Trader: Today “Just Doesn’t Feel Right”

Tyler Durden

Thu, 07/16/2020 – 08:20

Authored by Richard Breslow via Bloomberg,

“Hey, it’s already Thursday.”

“Ugh, it’s only Thursday.”

Both statements are legitimate ways of looking at the world. But they sure bring you to different conclusions. Traders have spent the entire night taking a dour view of every piece of news. And I guess if your focus is Chinese equities, that’s understandable. But, that aside, it just doesn’t feel right. And it will be interesting to see if this mood lasts the day. It has barely started and I’m dying to see how it ends.

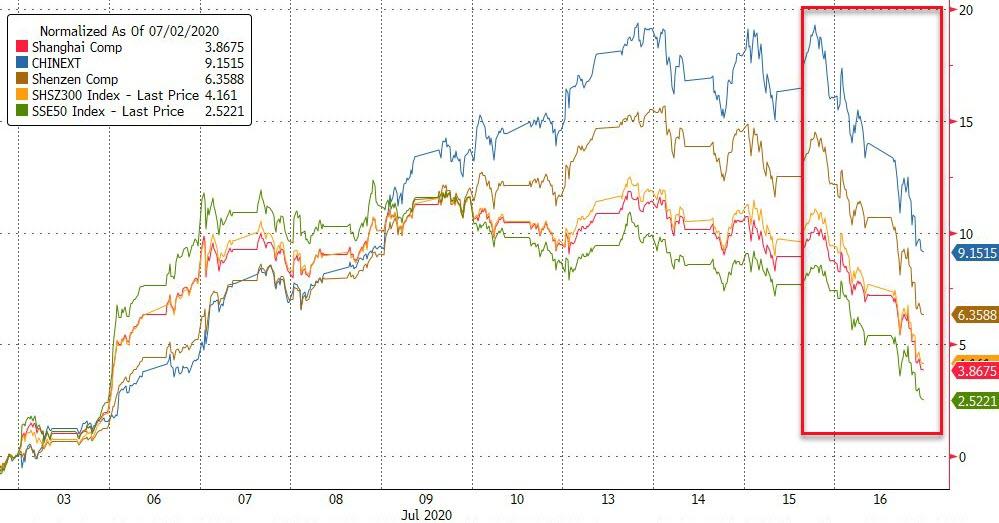

In case you haven’t looked, equity indexes in China got harpooned. They went up in a bubbly frenzy and came down today in just as dramatic fashion. The CSI 300 got most of the press, but still remains well up on the year.

No one likes getting caught on the wrong side of a move like this, but in the long run, taking out some of the froth might prove a healthy development all around. What’s interesting is how modest the knock-on effects to European markets and U.S. futures was compared with what you might ordinarily expect. And that is bullish. One trader’s view that the SPX couldn’t maintain the break above its resistance zone yesterday, is another’s being impressed how well futures have held in there so far today.

The economic numbers that have come out overnight have, mostly, been pretty good. The market seemed inclined to pick out the portions that could cast them in a less flattering light. Australian unemployment was a beat. Even if heavily influenced by part-timers. But the unemployment rate ticked up. And that got the attention. No matter that the participation rate was higher. The U.K. number was solid. And they sold into it. And of course in China, a really good GDP lost out to a retail sales miss and their largest liquor producer coming under official criticism. If you owned that stock today, it did prove alcohol in excess can be bad for your health.

Markets have been excited at the prospect of a virus vaccine being developed. The excitement has been rampant and asset prices reacted quickly to the news. Even if somewhat prematurely. Today, it has been back to detailing the number of new cases and potential hotspots. Old news, new news depends on the mood of the day. Traders are entitled to focus where they choose, but it’s hard not to feel that we were reacting to the price action and not the other way around.

Fed speaker comments have also been discussed. Some have taken them as frustratingly downbeat. Long road ahead. Others that “more” is coming and traders love that. The fact is, both are true. Main Street commentators stressed the former and Wall Streeters the latter. Little surprise there. And I have found it interesting how various people reacted to those bank earnings. You can, perhaps, fault the authorities for their policy mix and lack of creativity, but hardly the banks for doing their jobs and taking advantage of the opportunities presented.

The ECB meets today. I suspect President Christine Lagarde will find a way of coming off as friendly not only to markets, but also to banks. Hear what she has to say before reacting to any early headlines that might look underwhelming. All these central bankers are still very much in accommodative mode. And intend to make sure all of the massive bond issuance that is coming is taken up smoothly.

And as the day goes on and we begin to focus more intently on the EU summit, don’t be overly distracted by talk of the Frugal Four. A deal is very likely to eventually get done. And even if it isn’t put to bed this weekend, the spin will be positive. They will keep taking bites out of the apple until something, even if it isn’t what some optimists may hope for, eventually gets done. Lean positive.

Maybe I’m being starry-eyed, but it just seems like there’s a good chance the day ends happier than it began. Time will tell.

via ZeroHedge News https://ift.tt/32kQOy9 Tyler Durden