Markets Are Choosing The ‘Blue Pill’ Of “Bliss & Ignorance”

Tyler Durden

Thu, 07/16/2020 – 13:45

The COVID Economy In Suspended Animation

Summary

-

The U.S. economy is not real and in a current state of “suspended animation”

-

The COVID rescue package has introduced significant distortions into the economy

-

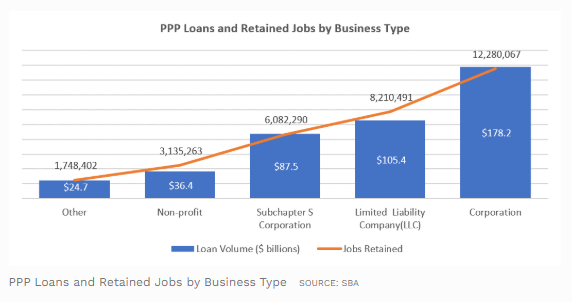

The “Corona Capitalists,” some very well capitalized and liquid corporations, have accounted for a large portion of the loan volume in the Paycheck Protection Program (PPP)

-

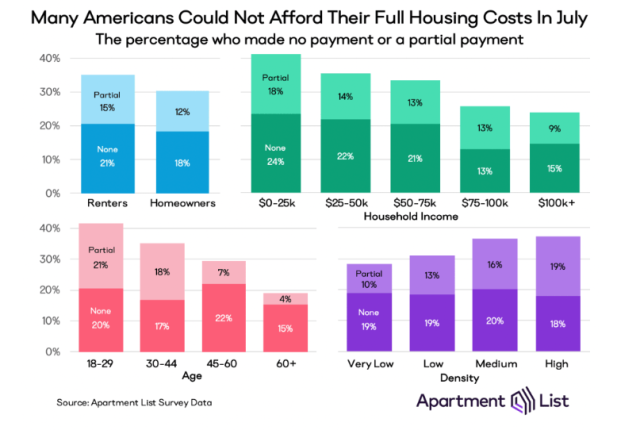

Almost 30 percent of renters and homeowners failed to make all or some of their payments in July

-

The buildup of rental and mortage payment arrears is a very complicated and potentially menancing problem, threatening the very heart of capitalism, itself

-

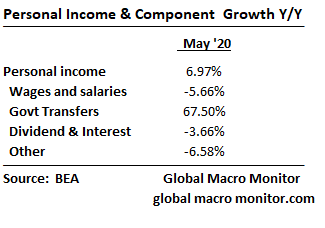

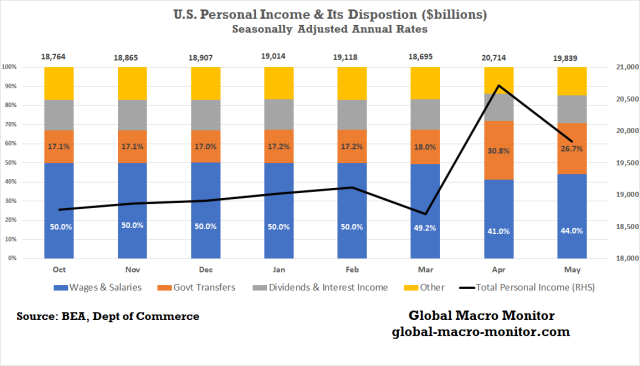

Personal income is up almost 7 percent year-on-year, though wages & salaries are down 6 percent, the result of a 70 percent increase in government transfer payments

-

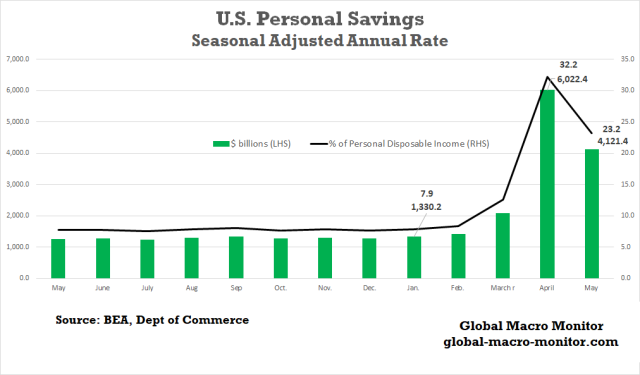

Personal savings skyrocketed from 7.9 percent of disposal personal income (DPI) in Janaury to 32.2 percent in April, providing some of the jet fuel for a rocketing stock market

