Netflix Tumbles After Crushing Q2 Expectations But Offers Dismal Q3 Outlook

Tyler Durden

Thu, 07/16/2020 – 16:10

While recent earnings reports from streaming giant Netflix have been a mixed bag, missing badly one year ago when US subs declined and forecasting the first annual drop this decade, then smashing expectations three quarters ago, then beating expectations two quarters ago but disappointing in its guidance, and finally smashing expectations with a blowout first quarter three months ago in which it added a record 15.8 million subs, but once again offering a somewhat weak outlook for a post-covid world, none of that mattered today when the company reported earnings for its first full “post Corona” quarter, when the only thing investors cared about was not whether the company would beat or miss expectations, but rather if Netflix, whose stock price has soared in the past month, remains a pandemic-proof company?

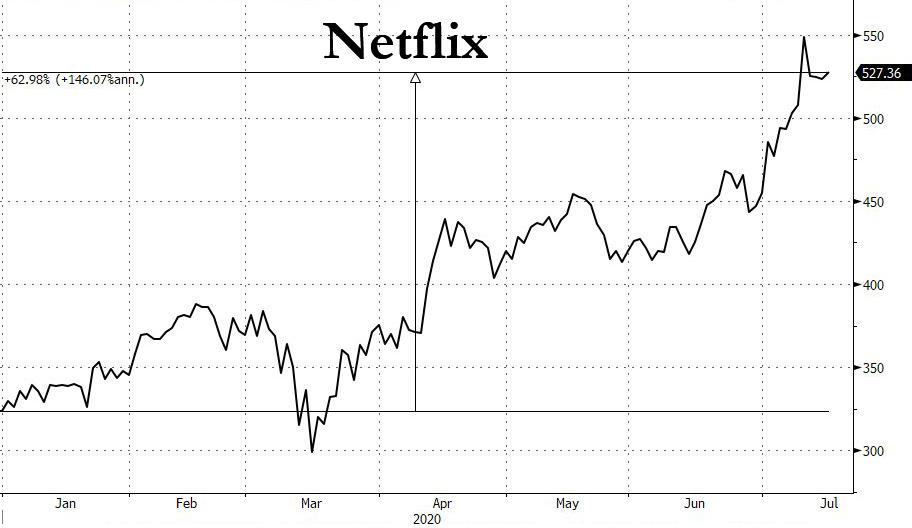

To be sure, the company has been riding a wave of optimism, its stock soaring over 60% this year – putting it in the top 10 for S&P 500 companies, similar to the gains seen by other shutdown beneficiaries Amazon.com and Ebay – and trading just shy of its all time high around $550, with investors pushing the shares to new highs and analysts seeing people download its app in record numbers. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on. But the biggest question remains how many future subs has covid brought to the present?

Indicatively, consensus expects 8.27 million new subs this quarter, although the whisper number is well above. As Bloomberg Intelligence writes, “streaming video is on a hot streak since the pandemic struck, and a 63% jump in 2Q app downloads suggests to us that Netflix may add about 10-12 million members in the quarter, well ahead of its guidance for 7.5 million. A steady content stream including titles such as “Space Force” and “Too Hot to Handle” have resonated with viewers, even as rivals have been hurt by production delays.”

If whispers are accurate, this would easily be the biggest second quarter – which traditionally is seasonally slow – in Netflix history.

At the same time, the world’s largest paid streaming service is also facing more intense and cutthroat (or rather cut-price) competition than ever. Comcast’s Peacock platform has been rolling out for a few months, along with the short-form video service Quibi. And AT&T’s big bet on streaming, HBO Max is also up and running now while Disney+ has been a massive hit.

So was Q2 the quarter that would unleash another sharp repricing higher for Netflix stock? Judging by the company’s report, the answer, is that this may have been as good as it gets.

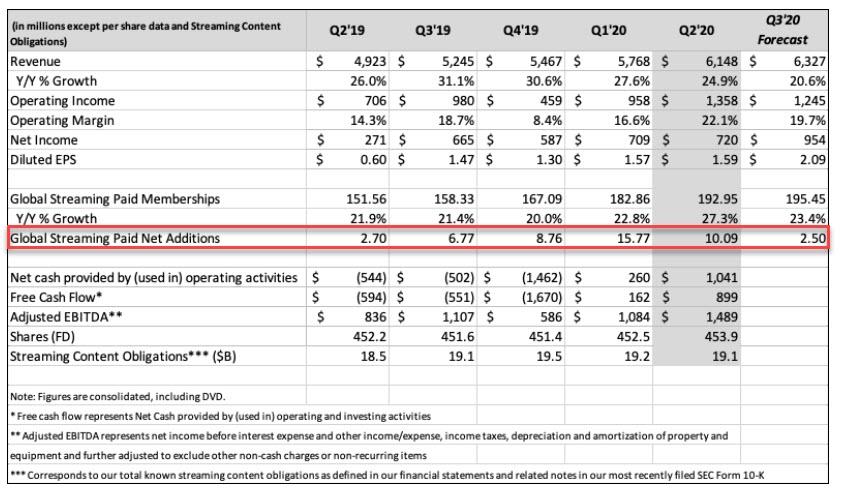

First, the good news which is that in Q2, Netflix did indeed beat expectations of 8.3MM, but fell squarely inside the whisper number:

- 2Q Streaming Paid Net Change +10.1M, Est. +8.20M

While the financials are traditionally secondary, the company beat on the top line in Q2 but missed on earnings:

- EPS $1.59, Est. $1.82

- Netflix 2Q Rev. $6.15B, Est. $6.09B

And summarized:

Commenting on the stellar Q2 results, the company said that:

- Revenue grew 25% year over year, while quarterly operating income exceeded $1 billion.

