“Wobbly” Markets Tread Water Ahead Of FOMC As Asian Covid Cases Surge

Tyler Durden

Wed, 07/29/2020 – 07:55

US equity futures and European shares fluctuated on Wednesday, treading water and generally unchanged ahead of the latest FOMC meeting at 2pm today, while a resurgence of COVID-19 cases in Asia (especially China, Japan and Hong Kong) kept investors cautious. The dollar slipped in the run-up to Wednesday’s decision from the Federal Reserve’s policy meeting.

Wall Street closed lower on Tuesday and the negative sentiment continued through the Asian session, with Japan’s Nikkei falling on a rising yen and a weak start to the corporate earnings season. The MSCI world equity index was flat in early trading while mixed corporate earnings sent MSCI’s main European Index down by a quarter of a point.

Deaths from coronavirus in the United States registered their biggest one-day increase since May on Tuesday, with this month’s spike in infections having forced some states to make a U-turn on the reopening of their economies. Asia and Europe have also been hit by new surges in COVID-19 infections, with several countries imposing new restrictions and Britain imposing 14-day quarantines on travellers from Spain. Global airlines cut their coronavirus recovery forecasts on Tuesday, saying it would take until 2024 – a year longer than previously expected – for passenger traffic to return to pre-crisis levels.

“It should be clear to investors that the virus itself is not going away,” said David Riley, chief investment strategist at BlueBay Asset Management. “It’s something that’s going to be there having an impact on behaviour, having an impact on economic activity through the remainder of this year and into much of next year.”

U.S. futures and European equities swung from losses to modest gains as major earnings streamed in. AMD jumped about 10% in the premarket after increasing its guidance and Starbucks advanced on a sales rebound. Seagate Technology tumbled after an earnings miss.

Europe’s STOXX 600 was up 0.1%, Germany’s DAX was down 0.1% and France’s CAC 40 gained 0.7% on the back of a flurry of better than feared results, including from heavyweight luxury group Kering. Spanish bank Santander reported a record second-quarter loss while Germany’s Deutsche Bank gave a slightly improved outlook. Barclays fell on bad loan provisions.

Asian stocks fell, led by energy and industrials, after rising in the last session. Markets in the region were mixed, with Japan’s Topix Index and India’s S&P BSE Sensex Index falling, and Shanghai Composite and Hong Kong’s Hang Seng Index rising. The Topix declined 1.3%, with Melco Holdings and SB Technology Corp falling the most. The Shanghai Composite Index countered the broader Asian weakness, rising 2.1%, with Xi’an Bright Laser Technologies and Anji Micro posting the biggest advances.

