S&P Futures Jump To Five Month High, Dollar Spikes In Bullish Start To New Month

Tyler Durden

Mon, 08/03/2020 – 08:19

World stocks rose and US futures jumped to the highest level since late February even as U.S. lawmakers struggled to agree on the next round of coronavirus aid while Covid cases around the globe continued to rise, while a squeeze on crowded short positions left the dollar clinging to a tentative bounce.

S&P 500 futures turned higher, reversing earlier losses with Microsoft rising in pre-market trading as it tried to salvage a deal for the U.S. operations of TikTok. Marathon Petroleum jumped after agreeing to sell its gasoline-station business for $21 billion. Still, investors remained jittery amid the lack of a progress on the stimulus package and White House Chief of Staff Mark Meadows not optimistic about a deal.

“Three months to go until the U.S. Presidential election! Surely Congress will want to get something over the line regarding new stimulus in the U.S. driven more by politics than necessarily economics,” said Chris Bailey, European strategist at Raymond James.

On Friday, Fitch Ratings cut the outlook on the United States’ triple-A credit rating to negative from stable and said the direction of fiscal policy depends in part on the November election and the resulting makeup of Congress, cautioning that policy gridlock could continue. However, as Reuters notes, those concerns have hardly hit the U.S. technology sector, evident in Friday’s record highs, with Apple overtaking Saudi Aramco to become the world’s most valuable company.

