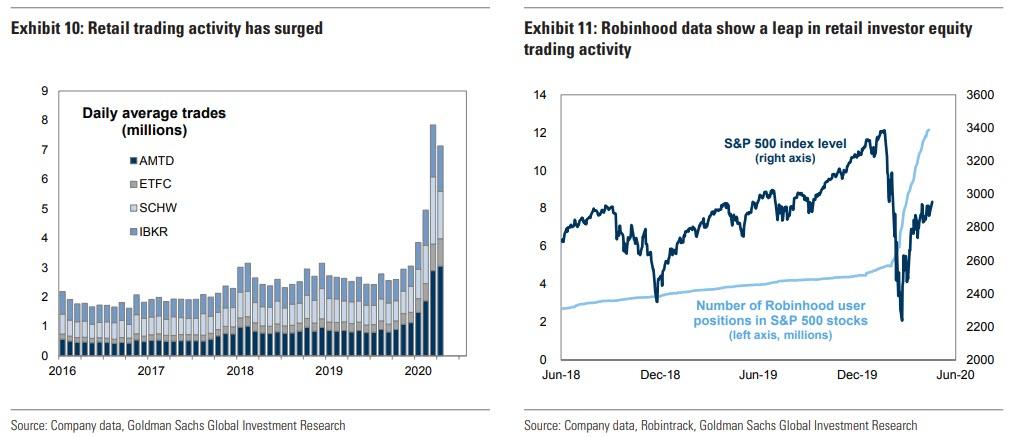

As Goldman confirms in its latest hedge fund performance tracker, the continued surge in retail investor trading activity has helped boost the growth stocks most popular with hedge funds, adding that “data collected by our equity analysts from brokers show daily average trades more than doubling in early 2020 relative to the typical pace in recent years.”

This echoes the data from Robinhood, which showed nearly a tripling in user activity this year, with the number of distinct user-positions in S&P 500 stocks rising from 4 million at the start of 2020 to 5 million at the market peak in February, 7 million at the S&P 500 trough in March, and 12 million today. This sharp increase in retail trading has helped a basket of popular retail stocks (which for those who have access can track it using Goldman’s Marquee platform under the GSXURFAV ticker) outperform the S&P 500 by 13 percentage points YTD.

