The Worst Is Over For Arizona’s COVID Breakout, Goldman Finds

Tyler Durden

Tue, 07/14/2020 – 21:30

Several months ago, the coronavirus pandemic mutated from a purely epidemiological phenomenon and became a full-blown political issue, with clear ideological divisions forming along the lines of whether or not to pursue strict shutdowns (and in some cases, whether to engage in another round of economic closures) all the way down to whether masks should be worn. The drivers here were self-evident: opponents of Trump and the current administration demanded even more caution, in some cases arguably in pursuit self-serving hopes of further economic pain (and more stimulus payments) that would make a Trump re-election difficult; in light of this it is understandable why the president hoped to put the pandemic in the rearview mirror and to accelerate the reopening of the economy which has cost tens of millions in jobs and trillions in new debt.

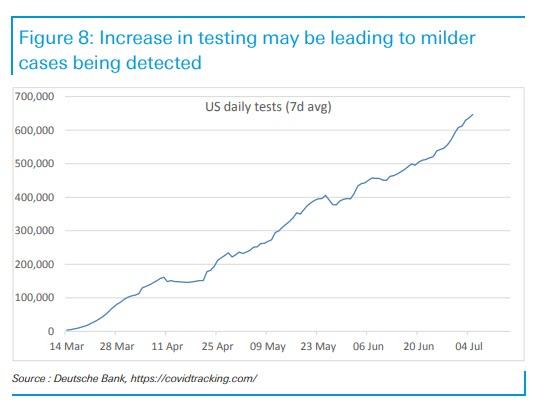

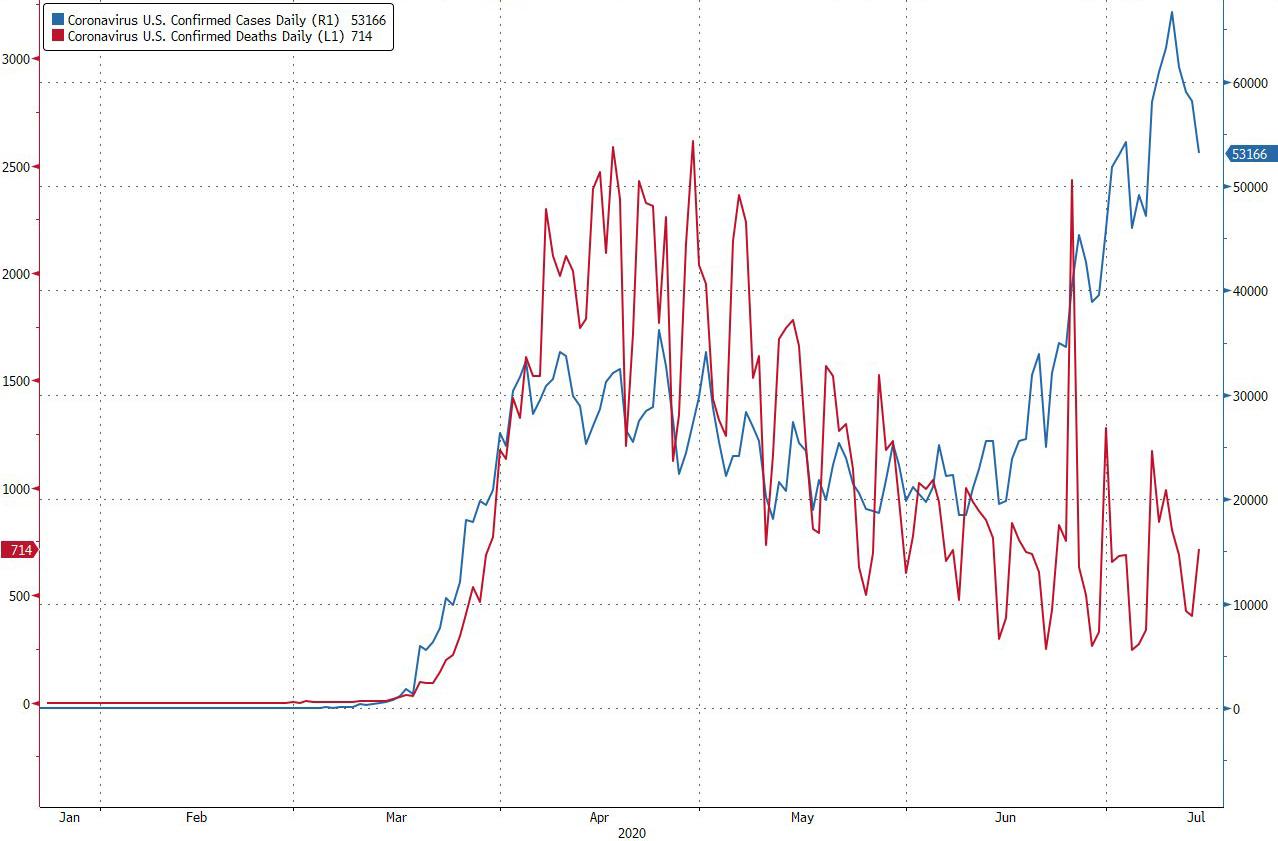

In recent weeks, a similar divide has also emerged on Wall Street, where pessimists such as Goldman have been emphasizing the recent surge in new cases across sunbelt states, warning that these would result in another spike in deaths, as well as reduction in mobility and overall cosumption and thus a fresh hit to the economy, as a new round of shutdowns – either mandatory or voluntary – were enacted. Optimists, meanwhile, would note that higher cases are merely a function of widespread testing…

… and pointed to the continued decline in covid-linked deaths which despite the jump in new cases, had failed to inflect higher, underscoring that the mortality rate appears to be much lower for younger covid patients. That said, the latest data appears to show that even the number of deaths now appears to be rising while total cases may have finally plateaued.

Last week, in a note that was clearly in the “optimistic” camp, BofA’s Hans Mikkelsen wrote that sharply elevated new daily Covid-19 case numbers highlight first and foremost more successful testing strategies (more tests, contact tracing, etc.), according to the University of Washington IHME model.

