“Losing The Bottom”: Market Capitulates On The Idea That Normalization Is Ever Again Possible

Tyler Durden

Sun, 06/14/2020 – 14:15

In the world of finance there are certain catch phrases that have withstood the test of time: one is Pimco’s “New Normal” meant to define the post-financial crisis world (which the firm’s CIO Marc Seidner, incidentally, is no longer that excited about saying on Friday he is “getting pretty sick of the phrase”). Another is Albert Edwards’ “Ice Age“, which however is now coming to an end with the SocGen strategist expecting a “Great Melt” to be unleashed soon (but not before a massive deflationary bust hits first).

A third such phrase is the “state of exception” defined by DB derivatives strategist Alex Kocic, which is meant to describe the world in which markets no longer function as they should due to interventions by central banks which are meant to stabilize these markets and revert them to a normal baseline, hence the “temporary” nature of these states although as we have often critiqued Kocic’s view over the past few years, it has always been our belief that the market simply will never be able to remove its ever-bigger training wheels, with central banks forced to intervene any time there is even modest turmoil, effectively making this state fully permanent.

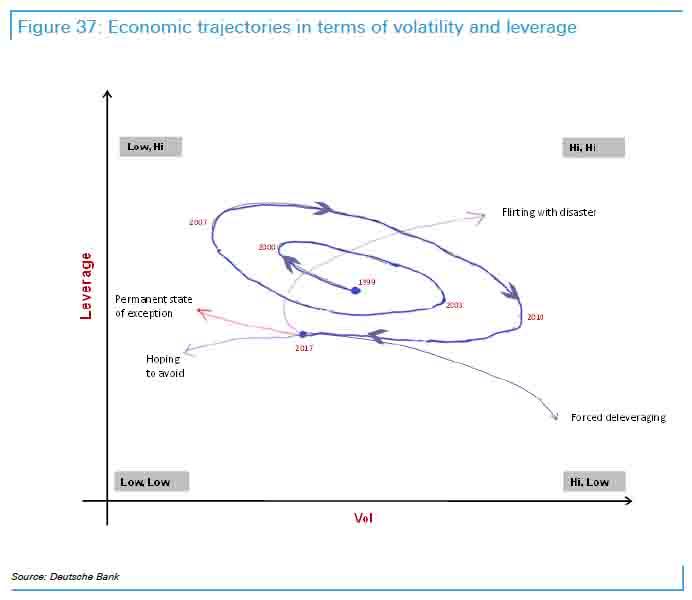

Back in December 2017, when looking at the feedback loop of volatility and leverage, Kocic himself hinted that an outcome such as this was likely…

… saying that there will come a point when “the spiraling trajectory cannot continue indefinitely; it has to stop at some point beyond which there will be no more bubbles. In many ways, it looks like the post-2008 represents the last lapse. A new game has to be reinvented for the old future to materialize, or a different paradigm altogether has to take over.”

Well, as Kocic now concedes, the events over the past three months were just that event, and the “permanent state of exception”, which those clutching at the straws of efficient markets had hoped would only be the latest temporary deviation, is truly permanent and is “here to stay.”

In his latest credit note, Kocic gives a quick recap on the political framing of the term he defined half a decade ago, defining it as follows:

In times of crisis, which shake up the accepted order of things, the enhanced power to transcend existing rules and laws in the name of “public good” are given to a superior entity, “the sovereign”, until the crisis is over.

To ensure popular support to what was effectively encroaching statism and USSR-style central planning of markets, Kocic then writes that “in the case of the last two financial crises, policy response in both cases has been articulated as the state of exception: Traditional rules and norms of the market were suspended for the purpose of self-preservation with central banks acting as “the sovereign”. The markets continue to function while the rules withdraw.”

As a result, “central banks rise above the normative constraints of the free markets and decide about their validity. They are the subject taking the ultimate decisions, other rules become only antechambers of their power. These decisions free central banks from all normative ties and they become the ultimate rule that governs the markets.”

Stated simply, central banks have taken on the role of the communist politburo, which micromanages the economy similar to what the USSR did for 5 decades, however to avoid allegations that capitalism is now dead and minimize references to the gruesome collapse of the USSR when central planning resulted in too much capital misallocation and too many bloated and inefficient enterprises, culminating with the collapse of the Soviet Union, the Fed’s role had to be framed as merely a temporary one.