-

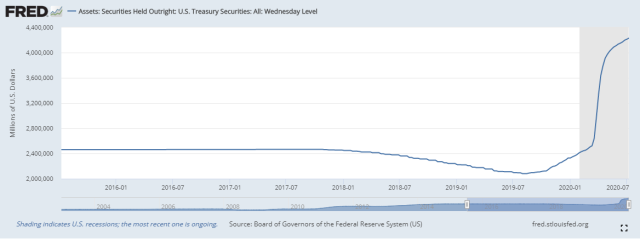

The Fed’s digital printing press has financed most, if not all of the increase in the transfers and savings

-

Markets remain detatched from economic reality

-

It behooves investors to know and understand the marginal buyer currently driving stock prices

In our July 1 post, Markets Have Jumped The Shark, we wrote about how the current state of the U.S. economy is not real and feels like it is in “suspended animation.”

We now have a few data points and some anecdotal stories for you to illustrate the stanger things that are going on out there.

Suspended Animation

Suspended animation has been understood as the slowing or stopping of life processes by exogenous or endogenous means without terminating life itself. Breathing, heartbeat and other involuntary functions may still occur, but they can only be detected by artificial means. For this reason, this procedure has been associated with a lethargic state in nature when animals or plants appear, over a period, to be dead but then can wake up or prevail without suffering any harm. – Wikipedia

Capitalism, Socialism, Or Corporate Socialism?

Over the past few months, we’ve spoken to many people, some in the gig economy, about how they are doing during this economic crisis. Many are in terrible shape and in need of government support. We also sense the COVID rescue plan is seriously distorting economic incentives, which are a necessary condition for a well-functioning economy.

A couple, we spoke with, both employed in the gig economy, one a public speaker, the other, an aide to seniors, said their monthly income has never been higher. Got that? Their income has never been higher, although they are both not working and collecting unemployment.

We are not trying to be insensitive or argue that income support is not needed, but what will happen when it abruptly comes to an end? The more important question is: can or will it ever end?

Another person, who owns a restaurant, has cut his home monthly rent payments by 80 percent, and has not paid his landlord rent on the restaurant since April. He just bought a $77k new Tesla last month as he “couldn’t pass up the discount and 2.5 percent financing Elon was offering.”

How he was able to secure a $60k plus auto loan at 2.5 percent while accruing, our guess $40k in rental payment arrears is beyond our pay grade. It sounds like Elon is doing a lot of vendor financing these days.

The New Stock Jocks

Moreover, this guy has never bought a stock in his life and told us he wants to pour one-third of his savings into Tesla stock.

He asked the price of the stock, which we quoted the close of that day at $1208.66. Then he queried about the price of Apple’s stock, which closed the day at $364.11, and said something to the effect,

Well, Apple is a bit cheaper, but I think I will make money in Tesla stock. All the millennials are going to be buying Teslas in the coming years.

This guy had no clue about normalizing both prices to earnings or other valuation metrics, just going with a gut feel. Does he reflect the average mentality of the marginal buyer driving the stock bubble that is now completely detached from reality?

We don’t know. Maybe or maybe not.

The absurdity is, wait for it…..if he had bought at the close that day, just seven trading days ago, the value of the one-third of his life savings he wanted to pour into Tesla would be 25 percent higher. Who looks like the fool here, folks?

By the way, did we mention this restauranteur also secured a $20k PPP COVID loan?

Here Come The Corona Capitalists

How about the story of Mitch McConnell’s family’s (wife Elaine Chao, Sectretary of Transportation) shipping business, the $1 billion-plus Foremost Group, receiving $300 to $1 billion in PPP loans, which were initially intended to keep small business’ afloat?