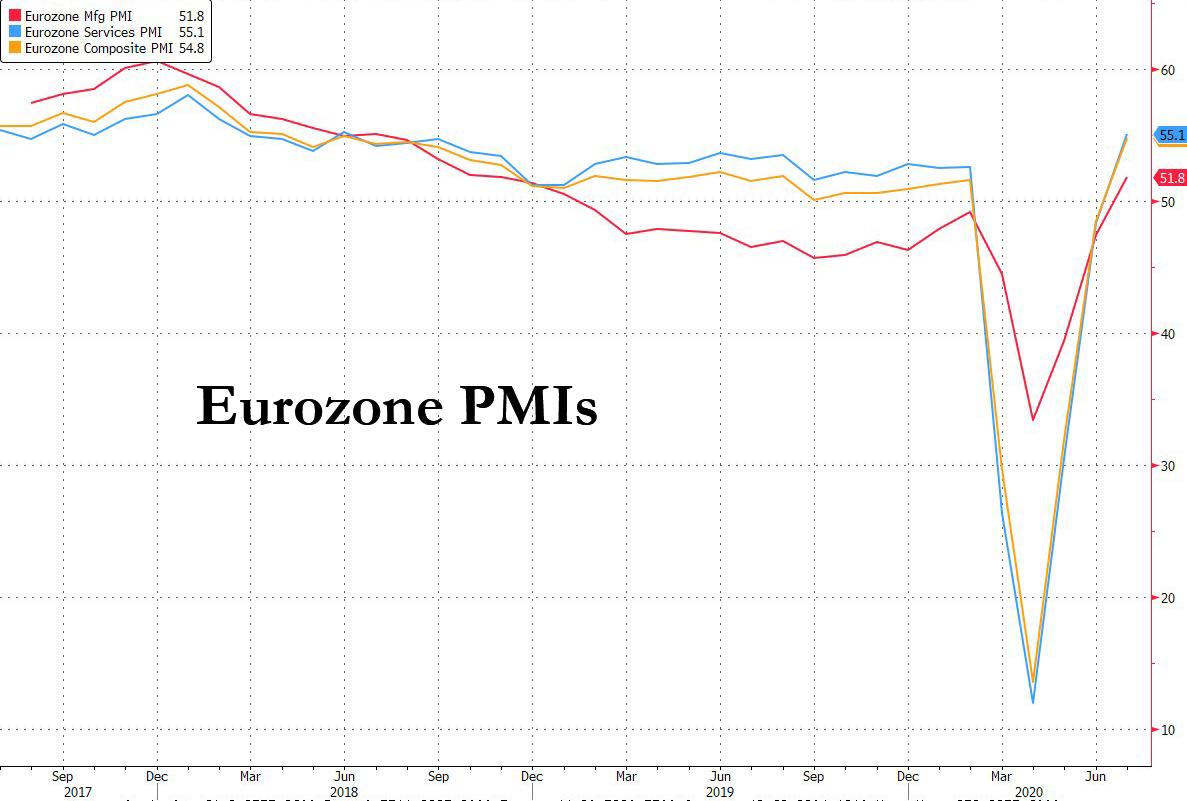

In Europe, stocks were up over 1% with all but four sector indexes advancing, with gains led by automakers, technology and chemicals sub- indexes, which are all up at least 1.7%. Travel and leisure stocks are the worst performers. Technology stocks rallied on positive read-across from peers on the other side of the Atlantic, while automobile shares jumped after the euro area recorded its first manufacturing expansion in one-and-a-half years when the final Eurozone mfg PMI printed at 51.8, above the 51.1 expected.

Spanish stocks, meanwhile, declined on Monday as the country saw the biggest jump in coronavirus cases since a national lockdown was lifted in June, while data showed international tourist arrivals to the country fell 98% year on year in June. “Second wave virus concerns are building in Australia, Europe etc. but no huge risk-aversion move,” said Bailey.

European gains were also limited by a selloff in big banks’ shares, with index heavyweight HSBC falling 5% to a fresh 11 year low after it warned that its bad debt charges could surge to as much as $13 billion, and France’s Societe Generale reported a 1.26 billion euro ($1.48 billion) second-quarter loss.

Earlier in the session, Asian stocks also gained, led by communications and health care, after falling in the last session. Most markets in the region were down, with Jakarta Composite dropping 2.8% and Singapore’s Straits Times Index falling 1.9%, while Japan’s Topix Index gained 1.8%. The Topix gained 1.8%, with ISB and ITmedia rising the most. The Shanghai Composite Index rose 1.8%, with Raytron Technology and Piesat Information Technology Co Ltd posting the biggest advances as investor margin debt resumed its climb.

Factory activity data from China showed the fastest pace of expansion in nearly a decade.

That helped China’s blue chips rally 1.6%, offsetting worries about U.S.-China relations. Japan’s Nikkei meanwhile added 2.2%, courtesy of a pullback in the yen.

“There is going to be a recovery — we shouldn’t lose track of that as we go through this period,” Anne Anderson, head of fixed income at UBS Asset Management Australia, said on Bloomberg TV. “But returning to where we were before we started is going to be a real challenge and is going to require ongoing monetary and fiscal support. It’s a long way out of here.”

Meanwhile, tension between the U.S. and China emerged as another threat to risk appetite. The Trump administration will announce measures shortly against “a broad array” of Chinese-owned software deemed to pose national-security risks, U.S. Secretary of State Michael Pompeo said. Even so, shares advanced in Japan and China, where mainland-listed technology stocks surged on expectations of support from Beijing in response to U.S. moves against Chinese-owned software companies.

In FX, Dollar bears also took some profits as short positions hit an 11 year high, with the Bloomberg Dollar Spot Index heading for its biggest two-day gain in seven weeks, with the greenback rising against all Group-of-10 peers except the Swedish krona and the yen.

but any further gains were capped by the slowing U.S. economic recovery from COVID-19 and real rates breaking below -1% for the first time.

The real 10Y rate hit a record low amid a marked flattening of the yield curve as investors wager on more accommodation from the Federal Reserve.

The euro and the pound were down only slightly with the dollar at $1.1755 per euro and $1.3065 per pound. Both the currencies recorded their best monthly gain in nearly a decade in July.

