Zimbabwe Shutters Stock Exchange, Blocks All Mobile Money Payments As Currency Collapses (Again)

Tyler Durden

Mon, 06/29/2020 – 10:15

For the fifth time in Zimbabwe’s history, its currency has just collapsed…

As Decrypt.co’s Adriana Hamacher reports, Zimbabwe’s government suspended all mobile money payments, including operations by dominant provider Ecocash on Friday. The Zimbabwe Stock Exchange was also ordered to stop trading, in a dramatic escalation of the nation’s currency crisis.

The government claims the move is to avert a conspiracy to sabotage the collapsing Zimbabwe dollar. But millions of Zimbabweans rely on digital payment operators because obtaining physical cash is so difficult. Ecocash is also commonly used to buy Bitcoin.

In response, Ecocash has promised to defy the ban. It maintains that only Zimbabwe’s central bank can order it to stop trading. Meanwhile, African crypto news outlet Bitcoinke claims “the demand for Bitcoin has skyrocketed” in the wake of the suspension—its sources claim the cryptocurrency is selling at 18% above the market rate.

Dear Valued Customer,

Continue Living Life the EcoCash Way!#LiveLifeTheEcoCashWay@eddie_chibi @JabangwePNN @FungaiMandiveyi @givemore_jojo @emiliachisango @CassavaSmartech pic.twitter.com/Sp6nv4SVoU

— EcoCash Zimbabwe (@EcoCashZW) June 26, 2020

A national currency, the Zimbabwe dollar or Zimdollar, was reintroduced in 2019, replacing a basket of national currencies including the Japanese Yen, the US dollar and pound sterling. To force citizens to leave the previous system, the government banned the domestic use of foreign currencies. But – with the government mired in corruption scandals – it swiftly lost ground to the US dollar. This is the fifth time in Zimbabwe’s history that its national currency has collapsed.

Meanwhile, inflation has risen above 750%.

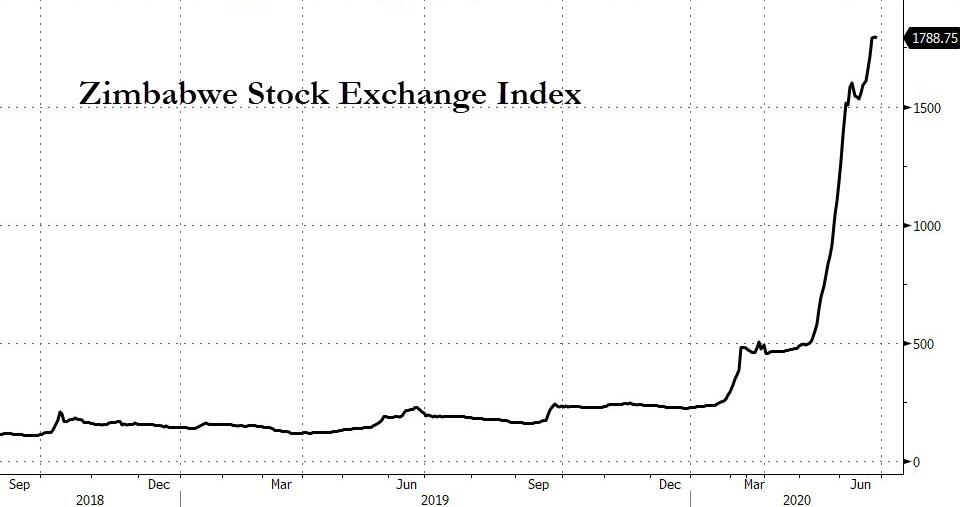

The local stock market has surged, as investors sought safe havens.

[ZH: Look how well the Zimbabwe ‘economy’ must be doing?]

But trading has now been suspended:

Following the statement issued by the Secretary for Information, Publicity and Broadcasting Services on June 26 2020, the Zimbabwe Stock Exchange Limited engaged both the Securities and Exchange Commission of Zimbabwe (SECZ) and the Ministry of Finance and Economic Development.

Whilst we await the guidance from our regulators on the operational modalities going forward, we notify our stakeholders that trading has been suspended until further notice.

For any enquiries, you can email info@zse.co.zw.

For and behalf of Zimbabwe Stock Exchange Limited.

ZSE CEO – Justin Bgoni

Many Zimbabweans have turned to digital payments and, in 2019, mobile wallets accounted for almost 85% of all transaction volumes, and 22.6% of value, according to the country’s central bank.

The government claims mobile payment operators and the stock exchange are either deliberately or inadvertently acting to sabotage the economy, and are the cause of the Zimdollar’s volatile black market exchange rate.

“Ecocash is acting as the centre pivot of the galloping black market foreign exchange rate therefore fuelling the incessant price hikes of goods and services that are bedevilling the economy & causing untold hardship yo the people of Zimbabwe.”

Ecocash destroyed the economy?👀 https://t.co/InOeBNWHDB

— Fadzayi Mahere (@advocatemahere) June 26, 2020

Ecocash denies any wrongdoing.

via ZeroHedge News https://ift.tt/2VrTuWi Tyler Durden