These Are The Top Volatility Events Of The Second Half

Tyler Durden

Thu, 07/16/2020 – 14:40

Last week, BofA’s Chief Investment Strategist reminded readers of his famous Flow Show report that the disconnect between macro and markets has never been greater – i.e., markets have never been more broken – but that is to be expected for the following three reasons:

-

Markets rationally being “irrational”: government and corporate bonds have been fixed (“nationalized”) by central banks, so why would anyone expect markets to connect with macro, why should credit & stocks price rationally.

-

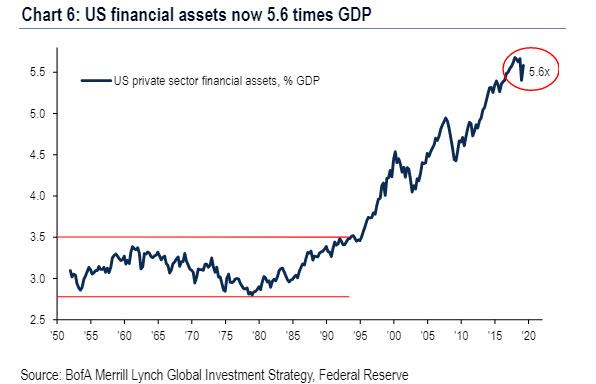

Markets leading macro: policy makers (see China this week) know higher asset prices necessary condition for macro recovery (Wall St assets are 5.6x size of US GDP)…

…V-shape recovery on Wall St leading V-shape recovery on Main St (see PMI’s & housing activity); gasoline demand good US mobility signal, up sharply to 9mn barrel/day from spring lows, watch to see if virus again negatively impacts economy.

-

Markets rationally pricing-in Max Liquidity, Minimal Growth backdrop, as they have done for 10 years; of 3042 stocks in MSCI ACWI currently 2141 >20% below their all-time highs, i.e. in a bear market.

Also consider this: if the S&P500 (3230 on Jan 1st) was just “tech, health care, Amazon, Google” it would now be 4173 , and if the S&P were “everything else” it would be 2924. No secret here, but US tech outperformance over US banks past 6 months biggest since 1999 tech bubble & 2008 GFC.

So with everyone well aware that the “market” no longer exists in a conventional sense but is merely a policy tool (to avoid, for example, a mass uprising should retirement fund values plunge and some 100 million Americans realize their retirement funds have vaporized) of fiscal and monetary authorities, does that mean that stocks will never go down again?

The answer depends on one’s time horizon. If one is focused on the next 2-3 months, then Hartnett says he is still bullish risk assets, targeting 2% on the 30Y Tsy, IG CDX sliding below 60 bps, and the S&P rising back over 3,250, while anticipating “choppy/higher summer price action.”

However, as we near the end of the 3rd quarter, the BofA strategist warns that in September the “range breaks” and cautions that “the time period from August 27th (this year’s Jackson Hole symposium has been physically canceled but it will still take place by zoom one imagines) to Sept 29th (1st Presidential Debate) packed with “volatility opportunities.” Among the key events as the summer ends are:

-

Fed decision on Yield Curve Control (they do it…means “peak stimulus”, or they don’t…which still means “peak stimulus”);

-

US-China tension to ratchet higher with HK elections, G7 meeting, US election;

-

US election gets priced-in just as society gears up for clash between virus-lockdown and back-to-office, back-to-school momentum.

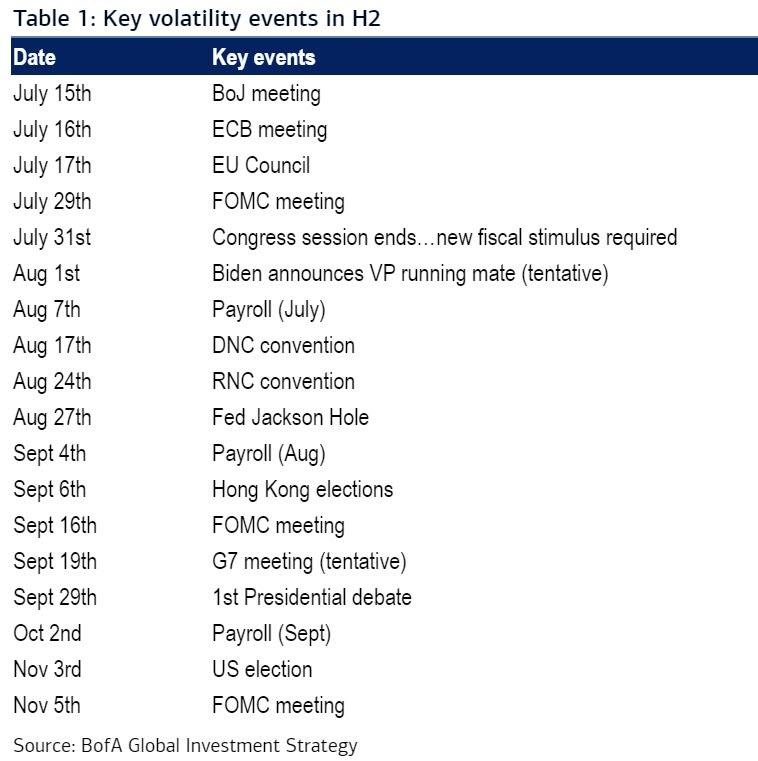

In summary, here are 18 key volatility events in the second half.

via ZeroHedge News https://ift.tt/2Wtddp5 Tyler Durden