World’s Largest Producer Of Small Gasoline Engines Files For Bankruptcy

Tyler Durden

Mon, 07/20/2020 – 22:30

Briggs & Stratton Corporation, the world’s largest manufacturer of small gasoline engines with headquarters in Wauwatosa, Wisconsin, filed petitions on Monday morning for a court-supervised voluntary reorganization under Chapter 11, along with plans to sell “all the company’s assets” to KPS Capital Partners.

The Fortune 1000 manufacturer of gasoline engines was able to secure a $677.5 million in Debtor-In-Possession (DIP) financing to support operations through reorganization efforts. The Company also said it “entered into a definitive stock and asset purchase agreement with KPS.”

To facilitate the sale process and address its debt obligations, the Company has filed petitions for a court-supervised voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. The Company has also obtained $677.5 million in DIP financing, with $265 million committed by KPS and the remaining $412.5 from the Company’s existing group of ABL lenders. Following court approval, the DIP facility will ensure that the Company has sufficient liquidity to continue normal operations and to meet its financial obligations during the Chapter 11 process, including the timely payment of employee wages and health benefits, continued servicing of customer orders and shipments, and other obligations.

This process will allow the Company to ensure the viability of its business while providing sufficient liquidity to fully support operations through the closing of the transaction. Briggs & Stratton believes this process will benefit its employees, customers, channel partners, and suppliers, and best positions the Company for long-term success. This filing does not include any of Briggs & Stratton’s international subsidiaries. – Briggs & Stratton’s press release states

Todd Teske, Briggs & Stratton’s CEO, stated the Company faced “challenges” during the virus pandemic that made reorganization “necessary and appropriate” for the survivability of the Company.

“Over the past several months, we have explored multiple options with our advisors to strengthen our financial position and flexibility. The challenges we have faced during the COVID-19 pandemic have made reorganization the difficult but necessary and appropriate path forward to secure our business. It also gives us support to execute on our strategic plans to bring greater value to our customers and channel partners. Throughout this process, Briggs & Stratton products will continue to be produced, distributed, sold and fully backed by our dedicated team,” said Teske.

Briggs & Stratton is the world’s top engine designer and manufacturer for outdoor power equipment, with 85% of the small engines produced in the U.S. The pandemic and resulting virus-induced recession have been brutal for the Company, with declining engine sales, resulting in a reduction in the US workforce.

Financial Times noted, in June, the Company had difficulty refinancing a $175 million bond that matured in September. Sources told FT the Company’s deteriorating position made it impossible to obtain refinancing funds in the bond market.

Add Briggs & Stratton to the list of bankrupted companies as an avalanche of bankruptcies is expected in the second half of the year.

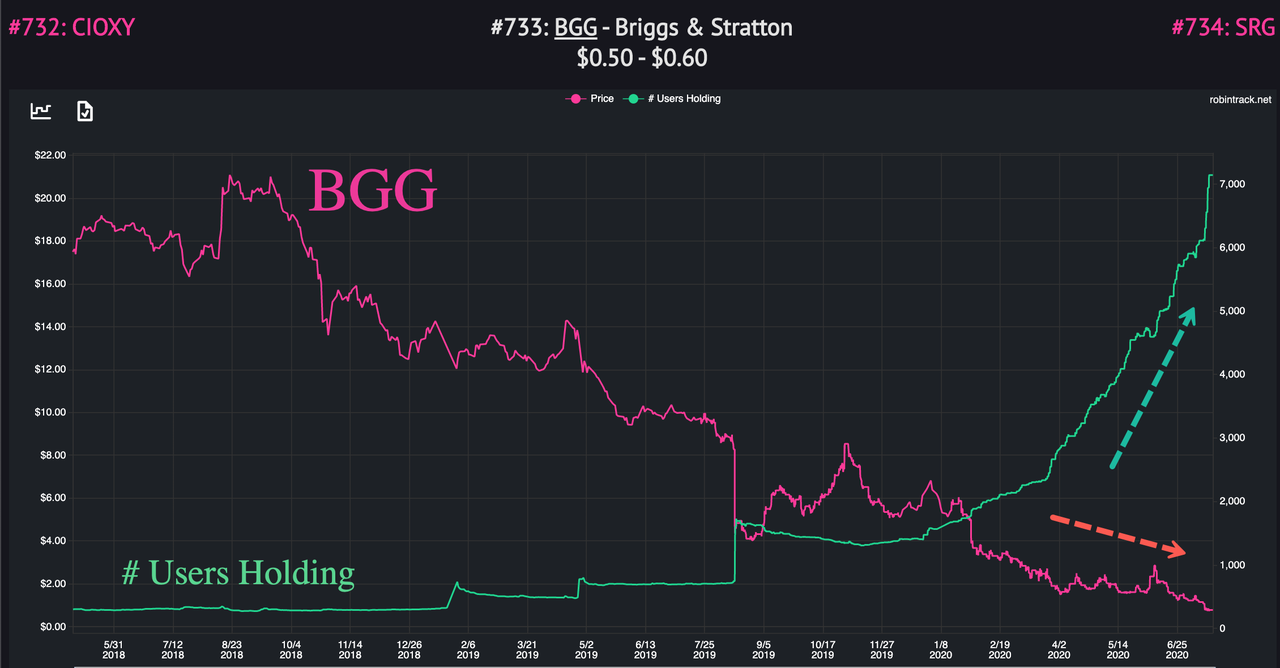

Not surprising whatsoever, Robinhood daytraders have panic bought collapsing Briggs & Stratton shares.

The bankruptcy wave is not over, it’s only getting started as the virus-induced recession will be more prolonged than previously thought.

via ZeroHedge News https://ift.tt/2OHkj57 Tyler Durden