“Amid improvements in business sentiment, signals are emerging that the initial boost from pent-up demand is fading and consumer confidence is slipping lower,” economists at Barclays wrote in a note. “Together with concerns about labour market and virus developments, this clouds the outlook and could be exacerbated if U.S. fiscal support is not renewed in time.“

In rates, 10-year Treasury yields were higher at 0.5576% after touching the lowest level since March last week. German government bond yields rose slightly to -0.527%. Treasuries bear steepened as month-end support came out of the market and investors looked ahead to Wednesday’s supply announcement where record sales of notes and bonds are expected. Yields higher by up to 3bp across long-end of the curve with front-end broadly anchored, steepening 2s10s, 5s30s by ~1.5bp each; 10-year yields around 0.545%, cheaper by 1.5bp vs. Friday close while bunds, gilts outperform by ~2bp each. Yields on 30-year U.S. Treasuries are set for the biggest daily increase since June 30 as U.S. equity futures advance and the bond curve bear-steepens. As Bloomberg adds, a busy week of IG corporate issuance also expected, adding to downside pressure on Treasuries along with delta hedging large option package.

The recent decline in the dollar combined with super-low real bond yields has been a boon for gold, which hit $1,984 an ounce on Monday and seemed on track to take out $2,000 soon.

In other commodities, oil prices eased on concerns about oversupply as OPEC and its allies are due to pull back from production cuts in August while an increase in COVID-19 cases raised fears of slower pick-up in fuel demand. Brent crude futures dipped 46 cents to $43.06 a barrel, while U.S. crude eased 51 cents to $39.76.

On today’s calendar, economic data include ISM and Markit manufacturing data. Ferrari is among today’s scheduled earnings.

Market Snapshot

- S&P 500 futures down 0.1% to 3,260.50

- STOXX Europe 600 up 0.4% to 357.57

- MXAP up 0.3% to 165.11

- MXAPJ down 0.4% to 549.24

- Nikkei up 2.2% to 22,195.38

- Topix up 1.8% to 1,522.64

- Hang Seng Index down 0.6% to 24,458.13

- Shanghai Composite up 1.8% to 3,367.97

- Sensex down 1.7% to 36,967.20

- Australia S&P/ASX 200 down 0.03% to 5,926.09

- Kospi up 0.07% to 2,251.04

- Brent Futures down 0.6% to $43.24/bbl

- Gold spot down 0.2% to $1,972.89

- U.S. Dollar Index up 0.1% to 93.44

- German 10Y yield rose 0.4 bps to -0.52%

- Euro down 0.03% to $1.1775

- Brent Futures down 0.6% to $43.24/bbl

- Italian 10Y yield rose 4.2 bps to 0.887%

- Spanish 10Y yield rose 0.2 bps to 0.342%

Top Overnight News from Bloomberg

- Factories across the euro area saw a stronger return to growth in July than initially reported, marking the region’s first manufacturing expansion in one-and-a-half years while economies from Germany to Italy beat expectations. In the U.K., although numbers were slightly below flash estimates, manufacturing grew at the fastest pace in almost three years as the nation’s lockdown eased

- Gold’s spot and futures prices opened the week by hitting records, with the metal for immediate delivery closing in on $2,000 an ounce as the search for haven assets continues amid the coronavirus pandemic

- Microsoft chief executive Satya Nadella attempted to salvage a deal for the U.S. operations of TikTok by speaking with President Donald Trump by phone

- Oil edged below $40 a barrel in New York as OPEC and allied producers started to unwind output cuts even as many countries are still struggling to contain the virus

Asian equity markets began the new trading month mixed after last Friday’s positive close on Wall St where the tech sector rallied following earnings from the industry giants including Apple which rose to a fresh record high, but with upside in the region restricted ahead of this week’s risk events and after continued stalemate in US coronavirus relief discussions. ASX 200 (flat) was subdued as gains in commodity related sectors were offset by underperformance in the top weighted financials and with trade hampered by reduced liquidity due to bank holiday in New South Wales, while risk appetite was also weighed by a state of disaster declaration in Victoria with the state capital of Melbourne to be subjected to tougher restrictions including a curfew through to at least September 13th. Nikkei 225 (+2.2%) was the stellar performer as it coat-tailed on recent favourable currency flows and after Q1 Final GDP topped estimates, although there were some notable losses seen in Shinsei Bank and Mazda post earnings, as well as Seven & I on news it is to acquire Speedway convenience stores from Marathon Petroleum in a deal valued around USD 18.9bln. Hang Seng (-0.6%) and Shanghai Comp. (+1.8%) were mixed after PBoC inaction resulted to a CNY 100bln liquidity drain and as participants digested a more than 50% drop in HSBC HY profits, as well as the highest Chinese Caixin Manufacturing PMI reading since 2011. There was also plenty of focus around tech after reports that President Trump is to allow 45 days for ByteDance to negotiate the sale of TikTok to Microsoft and will reportedly take action on Chinese software companies that threaten national security in the approaching days. Finally, 10yr JGBs were lower amid a surge in Japanese stocks and with the BoJ present in the market for JPY 450bln of JGBs predominantly focused on 1yr-3yr maturities, while the central bank recently announced its buying intentions for August in which it maintained the current pace of purchases for all maturities.

