US Manufacturing ‘Soft’ Survey Data Disappoints With Modest Rebound

Tyler Durden

Mon, 06/01/2020 – 10:04

Following May’s preliminary PMI rebound, final ‘soft’ survey data for the US manufacturing sector was expected to consolidate its rebound.

However, while Markit’s PMI held its rebound at 39.8 (from 36.1) it was slightly below the 40.0 expectations and showed no improvement over the flash print.

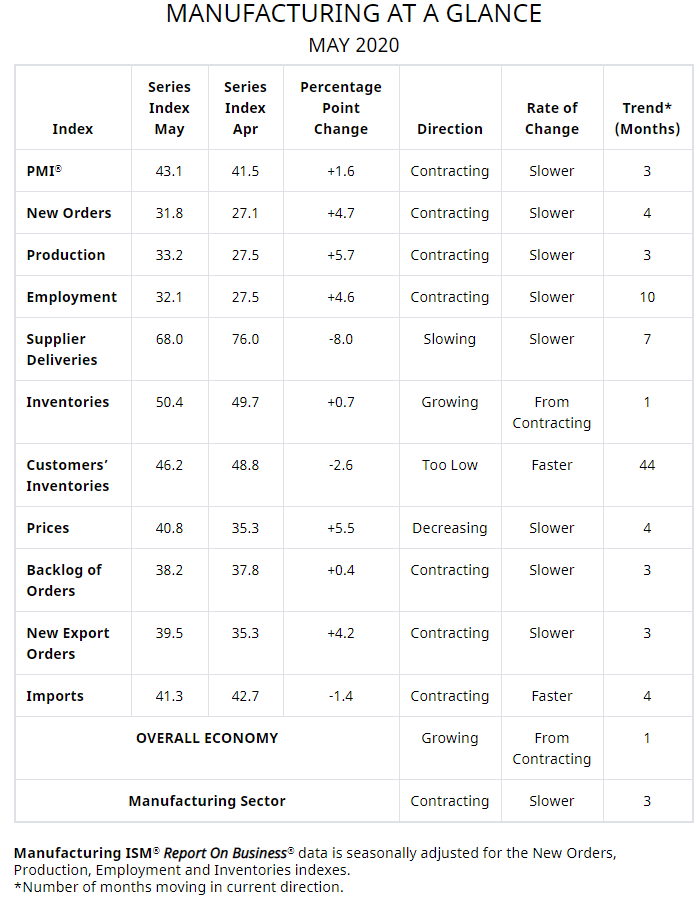

ISM Manufacturing showed a similar picture – with a modest rebound but disappointingly missing expectations (up from 41.5 to 43.1, but less than the 43.8 exp)

Source: Bloomberg

Markit reports that a marked decline in total sales and negative sentiment towards the outlook for output over the coming year drove employment down, as firms reduced workforce numbers substantially. At the same time, lower input buying and weaker overall demand conditions put pressure on suppliers to lower their prices. Consequently, input costs fell again, in turn helping manufacturers to cut their output charges at a record pace as firms sought to remain competitive.

Under the hood of ISM’s data, things are not pretty…

While most respondents suggested some level of optimism that the corner has been turned:

-

“Fuel sales demand are beginning to rebound in May as stay-at-home orders are lifted across the country.” (Petroleum & Coal Products)

-

“Returning to full production for automotive, ramp-up will still depend on speed of automotive start-ups. We have built up inventory to stock. Ready to ship.” (Fabricated Metal Products)

-

“Business activity remains strong for consumable applications and very weak in durable segments.” (Plastics & Rubber Products)

-

“We see a lot of positive signs, despite what’s going on. People seem to continue to be building and looking to projects for fall of 2020 and beyond. There is good optimism out there.” (Nonmetallic Mineral Products)

-

“Despite the COVID-19 issues, we are seeing an increase of quoting activity. This has not turned into orders yet, but it is a positive sign.” (Computer & Electronic Products)

There were a few non-believers:

-

“Current conditions in the automotive, construction, oil and gas, agriculture equipment, and tube/pipe markets are all adversely impacting our business results.” (Chemical Products)

-

“We see an issue with suppliers that are affecting production. At the same time, social distancing measures in [the] manufacturing plant and customer demand are impacting the rate of production.” (Transportation Equipment)

-

“Increased COVID-19 sales in the food business has really stressed our production capabilities.” (Food, Beverage & Tobacco Products)

Digging into some of the pricing details, We see the following “essential” commodities higher in price:

Alcohols; Crude Oil; Freight; Personal Protective Equipment (PPE; PPE — Gloves; and PPE— Masks

But most other commodities are lower in price…

Acrylate Monomers; Aluminum; Base Oils; Copper; Corn; Diesel Fuel (3); Methanol; Nylon; Oil Based Products; Packaging Materials; Plastic Products; Polypropylene; Solvents; Steel; Steel — Carbon; Steel — Cold Rolled; Steel — Hot Rolled; Steel — Stainless; and Steel Products.

Chris Williamson, Chief Business Economist at IHS Markit said:

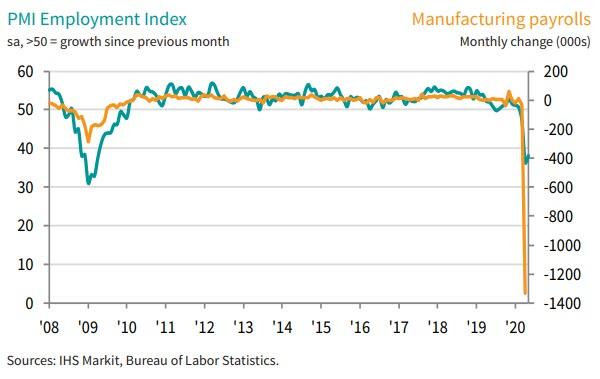

“Manufacturing remained in a deep downturn in May, as measures taken to contain the spread of COVID-19 continued to cause production losses, disrupt supply chains and hit demand. Job losses meanwhile continued to run at one of the highest rates in over a decade, and pricing power has collapsed.

“With increasing numbers of companies restarting production, we should see some improvements in the output trend in coming months, and it was reassuring to see signs of the downturn already starting to ease in May, suggesting April was the eye of the storm as far as the production collapse is concerned.

“There remains a high risk that any recovery will be frustratingly slow as ongoing social distancing measures, high unemployment, job insecurity and damaged balance sheets constrain consumer and business spending. The recovery will of course also fade quickly if virus infections start to rise again. For now, however, we focus on the good news that we may be past the worst in terms of the economic decline.”

But, despite all that, The Dow is back to pricing in economic expansion…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2Xk1Oc1 Tyler Durden