Gartman: “I’m Getting Out Of Gold”

Tyler Durden

Tue, 07/28/2020 – 14:40

Ever since Dennis Gartman quit the newsletter business on Dec 31, 2019, there has been a distinct void in the markets, with algos, daytraders and institutions alike unsure how to trade and what to do now that there is no “sure thing” to fade (in fact, some have speculated whether the dismal volumes and lack of institutional participation in the market outside of the March crash have something to do with the lack of the contrarianism spawned by the Gartman Letter).

Well, good news!

Perhaps missing the media spotlight that having a daily newsletter afforded him, Dennis Gartman finally made a long-anticipated appearance this morning, discussing the one topic that is on everyone’s lips: precious metals.

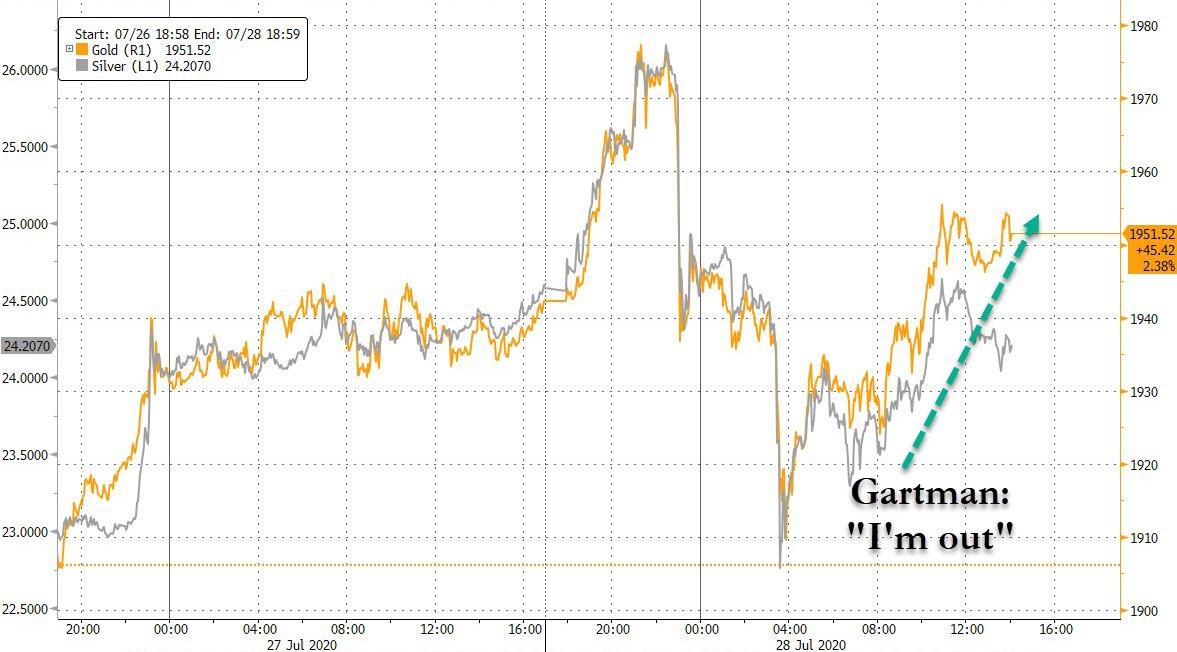

And goldbugs take heart: after last night’s sudden, sharp drop in the price of gold moments after the Dec future hit a record high $2,000/oz, there has been some speculation that this could be it for gold’s run. Maybe… although if Gartman’s infamous “contrarianism” is any indication, what happens next is nothing short of a historic surge even higher in gold (in line with what even Goldman, which this morning hiked its price target from $2000 to $2300, now expects). Speaking to Fox Business News, Gartman – who apparently is now the University of Akron Endowment Committee Chair – said that he is “getting out of gold”…

This is the best buy signal for #gold yet. pic.twitter.com/rFtSNc64es

— Peter Schiff (@PeterSchiff) July 28, 2020

… which coming from the man who famously once said that oil would never rise above $44/barrel in his lifetime, is all gold bulls needed to hear, and may explain why after slumping early on Tuesday, the precious metals complex has been on a tear again, with gold trading at $1,950 and silver above $24.

To be fair to Gartman, he is not the only one getting out of gold. Lombard Odier Chief Economist Samy Chaar told CNBC on Monday that his team had sold half of their position in gold. Chaar said that while holding some gold was important in a world where a lot of debt is negative-yielding, the deep negativity of U.S. real interest rates creates some “vulnerability” for gold at the current price levels, since such low rates are not sustainable given the economic outlook.