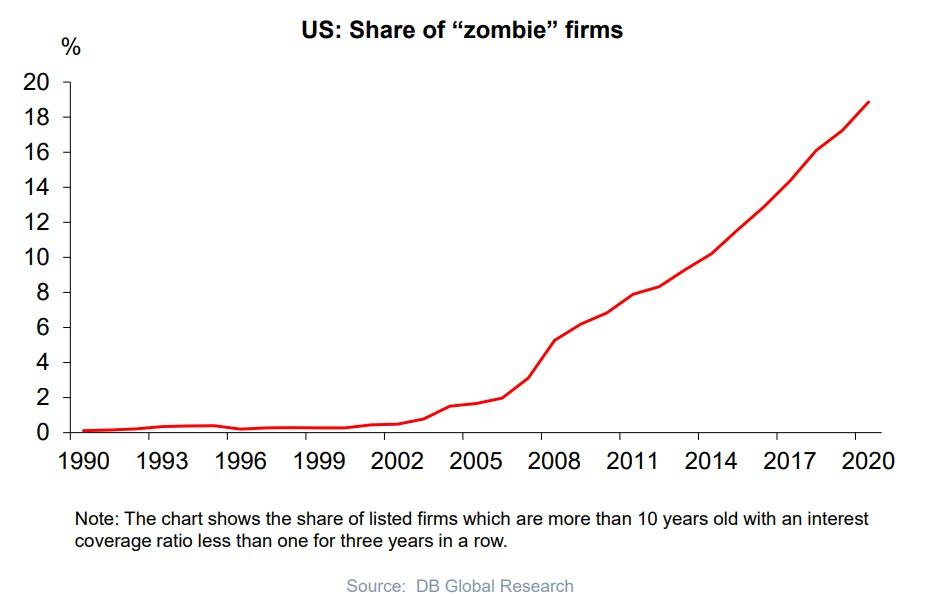

With that in mind, Kocic explains that this “position of enormous power…. works on the environment of the markets so that the markets voluntarily decides in favor of central banks’ decisions and actions. This in turn creates a low-frequency positive feedback loop between central banks and markets which, although supportive while it lasts, can cause contentious reactions when withdrawn. We have been there before, the memory is still fresh.” Incidentally, nowhere is the creeping Sovietization of the US economy more evident than in the surge of zombie companies, which according to Deutsche Bank’s Torsten Slok are now a fifth of all US corporations (which brings up a critical question of where is the tipping point before the sheer propensity of zombies crashes the entire economy which can not be supported by a handful of tech stocks any more, but that is a discussion for another post).

This brings us to the present, where in the aftermath of the Fed’s grotesque takeover of capital markets following the March crash, Kocic writes that “here we go again, the state of exception is back, although this time it is really different.”

Why? Because as a result of what appears to be the full “Austrianization” of Kocic, the strategist agrees with what we have been saying for the past decade, namely that “with every new crisis problems have become deeper and more difficult to manage” which was to be expected in a world in which constant bailouts from central banks prevent a normal corrective process to occur as the imbalances and excesses continue to pile up resulting in ever greater shocks to the system, requiring ever greater bailouts, and even greater debt, i.e., borrowing from the future until, as Eric Peters, recently said “We Have Reached The Point Where The Entirety Of Future Prosperity Has Been Pulled To The Present.“

Conceding that central planning has won, Kocic admits that the untenable problems which have not been fixed but merely swept underneath the rug, “pile up on top of the unresolved problems from previous crises forming an accumulated residual which, with time, erodes market’s ability to recover. As a consequence, new crises become increasingly more difficult to manage requiring an ever more extended accommodation and heavier handed policy intervention. This in turn diminishes market’s ability and/or desire to re-emancipate itself and to function on its own, producing the reinforcing loop between market’s “apathy” and Fed’s addiction liability.”

However, where Kocic does provide some fresh perspective is his quantification of these dire conclusion, and specifically the admission that as of this moment, the entire market has come to grips with the understanding that the Fed can never again step back.

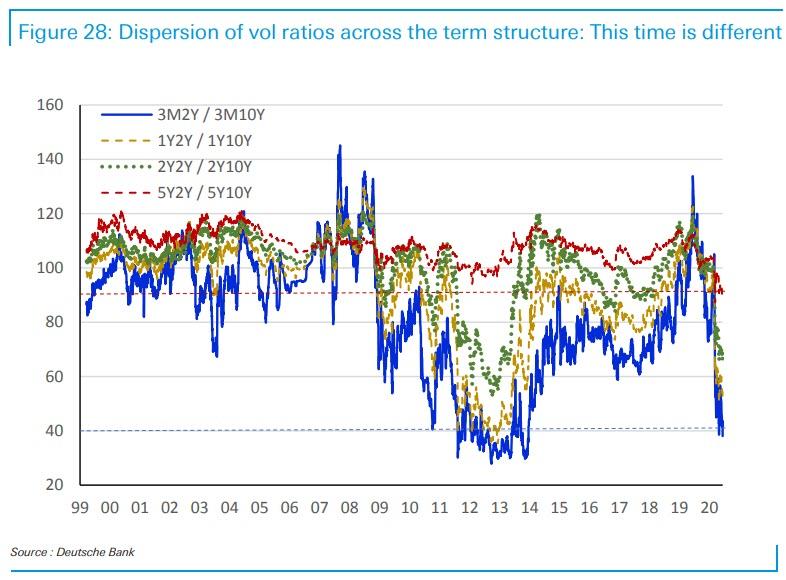

To do that, Kocic present a chart showing the dispersion of vol ratios across the term structure, where he spots something that suggests that “this time it’s different”:

The figure shows the history of the 2Y / 10Y vol ratios across the term structure, from 3M2Y / 3M10Y to 5Y2Y / 5Y10Y. In normal markets, when the Fed is active at the front end of the curve, the entire term structure of these ratios resides (on the average) above 100%. As the shocks are administered through the front end and attenuated as they propagate to the back end, the front end leads in both directions – the curve responds to the Fed shocks through bull steepening or bear flattening. During QE, the front end is parked near zero, while the back end moves in response to Fed purchases and expresses the referendum on their success. Back end is more volatile than the front end as the curve bear steepens or bull flattens. The ratios, at least the gamma sector, declines below 100%.

