Wall Street Firms Are Considering A Mass Exodus From New York

Tyler Durden

Tue, 07/21/2020 – 17:25

Wall Street is about to see a mass exodus.

Firms in New York’s financial district are facing an onslaught of headwinds amounting to great reasons to simply pick up and leave: employees working from home, unused office space, a mayor who has squelched law and order in the city and a state legislature obsessed with taxation, just to name a few.

That’s why we weren’t surprised when Bloomberg reported that New York’s financial and professional-services industries are considering eliminating up to 20% of their footprint in the city.

About 25% of employers are considering paring their footprint in the city by at least 20% and about 16% expect to move jobs out of the city, according to a study conducted by the Partnership for New York City.

Companies are only expecting that 10% of their employees will return to the office this summer. That number only bumps up to 40% by the end of 2020. City and state tax revenue losses could exceed $37 billion during the next two years as a result, to which we say good, maybe it’ll give the state’s politicians less terrible ideas – like Elon Musk’s “Solar Roof” factory in Buffalo – to piss away taxpayers’ hard earned money on.

The city’s economy could shrink by as much as 13% this year, the study predicts. It also found that aside from Covid-19 safety, the most important issues in the city are “aiding small and minority-owned businesses; improving online education and job training; producing affordable housing; reforming budgeting and taxes; and advancing renewable energy, digital infrastructure and freight-delivery optimization.”

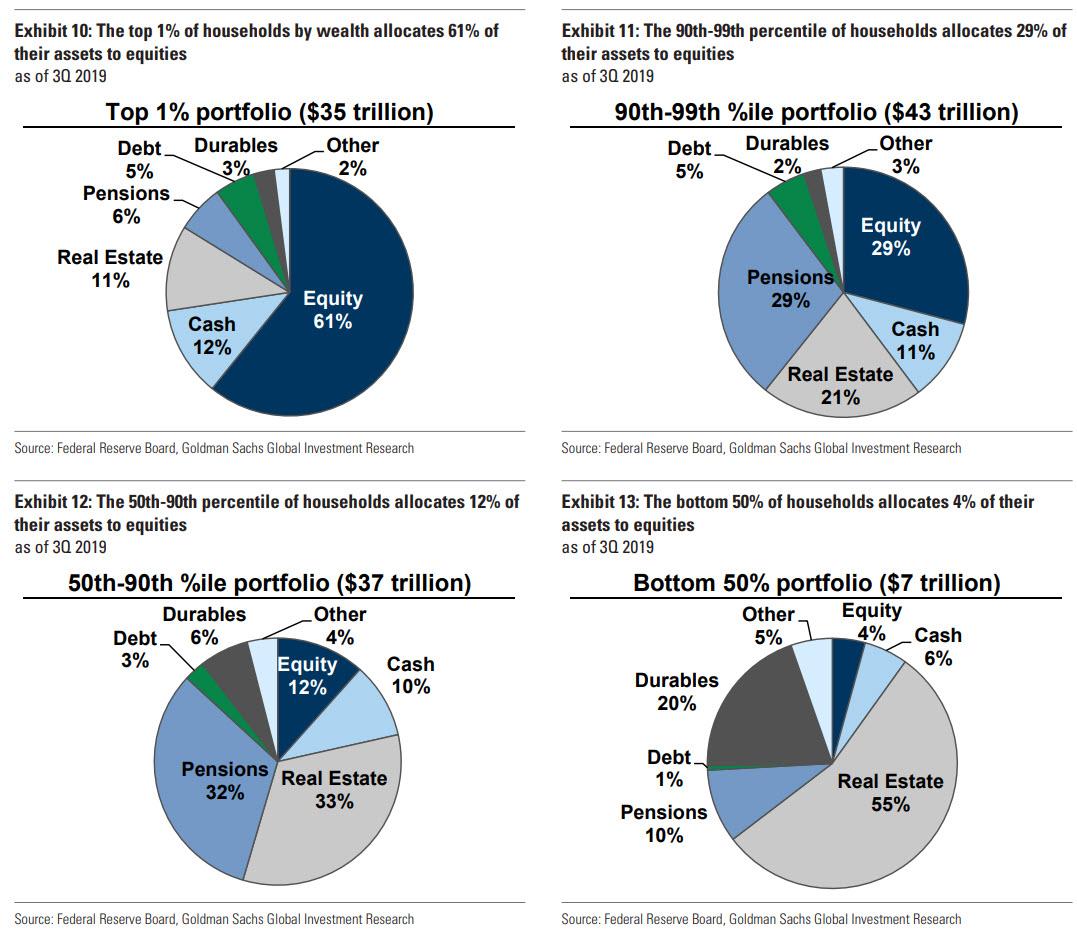

Recall, we wrote yesterday about New York Democrats seeking to tax stock trades in the state. “It’s no wonder thousands of hedge fund managers are leaving the city for far more hospitable places like Florida,” we commented.