Another strategist, whose work we have come to appreciate quite a bit in recent months, and who also decided to take profits on gold, is Nordea’s Andreas Steno Larsen, who this morning tweeted that he is also “out of my long Gold position”

I am also out of my long Gold position, fwiw. pic.twitter.com/fXjTOuYdVj

— AndreasStenoLarsen (@AndreasSteno) July 28, 2020

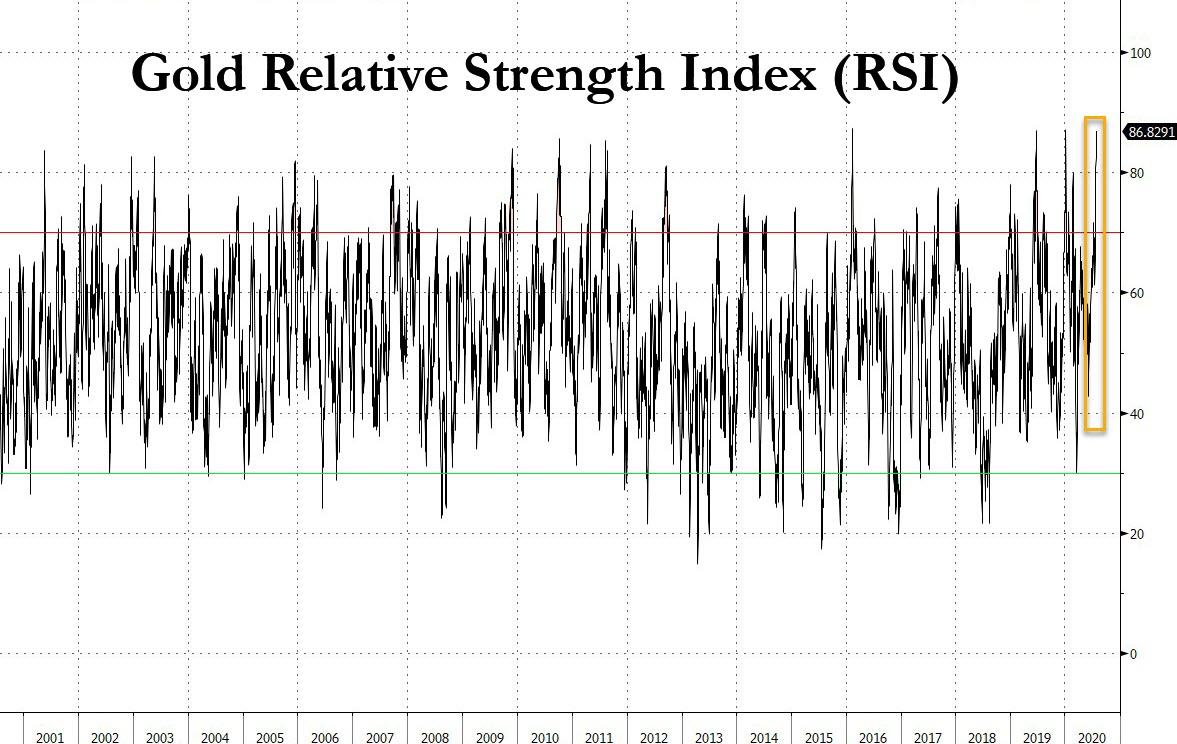

Which begs the possibility that perhaps Gartman will be right this time: after all, as Bloomberg noted this morning, with spot gold’s RSI hitting a massive 85 yesterday, “only the fifth time that the bullion was so overbought since 2000” gold may be in for a brief retreat in the next few days before resuming its rally, if history is any guide.

In all four previous occasions, gold declined over the next 10 days, with an average loss of 0.83%, according to Bloomberg’s trading signal function. So the pullback this morning after seven straight days of gains is in line with the historical norm.

That said, as Bloomberg’s Ye Xie points out, this indicator does not spell the end of gold’s rally as in the past, the precious metal eventually resumed the rally after brief periods of consolidation in the previous four occasions: “The most recent one when RSI hit above 85 occurred on Jan. 6, with gold at $1566 per ounce. Bullion has since climbed 24%.” Meanwhile, as Goldman explained earlier, in the current environment where both real yields and the dollar are likely to drop more, “it’s likely that gold will continue to shine in the months to come.”

And what better way to ensure that this prediction comes to light than having Dave Portnoy, who is enjoying a bit of a personal vendetta with Gartman, to tell his retail daytrading army to go all in gold.

via ZeroHedge News https://ift.tt/2P1NBeK Tyler Durden