Blistering Demand For Record Big 7Y Treasury Auction

Tyler Durden

Tue, 07/28/2020 – 13:19

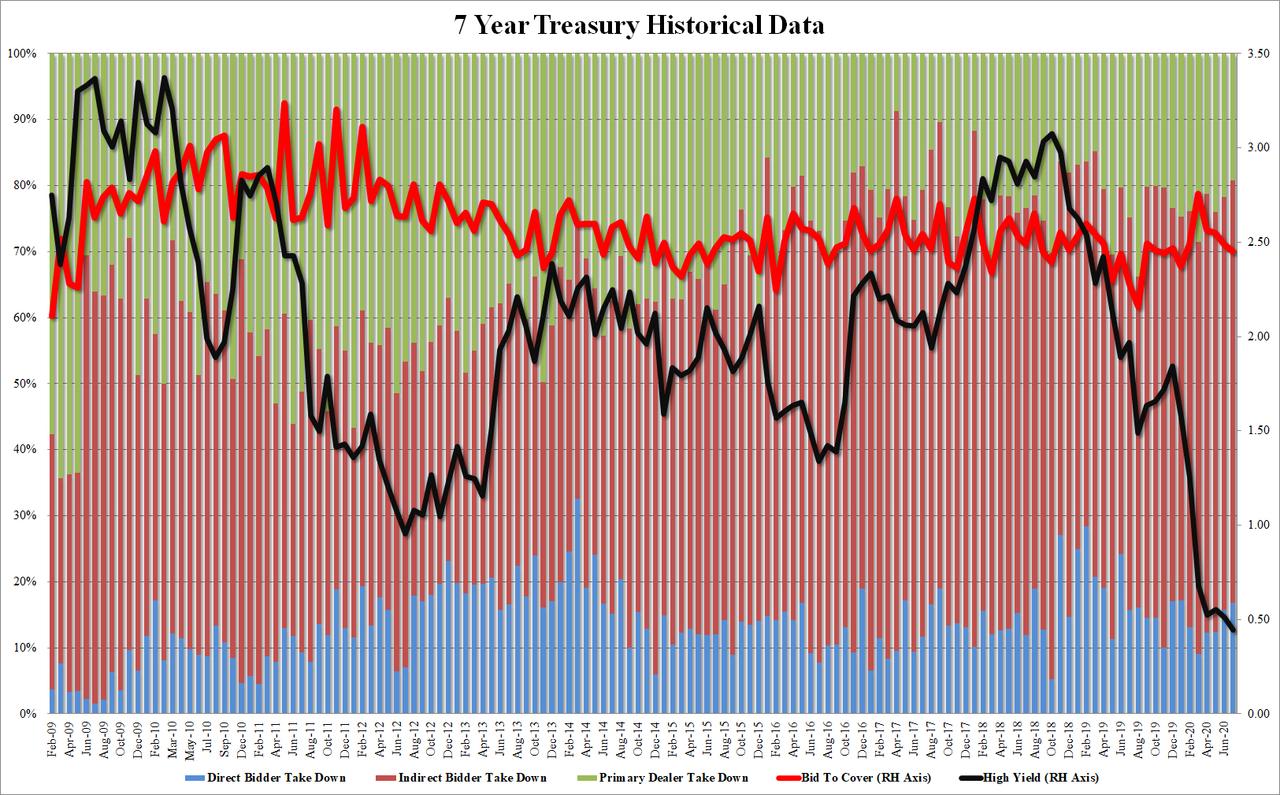

After two ugly auctions to start the abbreviated Treasury week on Monday (due to the FOMC on Thursday), moments ago the Treasury sold another record-sized batch of paper, this time in the form of $44 billion of 7 Year notes, and unlike yesterday’s 2Y and 5Y sles, this one went without a glitch.

As has been the case recently, the auction priced at a record low yield of just 0.446%, which was not only well below last month’s 0.511%, but also stopped through the 0.452% When Issued by 0.6bps.

The bid to cover was a slight drop from last month’s 2.489 to 2.449, which was below the 2.54 six-auction average, but the internals were solid, with Indirects taking down 63.9%, the highest since April and above the 62.7% recent average, while Directs took down 16.8%, above the 13.3% average leaving Dealers with 19.3% of the take down.

Overall, another stellar auction at the belly of the curve, which comes just before the FOMC, suggesting that any fears prompted by yesterday’s ugly auctions were session specific and nothing has fundamentally changed with investor demand for US debt… of which a record amount will be sold in the coming years.

via ZeroHedge News https://ift.tt/2Xl8ZAz Tyler Durden