The Lousiville Courier-Journal reports,

The Paycheck Protection Program, or PPP, was established by the federal coronavirus relief package McConnell, R-Ky., shepherded through the Senate.

…A Department of Transportation spokesperson said Chao didn’t know about the loan either. “As mentioned before, the Secretary has no connection to the business and she had no idea a loan was obtained,” a spokesperson said in a statement Tuesday.

If you are not outraged yet, how about this one,

…Diamond Offshore Drilling secured a $9.7 million tax refund under the Covid-19 stimulus bill Congress passed in March, before filing to reorganize in bankruptcy court the next month. Then it won approval from a bankruptcy judge to pay its executives the same amount, as cash incentives.

These Corona Capitalists, many of who are well-capitalized and highly liquid, are ubiquitous and feeding at the public trough like pigs in shit.

According to Forbes,

The Small Business Administration (SBA) released details about Paycheck Protection Program (PPP) loans.

The data doesn’t cover all PPP loans—just those over $150,000. That still includes more than 660,000 loans valued at more than $429 billion,* about 84% of the $510 billion in PPP loans that have been issued.

The data begs three questions: 1) Who got what? 2) Where did they get it from? and 3) How well did the loans perform?

Corporations accounted for roughly 40% of loan volume and retained jobs, followed by limited liability companies (LLCs) at about a quarter of both metrics.

– Forbes

Remember this when you contemplate how real the employment and unemployment data are. The PPP loans are effectively another form of unemployment insurance.

Call us cynical, but we are starting to suspect the loan program was, in part, structured to hide and mislead the true unemployment numbers.

A Post analysis of data on 4.9 million loans released last week by the Small Business Administration shows that many companies are reported to have “retained” far more workers than they employ. Likewise, in some cases the agency’s jobs claim for entire industries surpasses the total number of workers in those sectors.

…For every loan offered to businesses under the program, the SBA lists a number of “jobs retained.” But in numerous cases, the listed number of jobs retained exceeded the total employment at the company, according to interviews with individual loan recipients.

– WashPost

Anyone surprised?

An Economic Rescue Plan Constructed In Panic

The above issues are the result of an economic program constructed in a panic with what, in hindsight, seems like little thought and planning, in order to keep the U.S. economy from collapsing. It’s easy for us, or anyone else to criticize, but they did get it done, and relatively quickly as there were very few other politically doable alternatives, in our opinion.

Is The End [Of Capitalism], My Friend?

If no better and sustainable plan is put forward, however, we fear it could spell the end of what is left of the small remnants of real capitalism as we know it. Who would of thunk it, taking place with “Mr. Free Market and King Dollar” himself, Larry Kudlow, at the economic helm?

Larry Kudlow is, of course, the chairman of the National Economic Council, in effect Trump’s chief economist. He’s also famous among those who follow such things for his remarkable track record of being wrong about everything, from his dismissal of those warning about a housing bubble as “bubbleheads” to his declaration a few months ago that the coronavirus was completely contained and wouldn’t inflict any economic damage.

Now, all of us get things wrong sometimes. But Kudlow is in a class of his own; as New York magazine’s Jonathan Chait memorably put it, he “has elevated flamboyant wrongness to a kind of performance art.” And he’s also notable because his solution to all problems is the same: cut taxes on rich people and corporations.

So who would want to listen to somebody with that record? Trump, obviously; but Kudlow didn’t come out of nowhere. He has long been the go-to economist for much of the Republican Party, along with Stephen Moore, who Trump tried to put on the Board of the Federal Reserve. Moore fell short, but not because of his inability to get facts right; he would probably be making monetary policy if he weren’t an alimony deadbeat.

The Road To Hell Is Paved With Good Intentions

Good intentions, as was the original intent of the COVID rescue plan, often lead to awful outcomes and consequences. More crudely and familar said,

“The road to hell is paved with good intentions” – Henry Bohn

We are reminded of the above idiom almost every day as we drive by the following sign on our way home from a nightly walk at the local lake.

