Goldman Spots An Ominous Inflection: Labor Market Recovery Has Stalled Out

Tyler Durden

Tue, 07/21/2020 – 10:25

While scrolling through Twitter this morning, we stumbled upon a thread from Bloomberg’s Joe Weisenthal arguing (somewhat facetiously) that the rebound in total compensation (which, crucially, includes enhanced unemployment benefits and the stimulus checks) and retail sales (driven in part by the shift to working from home and a reaction to the shortages of critical supplies that plagued US pharmacies and supermarkets) suggests that the US economy did experience a “V-shaped recovery” after all, and that the only way this will end is if Congress pulls the plug (by not approving more stimulus checks and ‘enhanced’ benefits). After all, the last round of expanded unemployment checks are going out in 5 days.

THE V-SHAPED RECOVERY WE JUST EXPERIENCED

In today’s @Markets newsletter, I wrote about how by some measures, we’ve already experienced a genuine V-Shaped Recovery, and the question now is if Congress pulls the plug. https://t.co/gC2ZuuNU0i pic.twitter.com/phRE6z3J4x

— Joe Weisenthal (@TheStalwart) July 20, 2020

The reason people are uncomfortable calling it a true V is that while income and spending have surged back to pre-crisis levels, employment and salary (ex unemployment insurance) remains depressed. So there’s a view that this recovery isn’t, like, really real. pic.twitter.com/T7X68wlXge

— Joe Weisenthal (@TheStalwart) July 20, 2020

But such distinctions are for other people to worry about IMO. Fact of the matter is that income and spending have rebounded so hard. Much faster than most people would have guessed in the middle of March. And basically anyone would call those lines above a V.

— Joe Weisenthal (@TheStalwart) July 20, 2020

Weezy can be forgiven for trolling readers with his “maybe the real V-shaped rebound was inside us all along” routine – that’s just what he does. In reality, one of the biggest reasons economists – or at least most economists – have stopped talking about a “V-shaped” rebound is that, despite two months of labor-market growth, some 50 million Americans have been marooned on the unemployment rolls.

And after this week ends, as Weezy acknowledges, Americans who are out of work will be forced to make do with less – a lot less.

At this point, 80% or more of US states have scaled back reopening measures, with many of these decisions coming in the past week or two. California, the biggest state in the US, has taken perhaps the most drastic measures to rollback its reopening.

Using real-time data, Goldman suggests that consumption is stalling out in July as restrictions are reimposed.

And if all US states who are rolling back their reopening efforts decide to go all-in like California, that could have a disastrous impact on consumption.

While it’s tempting to believe that any new restrictions would simply push growth back from Q3 and Q4 to 2021, as Goldman points out, the situation unfortunately isn’t that simple. Because the longer businesses remain shuttered, the more likely they will fail and close their doors permanently.

Meanwhile, the longer a given worker remains furloughed, the greater the chance that they’ll lose touch with their former employer.

Even a temporary stalling of the economy threatens to inflict some longer-term damage, however. We have highlighted the risk that operating well below normal for too long will cause scarring effects on the business sector and the labor market, which we monitor in our weekly US economic recovery tracker. For businesses like bars and restaurants, being forced to close a second time—and shortly after Paycheck Protection Program funds have been exhausted in most cases—could lead to a jump in permanent closures, though further support from the Phase 4 fiscal package should help.

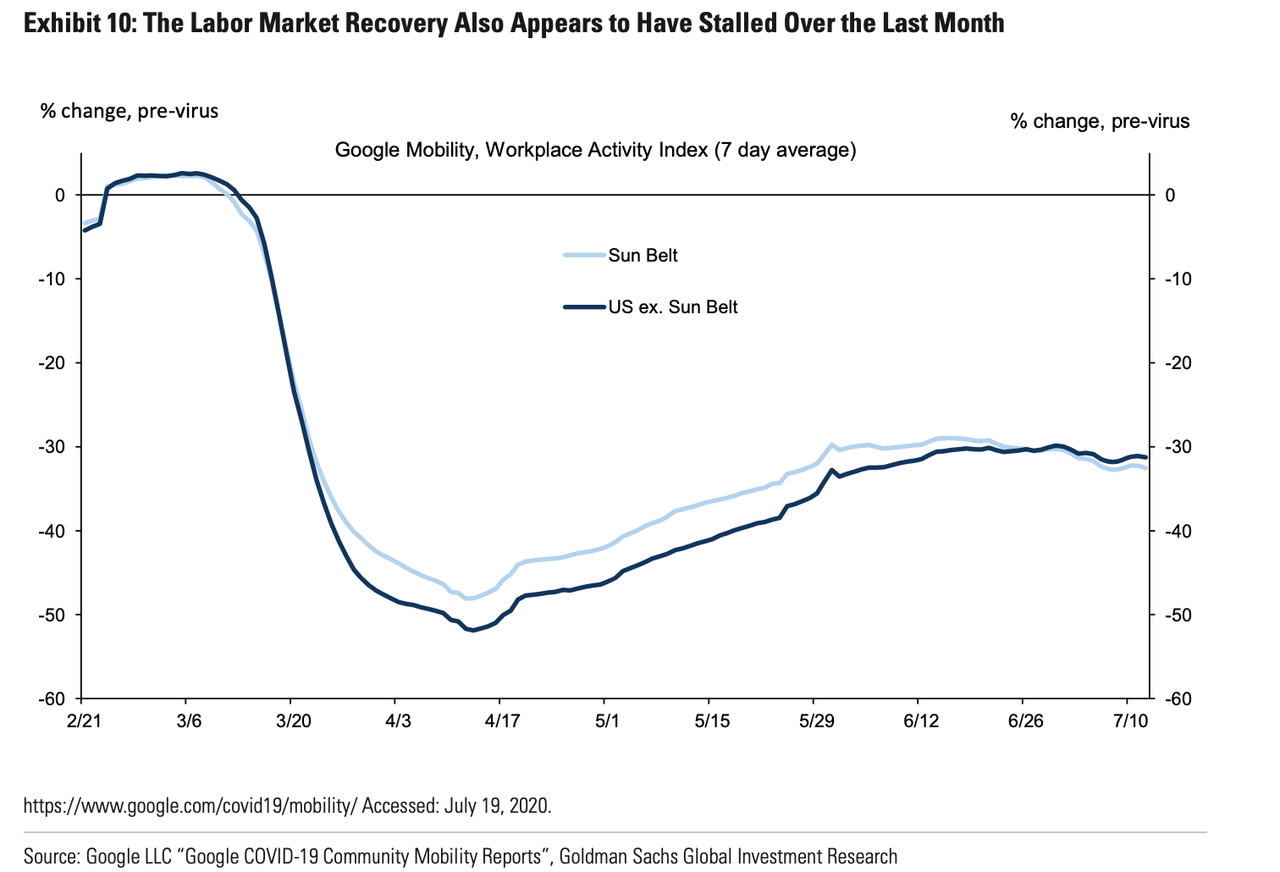

Similarly, many of the over 80% of newly unemployed workers who remain on temporary layoff likely have a limited window of time to get back to their old jobs before the connection with their former employer is lost. Exhibit 10 shows that employment growth is also likely to stall in July after two months of healthy gains. Even if the stall in rehiring lasts only a couple of months, it could have lasting effects.

Finally, using real-time data from Google’s Mobility project, Goldman warns that after two months of rebound-driven growth, the job market is expected to stall in July.

Even if rehiring stalls out for only a few months, it could still have a lasting impact as the global economy tries to shake off the trappings of the pandemic.

via ZeroHedge News https://ift.tt/3hhyIRC Tyler Durden