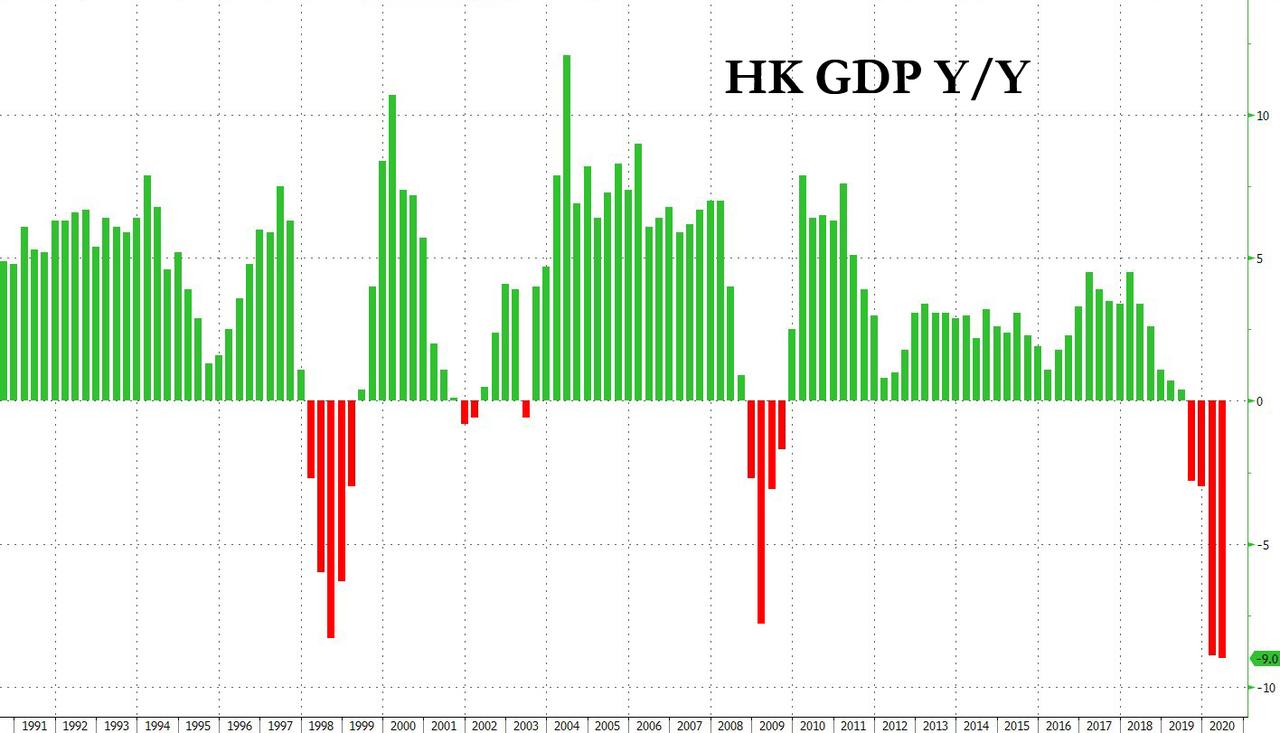

In Asian economic news, the Hong Kong recession turned into a depression, with the preliminary reading of Q2 Hong Kong GDP growth coming in at an all time low -9.0% yoy, while in quarter-over-quarter non-annualized terms, real GDP contracted by 0.1% in Q2, vs. a 5.5% decline in Q1 2020. Private consumption, fixed investment and services trade fell further on a year-over-year basis while goods trade growth turned less negative in Q2 compared with Q1, helped by the recovery of the mainland China economy. Looking ahead, external demand might recover in Q3 but the recent surge of local coronavirus cases and the related tightening of social distancing requirements could weigh on domestic activity.

“Global stock markets appear to be starting to get a little wobbly as the latest earnings numbers start to paint a picture of a global economy that could start to face a challenging time in the weeks and months ahead,” wrote Michael Hewson, chief market analyst at CMC Markets UK. “The resurgence of coronavirus cases starting to get reported across the world is prompting the realisation that hopes of a V-shaped recovery are starting to look like pie in the sky.”

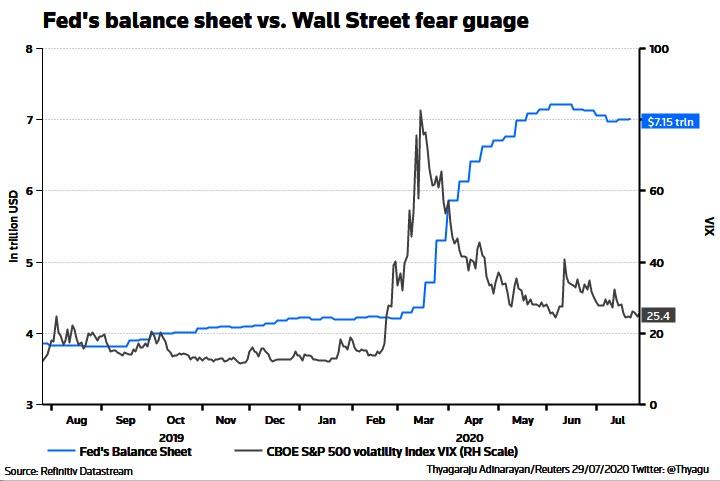

Investors will be keeping a close eye on the U.S. Federal Reserve which concludes its two-day meeting. The Fed is expected to sound reassuringly accommodative at its policy review later in the day and perhaps open the door to a higher tolerance for inflation – something dollar bears think could squash real yields and sink the currency even further. With data from unemployment claims to credit-card spending and air travel plateauing in July, Fed Chairman Powell is expected to reinforce his message that it will do whatever it can to support the recovery, while repeating a call for fiscal aid from Congress.