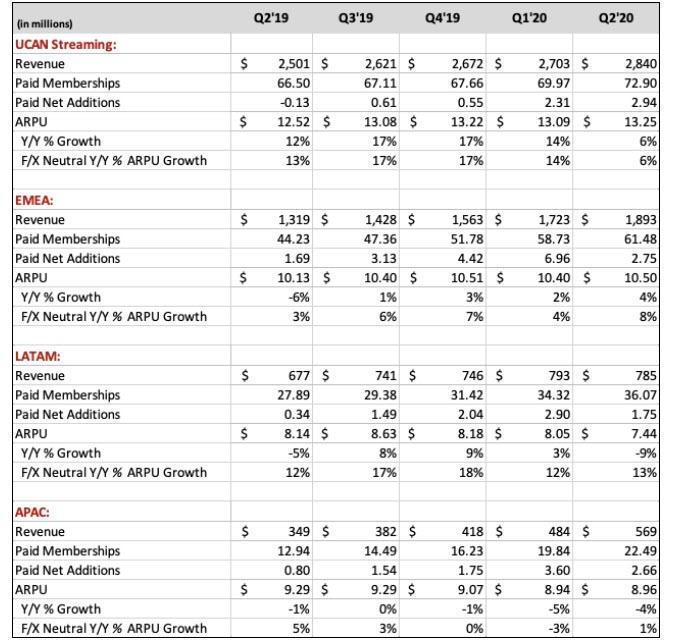

- Average streaming paid memberships in Q2 rose 25% year over year while streaming ARPU increased 0.4% year over year (excluding a -$289m impact from foreign exchange (F/X), streaming ARPU grew 5% year over year) .

- Operating margin expanded 770 basis points year over year to 22.1%, above the guidance forecast due to higher than expected membership and revenue growth.

- Content and marketing expenses were lower than we expected, as the pandemic delayed some planned spend.

- EPS of $1.59 vs. $0.60 a year ago included a $119m non-cash unrealized loss from F/X remeasurement on Euro denominated debt and a $220m non-cash valuation allowance for deferred tax assets

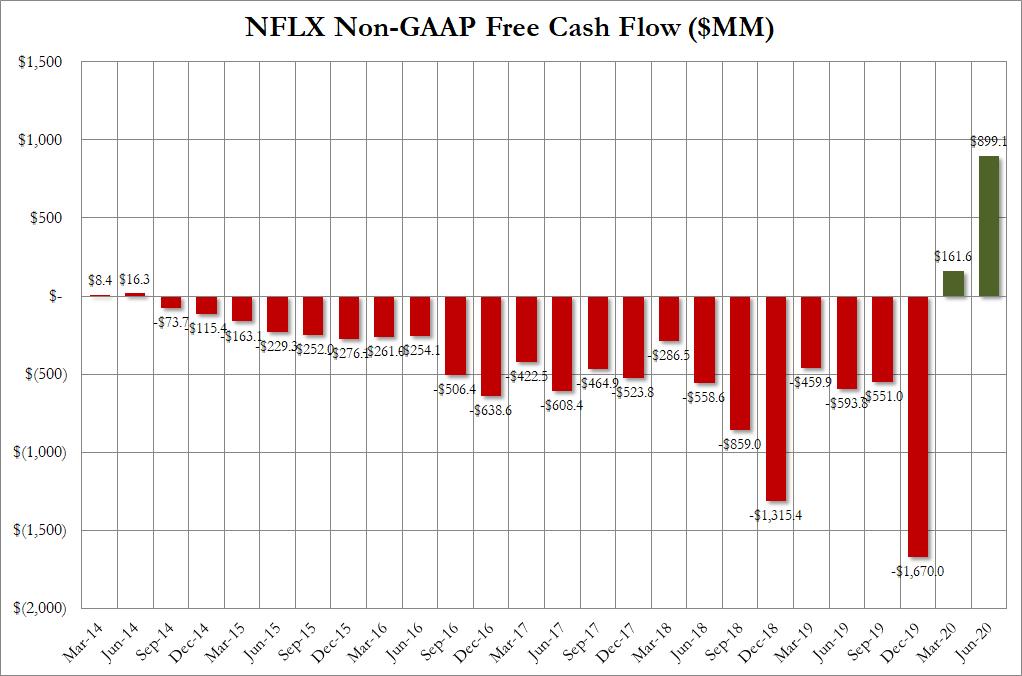

There was more good news: for the second quarter in a row, Netflix reported a second quarter of positive cash flow (up $900MM), and now expects cash flow to be breakeven to positive for the full year 2020 as well. It had previously expected -$1 billion or better.