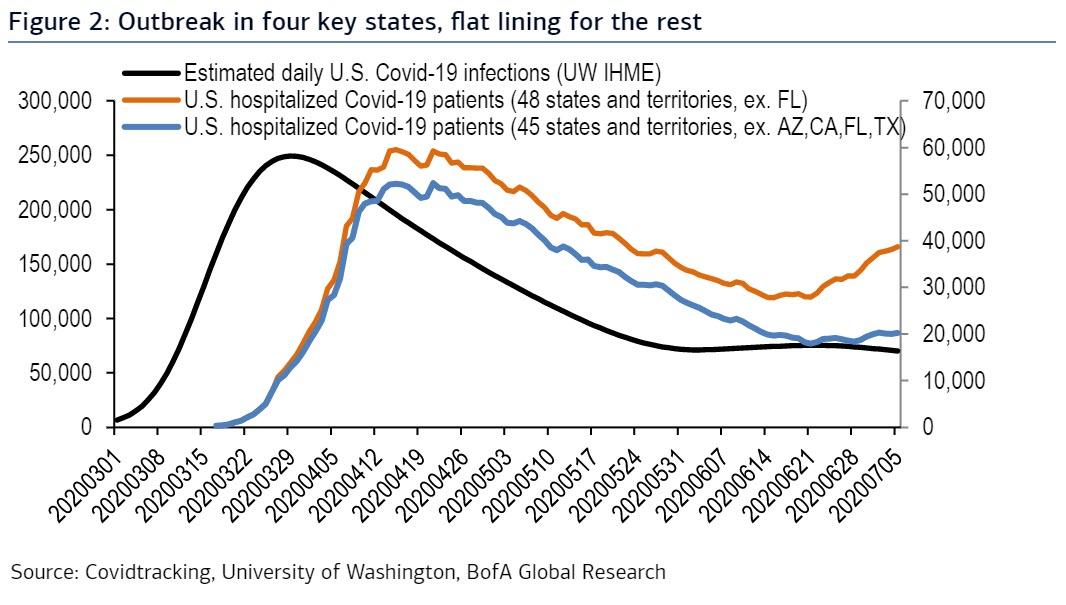

The strategist also said that “to gauge the spread of Covid-19 we prefer to look at number of hospitalized people that, although a bit lagged (in March/April the peak in number of hospitalized came 17 days after the peak in newly infected, according to the IHME model), is less dependent on testing strategy.”

While hospitalizations were clearly up in the U.S., BofA pointed out that if one excludes the four states “we find they are more accurately described as flat lining.” Moreover, BofA calculates that in the new outbreak the daily number of infected people peaked on June 21st at 75,179, up from 71,112 on June 1st, and sharply above yesterday’s 69,987 estimate, again according to the IHME model.

The optimistic conclusion: “Should hospitalizations again be lagged 17 days that would imply (local) peak hospitalizations on July 8.“

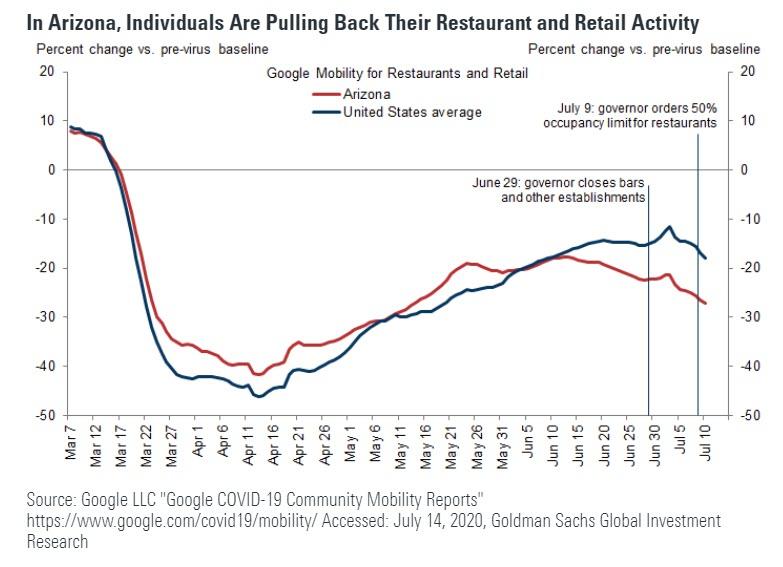

Fast forward to today, when following several weeks of downbeat comments, Goldman may have also turned somewhat optimistic on US chances, with chief economist Jan Hatzius (we are all epidemiologists now) writing that “today, confirmed new cases (7-day moving average) are now lower compared to one week ago” and noting that “it is possible that case growth could be at the beginning of a sustained downward trajectory” even though as he concedes, the positive test rate remains very high, and virus spread is weighing significantly on the state’s available hospital resources. A sustained decline in new cases would take several days to translate to lower hospitalizations and more available hospital capacity.

As Goldman notes, the decline in new confirmed cases follows a drop in restaurant and retail activity in the state, which many have previously linked to rising cases. Over the past few weeks, even before the Governor of Arizona ordered targeted restrictions on bar, restaurant, and other activity, individuals began to voluntarily scale back their mobility, consistent with our analysis last week that the level of new cases significantly predicts lower levels of activity.