Investors are also focused on U.S. Congress and White House as they clash over new measures to replace enhanced coronavirus unemployment benefits that are due to expire on Friday. BlueBay’s Riley said the market consensus was that a $1 trillion support package will be agreed. “I think that’s a kind of bare minimum and that won’t be the last that will be needed,” he said.

“The Fed may not announce anything new but there is an assumption that monetary and fiscal policy will be there to bridge the gap,” said Chris Chapman, a portfolio manager at Manulife Investment. “Plus, there is a lot of optimism about potential vaccines, given how many are in the works. The combination of those factors gives people reason to look at risk.”

After today’s Fed announcement, investors will keep an eye on earnings this week from Amazon.Com, Apple and Alphabet for clues on whether the resurgence of Covid-19 is affecting tech companies and a recovery in the global economy. A drop in U.S. consumer confidence added to evidence that the pace of the rebound is cooling as the virus interrupts reopenings in several states.

In rates, Treasuries drifted lower into early U.S. session as S&P 500 E-minis pare losses, weighing on long end of the curve. Broadly calm price action was evident in Asia, early Europe on low volumes ahead of Fed decision where no policy move is expected but some strategists have suggested an extension in duration of bond purchases is a possibility in the near-term. U.S yields were cheaper by 1bp-2bp at long with 2s10s, 5s30s steeper by ~1bp; 10-year yields ~0.59%, higher by 1.2bp vs Tuesday’s close. Asia session UST futures volumes dropped back to 60% of 20-day average levels as looming FOMC decision curbed risk-taking. High-grade euro zone bond yields dropped to their lowest in more than two months. The German 10-year yield was at -0.505%, having hit as low as -0.521%.

In FX, a gauge of the dollar fell to the lowest level since mid-2018 amid gloomy sentiment on virus recovery and a drop in U.S. consumer confidence, heading toward its worst monthly performance against peers in almost one decade. The euro resumed its advance, rising 0.5% toward the $1.18 mark while the pound advanced for a ninth day to the strongest level since March. The Norwegian krone leads gains among G-10 currencies as crude prices rally; the Aussie dollar outperforms its Kiwi peer after Australian CPI data beat estimates.

In commodities, gold hovered just below its record $2,000 an ounce and Bitcoin was steady just above $11,000 as the two assets took a breather after eight-day rallies. Gold was down 0.2% at $1,957.32 an ounce. Oil prices climbed after a surprise drop in U.S. crude inventories was enough to offset concerns about U.S. fuel demand, though concerns about the record increases in COVID-19 infections kept gains in check.

Lastly to the day ahead, where the big event is the Federal Reserve meeting in the US and Chair Powell’s press conference. On the data front we will get weekly MBA mortgage applications, June advance goods trade balance, pending home sales and preliminary June wholesale inventories. Also it is a large earnings day with Sanofi, Rio into, GlaxoSmithKline, Qualcomm, PayPal, Boeing, Santander, General Electric, General Motors, Barclays and Nomura all reporting.

