EU Launches Investigation Into German Regulator That Helped Cover Up Wirecard’s Historic Fraud

Tyler Durden

Fri, 06/26/2020 – 06:53

It’s a saying seemingly as old as humanity itself: The bigger they are, the harder they fall.

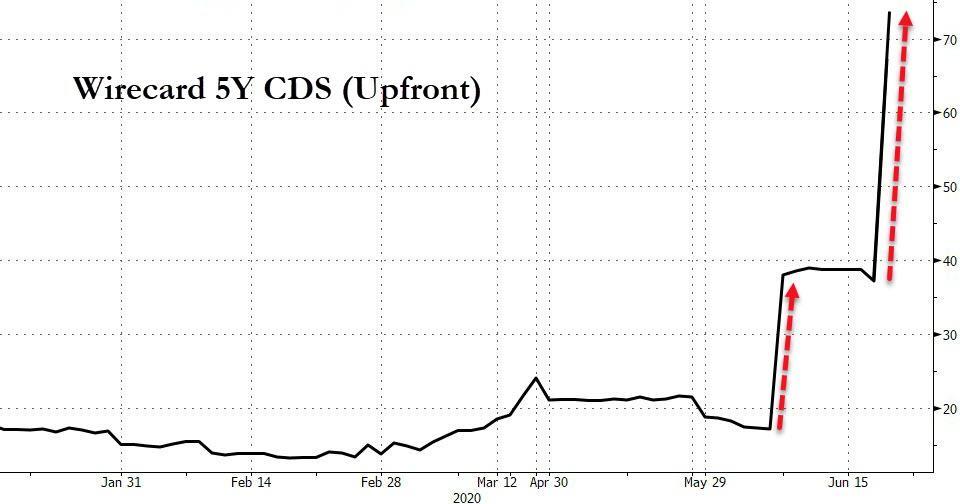

Yesterday, Wirecard, an enterprise once valued at more than $20 billion on the public markets, filed for insolvency as its shares are now almost worthless while many who bought insurance against the company’s debt (an extremely cost-effective position thanks to its low theta) have earned returns as high as 300% or 400%, or, in some cases, even more.

For those who haven’t been closely following the Wirecard saga over the past 2 years (as the FT’s Dan McCrum and other members of the investigations team doggedly persevered in their coverage of what’s undoubtedly the biggest corporate accounting fraud in German post-war history), one of the most interesting aspects of the story is the role that Germany’s financial regulators played in fending off threats to the DAX 30 component, even at times openly citing “contagion risk” to fragile European markets as its motivation for protecting what turned out to be a gang of criminal profiteers.

And finally, it appears BaFin, the Munich-based regulator who caused the FT so much stress during the investigation, will soon receive its just desserts as Brussels calls for a probe into the German regulator.

European financial regulators are still reeling from their embarrassing failure to root out a massive money laundering fraud that involved several of the Continent’s biggest multinational banks, and apparently allowed criminal organizations (and even Vladimir Putin himself, possibly) to clandestinely move money out of the CIS and in to the European Union and the US. This latest stain on BaFin’s reputation must be addressed if officials hope to restore credibility in their financial system.

According to the FT, Valdis Dombrovskis, the EU’s executive vice-president in charge of financial services policy, is writing to the bloc’s top markets supervisor asking it to assess BaFin’s handling of the Wirecard fiasco. Dombrovskis reportedly said the EU should be prepared to investigate the German regulator for “breach of union law” if the preliminary probe by the European Securities and Markets Authority (better known as ESMA) uncovers any rule-breaking. “We will be asking Esma to investigate whether there have been supervisory failures and if so to set out a possible course of action,” Dombrovskis told the FT. “We need to clarify what went wrong.” He will set a mid-July deadline for Esma to reply.

Brussels is worried that the company’s collapse, something more redolent of Chinese and Hong Kong markets, where ongoing frauds are routinely given a sheen of legitimacy, threatens investor trust in the EU, and could have lasting implications if it’s not dealt with swiftly. Regulators must show that they’re learning from these massive mistakes.

As the FT writes, the investigation is an “embarrassment” for Germany just as it’s assuming the rotating presidency of the bloc.

“This is certainly something that requires investigation,” Mr Dombrovskis said. “As we deepen capital markets and we move forward with the next stages of the Capital Markets Union, an important element is investors’ trust investing in publicly listed companies.” “Investors need to be sure that they are receiving proper and truthful information . . . and that provision of this financial information is properly supervised,” he said. Mr Dombrovskis’s call on Esma to intervene is an embarrassment for Germany only days before it assumes the rotating presidency of the EU. He told the FT that the question was whether BaFin fulfilled its obligations to enforce an EU law on listed companies’ financial statements, known as the transparency directive. The law hands clear responsibilities to national supervisors like BaFin to make sure companies fulfil their obligations. Esma, a pan-EU watchdog based in Paris, sets “common enforcement priorities” for national regulators each year.

[…]

“Given longstanding allegations about Wirecard’s financial accounting, we expect the German authorities including BaFin will now thoroughly investigate whether Wirecard accounts correspond to EU legislation,” Mr Dombrovskis said.

As BaFin prepares for its well-deserved comeuppance after effectively allowing itself to be pimped out by a (soon-to-be-former) DAX 30 (soon to be DAX 29) member, acting like a formidable attack dog fending off journalists and short-sellers alike, one of the most satisfying twists in the Wirecard saga was the vindication of dogged FT investigative journalist Dan McCrum. McCrum pursued Wirecard despite becoming the target of a BaFin investigation into stock manipulation which was, as we now know, based on suspicions that were 100% baseless. He faced down myriad threats, both real and perceived, over a period of a couple of years. The level of pushback was stunning, as McCrum explained. At times, he felt like he was being gaslighted. But in the end, the old journalists’ intuition that the harder the pushback, the bigger the truth, won out.

via ZeroHedge News https://ift.tt/2NxsrEF Tyler Durden