Dalio’s Bridgewater Warns Of “Lost Decade” For Stocks

Tyler Durden

Thu, 06/18/2020 – 15:10

At the end of January, when the news media was reporting of the first cases of an odd pneumonia-like diseases spreading in Wuhan, Ray Dalio appeared on CNBC during the annual billionaire pilgrimage to Davos, where he made a comment that would soon come back to haunt him: “You can’t jump into cash. Cash is trash.”

“You can’t jump into cash. Cash is trash,” says @RayDalio. “You have to have a well-diversified portfolio, you have to be global, and you have to have balance…and you have to have a certain amount of gold in your portfolio.” pic.twitter.com/lZqCnvsqBh

— Squawk Box (@SquawkCNBC) January 21, 2020

Little did Dalio know that just one month later the global economy would grind to a halt, the US stock market would suffer the biggest drop since the financial crisis, the Fed would announce the biggest ever bailout of corporate America and Congress would unleash a fiscal stimulus program the likes of which have never before been seen.

Fast forward five months, when in a recent letter to Bridgewater investors, Dalio warns that a reversal of the strong growth seen over the years in U.S. corporate profit margins could lead to a “lost decade” for equity investors.

So… cash is king?

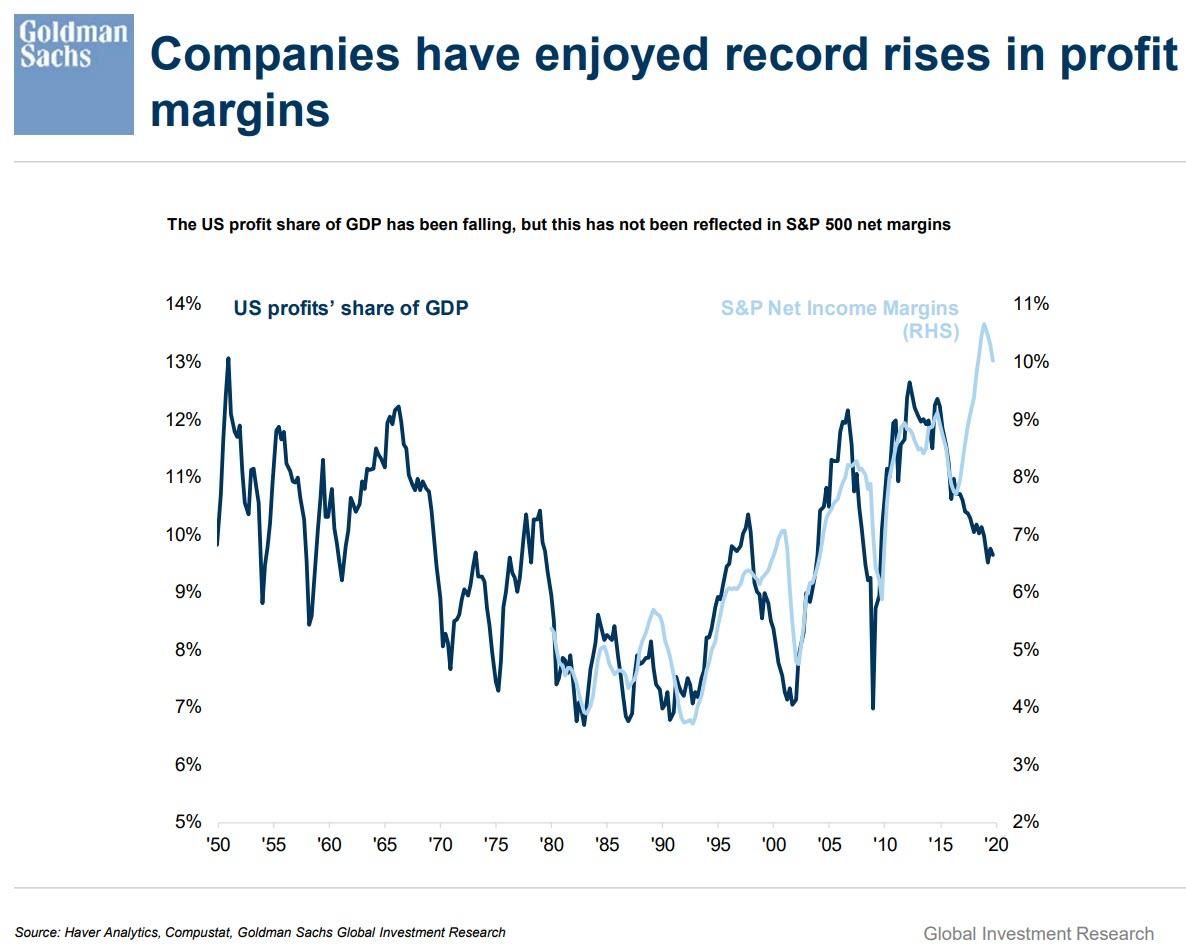

In the June 16 letter seen by Bloomberg, Bridgewater analysts write that the margins, which have provided a big chunk of the excess return of equities over cash, could face a shift that would go beyond the current cyclical downturn in earnings. They are referring to the following dramatic divergence between S&P income margins – which are at all time high s- and the true, unvarnished corporate profits, which as shown in the Goldman chart below have tumbled to decade lows even before the Coronavirus pandemic hit.