Economic incentives matter, folks. The U.S. and global economy are in desperate need of massive economic structural reforms with a well thought out plan designed and executed by well-trained policy wonks.

The goose that lays of the golden eggs is slowly dying, being poisoned, among other things, by bad policy, some well-intentioned, and some just outright corrupt and political. If we do not get it right soon, and the path is narrowing, the country and world are going to be much poorer.

Skating On The Legal Edge Of Private Property Rights

Take a look at the following chart of the number of homeowners and renters who ran arrears on their July payments.

Then ask yourself, does this look like a healthy economy justifying the “rocket ship” stock market? Seriously?

Commercial Rents

The commercial sector is not doing much better,

This month, Old Navy paid 10 percent of what it owed and Bed Bath & Beyond paid almost 8 percent, an increase from zero last month, according to the report. It is unknown for which locations the payments were made. Levi’s is not included in the report.

Overall, rent collection from national retailers increased to 62 percent so far this month from 55 percent at the same point last month. — The Real Deal

The stock of rental arrears, which have been effectivly sanctioned by legal authortities, are becoming so large they will almost certainly not be paid down in full. Somebody is going to have to take the hit.

Moreover, landlords are beginning to challenge the legal authority of such laws,

The federal lawsuit challenges a package of bills that Mayor Bill de Blasio signed in May, including one that temporarily bars landlords from going after the personal assets of restaurant and store owners who owe rent.

The lawsuit alleges that Mayor Bill de Blasio’s actions deny landlords’ First Amendment rights and violate the contract clause of the Constitution, among other laws. Commercial leases often have clauses that allow the landlord to target the personal assets of tenants who walk out on a lease.

Stephen Younger, the lead attorney on the case, said that the laws passed by the city are too broad, and can protect large corporations capable of paying rent despite the pandemic at the expense of small landlords. – The Real Deal

We have no idea how these issues are going to be resolved.

There is little political appetite for mass evictions, throwing homeowners, renters, and small businesses out on the street, but on the other hand, the legal system is skating right on the edge of jettisoning private property rights.

We will never forget the sign that hung in the historical epic movie, Reds, starring Warren Beatty, about the life and career of John Reed, who chronicled the Russian Revolution in his 1919 book Ten Days That Shook the World,

Private Property Is Theft

We are skating a lot closer to the edge than most realize, folks, and unless some policy wonks and great thinkers put together a plan, and fast, the future of the economy, shall we say is going to become very confusing.

Our priors are some type of legislation will evolve, possibly an amendent to the bankruptcy code to forgive the stock of arrears. Somebody is going to have to take the hit, however.

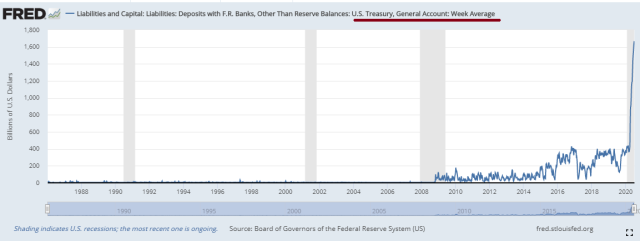

We suspect the massive stock of unpaid rents and mortgages will some how come back to the banks, and the Fed will take it off their balance sheet and monetize the losses. To paraphrase the late owner of the Oakland Raiders, Al Davis,

Just print, baby!

To wit, we say, gold, baby!

Personal & Saving Up, Wages & Salaries Down

Speaking of printing, we almost fell out of our chairs after we constructed the following table and charts,

Personal income was up almost 7 percent year-on-year in May, while wages and salaries were falling, only because government transfers were up nearly 70 percent.

The chart illustrates government transfers, which include Social Security, Medicare, Medicaid, unemployment insurance, and among other things, increased from 17 percent of personal income in December to over 30 percent in April, The result of the COVID support payments made to households, financed mostly by the Fed’s digital printing press.

Treasury Securities Held Outright By The Federal Reserve

U.S. Treasury General Account Balance Held At The Federal Reserve

The mirror image is the massive increase in personal savings, which, in large part, has been the jet fuel goosing the stock market. The enormous ramp in savings is a mirage, however, and the result of Jerome Powell’s digital printing press.

