Bonds Bid, Stocks Skid, As Banks & Big-Tech Breakdown

Tyler Durden

Thu, 07/16/2020 – 16:00

Better than expected Chinese GDP (but weak retail sales) and better than expected US retail sales? What’s not to love? Well the “good news is bad news” market is back as investors start getting anxious that this ‘V’ rebound is prematurely reassuring (July 31st – handouts end) central planners that they have done enough…

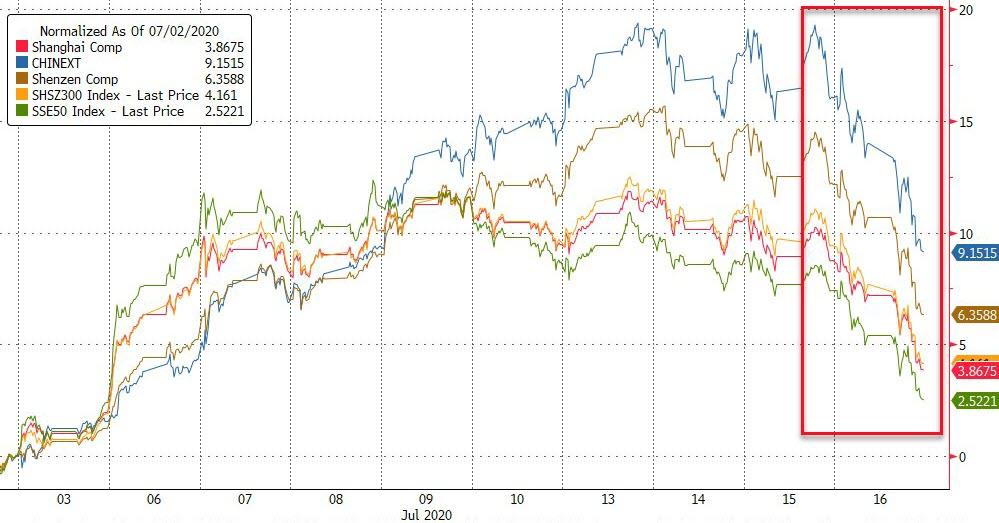

Chinese stocks tanked overnight…

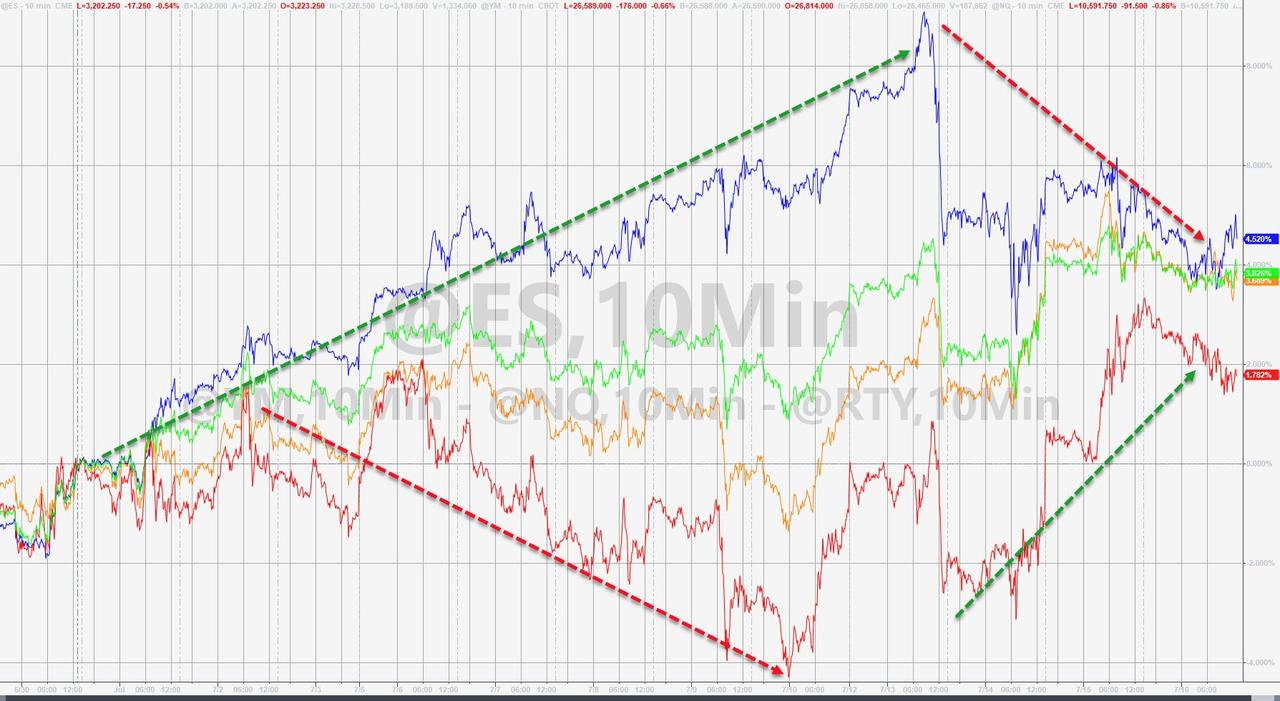

And US stocks shocked the world with a red close (Nasdaq and Small Caps underperformed)…