Kocic then adds that “as this state of suspension of traditional rules of yield curve dynamics is expected to be temporary — this is the essential part of the state of exception — the options market expresses the view of the horizon over which the market would normalize. The long dated ratios generally remain stable despite collapse of the short dated ones. This is the dispersion that we observe both post 2008 and now.”

Why is the chart different this time? Because while the dispersion is expected, “the long-dated end has developed new structure in 2020.”

Until this year 5Y vol ratio, 5Y2Y / 5Y10Y, has never declined meaningfully below 100% (this is highlighted by the red horizontal dashed line). In the past, pre-2008, monetary policy was always one of the main sources of volatility — front end almost always delivered more vol than the back end. Monetary policy shocks were swift and the market metabolized them quickly. Long-dated front/back vol ratios were always trading above 100% as short tenors vol carried a premium due to uncertainty related to a possibility that future monetary policy would need a heavier hand and that possible reversal of policy could cause additional volatility in the market.

And in a victory for all those who have long claimed that the Fed, having increasingly taken over the market in the past 11 years will never again be able to step away, but will instead be forced to increasingly extend its control over all asset classes, the market now agrees. Here is Kocic:

… the loss of the bottom of the 5Y ratios, their decisive and swift decline well below 100% (Figure) is indicative of something new – market’s skepticism that rates will normalize any time soon, if at all, that the traditional dynamics of rates cuts and hikes as the essence of monetary policy will not return in the foreseeable future.

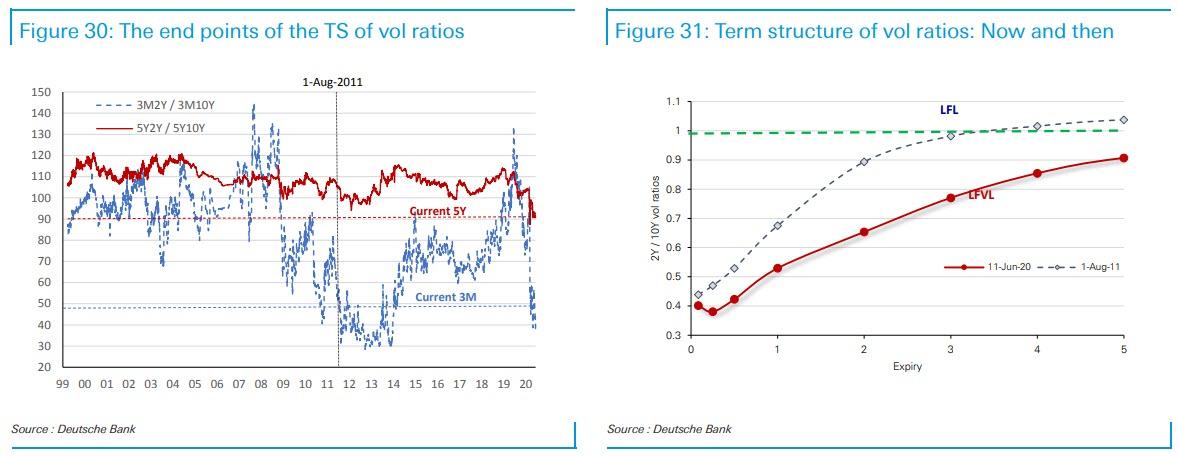

Another way to visualize the market’s determination of the “duration” of the state of exception, i.e., the period when central banks are in absolute control, are the two charts below meant to facilitate a comparison of the current term structure of the ratios with a snapshot in mid-2011 when gamma reached the same levels as we are observing today. The thing to note is that, as Kocic says, “while in 2011, the ratios rose rapidly and reached 100% over subsequent three years, current term structure is rising slowly, never reaching the previous levels. This extends even beyond 5Y expiries.”

In short, looking at the market, the DB streategist sees “a capitulation on the idea of return to normalcy over all horizons – the ratio increases along the term structures, but never rises above 100%”

With that in mind, the resulting punchline should be quite familiar to our readers: after all we have been pounding the table on this from the beginning – there is no longer even the possibility of rebooting the system under the current paradigm, let alone having a functioning market:

The way the markets are pricing the evolution of the current crisis in combination with the policy response no longer looks like a state of exception, but as a new rule which is here to stay for an extended period of time.

Needless to say, this has been our core thesis from day one, and is also the reason why we remain steadfastly in the corner of hard assets as a world in which the only backstop of economic, monetary, political and social stability is accelerating dilution of fiat, means that currency collapse is only a matter of time.

via ZeroHedge News https://ift.tt/3hCaDWW Tyler Durden