Top Asian News

- Why Investors Keep Losing Money Betting Against the Hong Kong Dollar Peg

- Goldman, BofA Left Off Ant IPO for Work With Alibaba Rivals

- SoftBank, Naver to Start Joint Tender Offer for Line on Aug. 4

Mixed trade in the European equity sphere (Euro Stoxx 50 +0.6%) after a similar lead from APAC markets, as participants remain on standby for this week’s key risk events – including US ISM and labour market report alongside any updates on fiscal stimulus talks. Core EU bourses saw some upside in the run-up to the Final Manufacturing PMIs, potentially on optimism for higher revisions, but indices have since remained contained. UK’s FTSE 100 lags the core markets on currency dynamics, and with the Financial sector hit on the back of dismal earnings from HSBC (-5.1%) where Q2 profit slumped and loan loss provisions rose almost seven-fold. Furthermore, SocGen (-3.1%) adds to the woes in the sector after posting a surprise loss due to pandemic impact on equity trading. Energy names have also lost steam amid price action in the complex, but overall European sectors remain mixed with no clear risk tone to be derived. The sectoral breakdown sees Travel and Leisure at the bottom as second wave fears materialise in the sector. Elsewhere of note, AI company Shanghai Zhizhen Network Technology is suing Apple for around USD 1.4bln over virtual assistant patent violations, WSJ reported.

Top European News

- U.K. Manufacturing Grows as Sector Starts Long Road to Recovery

- Euro-Area Factories Returned to Growth Amid Severe Jobs Cuts

- Real Estate Stocks Fall on Lockdown Concerns, Negative Sentiment

In FX, mixed macro impulses for the Franc as Swiss CPI was considerably firmer than forecast, but the manufacturing PMI fell short of expectations and the key 50.0 mark to leave Usd/Chf eyeing 0.9200 and Eur/Chf even closer to 1.0800 following yet another rise in weekly bank sight deposits. Moreover, the cross has rebounded amidst Eurozone manufacturing PMIs that beat consensus and underpinned EU stocks alongside economic recovery hopes. Conversely, the COVID-19 escalation in Melbourne, Victoria has prompted a state of disaster amidst tougher restrictions and a curfew in the capital until September 13, at the earliest, on the eve of the RBA policy meeting – full preview of the event available on the headline feed – to the detriment of the Aussie that is holding just above 0.7100 vs the Greenback compared to last Friday’s 0.7200+ new ytd peak.

- USD – The Dollar has handed back some of its pre-month end gains after the DXY rebounded further from fresh 2020 lows (92.546) to 93.708 and is now pivoting 93.500, with additional support coming via M&A flows due to deals amounting to Usd 16.4 bn and Usd 21 bn for US companies from German and Japanese rivals respectively. Ahead, the final Markit manufacturing PMI, ISM equivalent and construction spending before a duo of Fed speakers (Bullard and Evans).