Market Snapshot

- S&P 500 futures up 0.2% to 3,220.50

- STOXX Europe 600 up 0.2% to 368.31

- MXAP down 0.3% to 167.20

- MXAPJ up 0.2% to 553.03

- Nikkei down 1.2% to 22,397.11

- Topix down 1.3% to 1,549.04

- Hang Seng Index up 0.5% to 24,883.14

- Shanghai Composite up 2.1% to 3,294.55

- Sensex down 0.6% to 38,281.38

- Australia S&P/ASX 200 down 0.2% to 6,006.39

- Kospi up 0.3% to 2,263.16

- Brent futures up 1.2% to $43.72/bbl

- Gold spot little changed at $1,959.01

- U.S. Dollar Index down 0.2% to 93.52

- German 10Y yield fell 0.3 bps to -0.511%

- Euro up 0.3% to $1.1749

- Italian 10Y yield rose 2.0 bps to 0.882%

- Spanish 10Y yield fell 0.5 bps to 0.351%

Top Overnight News

- The ECB will look at inflation in deciding when to unwind its pandemic stimulus program, said policy maker Yannis Stournaras, suggesting the plan may continue longer than anticipated

- The U.K. is signing a deal with GlaxoSmithKline Plc and Sanofi to secure as many as 60 million doses of their experimental shot for a coronavirus vaccine

- Traders are betting central bankers will pin down global borrowing costs to historic lows for years to come

- The damage to European jobs from virus lockdowns may only be temporarily held at bay by furlough programs, ECB researchers say

- Credit Suisse Group AG is set to announce a sweeping overhaul of its business, merging its investment bank and capital-markets unit

Asian equity markets traded somewhat indecisively following a lacklustre handover from Wall St where participants pondered over a slew of mixed earnings and as the looming FOMC conclusion and approaching fiscal cliff added to the cautious tone. ASX 200 (-0.2%) and Nikkei 225 (-1.2%) were subdued with Australia contained by underperformance in the commodity-related sectors and tech, as well as the ongoing second wave fears which has prompted Queensland state to shut all borders to the greater Sydney area in New South Wales, while Tokyo stocks were hampered by detrimental currency flows and with focus also centred on earnings updates. This includes Nissan which shares slumped around 10% after it flagged a record loss for the year and Canon shares suffered double-digit declines following an 80% drop in H1 net, while McDonald’s Holdings Japan were also heavily pressured on news McDonald’s Corp plans to substantially reduce its stake in the Co. to around 35% from 49.99%. Hang Seng (+0.5%) and Shanghai Comp. (+2.1%) swung between gains and losses with early opening weakness eventually pared after the PBoC’s marginal liquidity effort and with headlines also dominated by earnings updates. Finally, 10yr JGBs gained as they took their cue from the bull flattening in US and subdued risk appetite in Tokyo, while the presence of the BoJ added to the support with the central bank in the market for JPY 800bln heavily focused on 1yr-5yr maturities.

Top Asian News

- Three Gorges Said to Mull $4 Billion Stake Sale in Overseas Unit

- Hong Kong’s Recession Extends With 9% Drop in Second Quarter

- Thai Gold Plan May Curb Baht Without Incurring U.S. Anger

- Nomura Joins Wall Street Giants in Profiting From Trading Boom

European equities (Eurostoxx 50 U/C) have traded with little in the way of firm direction thus far in what has been a morning largely dominated by individual earnings reports rather than broader macro themes. Sector-wise retail names outperform peers with Kering (+4.2%) shares firmer post-earnings despite revenues plunging by around 30% and cautioning that losses in H1 revenue will likely not be offset in H2. Additionally, UK retailer Next (+6.0%) are the top performer in the Stoxx 600 post-earnings with the Co. forecasting an improvement to its baseline scenario seen in April and expectations of making a profit even in the worst-case scenario. Elsewhere, the European banking sector has been in focus today with Deutsche Bank (-2.0%) opening with gains of around 3% before staging a pullback throughout the session following pre-market earnings in which the Co. exceeded revenue expectations for Q2 and raised its revenue outlook. To the downside in the sector, Barclays (-4.3%) are lower on the session post-earnings with the Co.’s provisions coming in above expectations amid fears of a pickup in bad loans amid the fallout from COVID. Elsewhere, BASF (-4.3%) are a notable laggard in Europe after Q2 sales were negatively impacted by a slightly lower price level and were unable to provide FY guidance. UK homebuilders are also suffering this morning following earnings from Taylor Wimpey (-8.9%) after posting a GBP 39.8mln loss and forecasting a 40% decline in home completions in 2020. Looking ahead, asides from the FOMC and wrangling in Washington over the stimulus bill, today’s docket sees another busy one for earnings with Anthem, Spotify, General Electric, Boston Scientific, Boeing, General Motors due to report in the pre-market with Qualcomm and Paypal due after-hours.