Consumers have a high propensity to save such one-off transfers and grants unless they perceive them as a permanent change to their income and cashflow,

What Is the Permanent Income Hypothesis?

The permanent income hypothesis is a theory of consumer spending stating that people will spend money at a level consistent with their expected long-term average income. The level of expected long-term income then becomes thought of as the level of “permanent” income that can be safely spent. A worker will save only if his or her current income is higher than the anticipated level of permanent income, in order to guard against future declines in income. – Investopedia

Moreover, unless the transfer payments are spent on the purchase of goods and services, either by consumers or the business sector, they do not register in economic growth.

Economic Recovery

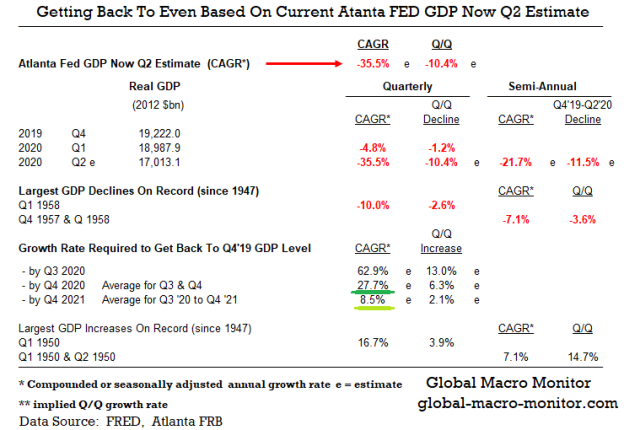

The following table illustrates that the real economy fell over 11.5 percent, 21.7 percent annualized, in the 1st half of 2020, assuming the Atlanta Fed’s GDP Now forecast for the Q2 holds at -35.5 percent on an annual basis. That is almost triple the next highest half-year decline, during the Eisenshower recession of 1958, where the auto and construction industry led the U.S. and world into a very short but sharp downturn.

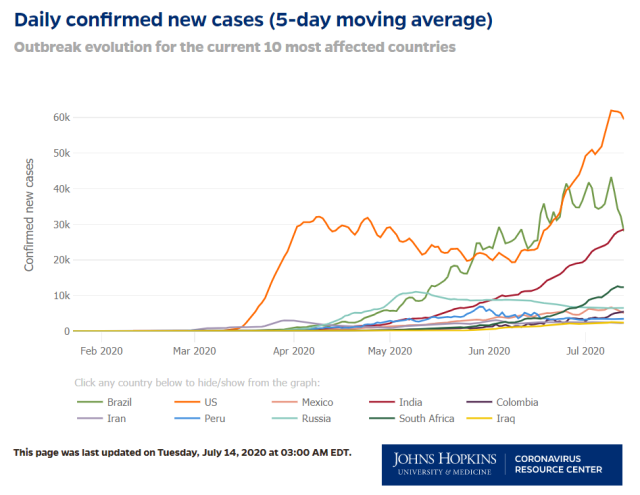

The 2020 contraction differs in that the government sector “flipped the switch off” on the economy during lockdowns to prevent the spread of the virus. A good analogy is that of a bungee cord. The economy is currently in bounce mode, how much and how robust the bounce will be is anyone’s guess and will undoubtedly be complicated by the recent spike in COVID cases.