Though all the US majors remain higher in July…

And so for all that good news… you get nothing!

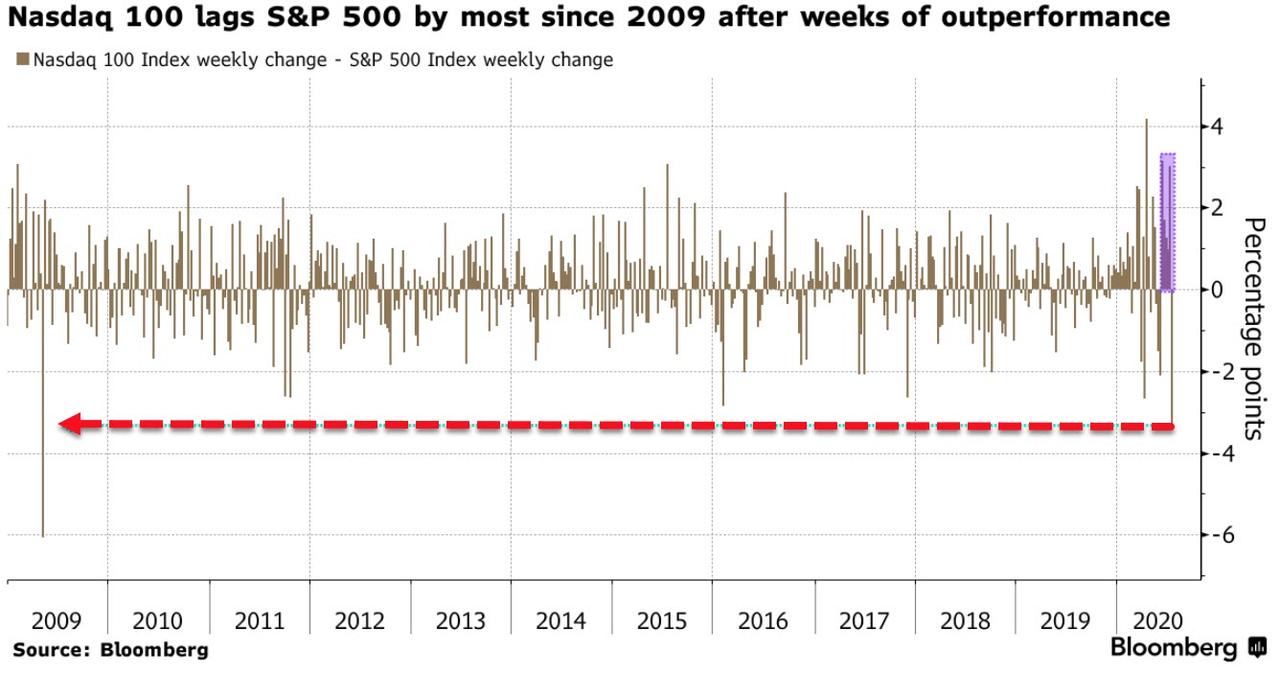

The Nasdaq has underperformed the S&P for 5 days in a row (the biggest 5-day underperformance in 3 months), erasing all of the Nasdaq’s outperformance in July…

Source: Bloomberg

In fact, Bloomberg notes that through today, this week has seen the Nasdaq 100 Index lagging the S&P 500 by the most since May 2009…

Banks remain very mixed on the week, mostly lower today…

Source: Bloomberg

FANG Stocks slipped lower and MAGA stocks have now lost almost $200 bn in market cap this week.

