The Fed Knows…

Tyler Durden

Sat, 07/18/2020 – 12:30

Authored by Sven Henrich via NorthmanTrader.com,

In this week’s edition of Straight Talk Guy, Dan and I are discussing a wide range of issues, tech, $NFLX, $TSLA, $AMZN, the sustainability of the sudden rotation trade, the $VIX, and vaccine optimism and its potential to propel markets even higher.

$SPX closed near the top of the range of the past 7 weeks aided by the machinations of OPEX week, a renewed expanding Fed balance sheet and incessant headlines of vaccine optimism, non stop Fed speakers, hope for fiscal stimulus and hope for a coming rotation trade on the heels of positive bank earnings, banks that benefitted tremendously from the Fed’s helping hand during the crisis.

As such the glaring cliff between Main Street and Wall Street continue to widen. Over 50 million Americans may have been forced to file for unemployment during this crisis but the banks have made out like bandits as have the tech billionaires having seen their stocks skyrocket to a disconnect versus the broader market not seen since the year 2000 bubble.

The rotation trade argument was supported buy a sudden flight from tech as key tech stocks reversed hard from their Monday opening highs and meandered for most of the week at lower levels.

But is the rotation trade a false flag signal? Rather does the tech reversal signal something more ominous in light of some key technical developments? As I highlighted last night:

Quick market update:

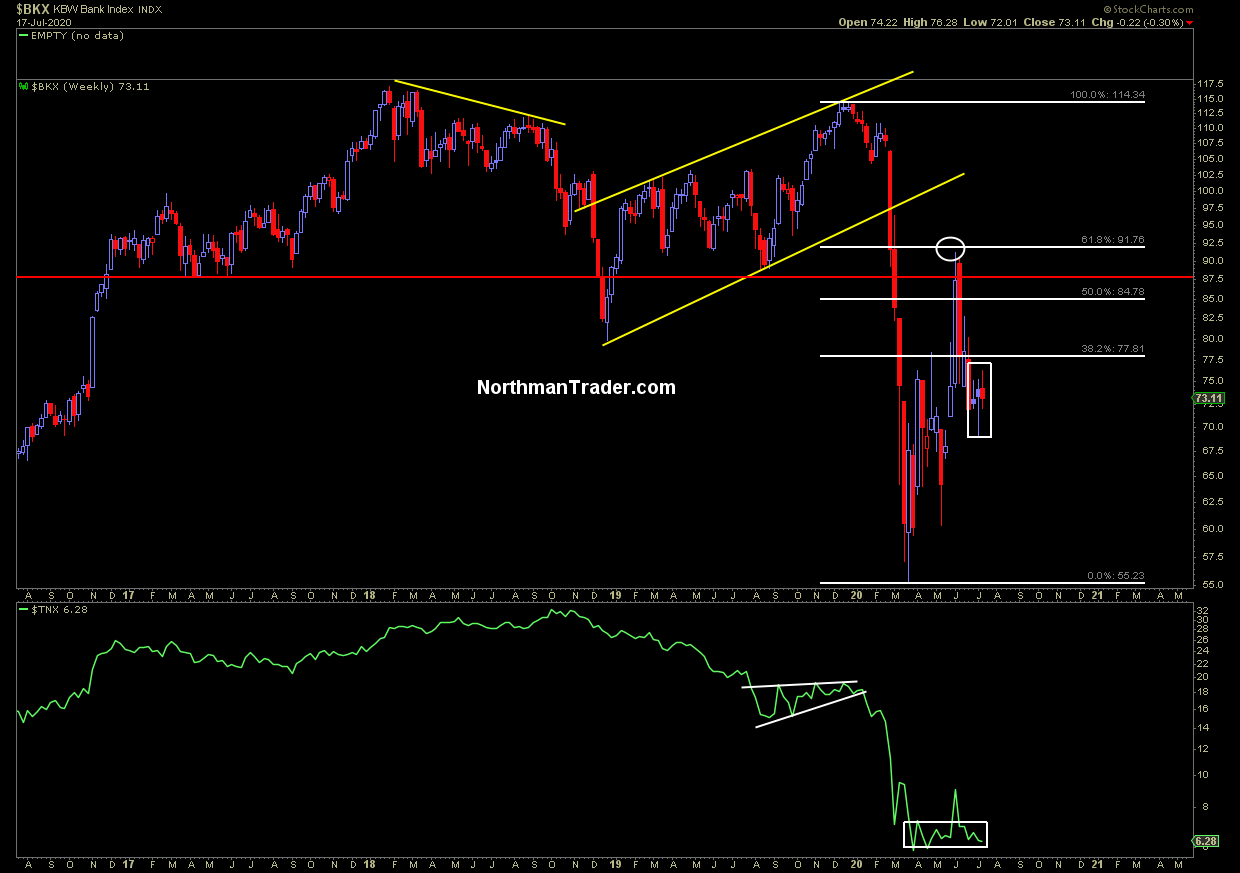

These 2 charts may be critically important in the days ahead. pic.twitter.com/2fahrVhzWD— Sven Henrich (@NorthmanTrader) July 17, 2020

Note the rotation trade argument has a lot to prove. Take banks and small caps who remain below the June highs with yields continuing to signal no V recovery::

Notable also this week: Several Fed speakers started to signal words of doubt about a V shape recovery and former Fed Chairs Bernanke and Yellen pleaded with Congress to sign off on another massive stimulus package. To not do so would be “catastrophic” according to Janet Yellen who, like Powell, is now declaring that all deficit spending concerns of previous years should now be ignored. Trillion dollar deficits bad, $4 trillion deficits no problem. Don’t worry about it and don’t worry about what we said just last year (Fed Chair Powell: ‘The U.S. federal government is on an unsustainable fiscal path).

However a glimmer of truth made its way into the public sphere. As readers well know I’ve been harping about the historic disconnect between stock markets and the economy for some time. Recessions typically see a cleansing of asset prices, not this time, as markets continue to flirt with historic highs.

On Friday US markets closed at 151.4% market cap to GDP close to all time highs:

This issue was suddenly acknowledged by non other than Fed Vice Chair Quarles:

That market cap to GDP disconnect I keep harping about?

The Fed knows:“We may be seeing significant pricing disconnects between the market & economic fundamentals, which could result in sudden & sharp repricing,” – Federal Reserve Vice Chairman Quarles.https://t.co/4lAmMiniE6

— Sven Henrich (@NorthmanTrader) July 15, 2020

The message: The Fed knows. The Fed knows markets are sitting on the very disconnect they have brought about with their liquidity injections (but refuse to publicly acknowledge), but the Fed is also trying to cover its butt in case things go astray.

So be aware, we’re in a bubble and the Fed has pretty much just acknowledged it without saying it.

Without further ado, please join us for edition number 10 of our Straight Talk series:

* * *

Also I’ll be posting a separate Market Video focusing on the latest technical implications this weekend (For those not already signed up for these videos please see link to sign up). For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/3hgRtF8 Tyler Durden