Copper Prices Stall After Massive Surge Amid Waning Recovery And Rising Sino-US Tensions

Tyler Durden

Sat, 07/25/2020 – 07:35

Copper prices have soared 50% in four months as global investors piled into the base metal betting on unprecedented central bank money printing and fiscal stimulus from governments would create a “V-shaped” recovery.

However, new signs are emerging the global recovery is stalling, especially with surging virus cases and deaths in the US, the world’s largest economy.

September copper futures trading on COMEX hit a resistance level in the last nine sessions, rejecting the $3-handle on several occasions.

Besides the global recovery stalling, Reuters notes “deepening U.S.-China confrontation” is another major factor in the base metal hitting technical resistance.

BMO commodity analyst Colin Hamilton said a correction in copper prices isn’t out of the question. He said after the correction, prices could continue higher because of low inventories.

“I’ll be expecting copper higher at the end of the year. We are playing the stimulus recovery,” Hamilton said.

Copper Retracement Levels

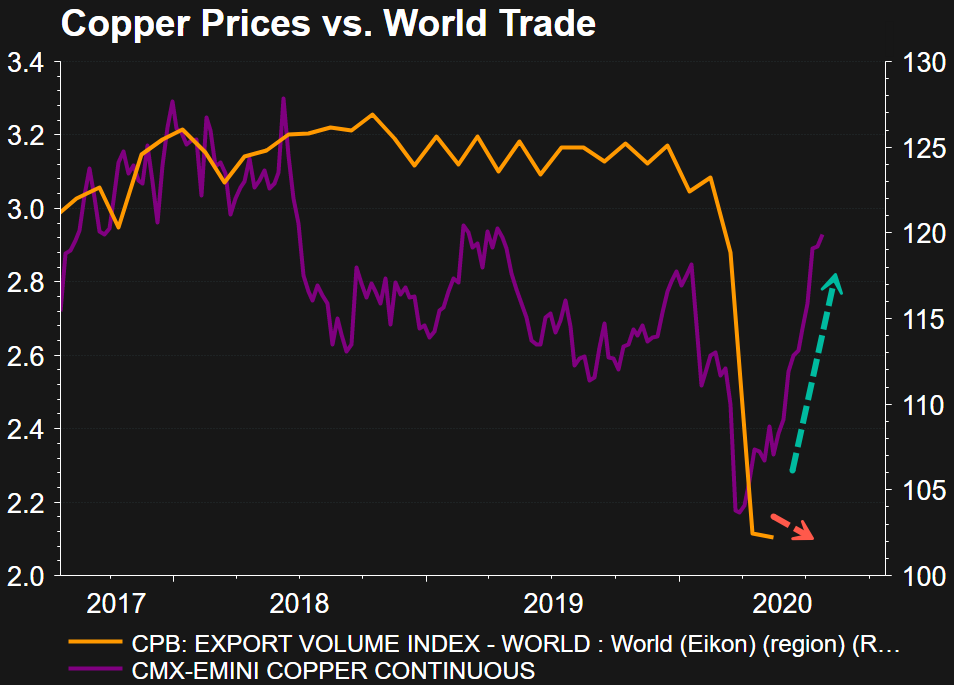

Copper is widely used in the global manufacturing sector and is a key component of automobiles, appliances, and electronics. The base metal is generally used as an economic barometer of world trade.

Copper Prices vs. World Trade

However, as Hamilton pointed out, copper prices are propped up on global stimulus, and with world trade continuing to sink, this all could suggest the base metal is headed for a correction phase.

via ZeroHedge News https://ift.tt/30PugTT Tyler Durden