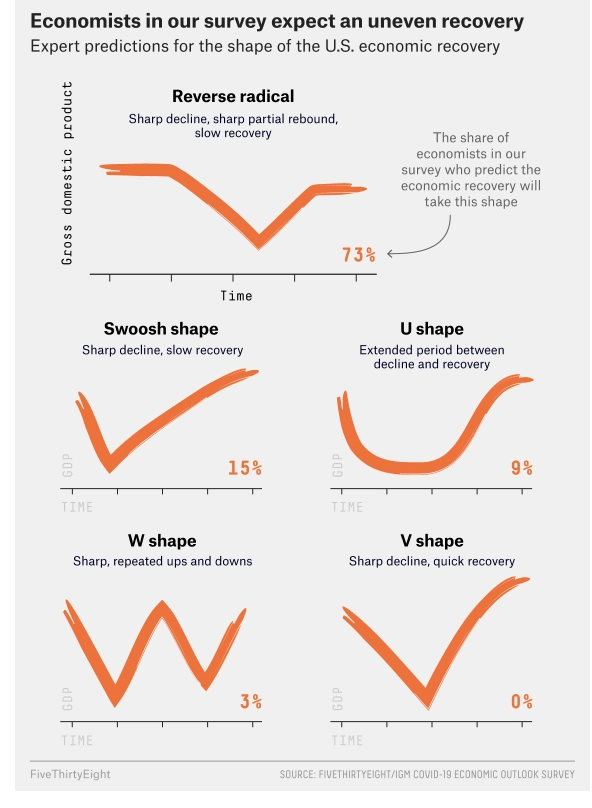

V-Shaped Recovery?

First, let us describe how we define a V-shaped recovery as there are many definitions, most of which are incomplete or vague, at best.

In the table below, we estimate the quarterly GDP prints it would take to generate our definition of a V-shaped recovery, where real output recovers its Q4 2019 level.

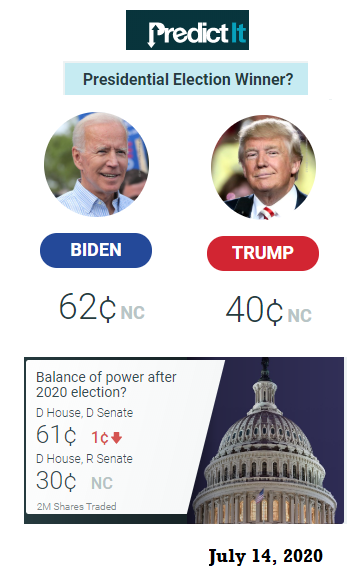

For example, for full recovery by Q4 2020, the headline GDP growth number would have to print an average of 27.7 percent in both Q3 and Q4. Entirely possible for Q3, in our opinion, not likely for Q4, however.

To fully recover by Q4 2021, the GDP releases will have to print an average of 8.5 percent over the next six quarters. Possible, and highly dependent of the new economic plan of a Biden Administration, which is looking increasingly likely by the day.

We do wonder, given all the distortions introduced as part of the COVID recovery plan, and the very likely change in government which is to come in January, what kind of economy will exist when we finally emerge from this heath crisis and economic rabbit hole.

Hysteresis

Readers of the Global Macro Monitor know that we adherents to the concept of hysteresis,

Hysteresis in the field of economics refers to an event in the economy that persists into the future, even after the factors that led to that event have been removed. – Investopedia

We first heard the term applied to trade and explained by a young Paul Krugman at a World Bank luncheon years ago. Though he was using the dollar exchange rate as the exerting force on the bending of import and export markets, he explained it in simple terms,

If you put enough pressure on a spoon by bending it for a long enough period of time, it will never return to its original position. So to it is with export and import markets. – Paul Krugman, paraphrased

We are starting to see anecdotal evidence in our community of hysteresis or permanent economic damage caused by the pandemic, which will remain even if the virus were to disappear tomorrow.

Small businesses, which make up almost 50 percent of the private labor force, are beginning to shutter in a big way,

Nearly 66,000 businesses have folded since March 1, according to data from Yelp, which provides a platform for local businesses to advertise their services and has been tracking announcements of closings posted on its site. From June 15 to June 29, the most recent period for which data is available, businesses were closing permanently at a higher rate than in the previous three months, Yelp found. During the same period, permanent closures increased by 3 percent overall, accounting for roughly 14 percent of total closures since March. – N.Y. Times, July 13

The following is a picture of a Peet’s Coffee, one of our favorite local coffee bars, which just closed last week.

And this from our good friend in a small coastal Northern California town.