- JPY/GBP/NZD – All intiailly firmer against the Buck, or off worst levels to be more precise, as the Yen regains composure following its aggressive reversal from the low 104.00 area to 106.40+, while Sterling revisited 1.3100 from not far off 1.3050 even though the final UK manufacturing PMI was revised down a tad and the coronavirus outbreak in Northern England has reached ‘major incident’ proportions in Greater Manchester. Elsewhere, the Kiwi is benefiting from the aforementioned Aussie travails to an extent given Aud/Nzd pulling back below 1.0750 to keep Nzd/Usd more buoyant on the 0.6600 handle despite reports that hedge funds are implementing bearish positions ahead of the RNBZ later in August.

- EUR/CAD/SEK/NOK – Some traction for the Euro within 1.1796-42 parameters vs the Greenback in wake of the better than prelim/anticipated Eurozone manufacturing PMIs, but no confirmed breach of resistance in the form of the 100 HMA (1.1779), while the Loonie is sub-1.3400 amidst another downturn in crude prices that is also hampering the Norwegian Krona relative to its Swedish counterpart after the manufacturing PMI reclaimed 50.0+ status and retail sales picked up pace. Indeed, Eur/Nok is hovering around 10.7500 in contrast to Eur/Sek testing 10.3100 vs highs of 10.7860 and 10.3515 respectively.

- EM – The Yuan is keeping its head above 7.0000 on the back of China’s Caixin manufacturing PMI exceeding forecast at 52.8 for the strongest print since January 2011 and the Rouble is consolidating off recent lows circa 74.0000 awaiting the latest CBR MPR, but the Rand is lagging near 17.3000 after a steep decline in SA tax receipts for the fy through end July.

In commodities, WTI and Brent front-month futures remain subdued in early European trade with little by way of fresh fundamental catalysts, but with that being said, OPEC+ are poised to ease the magnitude of the agreed-upon cuts this month which will see an additional 1.9mln BPD of supply entering the market – this was reflected by the Russian oil and gas condensate output for the first half of August. It is also worth bearing in mind that the extra supply comes against the backdrop of rising second-wave fears which have prompted some cities to re-enter lockdown, whilst others deferred their reopening plans. Elsewhere, spot gold remains uneventful after testing support at USD 1970/oz (vs. fresh high 1987.94), with the yellow metal decoupled from Dollar dynamics (for now) as prices remain near record highs. Spot silver sees similar lacklustre action sub 24.50/oz. Turning to base metals, Dalian iron ore futures rose in excess of 4% to hit 12-month highs on a firm demand outlook. Conversely, copper touched a three-week low despite the strong Chinese factory data, with some citing second wave fears.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 51.3, prior 51.3

- 10am: ISM Manufacturing, est. 53.5, prior 52.6

- 10am: Construction Spending MoM, est. 1.0%, prior -2.1%

- Wards Total Vehicle Sales, est. 14m, prior 13.1m

DB’s Jim Reid concludes the overnight wrap

A happy August to you all. This morning’s EMR is brought to you by the powers of paracetamol and ibuprofen as I played my one and only game of cricket this season over the weekend. It was President’s Day and I’m the President of my club so I couldn’t really avoid coming out of semi-retirement for a game I played pretty much every summer weekend from around 1983 to 2011. Running, diving, throwing, bowling, eating a big tea all took a big toll out of me.

My performance certainly wasn’t as good as markets were in July, unless the dollar was my benchmark. Craig (who is still in a state of shock after Arsenal won the FA Cup final on Saturday) has already published July’s performance review this morning (link here) where the highlights were a bumper month for Silver and Gold and a poor month for the dollar. Silver (c.+35%) had its best month since December 1979 and the dollar the worse for a decade. US equities had a good month in spite of rising virus caseloads due to a strong earnings season relative to expectations, especially in tech towards the end of the month. YTD Silver, Gold and the NASDAQ have been the three best performers while at the bottom of the leaderboard Brent, WTI and European Banks are all down at least 30%.

