Millennials Flood Into Precious Metals: Is Gold The Next TSLA?

Tyler Durden

Thu, 07/23/2020 – 10:44

As precious metals accelerated higher in the last few days, we joked (kinda) on Twitter that the surge in momentum would soon become a magnet for the new trading gurus manning their desks at home – whether in China or Chinatown – and send it to new all time highs.

All gold needs to hit 2,500 is for China’s momentum maniacs or the Robinhooders to start chasing it

— zerohedge (@zerohedge) July 22, 2020

One day later, it’s happening as Robinhood users flood into the gold and silver ETFs. For SLV, the number of RH users holding the ETF has surged from around 15,000 to 20,000 in the last few days…

… making it the 16th most popular pick on Robinhood as of the past 24 hours.

In GLD, we have seen less of a sudden surge so far, but the higher it goes the more RH users are buying with over 28,000 now holding the gold ETF…

And in typical Robinhood fashion, every dip is being furiously bought:

Does this spell disaster for the rally in precious metals? With momo chasers piling in at the margin? Well it didn’t seem to hurt TSLA…

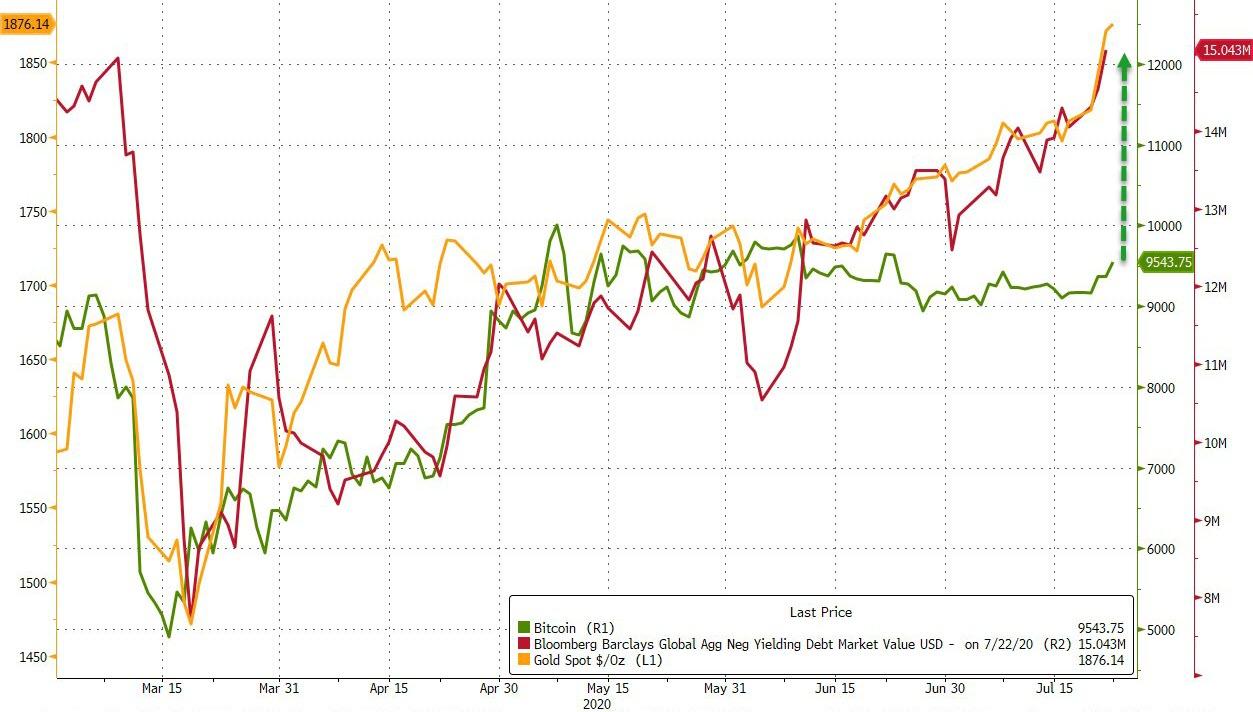

And besides, there are plenty of fundamental drivers for re-allocation into precious metals (as opposed to the vapor underlying TSLA’s acceleration), including the resurgence in global negative-yielding debt…

The question is, will CNBC cheer the retail participation in gold and silver as loudly as they celebrate the millennials buying the most expensive stock market ever?

via ZeroHedge News https://ift.tt/3jsbCtH Tyler Durden