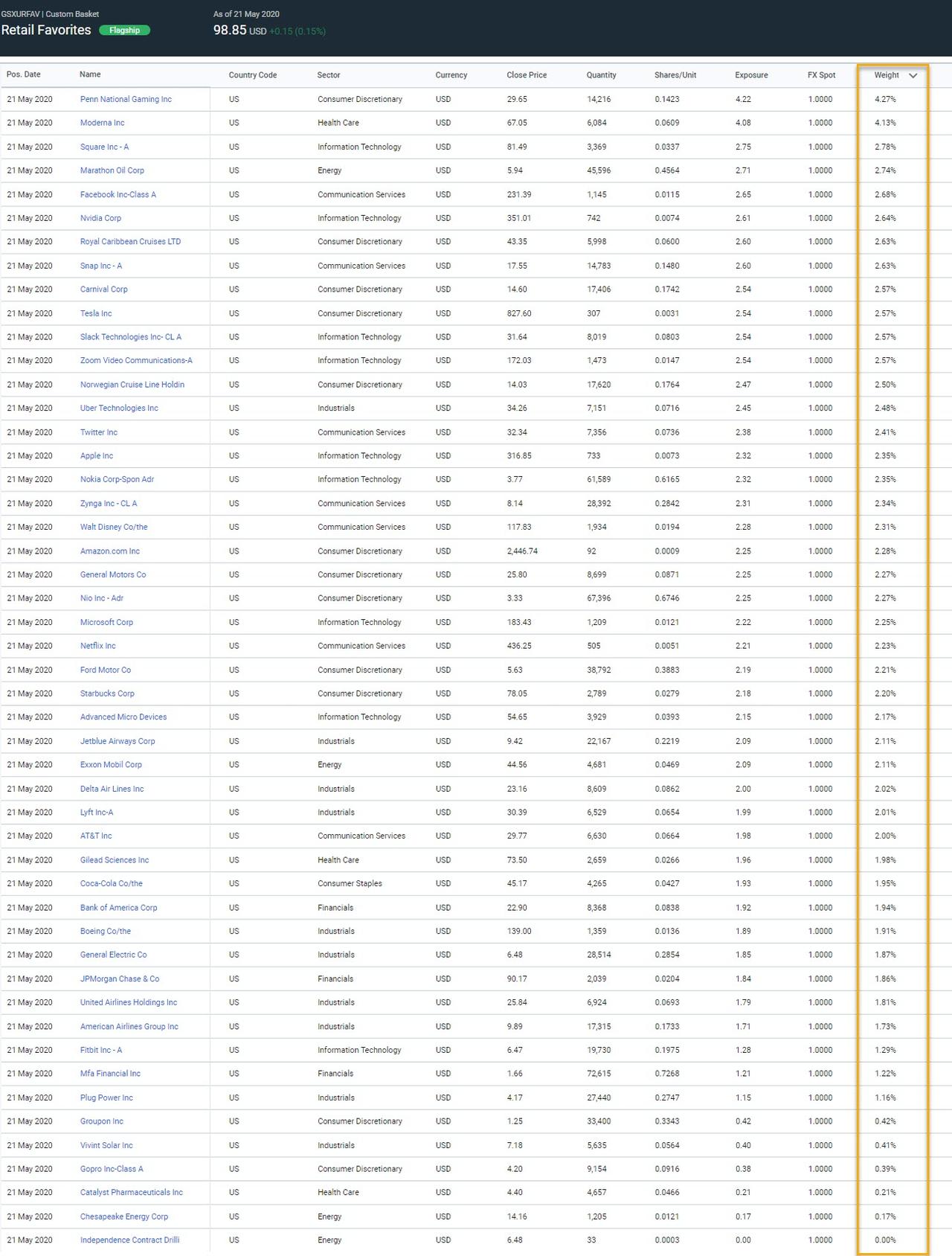

And, as Goldman notes, “because so many retail favorite stocks are also popular with hedge funds, the retail trading surge has also benefited the performance of hedge fund portfolios. Eleven of the 50 stocks in our Hedge Fund VIP basket also rank among the 50 most popular retail trading stocks, including the top three stocks in the VIP list (AMZN, MSFT, and FB).” The full list of the 50 most popular retail stocks is below (while the matching hedge fund VIP list can be seen here).

This means that as a result of this cross-investor “symbiosis”, one where the Fed’s intervention means that there are just a handful of stocks that everyone must buy in hopes of outperforming the broader market, the 11 stocks in common have returned a median 18% YTD compared to a median.

But the punchline is that as a result of the massive concentration in non-FAAMG stocks across hedge funds which as we explained earlier have punished the smart money, retail investors are once again outperforming hedge funds!

Needless to say, this is a bizarre outcome: after all, what is the point of all the in-depth analysis conducted by hedge funds if 20-year-old retail investors armed with just an online trading platform and listening to CNBC can outperform them?

And as hedge funds struggle with this existential dilemma – which will last as long as central banks step in every single time to prop up the market now that moral hazard has officially been banished – we remind readers that this is not the first time retail managed to outperform hedge funds in recent months. In fact, in late February – just two days after the S&P hit an all time high – the we posted the exact same observation, and concluded by saying that “while it is certainly a novelty to see retail investors outperform hedge funds, we doubt this divergence will last long.“

It did not, and the market crashed just days later.

So fast forward three months to today when the same bizarro divergence is back, prompting many to ask if the same selloff we observed in early March is about to strike again? With the Fed going all in to make sure it does not, this time it may – in fact- be different, but according to Wall Street pros (who, let’s face it, now have less clout than daytrading Joe Sixpack if based on performance) this latest torrid scramble by retail investors will again “end badly“:

“Obviously you’re exposing yourself, depending on how you’re doing it, to catastrophic losses,” said Brian Nick, chief investment strategist at Nuveen. “If you get a lot of investors in either individual securities, companies or investment strategies that they may not have experience with, it could lead to unhappy investors down the road.”

“There is a long, documented history of retail investors chasing a handful of story stocks and then getting burned,” said James Pillow, managing director at Moors & Cabot Inc. “We humans love a good narrative. I cannot imagine this time around ending any different.”

Perhaps. But for now it is the hedge funds that are again chasing retail investors, because as Deutsche Bank’s Parag Thatte writes in his latest Investor Positioning and Flows report, “long/short hedge funds, measured beta to the mega cap growth as a whole is below historical average but has been rising over the last three months.”

At the end of the day, however, what happens next depends entirely on the Fed. After all, as one after another strategist now admit – most recently Bank of America – this is a “Fake market” where “government and corporate bond prices have been fixed by central banks.” One may, in fact, call it legalized gambling and that’s precisely what one of the retail gamblers “investors” admitted when interviewed by Bloomberg:

[Meet] Ameer Umarov, a cab driver in Arizona with an interest in math and a passion for video games. Months ago, when he realized the coronavirus was growing into a global health crisis, he reactivated his Amazon.com account to make some purchases. Not for masks or hand sanitizer — for books on stock trading. Two a week, at one point.

When equities started surging in late March, Umarov stayed away, scared by the volatility. He was ready to act by the first week of April. He bought shares of Boeing Co., a bad decision that set him back more than $4,000. But a stake in Halliburton Co. brought him $9,800, after he sold shares on the day of a 16% rally late last month. A few other purchases — Goldman Sachs and Micron Technology Inc., among them — yielded mixed results. All told, Umarov is down some $400 since he began.

“It’s a gamble, but a highly intellectual gamble,” he said by phone. “It’s about knowledge and risk, but especially for guys like me, it’s all about sheer luck.”

Umarov is right: the Fed’s endless interventions have made a mockery the “market”, obviating any fundamental analysis or in-depth research, and ushered in the biggest casino known to man. Which is why in a time when a trade’s success depends only on whether one picked the right side of the coin toss, it is no surprise that a millennial investor armed with nothing more than a trading platform can outperform the “smartest men in the room.”

via ZeroHedge News https://ift.tt/2Ztjd3A Tyler Durden