In terms of how August is faring so far, it’s been a mixed start in Asia with the Nikkei (+1.95%) and Shanghai Comp (+1.08%) both posting decent gains, the Hang Seng (-0.95%) down and the Kospi and ASX little changed. Meanwhile, yields on 10yr USTs are up +1.3bps and futures on the S&P 500 are down -0.08%. In terms of data releases, China’s June Caixin manufacturing PMI came in at 52.8 (vs. 51.1 expected) which was the highest reading since Jan 2011 while Japan’s final manufacturing PMI reading was confirmed at 45.2 (vs. 42.6 in preliminary read). We also got Japan’s final annualized 1Q GDP print this morning, printing at -2.2% qoq (vs. -2.8% qoq expected).

In terms of weekend news, US Secretary of State Michael Pompeo has said that the White House will announce measures against “a broad array” of Chinese-owned software deemed to pose national-security risks. This follows President Trump saying on Friday that he intends to ban music-video app TikTok from the US. Meanwhile, on the fiscal stimulus negotiations in the US, there are reports that Democrats and Republicans continue to remain far apart on the plan to restore a $600-per-week jobless benefit that expired last week. Negotiations will continue today.

Looking at coronavirus numbers for the weekend, growth rates for new cases slowed in the US to an average of 1.13% per day (vs. average growth of 1.70% over last 5 weekends). The same was true for the most populous states like Texas, Florida, California and Arizona. The fatalities growth rate also slowed in Texas (1.35% vs. 1.89%) and Arizona (0.96% vs. 2.45%) but continues to remain high in Florida (1.75% vs. 1.34%) and California (1.13% vs. 0.73%). Meanwhile, the White House coronavirus task force head Deborah Birx said the pandemic is in a “new phase” as it spreads across U.S. rural and urban areas. In Asia, Australia’s Victoria state declared a state of disaster and has ordered Melbourne’s residents to stay home except for work, medical care, provisions or exercise. The city is now under curfew between 8 p.m. and 5 a.m and the new restrictions will be in force for six weeks. The state reported 671 new cases in the past 24 hours. Please see the regular case and fatalities table in the PDF for more. Finally, the latest on a possible vaccine is that the Serum Institute of India received approval for conducting phase two and three clinical trials of the Covid-19 vaccine candidate developed by the University of Oxford and AstraZeneca in the country.

Looking ahead to this week now, the release of PMIs from around the world (today and Wednesday mostly) will set the tone, before the July US jobs report on Friday rounds out the week. On the central bank front, we will hear the monetary policy decision from the Bank of England and Governor Bailey’s ensuing press conference on Thursday. The market also enters the second half of Q2 earnings season, which has already seen a record number of beats in the S&P 500.

Going through in more detail now, the majority of manufacturing PMIs are out on today, before services and composite PMIs come out on Wednesday for the most part. There’ll also be the ISM manufacturing index from the US (today). The key here will be to see how differentiated PMIs are given that some governments around the world are cautiously easing restrictions with others needing to tighten. For the countries where we already have a flash PMI reading, they generally showed that the recovery has more momentum in Europe than in the US. Many of the flash European levels were the strongest in at least two years, while both manufacturing and services PMIs in the US failed to meet expectations. As ever caution is required as these are diffusion indices which simply monitor whether activity is better or worse than the previous month. Remember that the US was never as shutdown as Europe so momentum was always likely to be more in the latter’s favour regardless of the recent rise in cases.

In terms of payrolls on Friday, markets are generally expecting a third straight month of gains, though likely at a slower rate than we saw in June. DB are looking for a further +900k gain in the headline, below consensus estimates at +1.578m. This follows last month’s blowout +4.8m increase. Our economists also see the unemployment rate falling to 10.5% from 11.1%, in line with the median estimate. This data will give some insight into how the renewed spread of the coronavirus through the US, especially in the South and West have affected the US economy. The rest of the key data can be found in the day by day week ahead guide at the end.

On the central bank front, one highlight will be the Bank of England meeting and Governor Bailey’s ensuing press conference on Thursday. While our DB economists are not expecting any change to the policy rate this meeting, there is a chance for a dovish surprise on the overall commentary and tone. Focus will be on the central bank’s economic projections, the ongoing review of the effective lower bound, and the path of QE. See their preview here .

