No Shortage Of Demand For Largest Ever 2Y Treasury Auction

Tyler Durden

Tue, 06/23/2020 – 13:18

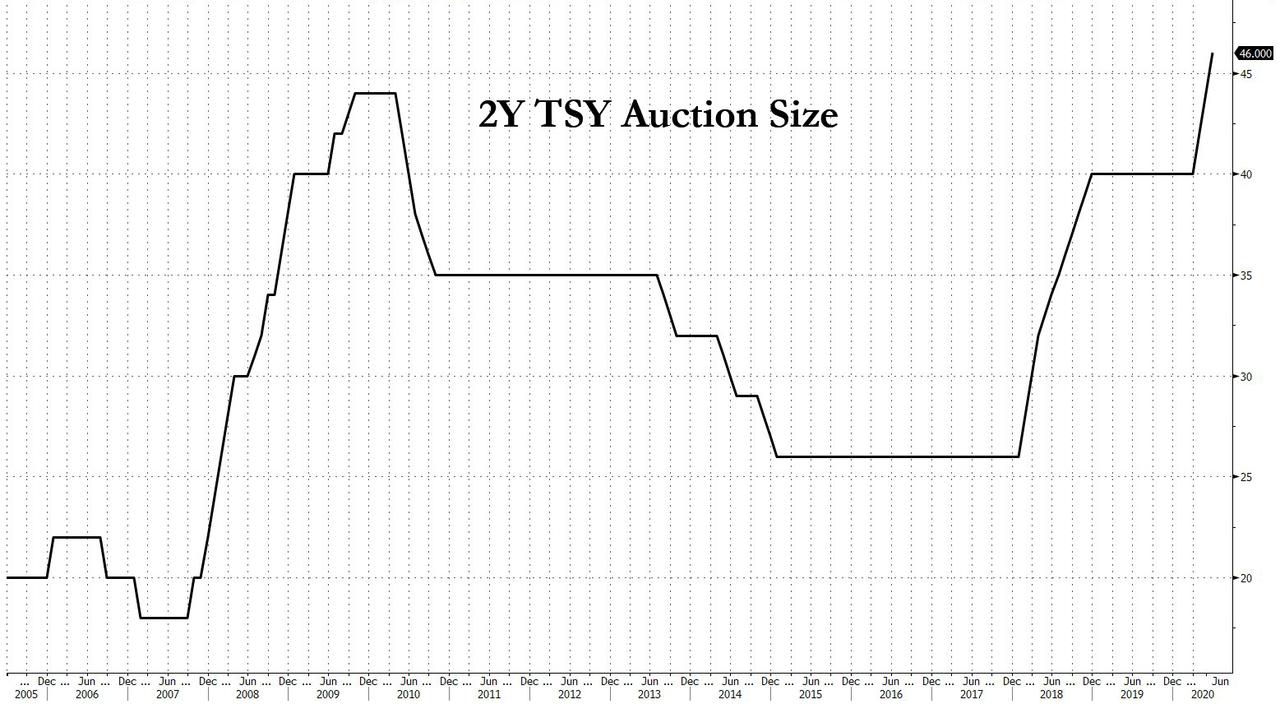

One month after the Treasury sold 2Y notes at an all time low yield of 0.176%, a time when the market was concerned with negative yields hitting as soon as November, moments ago the US Treasury sold a record $46BN in 2Y notes in a generally strong auction.

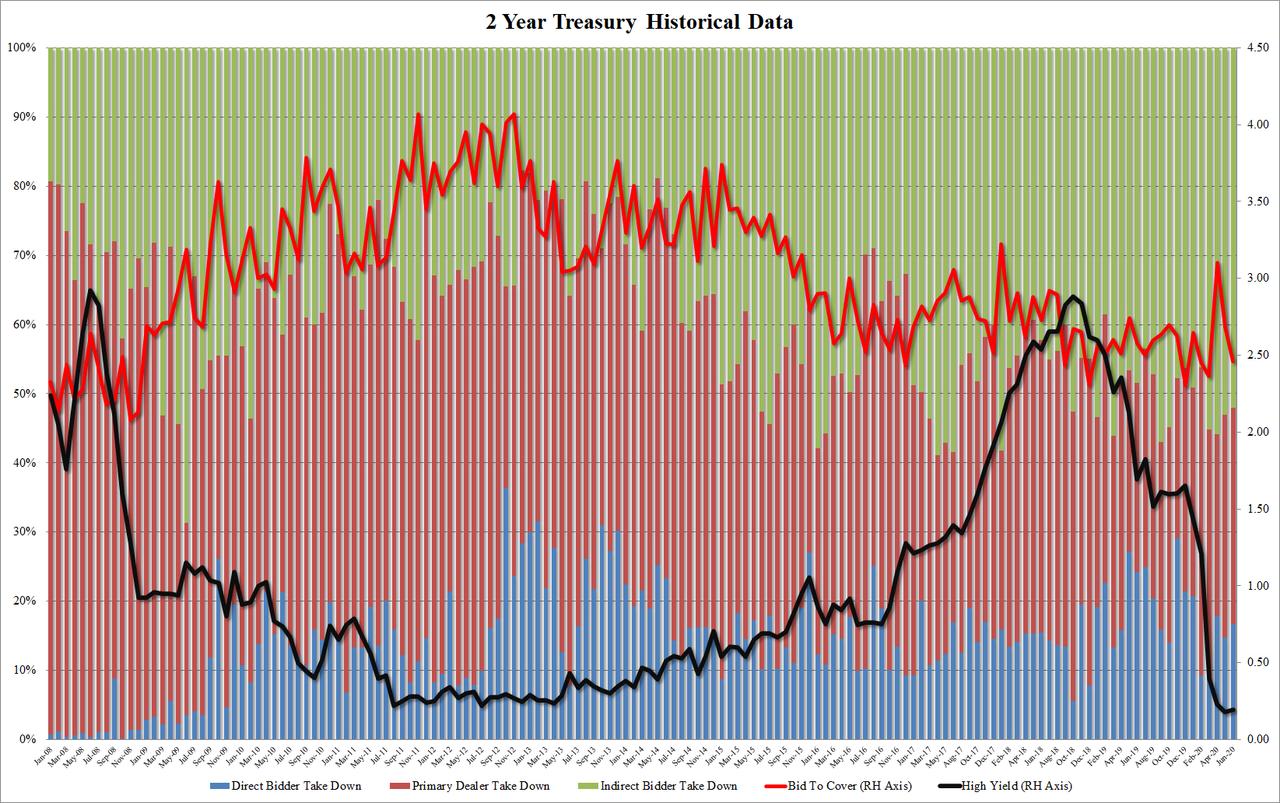

Starting at the top, today’s auction priced at a yield of 0.193%, stopping through the When Issued 0.197% by 0.4bps, and while it was fractionally above last month’s record low 2Y stop of 0.176% this was still the second lowest amount the US government has paid to borrow for 2 years.

The bid to cover was not quite as good, sliding for a 3rd consecutive month from 2.683 last month to 2.458, the lowest since March, and a far cry from the 3.102 in April.

The internals were solid, with Indirects taking down 52.0%, which while below last month’s 53.1% was above the recent 6 auction average of 50.9%. And with Directs taking another 16.8%, just slightly above last month’s 14.8%, Dealers were left holding to 31.2%.

Overall, a solid 2Y auction pricing at the second lowest yield on record as there was clearly no shortage of buyers for the biggest 2Y offering on record.

via ZeroHedge News https://ift.tt/2YpzQfq Tyler Durden