Of course, a lot of this was due to the effective shutdown in production, leading to a hard stop to most expenses. However, as the world slowly re-opens, NFLX said “its main business priority is to restart our productions safely and in a manner consistent with local health and safety standards to ensure that our members can enjoy a diverse range of high quality new content.”

Today, we’re slowly resuming productions in many parts of the world. We are furthest along in Asia Pacific (where we never fully shut down in Korea, for example) and are now shooting live action series like season 2 of our Japanese original The Naked Director. In EMEA, we are now back in production in many countries, including Germany, France, Spain, Poland, Italy, and the UK. While we recently resumed production on two films in California and two stop-motion animation projects in Oregon and expect some more of our US productions to get going this quarter, current infection trends create more uncertainty for our productions in the US. Parts of the world like India and some of Latin America are also more challenging and we are hoping to restart later in the year in these regions.

The pandemic and pauses in production are impacting our competitors and suppliers similarly. With our large library of thousands of titles and strong recommendations, we believe our member satisfaction will remain high.

Now the bad news: what sparked a furious selloff in the stock was not the impressive Q2 performance or even the fact that NFLX was stupid enough to generate almost a $1 billion in cash flow (we joke) but the company’s Q3 outlook, which was half of what consensus expected:

- Netflix Sees 3Q Streaming Paid Net Change +2.50M, Est. +5.12M

Here is the company’s forecast with the disappointing Q3 guidance highlighted:

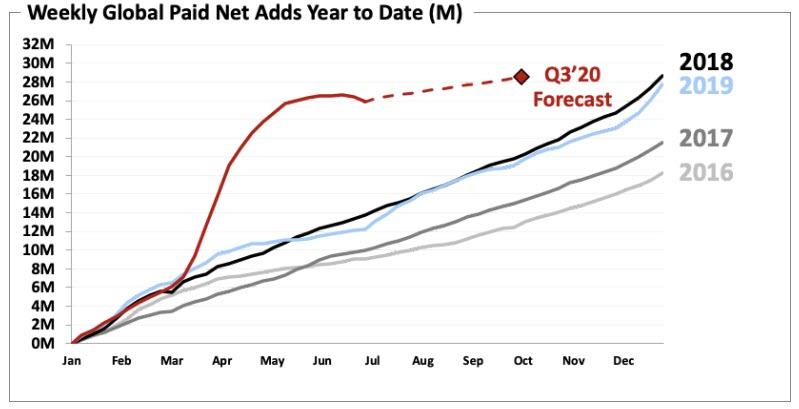

Here is how Netflix discussed the boundary between the stellar Q2 and what it warns will be a poor Q3: the company added a Q2-record 10.1m paid memberships vs. 2.7m in last year’s Q2. The positive variance relative to the company’s 7.5m forecast was due to better-than-forecast acquisition and retention. In the first half of this year, Netflix has added 26MM paid memberships, nearly on par with the 28MM for all of 2019. However, as the company warned previously, (and can be seen in the graph below), growth is slowing as consumers get through the initial shock of Covid and social restrictions. Paid net additions for the month of June also included the subscriptions we cancelled for the small percentage of members who had not used the service recently.

Looking ahead, Netflix forecasts just 2.5m paid net adds for Q3’20 vs. 6.8m in the prior year quarter. As the company indicated in its Q1’20 letter, it expects paid net adds will be down year over year in the second half as our strong first half performance likely pulled forward some demand from the second half of the year. In addition, Q3’19 included the positive impact of new seasons of both Stranger Things and La Casa de Papel (aka Money Heist). We continue to view the quarter-to-quarter fluctuations in paid net adds as not that meaningful in the context of the long run adoption of internet entertainment which we believe provides us with many years of strong growth ahead.

In other words, as many expected, NFLX has merely been pulling subs into the present due to covid, however as a result the future “backlog” is looking rather poor.

Sure enough, in his letter to shareholders, Netflix CEO Reed Hastings said the pandemic led to a boom in the first half of the year and warned that it won’t continue: “In Q1 and Q2, we saw significant pull-forward of our underlying adoption leading to huge growth in the first half of this year (26 million paid net adds vs. prior year of 12 million). As a result, we expect less growth for the second half of 2020 compared to the prior year.”

The market was not happy with this guidance dramatic drop in projected new subs, which would be the second lowest going back to 2016, and the stock has been hammered after hours, tumbling as much as 10%.

NFLX’ plunge has dragged down most other streaming companies, including ROKU -2.1%, AMZN -1.5%, FB -1.3%, and is hitting Nasdaq futures.

Developing

via ZeroHedge News https://ift.tt/3fzIIpa Tyler Durden