Top European News

- U.K. Builds Up Covid Vaccine Supply With Glaxo, Sanofi Deal

- BC Partners Seals Buyout of $3.4 Billion Italy Machine Firm IMA

- ECB’s Stournaras Says Virus Bond-Plan Exit Depends on Inflation

- Barclays Signals Economic Pain Ahead With Bad Loan Charges

In FX, some may cite pre-FOMC caution as a reason for renewed USD downside pressure, but in truth the Greenback was already wilting towards the end of Tuesday’s EU session after the DXY failed to build a base back on the 94.000 handle and the index is now struggling to keep sight of 93.500 within a 93.800-385 range. Prior to the main events (policy announcement at 19.00BST and press conference chaired by Powell at 19.30BST), a raft of US data, but nothing top-tier or likely to alter the Buck’s largely luckless fortunes, especially as month end selling could start in earnest from today.

- AUD/CHF/EUR – The major beneficiaries of the latest US Dollar downturn, with the Aussie within a whisker of recent highs and not too far from 0.7200 in wake of fractionally better than expected Q2 CPI data overnight (though still deflationary and the biggest q/q decline on record). Meanwhile, the Franc is forging fresh multi-year gains through 0.9150 and the Euro has bounced following a test of 1.1700 yesterday to 1.1760+ and eyeing its 1.1781 peak from Monday, which would expose 1.1800 again and a 1.1815-51 resistance zone.

- GBP/CAD/JPY/NZD – Also advancing mainly at the Greenback’s expense, as Cable breaches another key chart hurdle around 1.2955 to open a path towards option barriers said to be sitting at 1.3000, the Loonie rebounds from sub-1.3400 to circa 1.3340, the Yen makes a more convincing break above 105.00 where 1 bn option expiries reside and the Kiwi returns to pivot 0.6650 after peering above 0.6675 and similar size expiry interest. Note, little sign of angst for the Jpy after Fitch downgraded Japan’s ratings outlook to negative from stable or dovish BoJ commentary via Amamiya.

- SCANDI/EM – Relatively upbeat Swedish industrial sentiment indicators helping to keep the Krona afloat and a bounce in crude assisting the Norwegian Crown, while EM currencies are deriving varying degrees of support from the broadly weak Buck. However, the Rand is also inflated by SA CPI rising for the first time in 4 months and Lira is lagging even though Turkish banks are said to have sold around Usd 2 bn to defend the Try and the CBRT upgraded it year end inflation forecast to 8.9% from 7.4%.

In commodities, WTI and Brent front month futures are firmer by circa 1% as it stands, with newsflow for the crude complex once again quiet and little aside from last night’s private inventories which printed a larger than expected to draw of 6.83mln. While the complex is supported this morning, it is only some USD 0.20/bbl firmer on the week for WTI and still off the week’s USD 41.91/bbl high and the month’s peak of USD 42.49/oz. For the session ahead focus will be on the EIA report for confirmation of the private release; albeit, expectations look for a modest build of 0.357mln from last week’s more substantial build of 4.892mln. Turning to metals, where spot gold is trading in the middle of a much narrower range after yesterday’s downside action which saw it drop near to the USD 1900/oz mark’ at present, the low is at USD 1948/oz and high some USD 14/oz above this. Elsewhere, Rio Tinto provided a H1 update, the first major iron ore miner to do so, remarking that order books are full given strong China demand for the ore and high prices in H1 helped alleviate COVID-19 related impacts; albeit, noted the recovery for US & Europe is tentative at present.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 4.1%

- 8:30am: Advance Goods Trade Balance, est. $75.4b deficit, prior $74.3b deficit

- 8:30am: Wholesale Inventories MoM, est. -0.5%, prior -1.2%; Retail Inventories MoM, est. -2.7%, prior -6.1%