This is the state of affairs in my small home town. @Carol_Kohlberg @macromon pic.twitter.com/uJR0ck0F9v

— David Herstle Jones (@ThinkInTheMorn) July 15, 2020

One Last Thing

Finally, we believe the COVID crisis will be a watershed event where the U.S. economy becomes fully digitized, and the tech sector, as reflected in the Nasdaq and Nasdaq100, will take the torch of leadership and begin to overshadow the S&P500. How long this transition takes is anybody’s guess.

The top five stocks in the S&P500, Apple, Microsoft, Amazon, Facebook, and Google, now make up almost 25 percent of the S&P’s total market capitalization and just about 50 percent of the NASDAQ 100. They are expensive but we don’t think they’re going away anytime soon.

In some sense, we do agree with the restaurateur referred to earlier in this post that we are now in the high tech millennial economy where the old fossil fuel industries will slowly decline – not go away – relative to renewables and all-electric cars.

We also wait with great anticipation for the next great thing, which will probably be conceived, birthed, and emerge from and through artificial intelligence (A.I.).

Markets

It’s stunning to us that the markets continue to hold up, choosing to take the blue pill of bliss and ignorance, believing the Wizard of Oz, dressed up as the Federal Reserve, will always be there to bail them out no matter their level of stupidity.

Then again, there really are no free markets left after the Fed has effectively nationalized just about anything that moves. Viva el Socialismo de Mercado!

We like to live in reality and have chosen to take the red pill, by the way.

The Marginal Buyer

It would behoove anyone and everyone in the markets to know who is, and to understand the marginal buyers that are now setting stock prices and then decide if they want to chase stocks alongside them.

Those of you who took an introductory Economics class in high school or college may remember learning that prices are set “at the margin”. That’s a fancy way to say that prices are set by the person (or people) willing to pay the most.

This person willing to pay top dollar is called the “marginal buyer”. Most of us don’t really think about him [her] much, but he (or she) is very, very important.

Why? Because the marginal buyer not only determines price levels, but also their stability and degree of volatility. The behavior of the marginal buyer, as well as the degree of competition for his/her “top dog” spot, sets the prices of nearly every asset class held by today’s investors. – Peak Prosperity

We know the buyer of last resort is the Fed. It’s unclear what is their reservation price or what level they will intervene to support and save stocks.

We are also fairly confident the marginal buyer is not the super smart money, such as Warren Buffett, Howard Marks, or Jeremey Grantham.

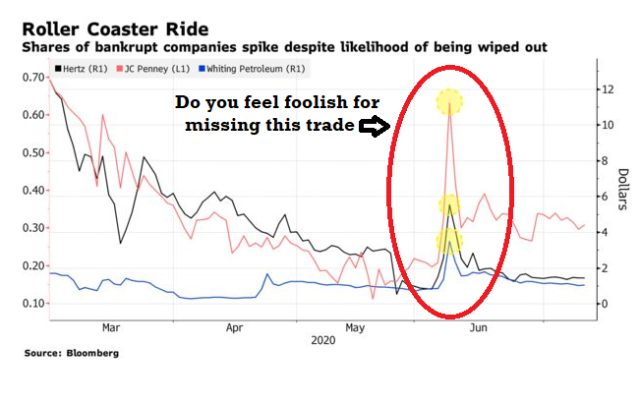

More likely they are the following bozos “all jacked up on Mountain Dew.”

Amateur investors who loaded up on J.C. Penney Co. shares as the retailer went bankrupt are now pleading with a judge to spare them from a complete wipeout.

…Those gains almost always prove fleeting, leaving retail traders with little to show for their stakes other than an expensive lesson in the U.S. corporate bankruptcy process — where shareholder value disappears almost as a rule. That’s because all creditors have to be made whole before equity owners get anything. For J.C. Penney investors, there’s little to suggest this time will prove any different. – Bloomberg

We didn’t feel foolish for missing the “massive move” in JC Penney, Hertz, and Whiting and would have taken the berating from talking heads on bubble vision for missing such a large move with our heads held high. Simply counseling, patience and that nobody can pick market tops.

As always, folks, we reserve the right to be wrong.

via ZeroHedge News https://ift.tt/32qqGli Tyler Durden