China Keeps Loan Prime Rates Unchanged For Another Month, Sparking Confusion Over Beijing’s Intentions

Tyler Durden

Sun, 06/21/2020 – 22:15

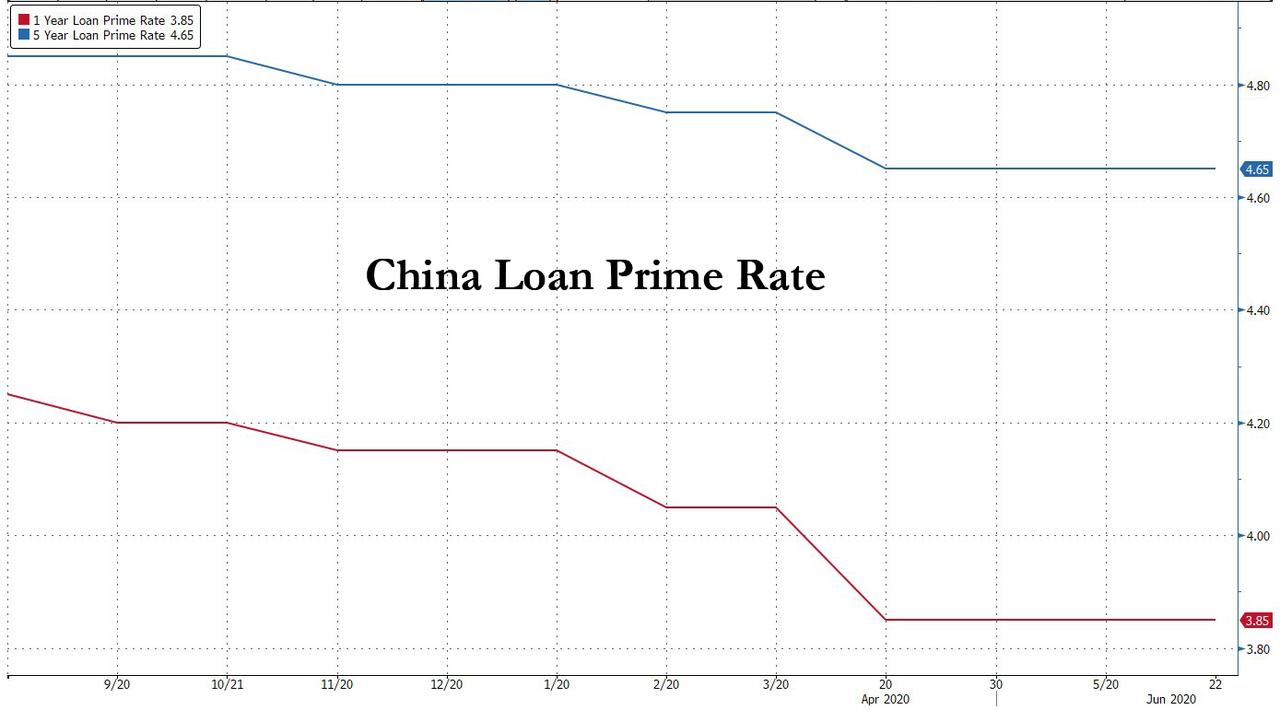

One month after unexpectedly keeping its 1 and 5-year Loan Prime Rates unchanged at 3.85% and 4.65% respectively following the April 19 rate cut (which came just as China was supposedly V-shaped recovering), moments ago Beijing did it again and kept China’s so-called Libor flat, with the benchmark LPRs for 1 and 5-year tenors unchanged at 3.85% and 4.60%.

As a reminder, the LPR is a recently launched market indicator of the price that lenders charge clients for new loans, released around the 20th day of every month.

While there was some speculation that after last month’s People’s Congress where the PBOC vowed it would ease financial conditions further including broad and RRR-based rate cuts, in its preview, SocGen correctly said that it expects “no change to China’s Loan Prime Rates, as the PBoC left the MLF rate unchanged last week.”

What the move would suggest is that while China – whose economy is still shrinking due to covid – is certainly desperate for easier funding conditions, we may have reached a critical threshold where banks may no longer be profitable should LPRs be cut further (especially now that borrowers have non-traditional, shadow sources of funding once again).

This brings up another point brought up by SocGen’s Kiyong Seong:

On top of the heavy bond supply since May, the PBoC’s reluctance to inject liquidity has also been partly accountable for the significant correction in CNY rates. To our understanding, this reluctance stemmed from the fact that abundant liquidity and easier borrowing conditions were being abused, flowing into financial products rather than the real economy. However, this development has been gradually contained by rising interest rates and regulatory action, allowing the PBoC to turn more dovish again, as the slow private-sector recovery calls for.

All this means that Beijing is stuck between a rock and a hard place, on one hand urgently needing more rate cuts, and on the other unable to implement them without causing even more bubbles (see shadow bank products and China’s nevernding housing bubble) and another round of impairments, NPL builds up and potential bank failures.

via ZeroHedge News https://ift.tt/37OV8Gn Tyler Durden