- 10am: Pending Home Sales MoM, est. 15.0%, prior 44.3%; YoY, est. 2.2%, prior -10.4%

- 2pm: FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

It was a day of treading carefully whilst working from home yesterday. Every time I went downstairs from my study to the kitchen to make a cuppa or to have lunch I had to watch my step as there were landmines everywhere. Yes yesterday was the day my wife decided to start to potty train our twins and leave their nappies behind forever. To say the results were mixed was an understatement. On day one Eddie has a 10-2 lead over Jamie on the star chart. Jamie kept on missing the target. We’re hoping for a high scoring draw every day for the rest of the week.

There haven’t been too many landmines this week in markets even with last night’s small pullback in US risk assets. From here the news flow should increase in a back-loaded week with a slew of earnings reports (including many large caps) and the conclusion of the FOMC today. Today will also see the CEOs from Amazon, Apple, Facebook and Alphabet come before the US Congress for an antitrust probe aimed at whether the companies are cutting off competition by crowding out smaller rivals.

There was a small taste of what today’s FOMC meeting could offer yesterday when the Fed announced that they are extending most of its emergency lending programs until the end of the year. Our US Economics team does not expect any significant policy announcements later though, instead they expect Chair Powell to set the stage for a more consequential announcement in September, likely around forward guidance, the balance sheet and the policy review later this year. For their full preview see here.

The S&P 500 closed -0.65% with a defensive twist to proceedings as Utilities (+1.56%) and Real Estate (+2.05) led the index higher while Tech Hardware (-1.84%) and Semis (-1.57%) were among the worst industries. With tech underperforming, possibly with some profit-taking ahead of a Fed meeting and month-end, the NASDAQ was down -1.27%.

On the other hand, European stocks gained slightly yesterday with the STOXX 600 up +0.48% as the theme of defensives (Real Estate +2.10% and Food & Bev +1.36%) outperforming persisted here as well. In yesterday’s CoTD we highlighted (see here) how with roughly a third of the S&P having reported, 85% are beating their earnings estimates. This is well ahead of the average 73% beat rate and the highest since our data starts in 2006 according to our colleague Binky Chadha.

Looking at some specific earnings from yesterday, semiconductor-maker Advanced Micro Devices increased its revenue forecast for the full year and was up +10.3% in after-market trading. Pfizer likewise rose (+3.97%) after the company raised its forecast and started a later-stage trial for a coronavirus vaccine. At the same time bellwethers like McDonald’s (-2.47%) and 3M (-4.84%) disappointed. The former saw same-store sales in the second quarter drop by -23.9%, slightly worse than analysts estimated, while the latter saw profits and revenues miss analyst estimates as their margins compressed during the pandemic.

Ahead of the FOMC, the USD index looked to trade positive for the first time in 8 sessions and only the second time in the last 13 and finished +0.03%. Gold rose +0.83%, gaining for the 8th day in a row, even with the dollar drop abating. However, Silver saw a small pullback, down -0.76% yesterday.

Elsewhere, core sovereign bonds were slightly higher as US 10yr yields fell -3.6bps to 0.579% and bunds dropped a smaller -1.7bps to -0.51%. Peripheral bonds showed a little waning risk sentiment as the spread of Italian, Spanish and Portuguese 10yr bonds to bunds rose by +3.3 to 3.6bps each.

Staying in Europe, there continues to be increasing measures to ensure there is no second wave. Greece has now reinstated compulsory mask wearing from today onward in all stores and the majority of indoor public spaces. Yesterday Madrid joined other regions of Spain in mandating face masks in public spaces, including in bars and restaurants. The local government also sought to limit gatherings in the area to 10 people, reducing capacity in public places. This comes even as Spanish Prime Minister Sanchez criticised the U.K. for including some Spanish islands to the country’s list of places that would require travelers to quarantine after returning, calling the decision “unbalanced” and citing the low case counts in those regions. This has caused the UK to re-examine the blanket rules for countries and may result in more tailored guidelines, according to Transport minister Charlotte Vere.

