Near Record Numbers On Wall Street Say Stocks Again “Overvalued”; Just 14% Believe In A V-Shaped Recovery

Tyler Durden

Tue, 07/14/2020 – 14:40

There was some good news and some bad news in the latest, July BofA Fund Manager Survey, but mostly confusion when it comes to the future of the economy and how the market resolves the tension between near record overvaluation and constant Fed tinkering and interventions.

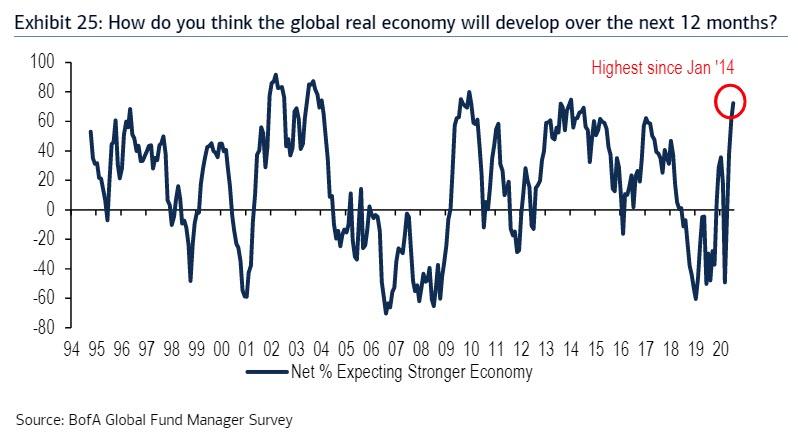

Starting with the economy, while 72% of those surveyed in the July survey (which took place July 2nd-July 9th and polled 201 participants with $607BN in AUM) expect stronger global growth, up 11 points from June, and the highest since Jan’14..

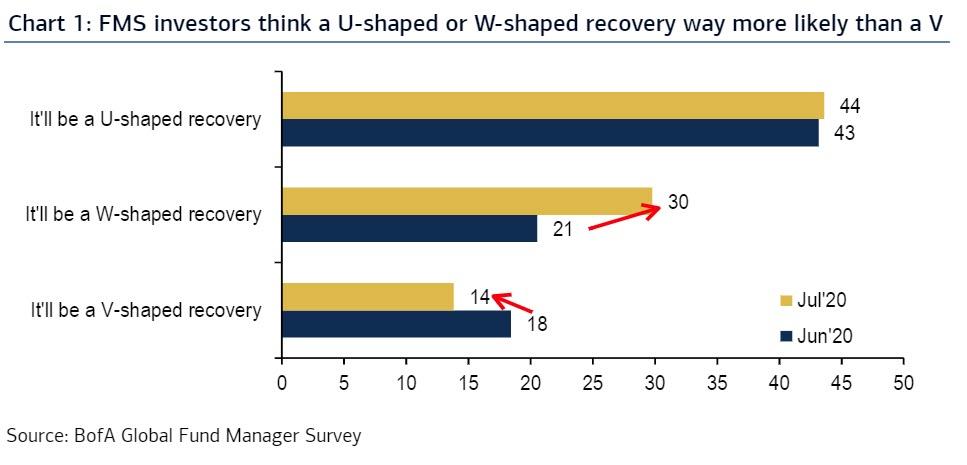

… conviction in the strength & duration of recovery continues to decline with just 14% now saying the recovery will be “V”-shaped, down from 18% last month, vs 44% expecting a “U”, and 30% a “W”.

