Market Cap Of Bankrupt Hertz Approaches $1 Billion Amid Unstoppable Flood Of Retail Buyers

Tyler Durden

Mon, 06/08/2020 – 14:28

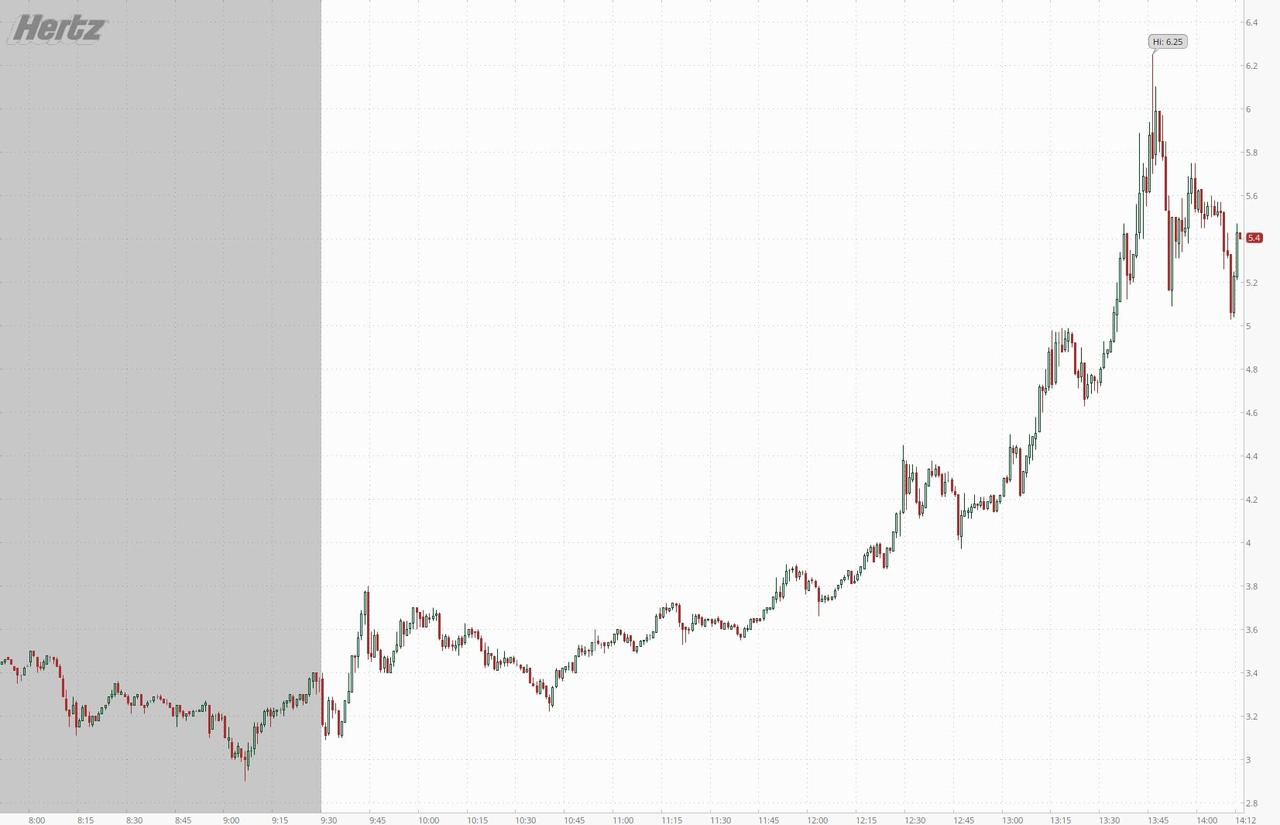

Nothing all that new here for those who have read our prior posts on the topic such as “Bankrupt Hertz Stock Soars 100% On Relentess Flood Of Retail Daytraders” and “Retail Investors Continue To Pile Into Bankrupt Hertz“, except to note that the move in stock of bankrupt Hertz where the herd of retail daytraders, has gone absolutely parabolic, with the stock rising as high as $6.25, nearly triple its Friday close of $2.57, and translating into a market cap of just under $900 million.

As a reminder, the stock was trading at 80 cents just last Thursday, returning approximately 800% in the past three trading days.