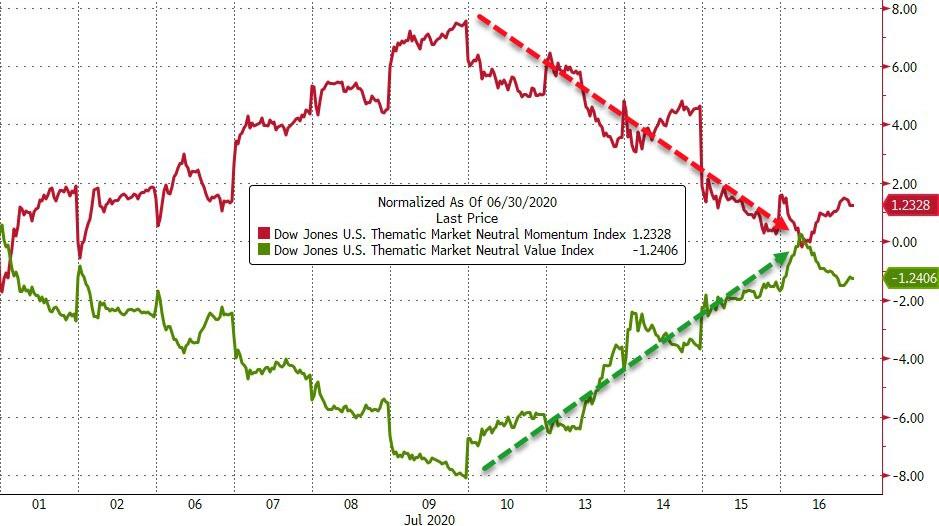

Momentum and Value have reversed the early month moves this week…

Source: Bloomberg

Treasury yields were all lower on the day (around 2bps), and are now all lower on the week with the belly outperforming…

Source: Bloomberg

As yields fell, 30Y mortgage rates hit a record low at 2.98%…

Source: Bloomberg

Additionally, as Bloomberg details, global borrowing costs for investment-grade companies have reached a record low as central-bank stimulus efforts more than offset concerns about the coronavirus. Bond yields tumbled to 1.73% after peaking at an eight-year-high 3.69% during the worst of the virus upheavals in March, according to an almost two-decade-old Bloomberg Barclays index. Yields on dollar notes, which make up two-thirds of the index, are at the lowest since at least 1973, following Federal Reserve support.

Source: Bloomberg

The dollar was bid today (as JPY weakened), almost back to unch on the week…

Source: Bloomberg

USDJPY spiked higher today (JPY weaker) for no good reason whatsoever (cough BoJ cough)…

Source: Bloomberg

Cryptos were hit overnight as Asia went to bed…

Source: Bloomberg

Commodities were all lower on the day as the dollar rallied, but silver leads on the week…

Source: Bloomberg

Gold futs fell back below $1800…

WTI fell back below $41…

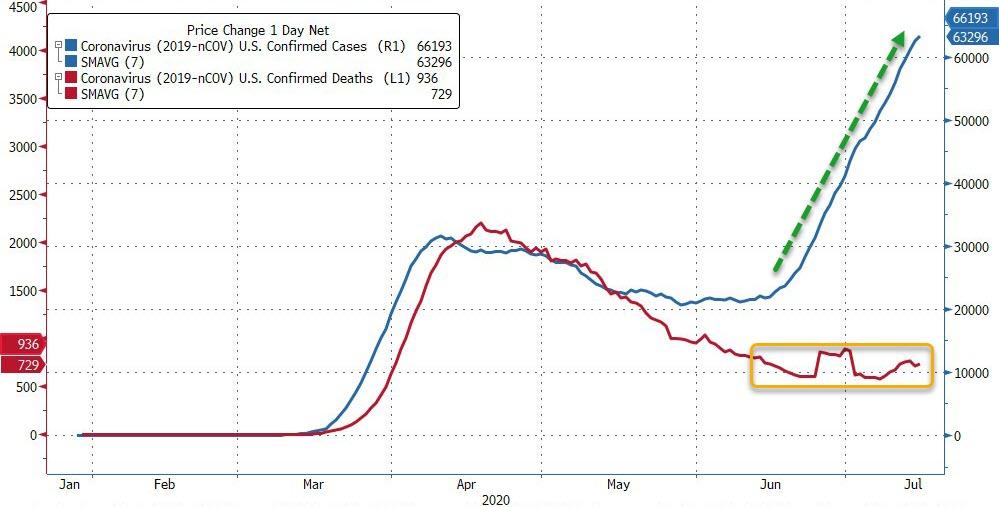

Finally, as cases continue to soar (7-day average), COVID deaths have ‘stabilized’ (7-day average) stalling their improving trend…

Source: Bloomberg

Treasury yields continue to languish near record lows as stocks begin (albeit very slowly and unremarkably) to stall…

Source: Bloomberg

As the link between Cyclicals and yields breaks entirely…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3926FTs Tyler Durden