“August Snoozer” On Deck With Dealers Back In “Long Gamma” But Everything Changes In September

Tyler Durden

Mon, 08/03/2020 – 15:37

Charlie McElligott’s prediction from last week that the Nasdaq could suffer from a nasty spill as dealer gamma had turned increasingly negative…

… was foiled by the blockbuster earnings from the mega tech companies which sent the Nasdaq to new all time highs, forcing dealers – and frankly everybody else – to chase the year’s best performing sector into the stratosphere.

And indeed, in his latest note from this morning, the Nomura strategist concedes that despite the overnight bear-steepening in USTs which typically is positive for Value and negative for Momentum stocks such as tech, “we see further NQ futs outperformance so far vs ES and RTY, as the “if it ain’t broke, don’t fix it” trade keeps going in a world of seemingly perpetually low yields/flat curves which benefits the “secular growth” Tech universe.” For confirmation, look no further than Apple which this morning hit a new all time high of $446/share, sending its market cap higher by as much as $230BN in just two days to a record $1.9 trillion!

And since the gamma overhang is no longer an issue, looking ahead McElligott now believes that “it’s likely we see secular “Growth” factor Tech/NDX outperform into what I expect to be an August local “peak” for USTs/flatteners/ duration-sensitives Equities (particularly with a pretty negative seasonal for risk-assets over next few weeks alongside historic outflows for US Equities).”

However, just like BofA, the Nomura strategist sees the party ending some time in September, when there is a “high potential” for Treasury/Rate downtrade due mostly to heavy fixed-income issuance coming to market and into Q4’s very “risk-on” cross-asset/sector/factor seasonality.

If one then traces the sequence of key market catalyst, McElligott expects the August Treasury peak to transition into a “short” into September, which could then create a “cross-asset crowded trade reversal impulse as Autumn begins, as an up-move in both nominal- and real- yields would also likely see a Gold pullback, steeper curves reverse flattening as the long-end feels the issuance, which then drives a “Value over Growth/Momentum” factor pain-trade in US Equities.”

What about volatility as a driver of returns?

Here McElligott calculates us that with trailing realized equity vol windows collapsing following a series of key drop-offs from the worst of the Feb/Mar VaR shocks, vol control funds have been “real” buyers of US Equities amounting to $72.1BN over the past 3 months (and $30.8B over the past month/$11.7B over the past 2 weeks). However, looking ahead the Nomura quant sees markets entering a period where this demand from vol control funds slowing to a trickle even if the tape were to to trade sideways, “and perversely, would see selling on sustained “up” daily returns.” Needless to say, if volatility were to spike, the trapdoor under the market will open as described last week in “Why Even A Small Uptick In Volatility Could “Kick-Start A Massive And Painful Domino-Like Liquidation Event” for the simple reason that the market is “massively” short volatility.

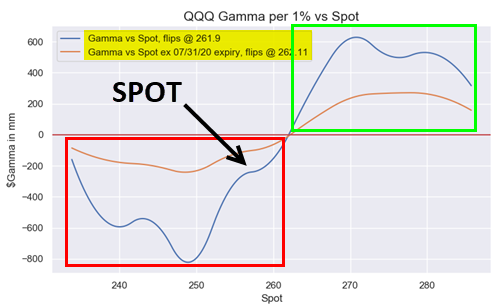

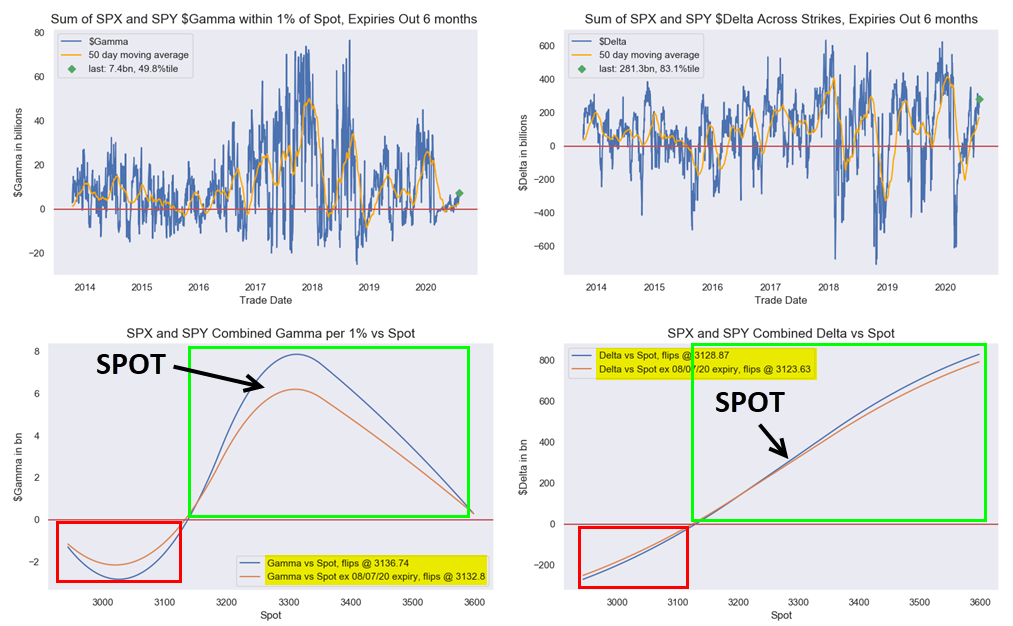

Finally looking at options positioning for US Equities Index & ETFs, McElligott sees both NDX (via the QQQs) and SPX/SPY consolidated showing some proper length again, after the Nasdaq escaped its close encounter with negative gamma last week, and as a result QQQ net Delta is now up to the 93rd %ile (after having turned sharply lower last week as we pointed out) while dealer gamma in SPX/SPY is at 83%ile…

… as last week’s rallies put both deep inside “long Gamma” territory, meaning it would require a powerful (and fast) blast down to risk opening-up something more insidious from a Dealer “pile-on” perspective.

via ZeroHedge News https://ift.tt/33oH0Ue Tyler Durden