The proposed bill is arguing for a 1.25 cent tax on the sale of stock worth $5 or less and a tax of up to 5 cents for stock worth over $20 per share.

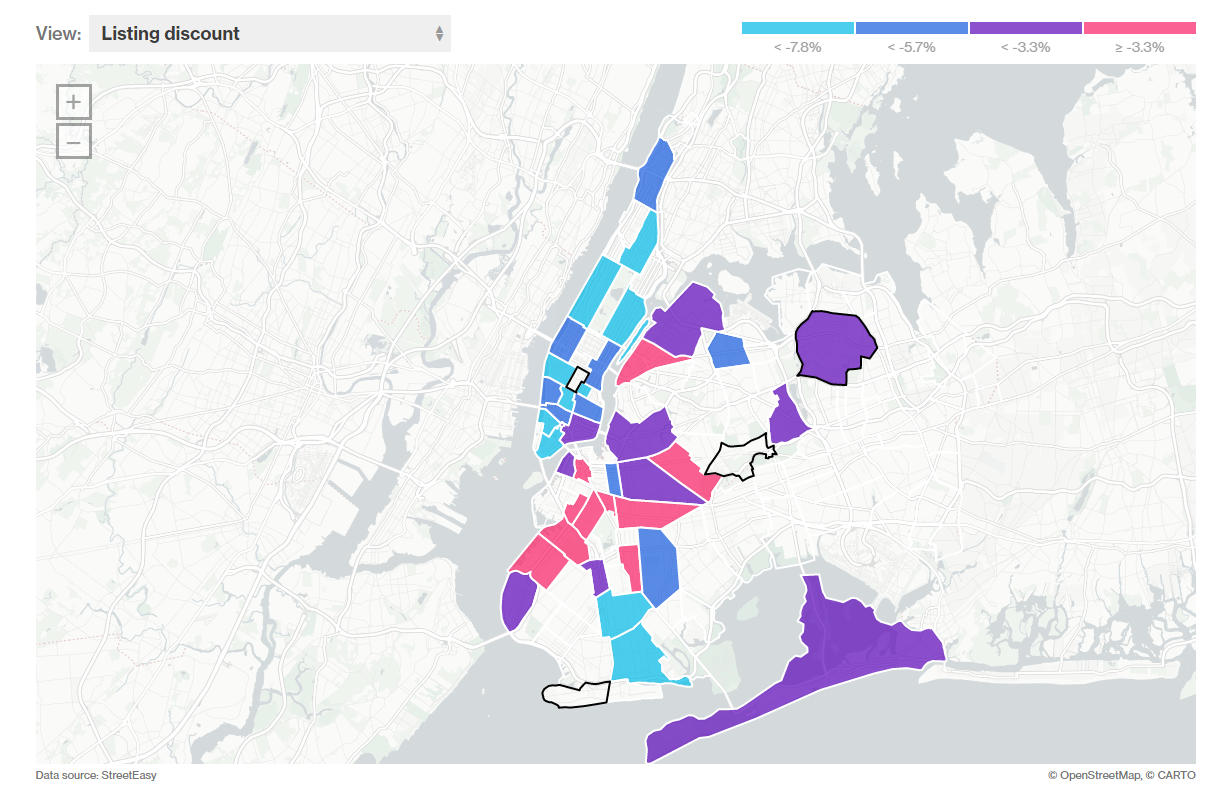

Also, just days ago we noted that apartment buildings nearest the city’s biggest and most prominent office towers were plunging in price, offering up ominous foreshadowing for commercial real estate in the city. Bloomberg found that the “office you never go to anymore” appears to not only be abandoned, but a black hole for the surrounding apartment prices.

In comparing rental listing prices, Bloomberg’s report found that:

- Manhattan had the biggest share of rental listings discounted from their original asking price in the second quarter

- The Flatiron area had the borough’s largest portion of reductions, with 45%

- In Midtown West and the Financial District, 40% and 42% of apartments got price cuts, respectively

- Outermost sections of Brooklyn and Queens had much lower rates of discounting in the quarter

- The share was 8.6% in Brooklyn’s Coney Island

- In Queens, 13% of Flushing rentals were reduced

To map the discounts, Bloomberg has created an interactive map that allows viewers to compare things like median sale price, price change, listing discount and several other factors for nearly any neighborhood in New York.

You can view the interactive map, in full, here.

via ZeroHedge News https://ift.tt/30NMllh Tyler Durden