New SEC Rule Means Holdings Of Dalio, Einhorn, Soros And More Could Go Completely Dark

Tyler Durden

Fri, 07/17/2020 – 05:30

Some of the biggest investors in the world would see their holdings “go dark” if the SEC implements a new rule concerning Form 13F disclosures that it has recently proposed.

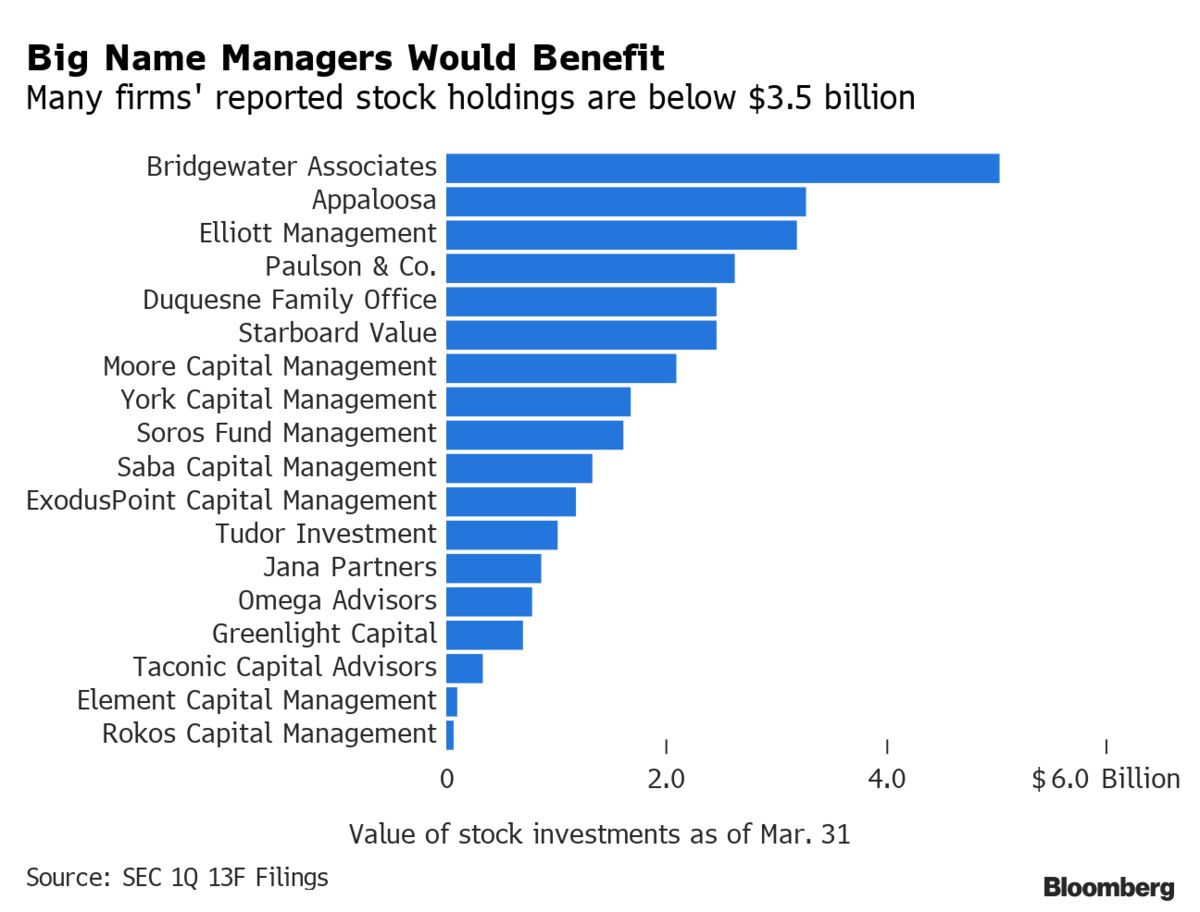

Names like Paulson, Einhorn, Druckenmiller, Bacon, Tudor Jones and Soros could all see an added layer of opacity to their holdings as a result of the SEC’s proposal to limit Form 13F filers to those who hold stakes of $3.5 billion or more. Even Ray Dalio, who manages $138 billion, could see added opacity to his holdings as a result of the rule. His firm holds only $5 billion in stocks.