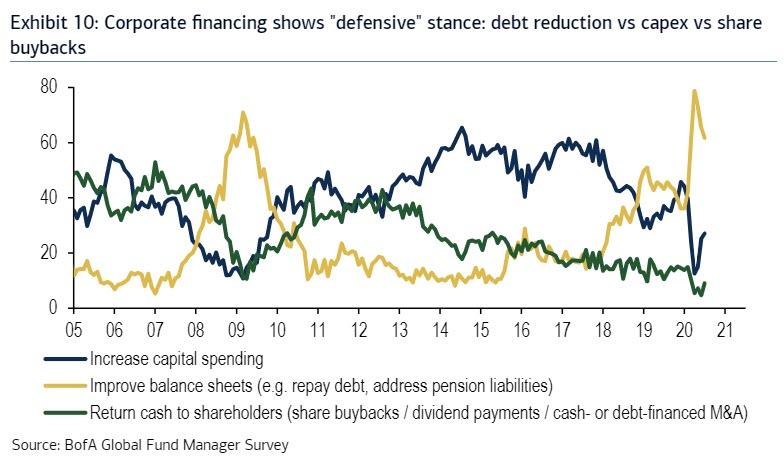

In a similar vein 62% of investors (CIO’s) want corporates (CEO’s) to improve balance sheets, vs only 27% wanting higher capex, and just 9% eager for higher dividends/buybacks.

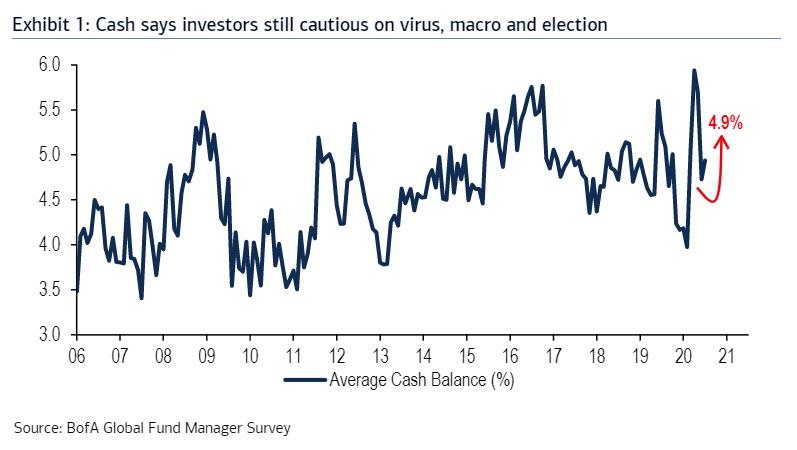

Meanwhile, looking at stocks, a renewed investor cautiousness has led to self-reported cash levels rising modestly to 4.9% (whether this is true in real life is a different matter), prompting BofA’s CIO Michael Hartnett to “predict choppy/higher summer prices, sell SPX>3250, buy<2950.” Putting the increase in cash to 4.9% from 4.7% in context, while it is down from the record hit in April/May, it remains on the high side, and just above the 10-year average of 4.7%: “cash says investors still cautious on virus, macro, and election”, according to Hartnett.

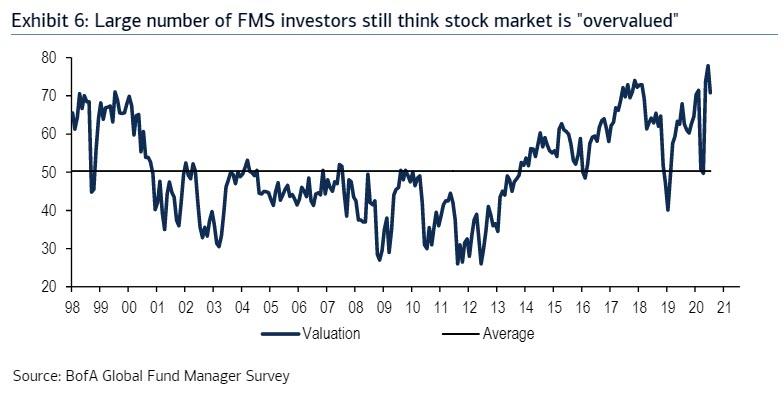

Yet somewhat disturbingly for the bulls, a near record 71% of FMS investors said the stock market is overvalued, which makes sense since not only is the Nasdaq at all time highs and the S&P just shy thereof, but P/E multiples are the highest they have ever been.

