Mall Giant Demands Rent Payments Even As It Skips Its Own

Tyler Durden

Tue, 06/23/2020 – 19:05

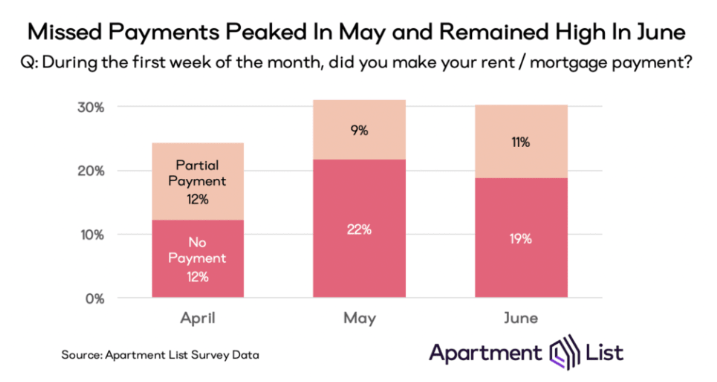

For all the talk of a V-shaped economy recovery – which predictably tends to always gravitate to the performance of the stock market which is acting as if the coronacrisis never happened and is now fully disconnected from all fundamentals – few have been willing to address the sobering fact that some 30% of Americans failed to make their June housing payment.

However, the situation is even more dire in the commercial real estate sector where defaults are soaring, and where the latest remittance data indicates that the June CMBS update will be absolutely catastrophic. One company affected directly by the ongoing implosion in CRE is Canadian investment/real estate conglomerate Brookfield Asset Management, which as the FT reports, is now chasing small retailers to pay thousands of dollars in rent on outlets that were forced to close during the coronavirus pandemic, yet even as the Canadian investment group skips payments on its mortgages and asks lenders for forbearance.

Now that the horror of the widespread shutdowns is fading into memory, some shopkeepers who lease kiosks and small stores inside Brookfield malls have been told to pay rent for April and May, a period during which the properties were mostly closed, the Financial Times reports, adding that “several tenants who asked for rent forgiveness described being asked to provide extensive financial information, including their personal tax returns for the past two years.”

The merchants, who requested anonymity for fear of antagonising a powerful landlord, said Brookfield ultimately refused to waive the payments, although it offered to give them until the end of 2021 to come up with the money.

Separately, a group of half a dozen tenants signed a joint plea for help and presented it to managers at one of the Canadian group’s shopping centers, although they received a less than warm welcome: “I will not address the merits of your ‘petition’,” a Brookfield lawyer wrote back adding that confidentiality clauses written into the shopkeepers’ leases meant that talking to each other about the contracts “could be deemed a default of your agreement with Brookfield.”

That response will hardly serve as the basis for a healthy, long-term relationship between the landlord and its clients. Indeed, three-quarters of Brookfield’s tenants have requested changes to their lease agreement, and the group said it had “actively engaged with all [of them] . . . prioritiz[ing] small businesses given their scale and immediate cash flow requirements.”

“We are now focused on national tenants,” Brookfield added, stating that it hoped to complete the discussions by September. “We have also been in active dialogue with our lenders given the subsequent impact this situation has had on our cash flow.”

What it means is that a handful of tenants will be allowed to push back rent payment for a month, maybe two max, but everyone else will be forced to come up with the cash. Why? Because Brookfield itself is now on the edge.

According to the report, “Brookfield has requested forbearance from lenders who are owed payments on a dozen of its malls, according to reports circulated to credit market participants who have bought the debt.” In other cases, Brookfield malls have been unable to repay mortgages that came due.

At malls where loans are falling due this year, “we have been in front of all of our lenders and just requested 12-month extensions,” Brookfield Properties’ chief financial officer Bryan Davis told investors last month.

As of last week, creditors of four of the malls had not decided whether to grant the requests, the reports state.

Brookfield’s concurrent discussions with its tenants – where it demands to be paid now – and lenders – where it demands not to pay indefinitely – highlight how the forced shutdown of much of the economy has caught mall operators in a bind, and demonstrates just how precarious the ongoing impairment in cash flows affects all players in the same chain.

Meanwhile, as we discussed earlier this month, as real estate executives say they are sympathetic to the plight of retailers, many of which were struggling even before government mandates closed their stores, at the same time mall operators are dependent on rent instalments to meet the payments due on their loans.

Brookfield last week became the second major landlord to sue clothes retailer Gap in a dispute over unpaid rent, shortly after Simon did the same. Among the major retailers that have acknowledged seeking rental relief from landlords are Bed Bath & Beyond, Levi Strauss and Urban Outfitters. Several chains are asking mall operators to waive rent for periods when their properties were closed. Ultimately, many retailer outlets will be forced to file for bankruptcy, resulting in far more pain for malls and is the reason why unlike stocks, various CMBS have seen only a modest bounce since the March lows.

via ZeroHedge News https://ift.tt/3fQN8HL Tyler Durden