The current threshold for Form 13F filers is $100 million and the value of most of these firms’ holdings in the U.S. is less than the proposed $3.5 billion threshold requirement.

Even Paul Singer’s Elliot Management could wind up going dark, as his firm has only about $3.4 billion in stocks and and convertible bonds and another $2 billion in equities, according to Bloomberg. Managers like Leon Cooperman have said that it would be nice to reduce the regulatory burden required for the current threshold.

NIRI spokesman Ted Allen thinks the new rule is a compromise for managers in exchange for requiring more timely 13F reports and a potential rule change that would require firms to disclose their short positions.

Allen said: “If this rule goes through, you will see more small and mid-sized companies getting ambushed by hedge funds. This will increase activism in all of the mid-cap companies because there will be less transparency.”

Andrew Park, a senior policy analyst at Americans for Financial Reform, has concerns about the new requirement: “I’m certain you could see firms that want to cap at $3.5 billion. There’s a pretty stark difference of having $3.49 billion versus $3.51 billion given these reporting requirements.”

Recall, on Wednesday morning, we laid out all of the new proposed rule changes. The SEC announced in a press release late last week that they were considering amending Form 13F to update a reporting threshold for institutional investors to a new standard that would all but eliminate the point of the filings to begin with.

Form 13F was put into place in 1978 to give transparency about larger institutions and their holdings. The threshold has not been changed for the last 40 years, which has prompted Jay Clayon’s SEC to raise the reporting threshold to $3.5 billion.

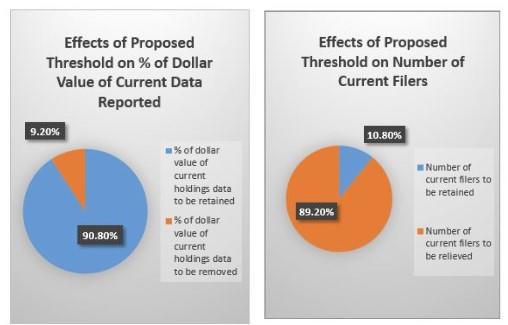

This would cut out almost 90% of all institutions that currently file Form 13F, all but eliminating it.

SEC Chairman Jay Clayton claims the change is to reduce the burden on smaller managers while keeping the same oversight on large positions from the biggest institutional managers.

“Monitoring equity holdings of large institutional investment managers is an important part of our regulation and oversight of the securities markets. Today’s proposal will update, for the first time in over 40 years, the 13F reporting threshold to a level that furthers the statutory goal of enabling the SEC to monitor holdings of larger investment managers while reducing unnecessary burdens on smaller managers,” Clayton said.

The agency estimates $68 million to $136 million in compliance costs could be saved by smaller managers: “The proposal estimates that, for smaller managers that would no longer file reports on Form 13F under the proposed threshold, these direct compliance costs could range from $15,000 to $30,000 annually per manager, depending on certain factors, resulting in direct compliance cost savings for these managers per year ranging from $68.1 million to $136 million.”

The SEC justifies the move by citing the growth in public equities since 1975. “In 1978, when Form 13F was adopted, the threshold for filing the form was set at $100 million, the amount in the underlying statute and representing a certain proportionate market value of U.S. equities,” it said.

It continued: “Since then, the overall value of U.S. public corporate equities has grown over 30 times (from $1.1 trillion to $35.6 trillion), and the relative significance of managing $100 million has declined considerably. The Commission and staff have received recommendations to revisit the Form 13F reporting threshold from a variety of sources over the years, including from the Commission’s Office of the Inspector General.”

via ZeroHedge News https://ift.tt/2ZBHpAt Tyler Durden