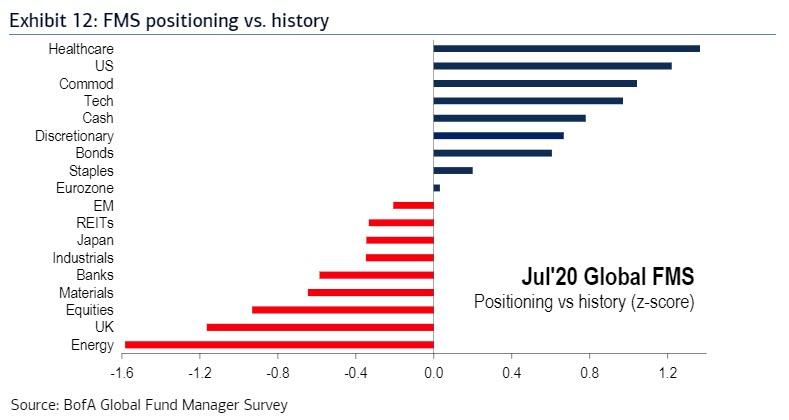

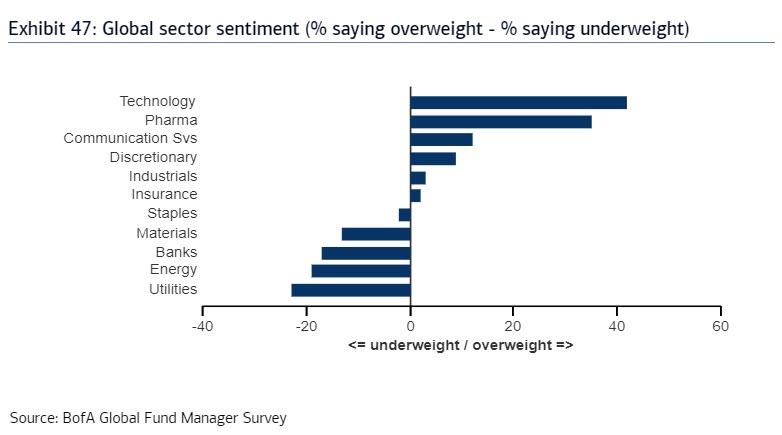

Despite their “revulsion” to investing in a massively overvalued market, BofA finds that asset allocators are stubbornly long health care, US, tech, cash, bonds, and short energy, UK, banks, industrials…

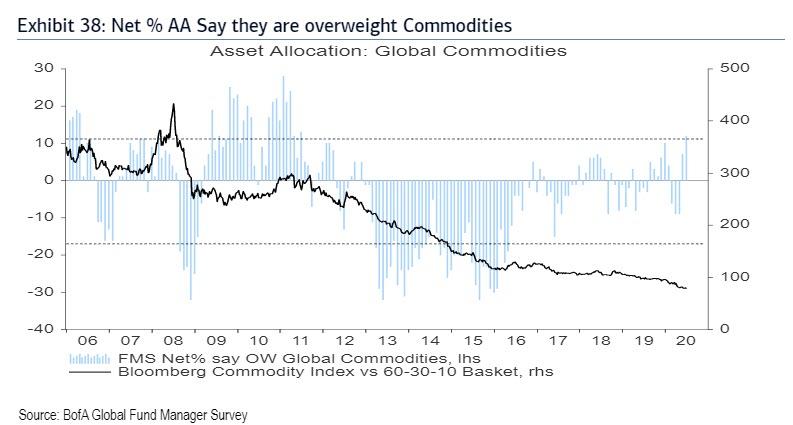

… but there are 2 notable shifts: allocation to commodities now at highest since July’11…