One small example of the difference between the virus in Europe and the US is in how it’s impacting sports. While the English Premier League announced that during the week ending 26 July, nearly 1,600 players and club staff were tested for COVID-19, of which zero tested positive, the American Baseball season has issues as the Miami Marlins have temporarily suspended playing with 17 of 30 players infected just a few games into the start of the season. Overall the US continues to see some case slowing in highly affected Western states such as California and Arizona. Both states saw their one day rise in cases under their weekly averages, while California’s 7-day average daily rise fell to 2% for the first time since early-June and Arizona’s fell to the lowest observed during the pandemic at 1.6%. Meanwhile, the positive-test rate in Texas fell to 12.83%, the lowest since June 25. However the US is still seeing c. 60,000 new cases per day across the country, which is nearly 18,000 more than exactly a month ago. The efforts to suppress the virus are likely to start showing in the macro data within the next few weeks.

In Asia, China reported over a hundred new cases overnight for the first time since it brought the outbreak in Wuhan under control. The majority of cases were reported from Xinjiang province’s capital city Urumqi, where authorities have isolated some communities, restricted public transport and ordered widespread testing. Meanwhile, Australia’s (relatively) hard-hit Victoria state reported 295 new cases in the past 24 hours, the lowest daily tally in 9 days with the state’s premier expressing hope that it is the start of a downward trend. Elsewhere, Hong Kong is mulling postponing September’s legislative elections by a year as the current outbreak is yet to come under control.

Markets in Asia are trading mixed overnight with the Shanghai Comp (+1.05%) outperforming but with the Hang Seng (+0.12%) and Kospi (+0.25%) also up. The Nikkei (-1.01%) is down possibly partly on news that Fitch have revised down the outlook on Japan’s sovereign rating to negative from stable while keeping the rating unchanged. Elsewhere, Futures on the S&P 500 are trading flattish while, spot gold and silver prices are down -0.25% and -0.50% respectively.

In terms of the all important US fiscal situation, Senate Republicans have officially kicked off negotiations with Democrats, though the presented $1trl relief package continues to have detractors in the GOP. While leaders in the Democratic party and the Republican Senators both oppose large portion of the bill, they both conceded that they need to find common ground and that the August recess is a deadline.

Sticking with the US, Democrats Presidential Candidate Joe Biden said overnight that he will seek for an amendment to the Federal Reserve Act that would require the Fed to report on racial economic gaps and what policies they are implementing to close these gaps. He said the Fed’s existing mandate promotes maximum employment and stable prices and “should add to that responsibility, and aggressively target persistent racial gaps in jobs, wages and wealth.” However, his campaign said later that Biden has not explicitly embraced a third mandate for the Fed but seeking one in the future is an option.

On the data front, the main news was out of the US where the Conference Board’s measure of consumer confidence in July fell 5.7pts to 92.6 (vs. 95.0 expected). Tellingly, the drop was led by declines in the “expectations” component, while the “present situation” index continued to improve slightly. There was also a great deal of differentiation on the state by state level. California fell to the lowest level since March 2013, Texas the lowest since Aug 2012, and Florida the lowest since Aug 2016. It is not hard to see this tied to the recent and ongoing spike in covid-19 cases in these states. The overall US level remains at lows last seen in 2016.

Lastly to the day ahead, where the big event is the Federal Reserve meeting in the US and Chair Powell’s press conference. On the data front we will get prints on France’s July consumer confidence, UK June consumer credit, mortgage approvals and M4 money supply. In the US data includes weekly MBA mortgage applications, June advance goods trade balance, pending home sales and preliminary June wholesale inventories. Also it is a large earnings day with Sanofi, Rio into, GlaxoSmithKline, Qualcomm, PayPal, Boeing, Santander, General Electric, General Motors, Barclays and Nomura all reporting.

via ZeroHedge News https://ift.tt/3378lu6 Tyler Durden