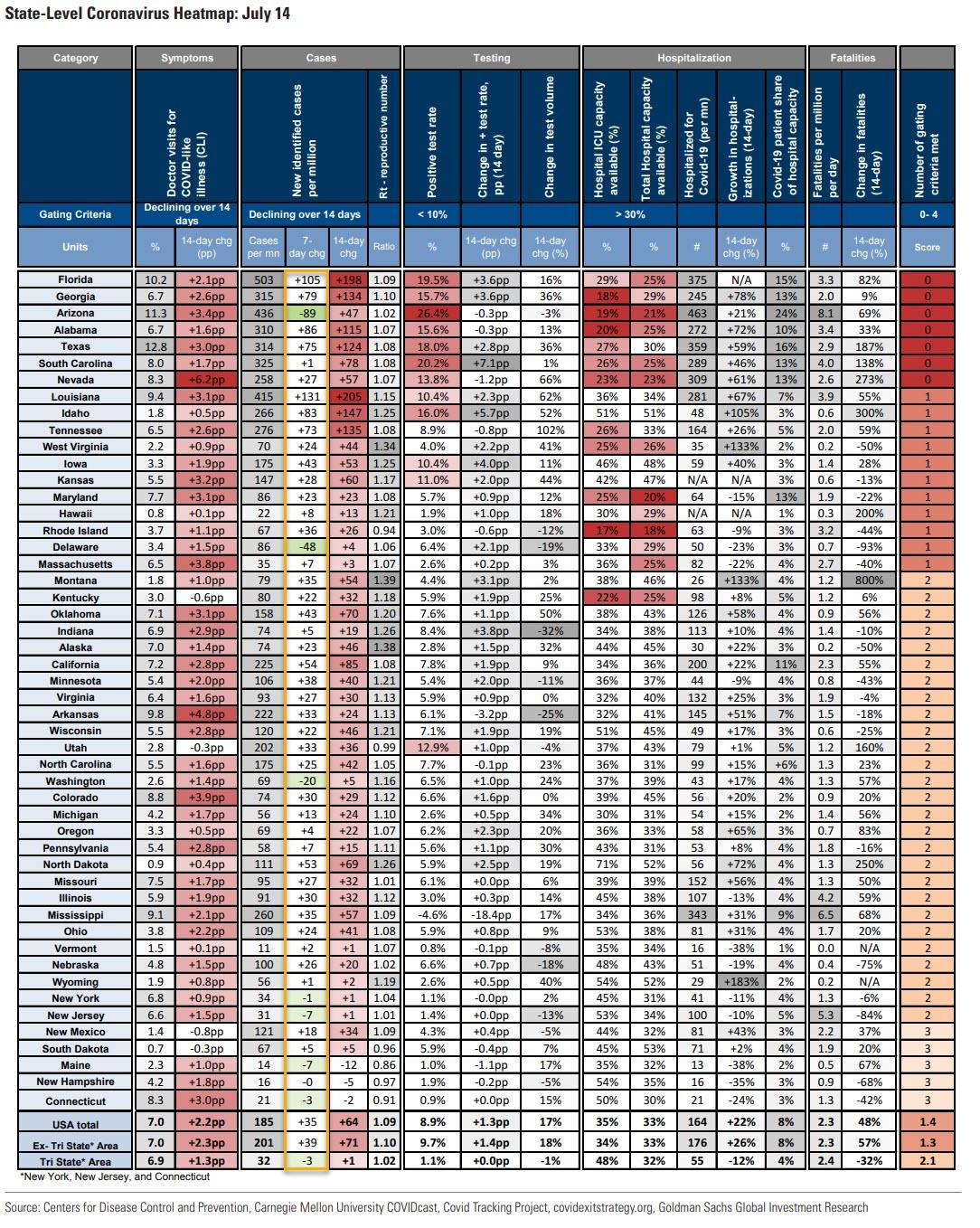

It’s not just Arizona that is sending out hopeful signs with the number of confirmed new cases declining in the state (and now the 7-day moving average of new cases lower than it was a week ago). To track which states may be beginning a downward trajectory, Goldman now includes a column in its state heatmap for the change in new cases vs 7 days ago, in addition to the change vs 14 days ago. Yet while Arizona may be exiting the woods, the US as a whole (and ex- the tristate area), is still seeing an overall increase, with 35 new cases per million as of July 14.

via ZeroHedge News https://ift.tt/3h0pido Tyler Durden