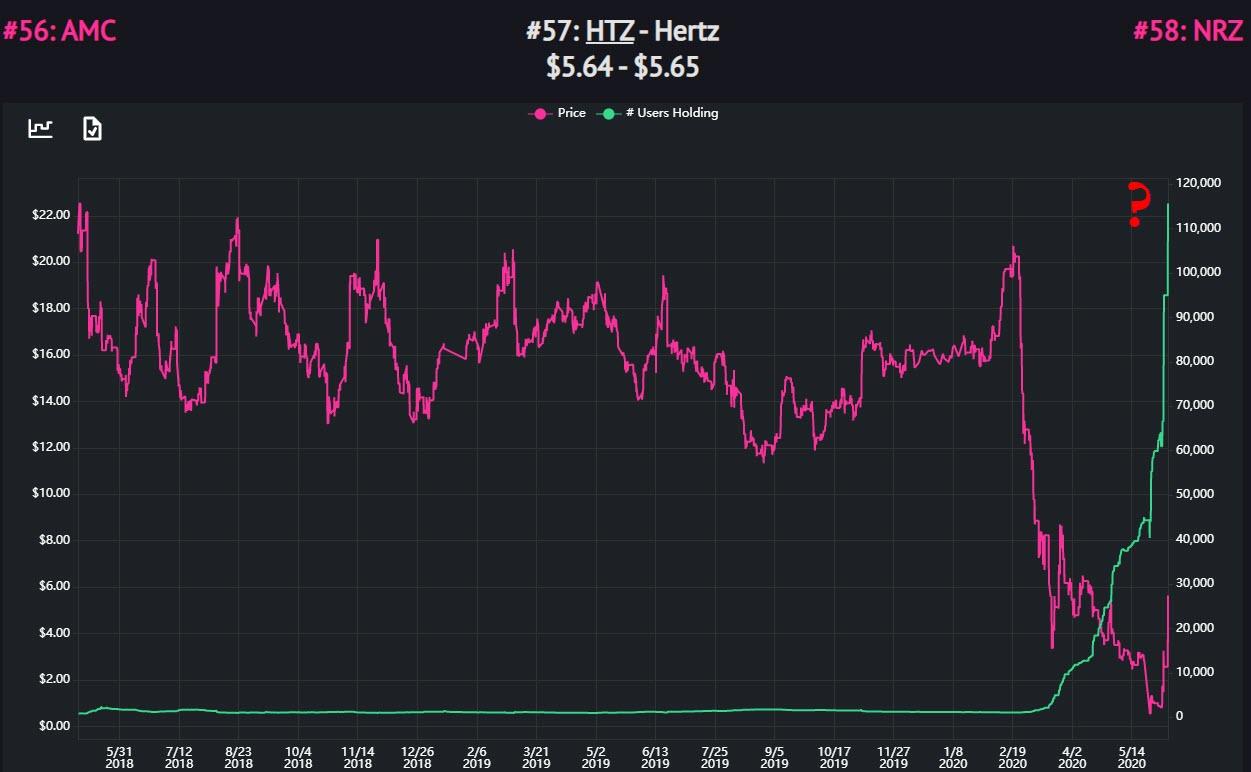

Why is the market cap of a bankrupt company where the vast majority of its bonds will be impaired and the pre-petition equity will receive nothing, trading at such a price? The answer can be found, as in so many other cases these days, with Robin Hood where almost 80,000 new buyers have emerged since the company filed for bankruptcy, sending the company stock soaring even though it is patently worthless.

The last time we saw euphoric retail mania such was in late 2017 when everyone had a coinbase account and pushed cryptocurrencies to levels that left fundamental investors stunned and fuming. Well, the same fundamental investors who still bother with such things as, well, fundamentals, instead of realizing that only the Fed matters, are once again stunned and fuming.

As for Hertz, we hope the company’s sells a few hundred million worth of stock – after all there is apparently endless demand for its shares – just so we can test the so-called “price discovery” of Powell’s latest and greatest FOMO bubble.

Joking aside, we hope that at some point the regulators (remember them) will step in and put an end to this insanity before too many gamblers lose their life savings. However, we won’t hold our breath as such an act would expose just how farcical this hot potato “market” has become.

via ZeroHedge News https://ift.tt/2UjOZMY Tyler Durden