Wirecard Shares Plunge 60% As Auditors ‘Unable To Verify’ $2 Billion In Cash On Its Books

Tyler Durden

Thu, 06/18/2020 – 06:36

Once again, it looks like the bears and the skeptics were right all along.

German payments company Wirecard delayed publication of its 2019 annual report, resulting in shares plunging by more than 50% and its bonds due in 2024 dropping 23 cents to around 58 cents on Thursday, as auditors failed to account for more than $2 billion cash balances that the company had previously reported, according to Reuters.

After having already delayed the report three times, Wirecard was set to finally release it on Thursday. However, in a not-entirely-unexpected admission, the company revealed that its auditor, Ernst & Young, was unable to verify €1.9 billion euros ($2.1 billion) in cash balances – or about a quarter of its balance sheet.

“There are indications that spurious balance confirmations had been provided” that created “a wrong perception of the existence of such cash balances or the holding of the accounts for to the benefit of Wirecard group companies,” the statement read. “The Wirecard management board is working intensively together with the auditor towards a clarification of the situation.”

Wirecard warned if there were no certified annual and consolidated statements by Friday, it would result in a 2 billion euro ($2.25 billion) loan being terminated.

As we’ve previously noted, German regulators have bent over backwards to accommodate Wirecard, even going so far as to discourage short sellers from targeting the stock, and launching an investigation into an FT reporter who published the first allegations about fraud within the fast-growing digital payments company.

- Wirecard Shares Sink As Theranos-Style Whistleblower Exposes Accounting Fraud

- Wirecard Sues The Financial Times Over “Slanderous, Unproven & False” Reporting

- Wirecard Shares Soar After Internal Probe Clears Company Of Fraud Allegations

- Wirecard Soars As Soft Bank Crushes Shorts After Buying 5.6% Stake

Wirecard shares fell 60% on Thursday, erasing nearly 2/3rds of their value.

Unsurprisingly, the FT journalist who faced a vicious attack on his credibility by both the company and German financial regulator BaFin is having the last laugh on twitter after the company, its army of goons, the German government and even some sell-side analysts attacked his reporting.

Wirecard was down 5 per cent at the open, recovered a bit since.

No sign of the full year figures for 2019 yet.

Press call was scheduled for 2pm CET.

— Dan McCrum (@FD) June 18, 2020

For background on Wirecard collapse today, these are the two key stories.

In October, we wrote that sales and profits appeared fraudulently inflated. https://t.co/8RKd75oGeT

In December, we wrote that “trustee accounts” were included in cash balances. https://t.co/UWIrIRpqnm— Dan McCrum (@FD) June 18, 2020

Story here Wirecard says €1.9bn of cash is missinghttps://t.co/0zHjHtHpMH

— Dan McCrum (@FD) June 18, 2020

Wirecard says €1.9bn of cash is missing, indications auditors deceived, €2bn of loans could be terminated if accounts not published tomorrow.

Stock down two-thirds, FT story imminent— Dan McCrum (@FD) June 18, 2020

First runs on Wirecard 0.5% 2024 bond coming in around the 50 cents mark. The goofy SoftBank convert even lower….

— Robert Smith (@BondHack) June 18, 2020

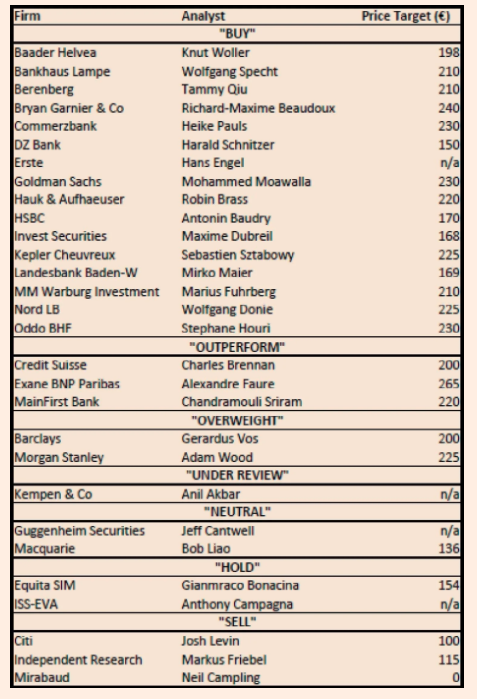

Now, those same sell-side analysts who questioned the FT probably have some explaining to do…

…as it appears the FT reporting has been largely vindicated.

via ZeroHedge News https://ift.tt/3fFpuhd Tyler Durden