Elsewhere in central banks, India and Brazil are also releasing their policy decisions on Wednesday and Thursday, respectively. The two countries have the highest confirmed coronavirus caseloads outside the US, and are expected to lower interest rates in light of the continued economic impact of the pandemic. Following the FOMC last week and the lifting of the blackout period, we will hear from the Fed’s Bullard, Evans, Mester and Kaplan.

Earnings will continue to be in focus, with 133 companies reporting from the S&P 500 and a further 95 from the STOXX 600. Among the releases include HSBC, Heineken, Siemens, Berkshire Hathaway, and Ferrari today. Then tomorrow markets will hear from Bayer, Diageo, Fidelity, BP, Walt Disney and Activision Blizzard. Wednesday will see Deutsche Post, Allianz, Humana, Bayerische Motoren, Regeneron Pharmaceuticals, CVS Health, MetLife and Fiserv release earnings. Following that, Thursday includes Merck, AXA, Siemens, adidas, Bristol-Myers Squibb, Novo Nordisk, Becton Dickinson & Co, Zoetis, T-Mobile, Illumina. Finally on Friday, Standard Life Aberdeen, Norwegian Cruise Line, Royal Caribbean Cruises and Ventas. So another busy week.

To review last week now, global equity markets were bifurcated with US stocks outperforming after beating low earning expectations, particularly in tech. The S&P 500 rose +1.73% (+0.77% Friday) led primarily by the mega cap tech stocks which reported towards the end of last week. With Apple, Facebook, and Amazon in particular surprising on earnings, the tech-focused Nasdaq outperformed this week as the index rose +3.69% (+1.49% Friday). Over 60% of the S&P have now reported and the index has seen a record of just under 85% of companies beat EPS estimates. Remember that the issue with this earnings season was that analysts didn’t increase their estimates in June as macro surprises beat. This left a great set up for earnings versus expectations.

Risk assets in Europe did not fare as well with European equities down -2.98% (-0.89%) over the 5 days, pushing the index down -1.11% for July. It was the first monthly loss since March as cyclical sectors led the declines following more concerns on the economic outlook and small rises in cases across the continent.

Even as US equities rose, core sovereign bonds fell with US 10yr Treasury yields falling -6.1bps (-1.8bps Friday) to a record closing low of 0.528%. Similarly, UK 10yr gilts rose +1.6bps on Friday to be just off Thursday’s all-time closing lows to fall -4.0bps overall on the week to 0.10%. German bunds fell -7.6bps to -0.52%, while a souring risk appetite saw wider peripheral spreads to bunds in Italy (+9.2bps), Spain (+6.3bps), Portugal (+7.1bps) and Greece (+9.7bps). The dollar fell over -1.0% on the week for the second week in a row, and has not seen a weekly rise since mid-June when economic data and US cases started getting worse again. With yields and the greenback falling, gold continued its breakneck rally. The metal rose +3.88% (+0.98% Friday) to another all-time record of $1975.86/oz.

On Friday, we received Q2 GDP data from the majority of Europe. This came following Thursday’s data out of the US, Germany and China. We learned that Euro Area quarterly GDP fell by -12.1%, right in-line with estimates and the largest decline on record. France GDP shrank -13.8% (vs. -15.2% expected), with the construction sector seeming to be hit the hardest after falling about -24% in the second quarter. Italy similarly showed a slightly ‘better’ GDP print than expected, coming in at -12.4% (vs. -15.5%). Unlike France and Italy, Spain’s data came in under projections with the economy contracting -18.5% (vs. -16.6% expected). In other data, German retail sales fell -1.6% MoM, better than the expected -3.3% drop, but somewhat expected given the +12.7% rise last month. In the US, July MNI Chicago PMI surprised by rising into expansionary territory at 51.9 vs 36.6 last month and well above the 44.0 estimate. Finally, the preliminary July University of Michigan survey showed sentiment fall -0.7pts to 72.5, just below estimates of 72.9. The slight drop in sentiment was driven by a -2.7pt move lower in current conditions even in light of a slight rise in expectations.

via ZeroHedge News https://ift.tt/2DfCyML Tyler Durden