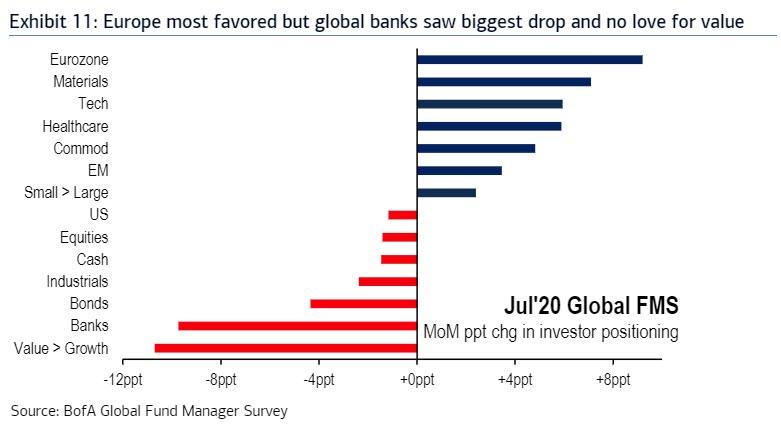

… and there was a big jump in European equity exposure & 42% want more Euro exposure.

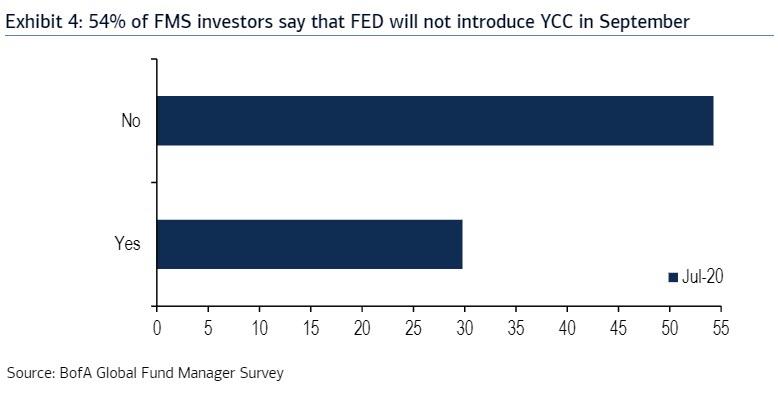

Of course, no discussion of the “market” would be complete without some thoughts on the Fed, and in this vein, a majority, or 54% of participants said the Fed will not introduce YCC in September:

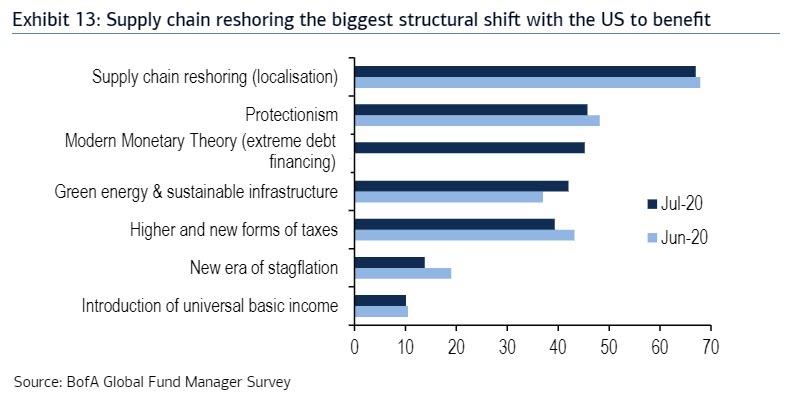

… while supply chain reshoring (67%) remains most likely structural shift post pandemic (with US the region most likely to benefit).

So what should one do to fade the consensus, which as we have showed on countless occasions is the best trade over the past decade? As BofA notes, the best short is tech stocks given positioning and stretched performance (more in a subsequent post on this), although in a world where shorts tend to lead to painful margin calls, one should rather focus on long ideas, and here the best long according to BofA is energy (oil prices acting well given whisper of higher OPEC supply) & banks (July FMS shows large drop in allocation to banks).

via ZeroHedge News https://ift.tt/3h0kR2c Tyler Durden