It Starts: Mortgage Delinquencies Suddenly Soar At Record Pace

Tyler Durden

Thu, 07/16/2020 – 06:00

Authored by Wolf Richter via WolfStreet.com,

OK, it’s actually worse.

Mortgages that are in forbearance and have not missed a payment before going into forbearance don’t count as delinquent.

They’re reported as “current.” And 8.2% of all mortgages in the US – or 4.1 million loans – are currently in forbearance, according to the Mortgage Bankers Association. But if they did not miss a payment before entering forbearance, they don’t count in the suddenly spiking delinquency data.

The onslaught of delinquencies came suddenly in April, according to CoreLogic, a property data and analytics company (owner of the Case-Shiller Home Price Index), which released its monthly Loan Performance Insights today. And it came after 27 months in a row of declining delinquency rates. These delinquency rates move in stages – and the early stages are now getting hit:

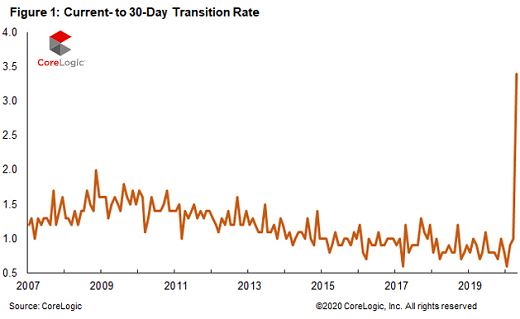

Transition from “Current” to 30-days past due: In April, the share of all mortgages that were past due, but less than 30 days, soared to 3.4% of all mortgages, the highest in the data going back to 1999. This was up from 0.7% in April last year. During the Housing Bust, this rate peaked in November 2008 at 2% (chart via CoreLogic):

From 30 to 59 days past due: The rate of these early delinquencies soared to 4.2% of all mortgages, the highest in the data going back to 1999. This was up from 1.7% in April last year.

From 60 to 89 days past due: As of April, this stage had not yet been impacted, with the rate remaining relatively low at 0.7% (up from 0.6% in April last year). This stage will jump in the report to be released a month from now when today’s 30-to-59-day delinquencies, that haven’t been cured by then, move into this stage.

Serious delinquencies, 90 days or more past due, including loans in foreclosure: As of April, this stage had not been impacted, and the rate ticked down to 1.2% (from 1.3% in April a year ago). We should see the rate rise in two months and further out.

Overall delinquency rate, 30-plus days, jumped to 6.1%, up from 3.6% in April last year. This was the highest overall delinquency rate since January 2016 (on the way down).

These delinquency rates are the first real impact seen on the housing market by the worst employment crisis in a lifetime, with over 32 million people claiming state or federal unemployment benefits. There is no way – despite rumors to the contrary – that a housing market sails unscathed through that kind of employment crisis.

Delinquency Hotspots:

The overall delinquency rate rose in every state. But there were some real hotspots, in terms of the percentage-point increase in the delinquency rate in April, compared to April a year ago:

-

New York: +4.7 percentage points

-

New Jersey: +4.6 percentage points

-

Nevada: +4.5 percentage points

-

Florida: +4.0 percentage points

-

Hawaii: +3.7 percentage points.

The worst hit metros are tourism destinations and New York City where the most devastating and deadliest outbreak of the Pandemic in the US occurred. These are massive increases in the delinquency rates in April:

-

Miami, FL: +6.7 percentage points

-

Kahului, HI: +6.2 percentage points

-

New York, NY: +5.5 percentage points

-

Atlantic City, NJ: +5.4 percentage points

-

Las Vegas, NV: +5.3 percentage points.

“With home prices expected to drop 6.6% by May 2021, thus depleting home equity buffers for borrowers, we can expect to see an increase in later-stage delinquency and foreclosure rates in the coming months,” CoreLogic said in the report.

With over 8% of the mortgages now being in forbearance, there is a lot of uncertainty about them as well – how many of them can exit forbearance or the extension and return to regular payments, and how many of them end up exiting forbearance and becoming delinquent.

CoreLogic expects to see “a rise in delinquencies in the next 12-18 months – especially as forbearance periods under the CARES Act come to a close,” the report said. To what extent the delinquencies deteriorate further depends largely on the labor market, and on unemployment, and that remains a horrible mess at the moment.

* * *

via ZeroHedge News https://ift.tt/2Wsf91f Tyler Durden