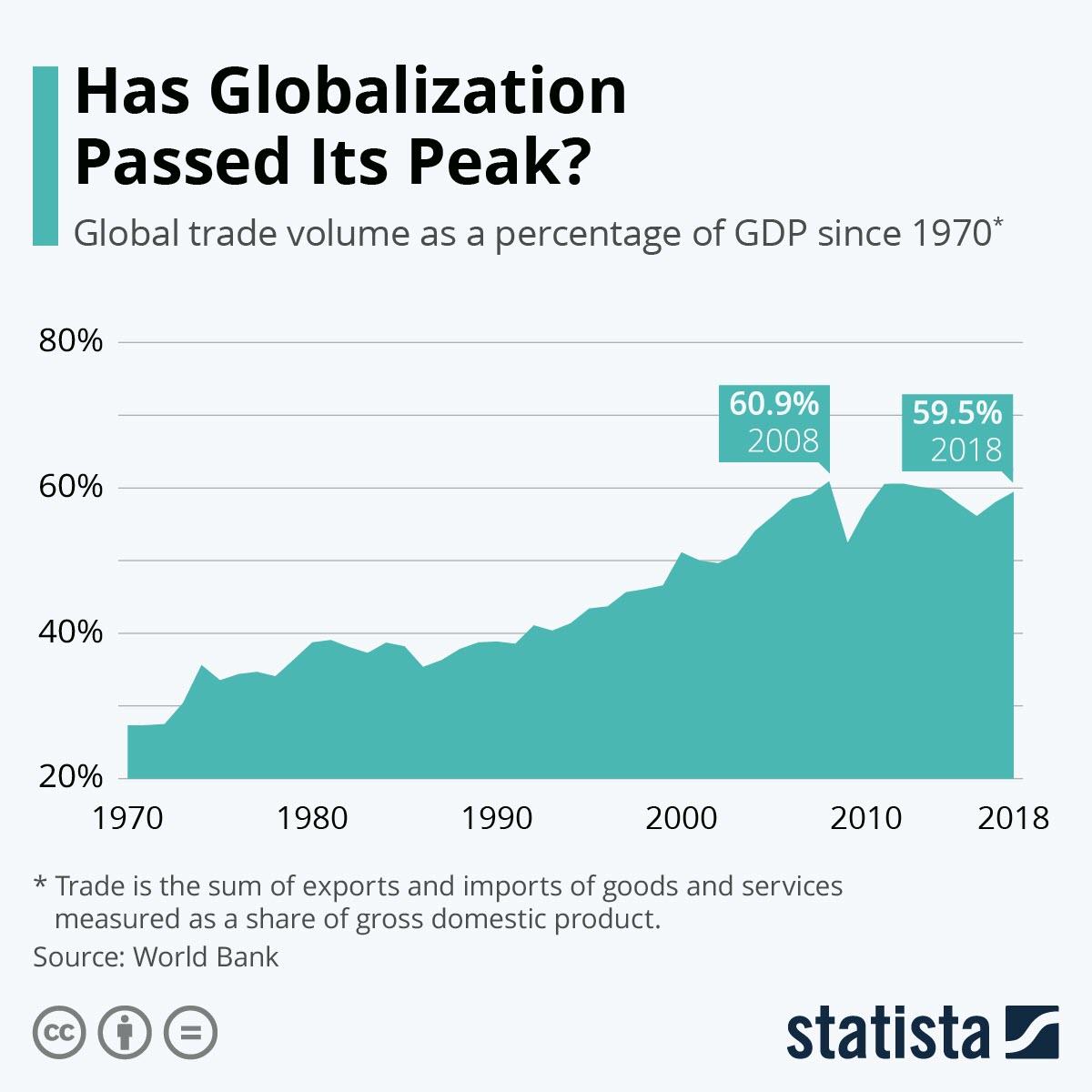

“Globalization, perhaps the largest driver of developed world profitability over the past few decades, has already peaked,” Bridgewater said adding that “now the U.S.-China conflict and global pandemic are further accelerating moves by multinationals to reshore and duplicate supply chains, with a focus on reliability as opposed to just cost optimization.”

The deglobalization trend has only accelerated in recent weeks as the pandemic-induced collapse in demand has already resulted in a huge fall in profit margins in the short term, the analysts added.

Bridgewater cited Intel and Taiwan Semi as two examples of companies that have announced their intentions to build production facilities in the U.S., despite the higher costs.

“Even if overall profits recover, some companies will die or their shares will devalue along the way. Left with lower levels of profits and cash shortfalls, companies are likely to come out on the other side of the coronavirus more indebted,” the report warned, appropriately just as the percentage of zombie corporations in the US – those that can’t even fund their their interest expense – is an all time high, and kept alive only thanks to the Fed’s direct purchases of corporate bonds.

Is Bridgewater right? Considering that less than half a year ago, its billionaire founder was urging the broader population to be in a well-diversified portfolio just before global stocks suffered their biggest crash in decades, one can certainly be cynical, especially in a time when retail daytraders on Robinhood can retire in just a few trading days if they pick the rick momentum stock du jour. On the other hand, if Dalio is right, he is effectively saying that the Fed will no longer be able to propel stocks ever higher, which coming at a time when Powell confirmed last week that it is his intention to blow an even bigger asset bubble in hopes of creating jobs, means that the Fed will lose control.

Of course, so far the Fed (and retail investors) are winning: as we reported last week, the hedge fund giant suffered a 15% drop in assets under management during March and April, as its assets fell to $138 billion at the end of April from $163 billion at the end of February.

via ZeroHedge News https://ift.tt/37GFTPJ Tyler Durden