The Unthinkable

Tyler Durden

Thu, 07/23/2020 – 15:50

Authored by Sven Henrich via NorthmanTrader.com,

You know where I stand: Markets have been bloated to high heaven via unlimited and unprecedented liquidity injections creating the illusion of a bull market when there is none. Yes indices such as $SPX and $NDX show incredible strength driven by a few single stocks, but as we discussed the rest of the market is far from bullish.

Equal weight keeps lagging:

…while virtually all market gains are driven by a handful of stocks:

In fact the broader markets has gone nowhere since mid April:

But still the few stocks are running overall market valuations to never before seen highs:

Yesterday markets closed at 155.3% market cap vs GDP with negative earnings growth no less

The largest financial bubble ever. pic.twitter.com/6ETTPMzVAk— Sven Henrich (@NorthmanTrader) July 23, 2020

…pushing P/E levels into ever higher extremes:

Who needs earnings growth when all you need is multiple expansion?

Hard to justify valuations with traditional metrics in this environment. You know metrics such as earnings, growth, etc. So best not do it according to none other than Fed hired Blackrock:

‘BlackRock Inc.’s senior quant has bad news for the likes of Bill Gross and Cliff Asness wagering on a comeback for value stocks. In the worldview of Jeff Shen, money managers need new investing methods because there’s no way to tell if betting on ostensibly cheap companies will work again. In fact, comparing share prices to fundamentals like corporate profits or book value is essentially futile in complex markets.

To fix misfiring quant strategies, the co-chief of the $106 billion systematic active equity group has a newfangled suggestion: Investors should scour alternative data for trading signals and end their obsession with valuation metrics.”

Yea, it’s hard to justify valuations in a bubble so best just make things up. It’s different this time. Don’t you know?

Besides, too strong is the draw towards the next stimulus carrot which awaits in the wings of a well advertised new fiscal stimulus package that both Democrats and Republicans pretend to fight over before eventually agreeing to it anyways. It’s an election year and nobody will risk standing in the way of throwing about some more free money. So that stimulus package is coming, unless someone is willing to create a big drama over it, perhaps as a way to create an election narrative? We’ll soon find out who is willing to risk what.

But don’t play too hard to get for this market has yet to prove it can rally other than on chasing stimulus and vaccine optimism headlines.. It just can’t make new highs without.

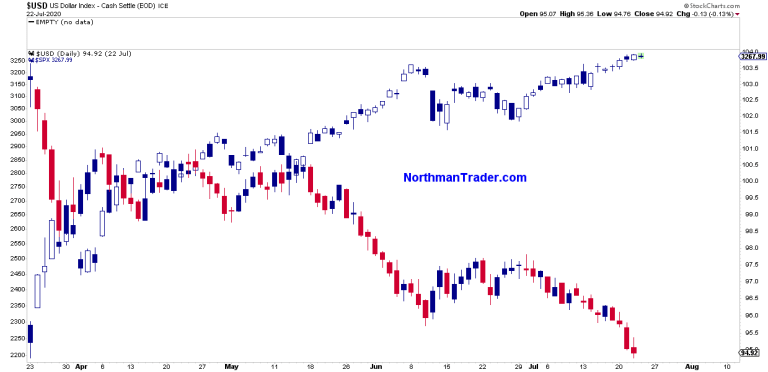

And in context of the entire rally it is perhaps nothing something very important: The US Dollar. In fact it may be argued that entire unlimited QE and M1 money supply expansion game has had one key net effect: Kill the dollar. The correlation since the March lows seems pretty self evident:

Dollar rises, stocks go down, dollar drops, stock rise. Magic. Currency destruction may make a bull market on paper, but in terms of purchasing power it creates nothing. Have you looked at yields lately? The 10 year now trading below 60bp. Quite the V recovery.

So dollar destruction, the key to keep equities and the bubble floating higher? Good luck with that as the US Dollar has just approached a key level. See, it’s not only stocks that are in trend charts, but also currencies.

And this here suggests the potential for a super bullish move to come in the Dollar:

Sharp rallies in the dollar have generally not been kind to equities in recent years. Think 2008, 2010, even 2015/2016 and then of course in early 2020. The Fed has managed to bring about this big recovery rally as a result of their programs, and with it they weakened the dollar. But now the dollar has hit its key rising trend, a trend in place since 2011.

The unthinkable: The dollar rises from here against all expectations defending its trend and if that happens, then this rally driven by liquidity and currency destruction will find itself subject to a very different environment, perhaps one of rebalancing. The good news for bulls in the short term may be that the US dollar tends to flirt with that lower trend line for a while before kicking off, remember it’s a weekly chart, but it just tagged its trend line so notice has been served which suggests it may reverse trend at any time. And if it does, then this super bullish chart may find itself at serious odds with a market that advertises itself to be super bullish on paper, but underneath is not.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/30UNmYP Tyler Durden